Crypto

Fintrac imposes $6 million fine on cryptocurrency exchange Binance Holdings

OTTAWA –

The federal anti-money laundering agency has issued a $6-million fine to cryptocurrency exchange company Binance Holdings Ltd.

Fintrac says Binance failed to register with the agency as a foreign money services business.

It also says the company failed to report large virtual currency transactions of $10,000 or more in the course of a single transaction, together with the prescribed information.

Fintrac chief executive Sarah Paquet says the agency will continue to work with businesses to help them understand and comply with their obligations.

Binance announced last year that it would withdraw from the Canadian market, citing regulatory concerns.

In November, the company agreed to pay a roughly US$4-billion settlement in the U.S. after breaking U.S. anti-money laundering and sanction laws.

Crypto

Cryptocurrency Strategist Foresees Potential Bitcoin Downturn Amid Recent Dip

A seasoned cryptocurrency strategist who astutely predicted the recent downturn of Bitcoin shed some light on the potential trajectory of the infamous digital currency. If there’s any weight to the analyst’s forecast, we are possibly on the threshold of a far more substantial bearish phase in the cryptocurrency market.

Earlier in the week, the world of cryptocurrency was still basking in the glow of Bitcoin’s steady ascent beyond $70,000. Amidst the euphoria, a handful of analysts raised caution flags. Notably, the analyst known as Xanrox had taken to the renowned platform TradingView, warning of a probable nosedive in Bitcoin’s price. His augment is supported by several indicators seen recently.

Xanrox’s analysis suggested that Bitcoin’s boom could be short-lived, forecasting a crash in June rooted in the price activity observed in May. An interesting marker that gained the attention of Xanrox was the formation of what he referred to as an “FVGAP” at the $62,000 level. According to him, this could potentially trigger a bullish surge for Bitcoin down the line. The reason being, such gaps typically tend to be filled sooner rather than later, thereby indicating an impending retrace.

Furthermore, Xanrox infers from the Elliott Wave Theory that Bitcoin has completed its first upward or “impulsive” wave, Wave 1, and that Wave 2 is poised to be bullish in nature. Yet, Xanrox’s analysis expands beyond these waves, he highlights the formation of a corrective ABC pattern taking place.

Additionally intriguing is the observation of a diminutive red trend line on that chart that has already exhibited signs of waning strength. This falling trend line, added to a rising wedge pattern observed by Xanrox, acts as a strong indicator of an incoming drop in the digital currency’s value.

Xanrox’s analysis was posted on late May, and since then, Bitcoin has seen a considerable drop, now hovering below $68,000. This sharp downturn partially confirms the analyst’s prediction, thereby warranting an update on his post, outlining the potential future of Bitcoin’s pricing.

In his follow-up content, he points out yet another red trendline on the brink of a breakdown, following the first. The presence of two staggering lower trend lines paints a gloomy picture of Bitcoin’s future value. Furthermore, Xanrox indicates that Bitcoin’s price has formed a symmetrical triangle, which he predicts will also break down, leading to a fall in its price.

As for the degree of the anticipated plunge, Xanrox’s illustration signals a drop toward the $62,000 level, implying a decline of over 10%. Such a trend could cause turbulence across the wide cryptocurrency market. The analyst advises caution in the months to come, as he perceives summer as a potentially low volatility period for Bitcoin.

At present, Bitcoin is positioned a notch below $68,000 according to the latest data. In spite of suffering a significant loss of 2.7% in the past week, it’s worth noting that the cryptocurrency still showcases a promising growth of around 10.28% on a monthly basis.

Crypto

As May comes to a close, the cryptocurrency market is trending upward, leading many to anticipate the imminent arrival of the long-speculated crypto summer. With the next bull run taking shape, individuals are increasingly exploring diverse methods to profit from digital assets.

Crypto

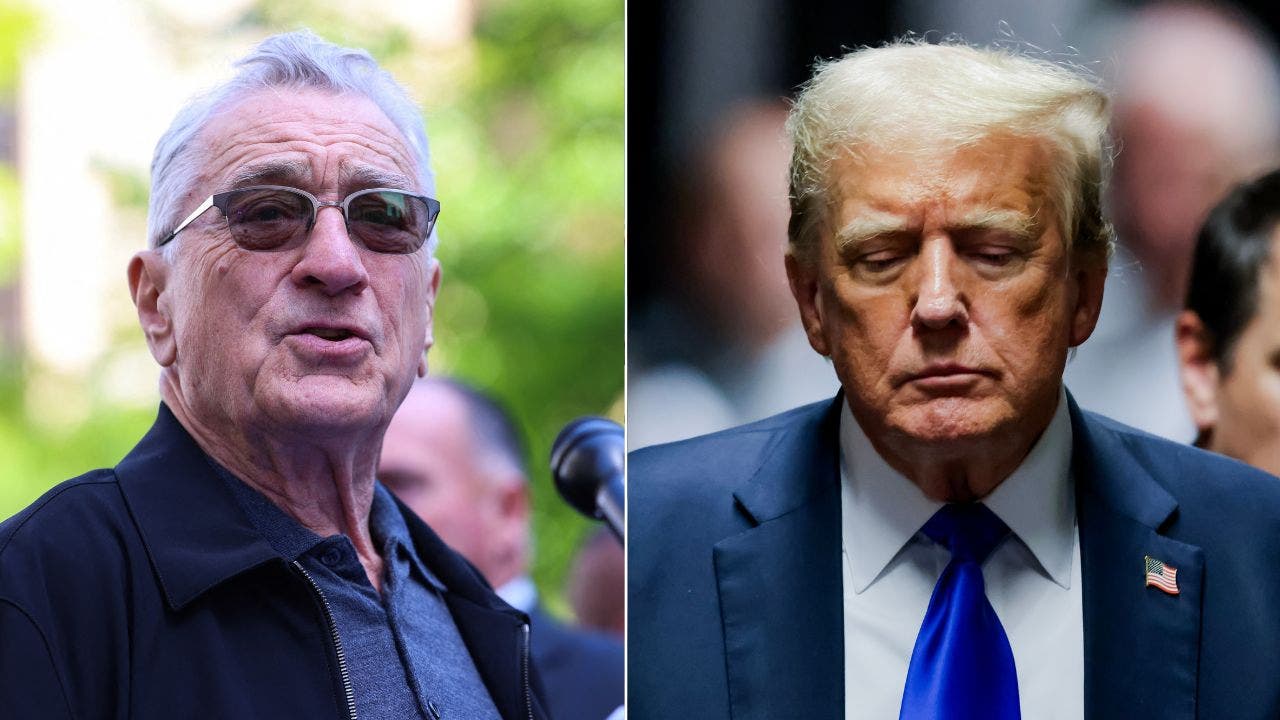

Robert Kennedy Jr. Applauds Trump's Crypto Commitment, Expresses Hope For Biden's Alignment

Presidential candidate Robert F. Kennedy Jr. has expressed his admiration for former President Donald Trump’s pro-cryptocurrency stance

What Happened: Kennedy made the remarks at the Consensus 2024 conference, CoinDesk reported Thursday.

“Commitment to crypto is a commitment to freedom and transparency,” Kennedy stated. He abstained from conjecturing whether Trump’s decision was politically driven, but expressed optimism that President Joe Biden would follow the same path.

Kennedy underscored the significance of transactional freedom and the necessity for a transparent currency. He also stressed the importance of America continuing to be the center of blockchain technology. Kennedy disclosed that he had acquired 21 bitcoins since the commencement of his campaign, in addition to purchasing three coins for each of his children.

See Also: Dogecoin Could Go To $0.322 If It Overcomes This Key Resistance Level, Analyst Notes

Furthermore, Kennedy expressed his intention, if elected, to establish cryptocurrency as a transactional currency. He voiced his conviction that cryptocurrency should be treated as a currency, not taxed as capital gains, and used for everyday purchases.

Why It Matters: Kennedy’s pro-cryptocurrency stance is not new. Earlier in March, he blamed big banks for turning Congress members against Bitcoin BTC/USD and emphasized the need for transactional freedom. He has also called cryptocurrencies the best hedge against inflation.

Interestingly enough, Trump’s view on Bitcoin was also negative around that time, in contrast to the 180-degree pivot that is currently on display.

In other news, RFKJ, the cryptocurrency themed on Kennedy, was rebranded as “BOBBY,” which Kennedy is affectionately called by his friends, family, and supporters.

Image Via Shutterstock

Price Action: At the time of writing, the PolitiFi token was trading at $0.00000259, following a 14% plunge in the last 24 hours, according to CoinMarketCap.

Read Next: Trump’s Maga Coin Jumps 7%, Coin Parodying Biden Sinks Despite Ex-President’s Conviction In Hush Money Trial —NFTs Also Show Strength

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

-

News1 week ago

News1 week agoRead Prosecutors’ Filing on Mar-a-Lago Evidence in Trump Documents Case

-

Politics1 week ago

Politics1 week agoMichael Cohen swore he had nothing derogatory on Trump, his ex-lawyer says – another lie – as testimony ends

-

News1 week ago

News1 week agoVince Fong wins special election to finish term of former House Speaker Kevin McCarthy

-

News1 week ago

News1 week agoVideo: Midwest Storms Destroy Homes

-

World1 week ago

World1 week ago€440k frozen in Italy over suspect scam by fake farmers

-

News1 week ago

News1 week agoBuy-now, pay-later returns and disputes are about to get federal oversight

-

News1 week ago

News1 week agoRead the I.C.J. Ruling on Israel’s Rafah Offensive

-

News1 week ago

News1 week agoVideo: Protesters Take Over U.C.L.A. Building