Crypto

SEC chair Gary Gensler has close ties with anti-crypto Sen. Elizabeth Warren

Securities and Exchange Commission Chairman Gary Gensler has maintained close ties to anti-cryptocurrency crusader Sen. Elizabeth Warren as his agency announced last week it was suing two of the biggest names in the industry.

Gensler, a longtime Democratic donor and the CFO for Hillary Clinton’s 2016 presidential campaign, has coordinated with Warren (D-Mass.) in cracking down on crypto since his confirmation in April 2021, exchanging letters with her on the dangers of the currencies and even working in concert to fire federal regulators who stand in the way.

The 65-year-old SEC head has donated exclusively to Democratic candidates for decades and supported Warren’s presidential candidacy during the 2020 Democratic primary, contributing $2,800 to the senator’s campaign fund — the maximum an individual could send at that time.

A top bundler for Hillary Clinton’s first presidential campaign in 2008, Gensler later served on the former secretary of state’s 2016 campaign, where he earned the nickname the “Elizabeth Whisperer” while operating as a middleman between Clinton and Warren, according to Politico.

Both the SEC chairman and Warren have targeted cryptocurrency exchanges, calling them a “Wild West” for investors, and the Massachusetts Democrat has introduced legislation to help Gensler beef up the agency’s regulatory authority.

Warren has argued that the move would halt “money laundering, theft and fraud schemes,” and even help fight climate change.

“Bitcoin requires so much computing activity that it eats up more energy than entire countries,” Warren tweeted in June 2021. “One of the easiest and least disruptive things we can do to fight the #ClimateCrisis is to crack down on environmentally wasteful cryptocurrencies.”

The senator has also won some Republican support for her efforts.

Last year, she and Sen. Roger Marshall (R-Kan.) introduced the Digital Asset Anti-Money Laundering Act, suggesting the bill would keep funds from flowing to terrorists and help stop online fentanyl trafficking.

But digital asset advocates have said the bill “would effectively ban crypto in the guise of fighting money laundering” and present an “unconstitutional assault” on cryptocurrency users.

Other Republicans also have introduced bills to remove Gensler, saying he has abused his authority as SEC chairman.

“American investors and industry deserve clear and consistent oversight, not political gamesmanship,” House Majority Whip Tom Emmer (R-Minn.) said in a statement announcing the legislation.

Gensler began his tenure with the ouster of former Public Company Accounting Oversight Board Chairman William Duhnke in June 2021, following calls from Warren and Sen. Bernie Sanders (I-Vt.) for his replacement.

The following year, the PCAOB signaled it will be taking a new direction in prioritizing audits of all digital assets, citing concerns over fraud.

The move came months after Warren and Sen. Ron Wyden (D-Ore.) had written to the regulator, saying it should exercise its authority to audit cryptocurrencies after the implosion of FTX this past November.

On June 5, Gensler’s SEC also sued the world’s largest cryptocurrency exchange, Binance, and the following day sued Coinbase, the largest US cryptocurrency exchange, as the agency accused both of having improperly failed to register.

“We don’t need more digital currency,” Gensler told Bloomberg following the lawsuits last Tuesday. “We already have digital currency. It’s called the US dollar.”

The following day, Warren and Sen. Chris Van Hollen (D-Md.) called on the Justice Department to open an investigation into Binance for allegedly lying to Congress.

An SEC spokesman declined to comment. A spokesman for Warren did not respond to a request for comment.

Crypto

Crypto execs increase personal security amid recent uptick in threats, kidnappings

Bitcoin Foundation Chairman Brock Pierce joins ‘Varney & Co.’ to discuss Trump’s ‘crypto strategic reserve’ plan.

Threats against high-profile names in the cryptocurrency world are rising as the value of industry holdings continues to grow.

Geno Roefaro, CEO of Florida-based SaferWatch, a security platform designed to enhance emergency response across public and private institutions, has observed a growing trend: organized crime groups are increasingly targeting individuals’ cryptocurrency holdings using “sophisticated methods.”

Jethro Pijlman, managing director of Netherlands-based Infinite Risks International, a firm that provides physical security and intelligence services to cryptocurrency holders, told FOX Business that threats against crypto executives have noticeably increased globally since 2021.

Last week, a group of men tried to attack the daughter of French crypto firm Paymium CEO Pierre Noizat on the street in Paris in broad daylight. Earlier this year, the founder of French crypto company Ledger and his wife were kidnapped. In a separate incident, the father of the head of another crypto company was also kidnapped, according to Reuters. While all of them were rescued, it provoked a sense of fear and urgency among other high-net-worth individuals in the sector.

Additionally, there has been a “particularly high concentration in Asia,” Pijlman said.

COINBASE ESTIMATES CYBERATTACK COULD COST CRYPTO EXCHANGE UP TO $400M

Jethro Pijlman, managing director of Netherlands-based Infinite Risks International, a firm that provides physical security and intelligence services to cryptocurrency holders, told FOX Business that threats against crypto executives have noticeably (iStock)

Coinbase revealed in a recent regulatory filing that it spent $6.2 million last year on personal security for CEO Brian Armstrong.

“This trend aligns with the cyclical nature of the crypto markets. Each cycle typically includes a euphoric phase marked by the rapid accumulation of wealth,” Pijlman said, noting that “it is common for individuals to publicly display their newfound prosperity through luxury vehicles, high-end real estate, expensive watches, and other status symbols, often showcased on YouTube, Instagram, and other social media platforms.”

Coinbase CEO Brian Armstrong speaks at the Milken Institute Global Conference in Beverly Hills, California, on May 2, 2022. (David Swanson / Reuters Photos)

Last fall, for instance, crypto entrepreneur Justin Sun purchased Maurizio Cattelan’s famed banana duct-taped to a wall artwork for $6.2 million. Not only was the purchase itself noteworthy, but Sun, who founded the Tron blockchain in 2017, was then filmed eating the viral fruit during a news conference in Hong Kong. To commemorate the moment, he also posted a tongue-in-cheek comment on X about the taste of the viral fruit.

“Unfortunately, this public exposure often occurs without adequate awareness of personal security risks,” Pijlman said, adding that “many individuals unintentionally share sensitive information online.” This includes travel itineraries, attendance at industry events or meetups, photos of luxury vehicles with visible license plates, identifiable backgrounds and real-time videos from upscale restaurants, clubs or private gatherings. Even posts or tags by friends can unintentionally reveal their location, according to Pijlman.

“This kind of content provides a treasure trove of intelligence for criminal organizations. It is not uncommon for such groups to monitor a target’s digital footprint for weeks or even months before executing a robbery or abduction. The level of detail available through open-source intelligence is often staggering,” he added.

COINBASE SUES SEC, FDIC FOR INFORMATION RELATING TO CRYPTO REGULATION

Pijlman said his firm applies the same techniques used to locate individuals in threat assessments to proactively protect its clients. This includes real-time alerts when oversharing occurs and helping clients adjust their online behavior to reduce exposure. The firm’s transportation services are delivered exclusively by security-trained drivers. In most major cities throughout Europe and the United States, the firm deploys executive protection agents, often with government or military backgrounds, who specialize in minimizing personal risk during client movements. It also offers residential security solutions, including armed protection.

Roefaro told FOX Business that the rapid rise in cryptocurrency wealth has added a new layer of complexity to executive protection.

In most major cities throughout Europe and the U.S., Infinite Risks International deploys executive protection agents, often with government or military backgrounds, who specialize in minimizing personal risk during client movements. (Reuters/Benoit Tessier/Illustration/File Photo / Reuters Photos)

“As digital fortunes grow, so does the risk of targeted attacks. The hiring of personal security by crypto high-rollers is not merely a trend but a strategic necessity,” Roefaro said. “It’s a clear indication that personal security must evolve in tandem with financial innovation.”

Roefaro’s company, which created a discrete device to help executives, other employees and their families get help without drawing any attention, also has a client in the cryptocurrency space.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

These are the most attractive type of high-value targets for organized crime, according to Roefaro, as the asset they are stealing is already in the form of digital currency. It is also hard for victims to recover from the losses because they transfer them internationally, Roefaro said.

Sean Worthington, founder of CloudCoin, one of the first cloud-based digital currencies developed outside of blockchain, said that cryptocurrencies like bitcoin carry inherent risks of theft and loss due to their reliance on a single critical component known as the private key.

“This ‘golden egg’ represents a fundamental vulnerability, as there are no built-in safeguards to mitigate the risk it poses. Insiders – such as system administrators or software developers at cryptocurrency firms – can potentially siphon funds undetected, leaving businesses exposed to significant financial losses with little recourse or accountability,” he said.

Crypto

Senate to try again to advance crypto bill after Democratic opposition tanked first vote

Washington — The Senate is expected to take a key procedural vote Monday evening on a crypto regulation bill after Democratic opposition tanked an initial attempt to advance the measure earlier this month amid concern over ties between the digital asset industry and the Trump family.

The first-of-its-kind legislation, known as the GENIUS Act, would create a regulatory framework for stablecoins — a type of cryptocurrency tied to the value of an asset like the U.S. dollar. After the measure advanced out of the Senate Banking Committee with bipartisan support in March, Senate GOP leadership first brought the measure to the floor earlier this month. But the measure had lost Democratic support in the intervening weeks amid concerns about President Trump and his family’s business ventures involving cryptocurrency.

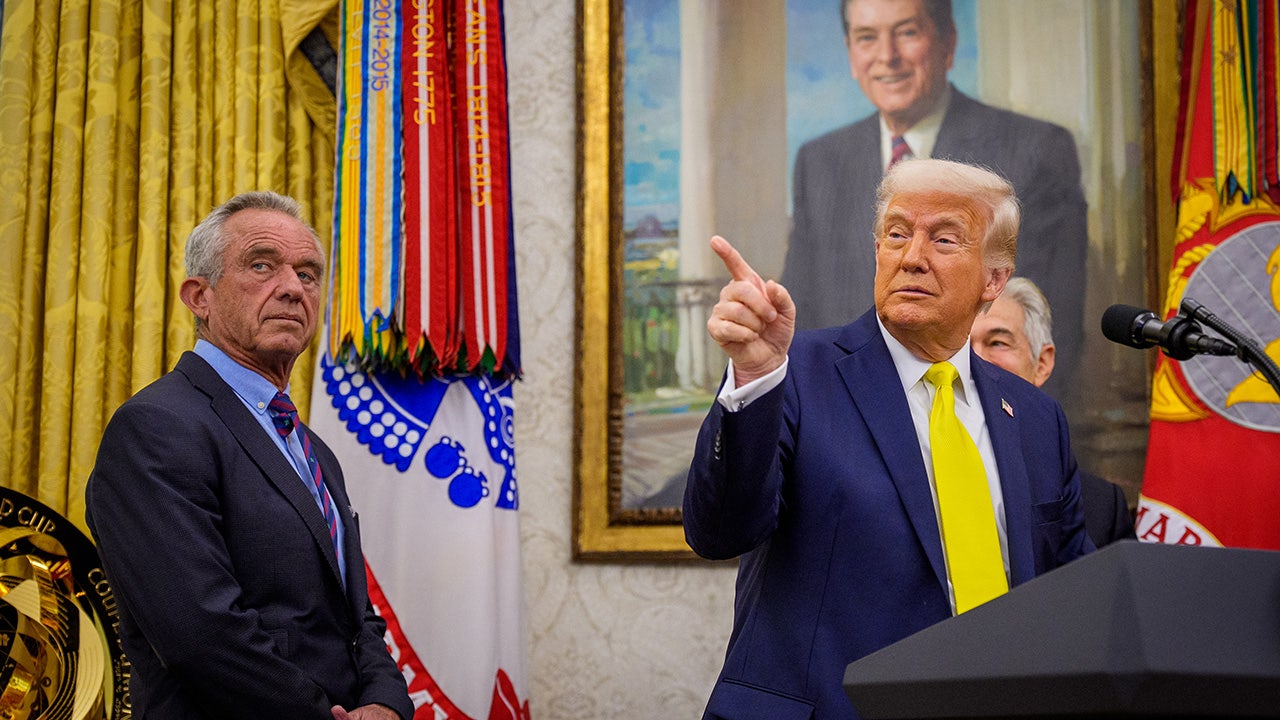

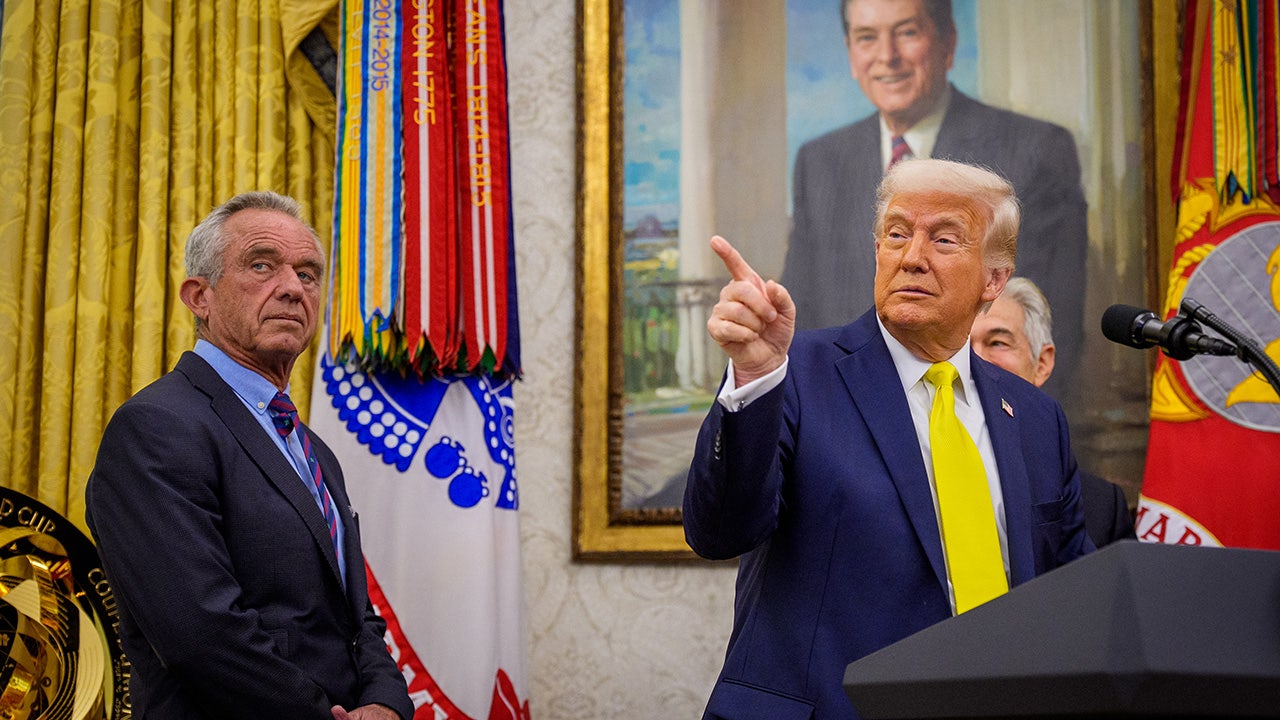

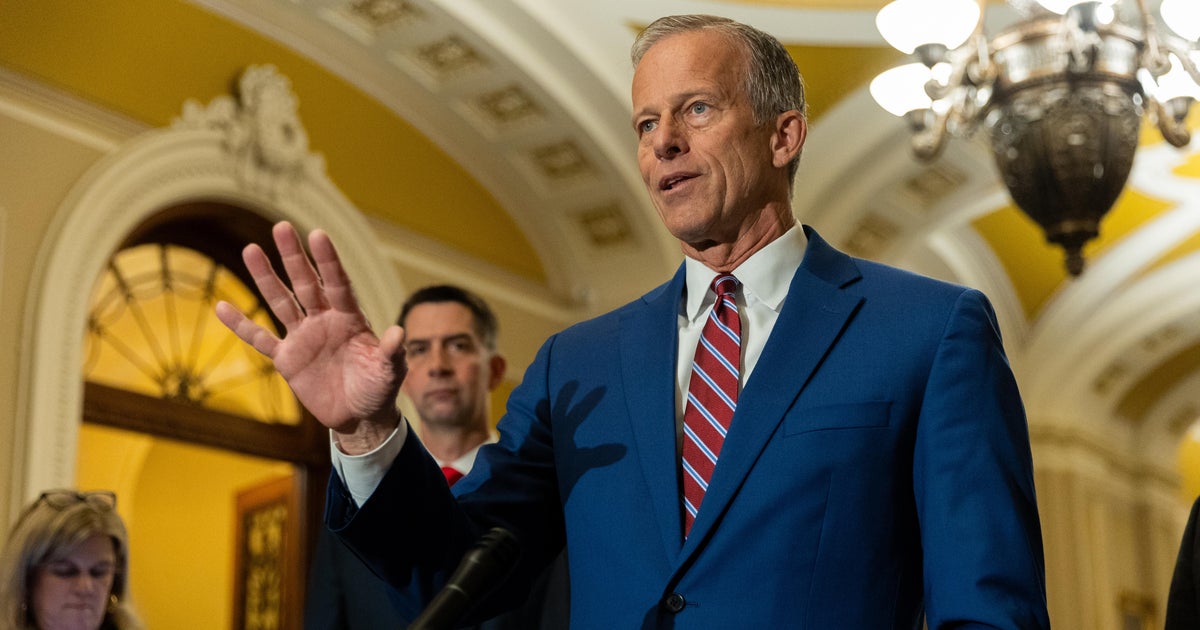

Senate Majority Leader John Thune said the upper chamber would try again to advance the legislation on Monday, while criticizing Democrats for blocking the measure from moving forward earlier this month, saying “this bill reflects the bipartisan consensus on this issue, and it’s had an open and bipartisan process since the very beginning.”

Thune, a South Dakota Republican, argued that Senate Democrats “inexplicably chose to block this legislation” earlier this month, while adding that “I’m hoping that the second time will be the charm.”

Nathan Posner/Anadolu via Getty Images

Since the failed vote earlier this month, negotiators returned to the table. And ahead of the procedural vote Monday, the measure saw backing from at least one Democrat as Sen. Mark Warner of Virginia advocated for the measure, calling it a “meaningful step forward,” though he added that it’s “not perfect.”

“The stablecoin market has reached nearly $250 billion and the U.S. can’t afford to keep standing on the sidelines,” Warner said in a statement. “We need clear rules of the road to protect consumers, defend national security, and support responsible innovation.”

Still, Warner pointed to concerns he said are shared among many senators about the Trump family’s “use of crypto technologies to evade oversight, hide shady financial dealings, and personally profit at the expense of everyday Americans,” after it was announced earlier this month that an Abu Dhabi-backed firm will invest billions of dollars in a Trump family-linked crypto firm, World Liberty Financial.

Warner said senators “have a duty to shine a light on these abuses,” but he argued “we cannot allow that corruption to blind us to the broader reality: blockchain technology is here to stay.”

Sen. Elizabeth Warren of Massachusetts, the top Democrat on the Senate Banking Committee, has been among the leading voices advocating for adding anti-corruption reforms to the legislation. Warren has outlined a handful of issues with the bill, saying that it puts consumers at risk and enables corruption. In a speech Monday on the Senate floor, Warren said her concerns have not been addressed and urged her colleagues to vote against the updated version.

“While a strong stablecoin bill is the best possible outcome, this weak bill is worse than no bill at all,” Warren said. “A bill that meaningfully strengthens oversight of the stablecoin market is worth enacting. A bill that turbocharges the stablecoin market, while facilitating the president’s corruption and undermining national security, financial stability, and consumer protection is worse than no bill at all.”

Whether the measure can advance in the upper chamber this time around remains to be seen. The measure fell short of the 60 votes necessary to move forward earlier this month, with all Senate Democrats and two Republicans — Sens. Rand Paul of Kentucky and Josh Hawley of Missouri — opposing. Paul has reservations about overregulation, while Hawley voted against the bill in part because it doesn’t prohibit big tech companies from creating their own stablecoins.

Sen. Bill Hagerty of Tennessee, who sponsored the legislation, defended the measure on CNBC’s “Squawk Box” Monday. He outlined that a lack of regulatory framework, which the bill would provide, makes for uncertainty — and results in innovative technology moving offshore. The Tennessee Republicans urged that “this will fix it,” while arguing that the bill has strong bipartisan support.

“We have broad policy agreement, Democrats and Republicans,” Hagerty said. “The question is can we get past the partisan politics and allow us to actually have a victory.”

Crypto

Bitcoin notches record weekly close after highest-ever daily close candle

Bitcoin has notched its highest-ever weekly close as crypto market momentum continues and the cryptocurrency is again nearing its all-time high.

Bitcoin (BTC) has closed at a weekly gain for the past six weeks in a row, and its most recent close at midnight UTC on May 18 was its highest weekly close ever at just below $106,500, according to TradingView.

Its last highest weekly close was in December when it reached $104,400. It later went on to reach an all-time high of $109,358 on Jan. 20, according to TradingView.

Bitcoin is now less than 3% away from its peak price and has gained 2% over the past 24 hours to trade around $104,730 at the time of writing.

Bitcoin also posted its highest-ever close in a 24-hour period on May 18. However, this is not the largest daily gain Bitcoin has made.

“Bitcoin just had its highest daily candle close… ever,” investor Scott Melker posted to X on May 19.

With a daily close above $105,000, “Bitcoin will develop a brand new higher high,” said analyst Rekt Capital.

Bitcoin’s weekly gains over the past six weeks are mirroring its gains in November when it added $30,000 in three of its largest weekly candles ever.

It has added around $12,000 so far in May, climbing from $94,000 to over $106,000 before it pulled back to around $105,400.

Related: BTC price to $116K next? Bitcoin trader sees ‘early week’ all-time high

Additionally, Arete Capital partner “McKenna” said the Coinbase premium had returned, which measures US sentiment by comparing the difference between Coinbase’s BTC/USD pair and Binance’s BTC/USDT equivalent.

The “strength of this bid on a Sunday night feels strange,” they said, adding its “possible someone knows some important news dropping next week.”

Bitcoin’s CAGR cools down

On May 18, analyst Willy Woo dived into Bitcoin’s compound annual growth rate (CAGR), noting that it was trending downward as the network continues to store more capital.

“BTC is now traded as the newest macro asset in 150 years, it’ll continue to absorb capital until it reaches its equilibrium,” he said.

Woo compared it to long-term monetary expansion of 5% and GDP growth of 3%, estimating that Bitcoin’s annual growth rate will be around 8% in around 15 to 20 years when it has settled.

“Until then, enjoy the ride because almost no publicly investable product can match BTC performance long term, even as BTC’s CAGR continues to erode.”

Magazine: Arthur Hayes $1M Bitcoin tip, altcoins ‘powerful rally’ looms: Hodler’s Digest

Mexico is suing Google over how it’s labeling the Gulf of Mexico DHS says Massachusetts city council member 'incited chaos' as ICE arrested 'violent criminal alien' A Professor’s Final Gift to Her Students: Her Life Savings President Trump takes on 'Big Pharma' by signing executive order to lower drug prices Video: Tufts Student Speaks Publicly After Release From Immigration Detention As Harvard Battles Trump, Its President Will Take a 25% Pay Cut Test Yourself on Memorable Lines From Popular Novels Why Trump Suddenly Declared Victory Over the Houthi Militia