Crypto

Where We See Crypto Mining Stocks Headed (Cryptocurrency:BTC-USD)

NiseriN

This article will compare, from a technical perspective, a few of the crypto mining stocks we follow closely at Crypto Waves. Specifically, we will take a look at (RIOT), (MARA), (CIFR), (CLSK), (HUT), (BITF), (HIVE), and (BTBT).

Since the summer highs, stock prices in the above list have lost between 56%-64% of their value from peak to (current) trough, in under three months! In roughly the same time frame, BTC has dropped 21.75% (from peak to (current) trough).

From a technical standpoint observing key oscillators, this class of stocks has reached very oversold levels, but are they investable? In our view on that matter, no. However, that does not mean the same as us ruling out the prospect of some very high return swing trades developing to the upside. In their current patterns, we view upside trades as quite speculative but we will lay out conditions for a prospective more attractive upside setup in a few of the miners.

The business of crypto mining is essentially companies hoping to capture the surplus value from generating newly minted coins vs. the cost of “mining” the block, which would convey to the “miner” newly minted coins as a reward. The costs consist of investment in capital expenditure in “Mining Rigs,” which are dedicated computer systems designed to perform the complex calculations required for mining. These rigs consist of multiple high-performance graphics processing units (GPUs) or application-specific integrated circuits (ASICs) that can handle the intense computational workload. The main operating cost is the power required to perform the computational workload.

Bitcoin (BTC-USD) undergoes a halving cycle roughly every four years. The event is referred to as a “halving” because when it takes place, the reward for each block mined is reduced to half of what it was preceding the event. The next expected halving is roughly six months away. Though we will not provide a deep dive into performance metrics of this industry, at the current BTC price and mining reward, this is not a profitable industry.

Much like precious metals miners, the earnings of these crypto mining businesses are strongly correlated to market prices in the underlying commodity being mined, in this case, we are primarily talking about Bitcoin.

Our thesis on BTC remains bullish. Fibonacci support ranges down to the $20k region, and so long as no sustained or meaningful break below this region develops, our confident expectation is for BTC to climb to the $40k-$49k region. Though I have less conviction about BTC moving directly above the 2021 high, and into $100k+ territory, without any breaks below the 2022 low, a technical setup has emerged for this prospect.

That said, while the thesis in BTC is more confidently bullish, especially in the long run, in which we do have strong conviction about moves well north of $100k, we can’t convey a strong investment grade thesis for the miners.

From a technical standpoint, though most miners had enormous gains from the pandemic lows into all-time highs and have held higher lows in the retrace into last year’s low, the patterns do not convey any confident prospect of reaching new all-time highs. Similarly, though the bounces from the 2022 lows into this year’s high have produced staggering gains, the patterns do not convey a confident prospect of exceeding the 2023 highs, let alone all-time highs.

The only positive aspects to report are that:

-

the charts are very oversold (but certainly can continue to become more oversold) and

-

(more importantly) some of these charts are displaying very corrective patterns in their declines off the 2023 highs. This is suggestive of these securities prospectively holding a higher low (above the 2022 low) and forming another rally segment to exceed the 2023 highs but without confidence to reach or exceed the all-time highs.

In the group with corrective decline patterns are the following tickers: MARA and CIFR. On the other hand, there are RIOT, HIVE, and BTBT. These all appear to have formed impulses from the summer highs which is very challenging to a prospective sustained bullish thesis, beyond a dead cat bounce. What’s particularly peculiar with RIOT and BTBT is that, while these have retraced considerably less of their rallies from last year’s low (while their patterns are most suggestive of downside follow-through), which sends a mixed message of sorts.

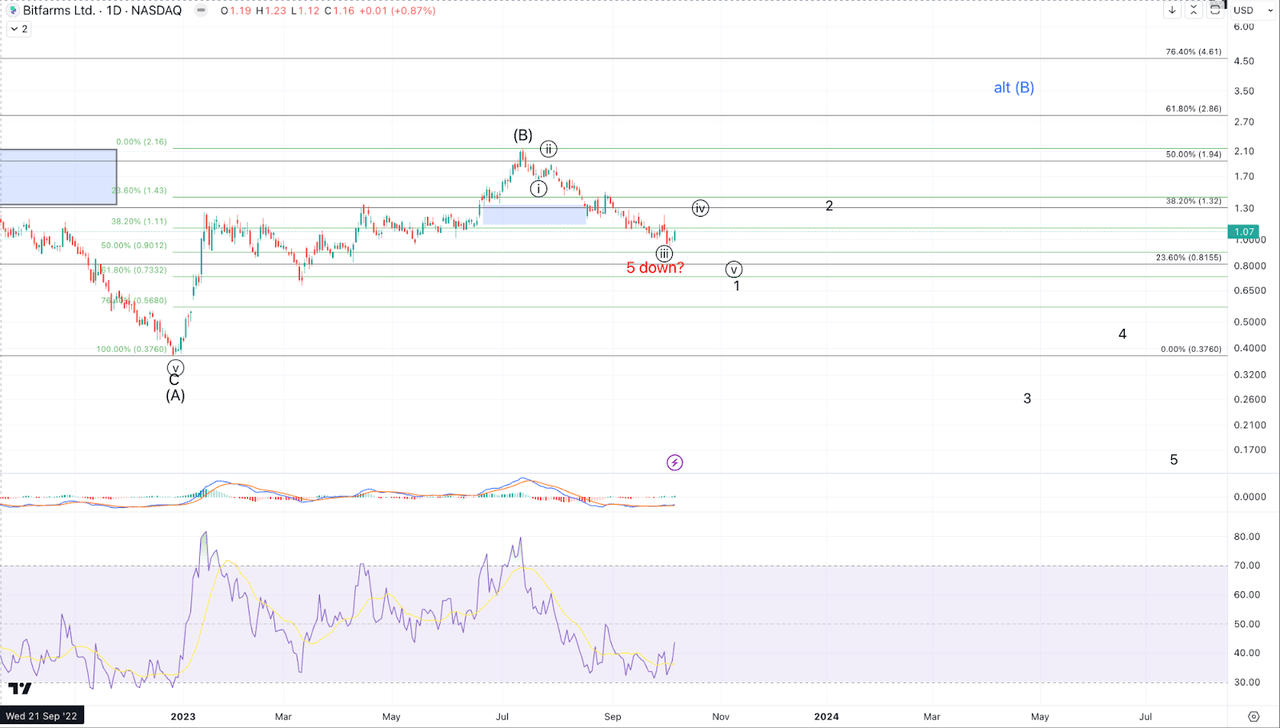

Of the remaining names mentioned near the heading of the article, HUT and BITF have patterns that appear to favor general downside continuation (with some corrective bounces) but that are less clearly impulsive to the downside. BITF possibly has 5 waves down already, but another corrective bounce followed by a lower low would make that pattern significantly more resolute (see below).

Lastly, we have CLSK. CLSK still has just three waves down from this summer’s high but is developing a potential impulse to the downside. Nevertheless, if price maintains above the 61.8% Fibonacci retrace and takes out some key resistance, a setup to the upside for considerable gains should not yet be ruled out.

Regarding all of the aforementioned names: Every single one is still maintaining its 61.8% retracement of the rally from the 2022 low into the summer 2023 highs (See charts below). So long as price is above those key levels, I can’t get strongly bearish. However, I do want to distinguish between those that are currently providing stronger signals of caution (RIOT, HIVE, and BTBT) and those that are better candidates, from an Elliott Wave perspective, for bigger bull runs in late 2023 and early 2024 (MARA and CIFR).

In summary, in the current posture, MARA and CIFR appear the least bad, even though MARA’s retrace is towards the larger end of the spectrum. All that said, a corrective decline is not sufficient, in our view, to start speculating with some positive expected value on the long side. What will be needed are micro impulsive rallies through resistance. Below we will review in detail some general conditions regarding price fluctuations in the coming weeks that would enable bullish setups to develop in MARA and CIFR. Though we’re skeptical about CLSK we have included it as well as the bullish potential is still intact albeit more farfetched.

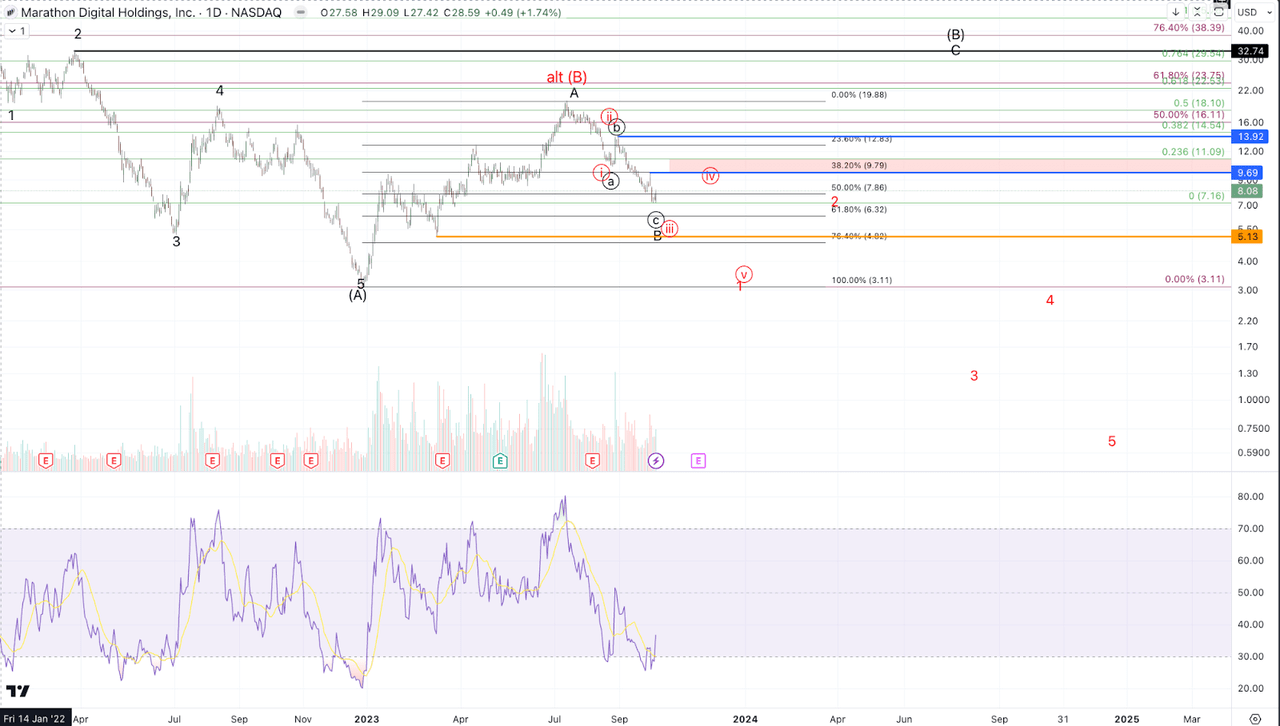

MARA (Marathon Digital Holdings, Inc.)

From the low near the end of 2022 to the 2023 high, MARA stock gained 540% and is currently (as of this writing) up 160%. From an Elliott Wave pattern perspective, MARA is interpreted to be forming a larger corrective move, in which the initial portion completed into the summer highs. The correction since then appears to be forming a higher low to set up a move to $32+ to test the March 2022 high. (Shown with the black labels on the accompanying chart)

As stated above, this is not a high confidence forecast (yet), but should price maintain support in a corrective decline and then develop impulsively to the upside from above $5~, a move to $32 is the preferred interpretation. The alternative thesis (displayed in red) is that price has completed its corrective bounce off the 2022 low and is starting a larger decline to under $2.

At a micro level, a move meaningfully over $9.70 is needed to establish at least a temporary low in place. That said, Fibonacci resistance for downside continuation sits between $10-$11.10. Ultimately, to become more confidently bullish from the current low, we’ll need to see a 5 wave rally up through the late August high of $14. Should such a move develop, I would consider pullbacks possible buying opportunities for a rally to $32-plus. Key levels to watch, should price decline further, are $6.32, which is the key Fibonacci 61.8% retrace, and $5.13, which is the March temporary low from which price launched. Sustained breaks below these levels reduce odds of upside continuation as per the black count.

Jason Appel (Crypto Waves)

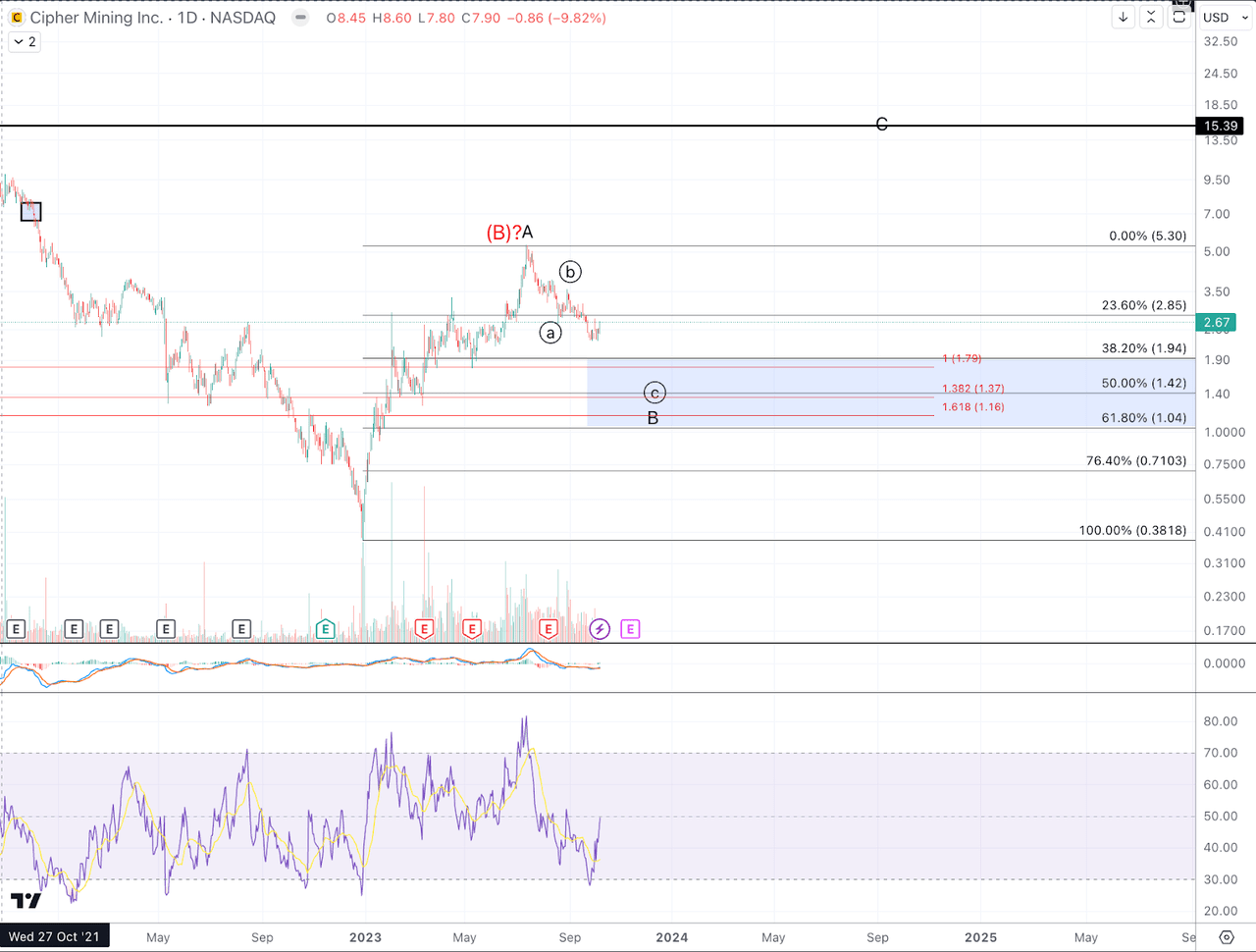

CIFR (Cipher Mining Inc.)

Cipher has so far produced the most shallow retrace of the bunch.

From the low near the end of 2022 to the 2023 high, CIFR stock gained 1288% and is currently (as of writing) up 600% from the 2022 low.

From a technical perspective (displayed in the black-lettered labels in the accompanying chart), Cipher appears to be forming a larger bounce in which the initial portion completed into the summer highs and with price pulling back correctively to form a higher low. Thus far, CIFR has retraced the least of its rally in the first half of the year, not yet having reached the key 38.2% Fibonacci retracement level. It’s reasonably likely that while price remains below $3.15, CIFR can see further extension downward into key confluence support in the $1.25-$1.80 region. That said, so long as price does not make a sustained break below $1, a rally back up to test near the all-time high at $15.39 looks like a viable prospect. All that said, for a confident set up to trade to the long side, traders will want to see a price turn up impulsively from the Fibonacci support region (roughly $1-$1.95) and take out some resistance. Considering that this decline from the July high still appears incomplete, we do not yet have key resistance levels to take out to establish a prospective low in place.

Jason Appel (Crypto Waves)

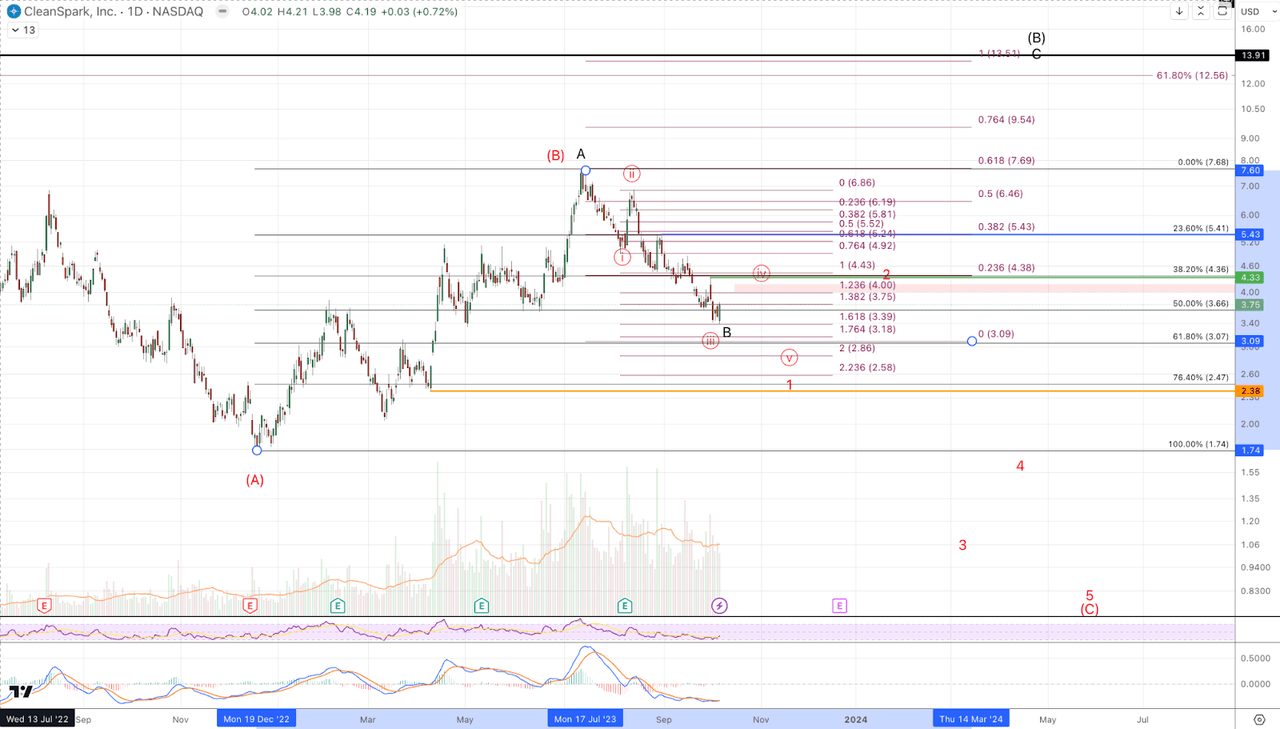

CLSK (CleanSpark, Inc.)

From the low near the end of 2022 to the 2023 high, CLSK stock gained 340% and is currently (as of writing) up 115%. The action counts best as 3 waves up which does not provide a high confidence prospect for upwards continuation. However, so far CLSK only has three waves down into Fibonacci support, which keeps alive the potential for another segment up to form a larger corrective move. Specifically, this entails a large degree 3 wave move in which the initial wave completed into the summer highs and price forming a higher low to set up a move to around $14 to test the March 2022 high. (This prospective path is displayed in black on the accompanying chart.)

As stated above, this is not a high confidence forecast (yet), but should price maintain support in a corrective decline and then develop impulsively to the upside from above $3~, a move to $14 ($13.91) is the preferred scenario though we should note this is even more speculative than with MARA. The alternative thesis (displayed in red) is that price has completed its corrective bounce off the 2022 low and is starting a larger decline to under $1.

Though the broad strokes appear set up like MARA, CLSK is in a more concerning posture. Though the decline down from the July high is still just three waves, the move is setting up more impulsively to the downside which is cause for concern to those entertaining a possible trade to the upside. On the micro level, it’s reasonable that the bounce from last week’s low continues higher and $4-$4.20 is the resistance region to watch. Should price rally correctively to resistance and then produce a lower low under $2.85, price will have a 5 wave impulsive decline from the summer highs, which suggests downside continuation as per the red count to become the favored perspective.

For the bullish case to assert itself, ideally, the low is in or perhaps one more low early this week that maintains the 61.8% Fibonacci retracement around $3 ($3.07). For a more advantageous long side setup, we will want to see an impulsive rally that resoundingly exceeds $4.33 with follow through above $5.45. At that point we’d see pullbacks as potential buying opportunities for a more reasonable prospective rally to $14.

Jason Appel (Crypto Waves)

More charts below (RIOT, HIVE, HUT, BTBT, BITF)

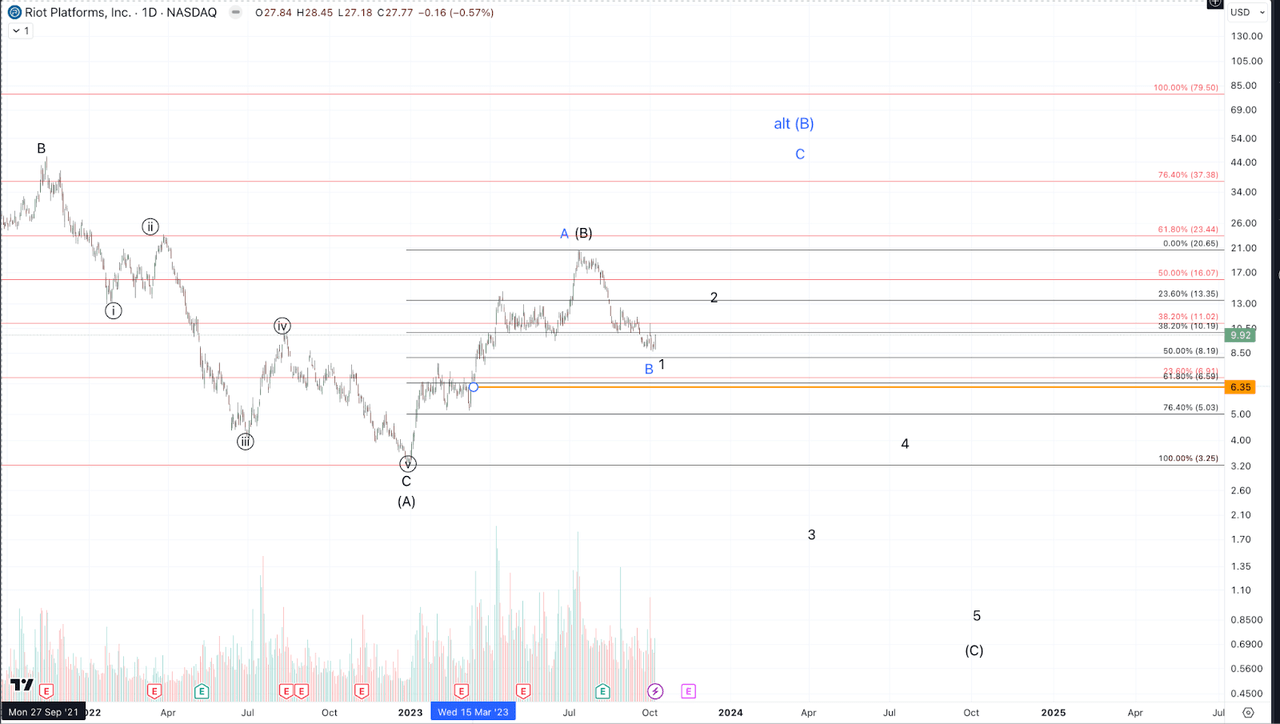

RIOT

Jason Appel (Crypto Waves)

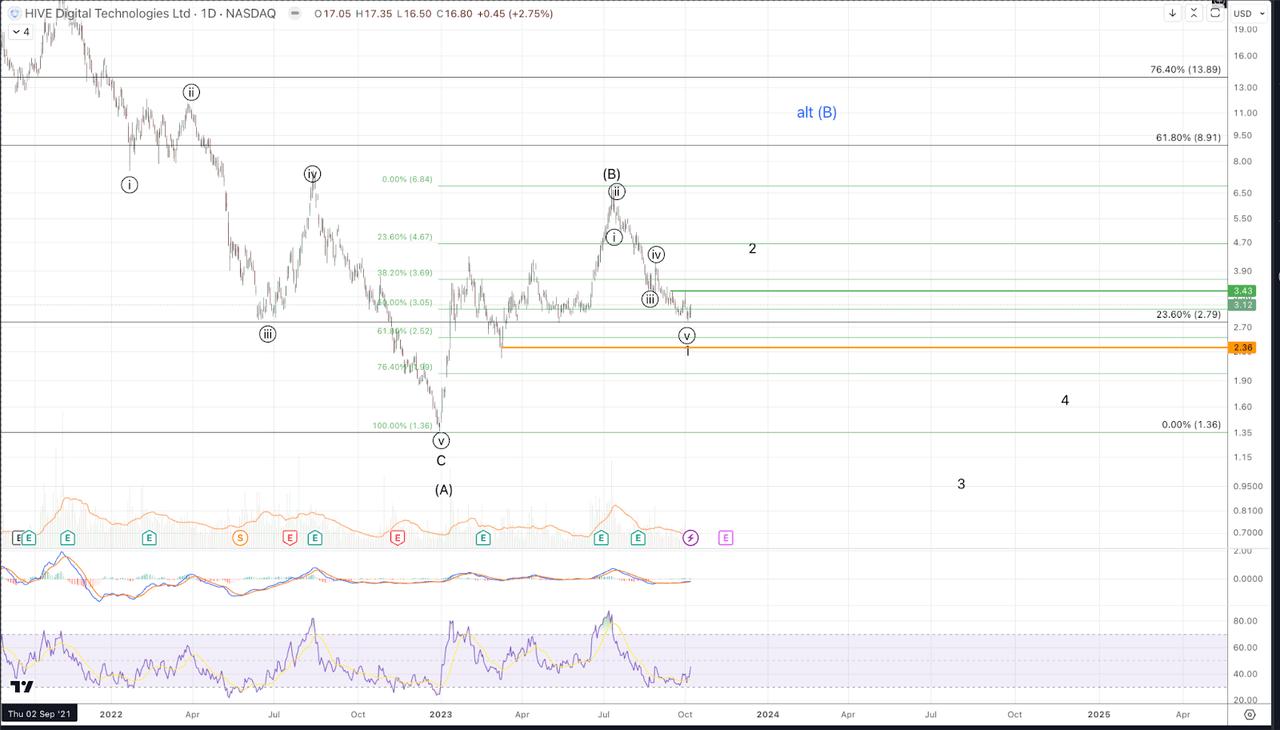

HIVE

Jason Appel (Crypto Waves)

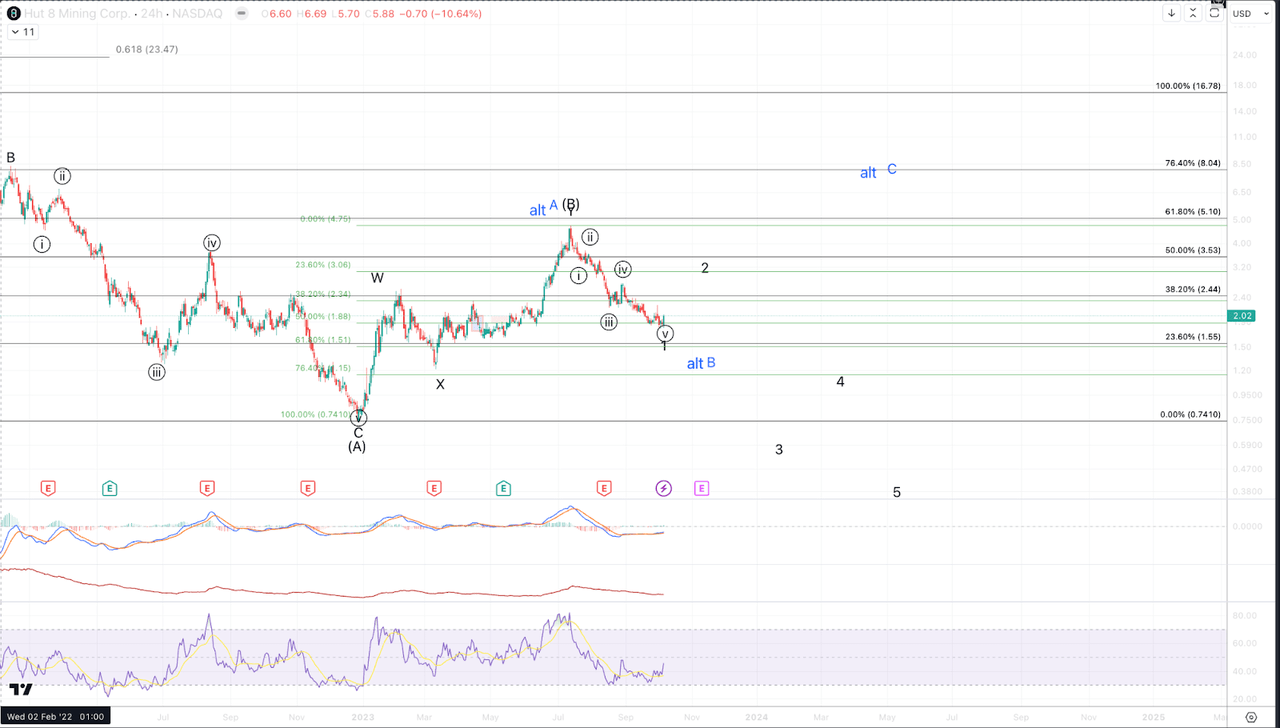

HUT

Jason Appel (Crypto Waves)

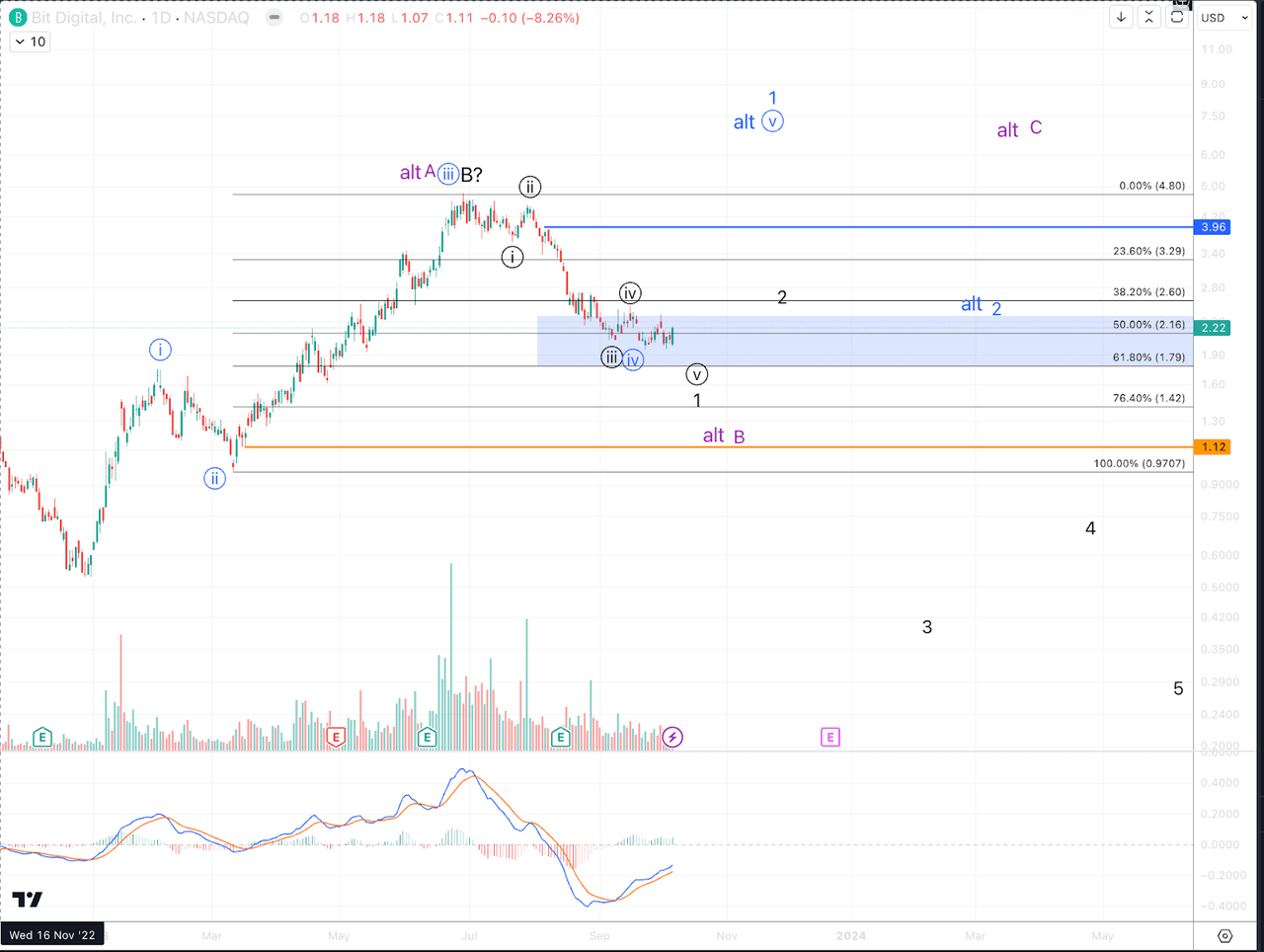

BTBT

Jason Appel (Crypto Waves)

BITF

Jason Appel (Crypto Waves)

Crypto

Bitcoin Buys a View: Trump Tower Dubai Embraces Cryptocurrency Payments via Deus X Pay

Deus X Pay, an institutional stablecoin payment solution setting new standards across the luxury sectors, is now enabling crypto payments for property purchases at the new Trump Tower Dubai, the first Trump International Hotel to be built in the Middle East.

The new $1 billion Trump Tower Dubai, unveiled through partnership with London-listed Dar Global,marks a breakthrough in global luxury real estate. Eric Trump, Executive Vice President of the Trump Organisation and son of US President Donald Trump, has recently announced that Bitcoin and other digital currencies will be accepted for condo sales.

Ziad El Chaar, CEO of Dar Global, said the Trump Tower Dubai is among the most ambitious Trump-branded residential towers globally, reflecting the project’s magnitude, stature, and symbolic significance in the region and internationally.

Trump previously told Gulf Business that Dubai is where luxury real estate and financial innovation intersect, and projects like Trump Tower Dubai are leading the way. By embracing technologies like stablecoins, buyers gain a faster, cheaper and more transparent way to secure exclusive, high-end properties while reshaping how luxury transactions are conducted.

Deus X Pay, a licensed Virtual Asset Service Provider (VASP) in Lithuania, offers institutional stablecoin payment solutions, enabling luxury sectors such as real estate, aviation and yachting to capitalise on this new era of finance. Deus X Pay CEO, Richard Crook, highlights that Dubai has created an environment where stablecoins can flourish as a practical, secure tool for international transactions (with Crypto Watch reporting that crypto adoption in the UAE is expected to surge 210% in 2025), giving premium buyers faster, frictionless access to high-value assets.

“Dubai’s forward-thinking stance has unlocked a whole new economy, and the gold standard for transactions of high-value assets. International buyers seek faster settlements, fewer cross-border complications and seamless access to premium developments. This project is a defining moment — not just for Deus X Pay, but for the global real estate sector. We are thrilled to deliver the regulated rails that make it possible for premium property buyers to transact instantly, compliantly and without the traditional delays or friction.”

The Trump Tower Dubai, an 80-story architectural icon, offers the highest international standards for ultra-high-net-worth travellers and long-stay residents. The exclusive building boasts 2-3 bedroom apartments and 4-bedroom penthouses valued at over AED 73 million, the highest outdoor swimming pool in the world, and has views of the world’s tallest building, the Burj Khalifa.

This new skyscraper is part of an expanding trend across private aviation, superyachts, and luxury collectables as high-end sectors embrace digital assets as a payment option to future-proof legacy industries.

About Deus X Pay

Deus X Pay is a regulated provider of institutional stablecoin payment solutions, revolutionising the authorisation, clearing, and settlement of cryptocurrency payments. We enhance global payment options for institutions, businesses, and corporations by seamlessly merging traditional finance with advanced digital payment infrastructure, enabling faster, more cost-effective, and secure transactions.

Fully compliant and regulated as a Virtual Asset Service Provider, Deus X Pay operates under a license in Lithuania, supervised by the Financial Crime Investigation Service (FNTT), the Czech Republic, supervised by the Financial Analytical Office (FAU), and in Canada, supervised by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

As a part of the innovative crypto investment firm Deus X Capital, we equip organisations with state-of-the-art financial tools aimed at fostering growth and success in today’s dynamic market.

Deus X Pay, an institutional stablecoin payment solution setting new standards across the luxury sectors, is now enabling crypto payments for property purchases at the new Trump Tower Dubai, the first Trump International Hotel to be built in the Middle East.

The new $1 billion Trump Tower Dubai, unveiled through partnership with London-listed Dar Global,marks a breakthrough in global luxury real estate. Eric Trump, Executive Vice President of the Trump Organisation and son of US President Donald Trump, has recently announced that Bitcoin and other digital currencies will be accepted for condo sales.

Ziad El Chaar, CEO of Dar Global, said the Trump Tower Dubai is among the most ambitious Trump-branded residential towers globally, reflecting the project’s magnitude, stature, and symbolic significance in the region and internationally.

Trump previously told Gulf Business that Dubai is where luxury real estate and financial innovation intersect, and projects like Trump Tower Dubai are leading the way. By embracing technologies like stablecoins, buyers gain a faster, cheaper and more transparent way to secure exclusive, high-end properties while reshaping how luxury transactions are conducted.

Deus X Pay, a licensed Virtual Asset Service Provider (VASP) in Lithuania, offers institutional stablecoin payment solutions, enabling luxury sectors such as real estate, aviation and yachting to capitalise on this new era of finance. Deus X Pay CEO, Richard Crook, highlights that Dubai has created an environment where stablecoins can flourish as a practical, secure tool for international transactions (with Crypto Watch reporting that crypto adoption in the UAE is expected to surge 210% in 2025), giving premium buyers faster, frictionless access to high-value assets.

“Dubai’s forward-thinking stance has unlocked a whole new economy, and the gold standard for transactions of high-value assets. International buyers seek faster settlements, fewer cross-border complications and seamless access to premium developments. This project is a defining moment — not just for Deus X Pay, but for the global real estate sector. We are thrilled to deliver the regulated rails that make it possible for premium property buyers to transact instantly, compliantly and without the traditional delays or friction.”

The Trump Tower Dubai, an 80-story architectural icon, offers the highest international standards for ultra-high-net-worth travellers and long-stay residents. The exclusive building boasts 2-3 bedroom apartments and 4-bedroom penthouses valued at over AED 73 million, the highest outdoor swimming pool in the world, and has views of the world’s tallest building, the Burj Khalifa.

This new skyscraper is part of an expanding trend across private aviation, superyachts, and luxury collectables as high-end sectors embrace digital assets as a payment option to future-proof legacy industries.

About Deus X Pay

Deus X Pay is a regulated provider of institutional stablecoin payment solutions, revolutionising the authorisation, clearing, and settlement of cryptocurrency payments. We enhance global payment options for institutions, businesses, and corporations by seamlessly merging traditional finance with advanced digital payment infrastructure, enabling faster, more cost-effective, and secure transactions.

Fully compliant and regulated as a Virtual Asset Service Provider, Deus X Pay operates under a license in Lithuania, supervised by the Financial Crime Investigation Service (FNTT), the Czech Republic, supervised by the Financial Analytical Office (FAU), and in Canada, supervised by the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

As a part of the innovative crypto investment firm Deus X Capital, we equip organisations with state-of-the-art financial tools aimed at fostering growth and success in today’s dynamic market.

Crypto

Crypto execs increase personal security amid recent uptick in threats, kidnappings

Bitcoin Foundation Chairman Brock Pierce joins ‘Varney & Co.’ to discuss Trump’s ‘crypto strategic reserve’ plan.

Threats against high-profile names in the cryptocurrency world are rising as the value of industry holdings continues to grow.

Geno Roefaro, CEO of Florida-based SaferWatch, a security platform designed to enhance emergency response across public and private institutions, has observed a growing trend: organized crime groups are increasingly targeting individuals’ cryptocurrency holdings using “sophisticated methods.”

Jethro Pijlman, managing director of Netherlands-based Infinite Risks International, a firm that provides physical security and intelligence services to cryptocurrency holders, told FOX Business that threats against crypto executives have noticeably increased globally since 2021.

Last week, a group of men tried to attack the daughter of French crypto firm Paymium CEO Pierre Noizat on the street in Paris in broad daylight. Earlier this year, the founder of French crypto company Ledger and his wife were kidnapped. In a separate incident, the father of the head of another crypto company was also kidnapped, according to Reuters. While all of them were rescued, it provoked a sense of fear and urgency among other high-net-worth individuals in the sector.

Additionally, there has been a “particularly high concentration in Asia,” Pijlman said.

COINBASE ESTIMATES CYBERATTACK COULD COST CRYPTO EXCHANGE UP TO $400M

Jethro Pijlman, managing director of Netherlands-based Infinite Risks International, a firm that provides physical security and intelligence services to cryptocurrency holders, told FOX Business that threats against crypto executives have noticeably (iStock)

Coinbase revealed in a recent regulatory filing that it spent $6.2 million last year on personal security for CEO Brian Armstrong.

“This trend aligns with the cyclical nature of the crypto markets. Each cycle typically includes a euphoric phase marked by the rapid accumulation of wealth,” Pijlman said, noting that “it is common for individuals to publicly display their newfound prosperity through luxury vehicles, high-end real estate, expensive watches, and other status symbols, often showcased on YouTube, Instagram, and other social media platforms.”

Coinbase CEO Brian Armstrong speaks at the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022. (David Swanson / Reuters Photos)

Last fall, for instance, crypto entrepreneur Justin Sun purchased Maurizio Cattelan’s famed banana duct-taped to a wall artwork for $6.2 million. Not only was the purchase itself noteworthy, but Sun, who founded the Tron blockchain in 2017, was then filmed eating the viral fruit during a news conference in Hong Kong. To commemorate the moment, he also posted a tongue-in-cheek comment on X about the taste of the viral fruit.

“Unfortunately, this public exposure often occurs without adequate awareness of personal security risks,” Pijlman said, adding that “many individuals unintentionally share sensitive information online.” This includes travel itineraries, attendance at industry events or meetups, photos of luxury vehicles with visible license plates, identifiable backgrounds and real-time videos from upscale restaurants, clubs or private gatherings. Even posts or tags by friends can unintentionally reveal their location, according to Pijlman.

“This kind of content provides a treasure trove of intelligence for criminal organizations. It is not uncommon for such groups to monitor a target’s digital footprint for weeks or even months before executing a robbery or abduction. The level of detail available through open-source intelligence is often staggering,” he added.

COINBASE SUES SEC, FDIC FOR INFORMATION RELATING TO CRYPTO REGULATION

Pijlman said his firm applies the same techniques used to locate individuals in threat assessments to proactively protect its clients. This includes real-time alerts when oversharing occurs and helping clients adjust their online behavior to reduce exposure. The firm’s transportation services are delivered exclusively by security-trained drivers. In most major cities throughout Europe and the United States, the firm deploys executive protection agents, often with government or military backgrounds, who specialize in minimizing personal risk during client movements. It also offers residential security solutions, including armed protection.

Roefaro told FOX Business that the rapid rise in cryptocurrency wealth has added a new layer of complexity to executive protection.

In most major cities throughout Europe and the U.S., Infinite Risks International deploys executive protection agents, often with government or military backgrounds, who specialize in minimizing personal risk during client movements. (Reuters/Benoit Tessier/Illustration/File Photo / Reuters Photos)

“As digital fortunes grow, so does the risk of targeted attacks. The hiring of personal security by crypto high-rollers is not merely a trend but a strategic necessity,” Roefaro said. “It’s a clear indication that personal security must evolve in tandem with financial innovation.”

Roefaro’s company, which created a discrete device to help executives, other employees and their families get help without drawing any attention, also has a client in the cryptocurrency space.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

These are the most attractive type of high-value targets for organized crime, according to Roefaro, as the asset they are stealing is already in the form of digital currency. It is also hard for victims to recover from the losses because they transfer them internationally, Roefaro said.

Sean Worthington, founder of CloudCoin, one of the first cloud-based digital currencies developed outside of blockchain, said that cryptocurrencies like bitcoin carry inherent risks of theft and loss due to their reliance on a single critical component known as the private key.

“This ‘golden egg’ represents a fundamental vulnerability, as there are no built-in safeguards to mitigate the risk it poses. Insiders – such as system administrators or software developers at cryptocurrency firms – can potentially siphon funds undetected, leaving businesses exposed to significant financial losses with little recourse or accountability,” he said.

Crypto

Senate to try again to advance crypto bill after Democratic opposition tanked first vote

Washington — The Senate is expected to take a key procedural vote Monday evening on a crypto regulation bill after Democratic opposition tanked an initial attempt to advance the measure earlier this month amid concern over ties between the digital asset industry and the Trump family.

The first-of-its-kind legislation, known as the GENIUS Act, would create a regulatory framework for stablecoins — a type of cryptocurrency tied to the value of an asset like the U.S. dollar. After the measure advanced out of the Senate Banking Committee with bipartisan support in March, Senate GOP leadership first brought the measure to the floor earlier this month. But the measure had lost Democratic support in the intervening weeks amid concerns about President Trump and his family’s business ventures involving cryptocurrency.

Senate Majority Leader John Thune said the upper chamber would try again to advance the legislation on Monday, while criticizing Democrats for blocking the measure from moving forward earlier this month, saying “this bill reflects the bipartisan consensus on this issue, and it’s had an open and bipartisan process since the very beginning.”

Thune, a South Dakota Republican, argued that Senate Democrats “inexplicably chose to block this legislation” earlier this month, while adding that “I’m hoping that the second time will be the charm.”

Nathan Posner/Anadolu via Getty Images

Since the failed vote earlier this month, negotiators returned to the table. And ahead of the procedural vote Monday, the measure saw backing from at least one Democrat as Sen. Mark Warner of Virginia advocated for the measure, calling it a “meaningful step forward,” though he added that it’s “not perfect.”

“The stablecoin market has reached nearly $250 billion and the U.S. can’t afford to keep standing on the sidelines,” Warner said in a statement. “We need clear rules of the road to protect consumers, defend national security, and support responsible innovation.”

Still, Warner pointed to concerns he said are shared among many senators about the Trump family’s “use of crypto technologies to evade oversight, hide shady financial dealings, and personally profit at the expense of everyday Americans,” after it was announced earlier this month that an Abu Dhabi-backed firm will invest billions of dollars in a Trump family-linked crypto firm, World Liberty Financial.

Warner said senators “have a duty to shine a light on these abuses,” but he argued “we cannot allow that corruption to blind us to the broader reality: blockchain technology is here to stay.”

Sen. Elizabeth Warren of Massachusetts, the top Democrat on the Senate Banking Committee, has been among the leading voices advocating for adding anti-corruption reforms to the legislation. Warren has outlined a handful of issues with the bill, saying that it puts consumers at risk and enables corruption. In a speech Monday on the Senate floor, Warren said her concerns have not been addressed and urged her colleagues to vote against the updated version.

“While a strong stablecoin bill is the best possible outcome, this weak bill is worse than no bill at all,” Warren said. “A bill that meaningfully strengthens oversight of the stablecoin market is worth enacting. A bill that turbocharges the stablecoin market, while facilitating the president’s corruption and undermining national security, financial stability, and consumer protection is worse than no bill at all.”

Whether the measure can advance in the upper chamber this time around remains to be seen. The measure fell short of the 60 votes necessary to move forward earlier this month, with all Senate Democrats and two Republicans — Sens. Rand Paul of Kentucky and Josh Hawley of Missouri — opposing. Paul has reservations about overregulation, while Hawley voted against the bill in part because it doesn’t prohibit big tech companies from creating their own stablecoins.

Sen. Bill Hagerty of Tennessee, who sponsored the legislation, defended the measure on CNBC’s “Squawk Box” Monday. He outlined that a lack of regulatory framework, which the bill would provide, makes for uncertainty — and results in innovative technology moving offshore. The Tennessee Republicans urged that “this will fix it,” while arguing that the bill has strong bipartisan support.

“We have broad policy agreement, Democrats and Republicans,” Hagerty said. “The question is can we get past the partisan politics and allow us to actually have a victory.”

-

Technology1 week ago

Technology1 week agoMexico is suing Google over how it’s labeling the Gulf of Mexico

-

Politics1 week ago

Politics1 week agoDHS says Massachusetts city council member 'incited chaos' as ICE arrested 'violent criminal alien'

-

Education1 week ago

Education1 week agoA Professor’s Final Gift to Her Students: Her Life Savings

-

Politics1 week ago

Politics1 week agoPresident Trump takes on 'Big Pharma' by signing executive order to lower drug prices

-

Education1 week ago

Education1 week agoVideo: Tufts Student Speaks Publicly After Release From Immigration Detention

-

News7 days ago

News7 days agoAs Harvard Battles Trump, Its President Will Take a 25% Pay Cut

-

Culture1 week ago

Culture1 week agoTest Yourself on Memorable Lines From Popular Novels

-

News1 week ago

News1 week agoWhy Trump Suddenly Declared Victory Over the Houthi Militia