Crypto

EU signs MiCA bill into law, setting stage for comprehensive cryptocurrency regime

| Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day’s top stories directly to your inbox. Sign up here! |

(Kitco News) – After years of development, officials in the European Union have officially signed the Markets in Crypto-Assets (MiCA) bill into law, setting the stage for the EU to implement a comprehensive cryptocurrency regulatory framework.

(Kitco News) – After years of development, officials in the European Union have officially signed the Markets in Crypto-Assets (MiCA) bill into law, setting the stage for the EU to implement a comprehensive cryptocurrency regulatory framework.

On Wednesday, Roberta Metsola, the European Parliament President, and Peter Kullgren, Sweden’s minister for rural affairs, signed the regulatory framework into law, capping nearly three years of work to formulate and amend the legislation.

Now that the signing ceremony has been completed, the framework is expected to go into effect after it is published in the Official Journal of the European Union, with many of MiCA’s regulations on crypto firms likely being implemented sometime in 2024.

The European Parliament conducted its final vote on the bill in April – passing the measure by a vote of 517 in favor and 38 against – after two consecutive delays and extended debates about the finer points of the bill, which looks to create a licensing regime for digital asset service providers in the EU.

In May, the finance ministers of all 27 member states of the EU unanimously voted to approve MiCA, which advanced the bill to be signed by Metsola and Kullgren. As it stands now, MiCA remains on track to become enforceable law by the third quarter of 2024, giving affected parties in the EU time to design their systems to comply with the new law.

MiCA lays out a framework for the European Union’s approach to regulating the cryptocurrency sector. Under the text of the legislation, the issuance of cryptocurrencies will be brought under the wing of institutional regulation, and it establishes a new regime for crypto-asset service providers across the EU’s member states.

The legislation is comprehensive and far-reaching, and its implementation will be carried out in phases. Provisions related to stablecoins could come into force as soon as July 2024, while many of the other provisions won’t take effect until January 2025 at the earliest.

In addition to requiring stablecoin issuers to obtain a license and hold suitable reserves, the legislation allows central banks to intervene in companies’ proposals to issue new stablecoins, referred to in MiCA as ‘asset-referenced tokens.’

It will also require the issuance of the stablecoins to cease if the tokens reach over 1 million transactions per day.

While the road to MiCA’s passage has been long, the work is not done for legislators, as several important sectors of the cryptocurrency ecosystem are not addressed in the bill, including non-fungible tokens (NFTs) and decentralized finance (DeFi) applications.

And companies need to tread carefully until MiCA is officially implemented, as noted by the European Securities and Markets Authority (ESMA), which issued a statement last Friday directing financial firms operating in the EU to proactively inform their customers of the regulatory status of the products they offer, with crypto a particular area of concern.

“Specifically on crypto assets, while the Markets in Crypto-Assets Regulation (MiCA) is close to adoption, crypto assets offered by investment firms will continue to be unregulated in most jurisdictions until MiCA applies,” the ESMA warned.

The regulator went on to highlight that until MiCA is fully implemented across the EU, when investment firms offer both regulated and unregulated products and services, “there is a significant risk that investors may misunderstand the protections they are afforded when investing in those unregulated products and/or services,” and may believe that the protections of the regulated ones apply to the unregulated ones.

The ESMA recommends that investment firms “take all necessary measures to ensure that clients are fully aware of the regulatory status of the product/service they are receiving,” and that they “clearly disclose to clients when regulatory protections do not apply to the product or service provided.”

While the ESMA is educating companies on how to prepare for the eventual implementation of MiCA, France is looking to implement the legislation ahead of its EU-wide integration, with the French Financial Markets Authority (AMF) exploring the option of providing companies with a “fast track” option which would allow them to come into compliance with MiCA regulations as soon as possible.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.

Crypto

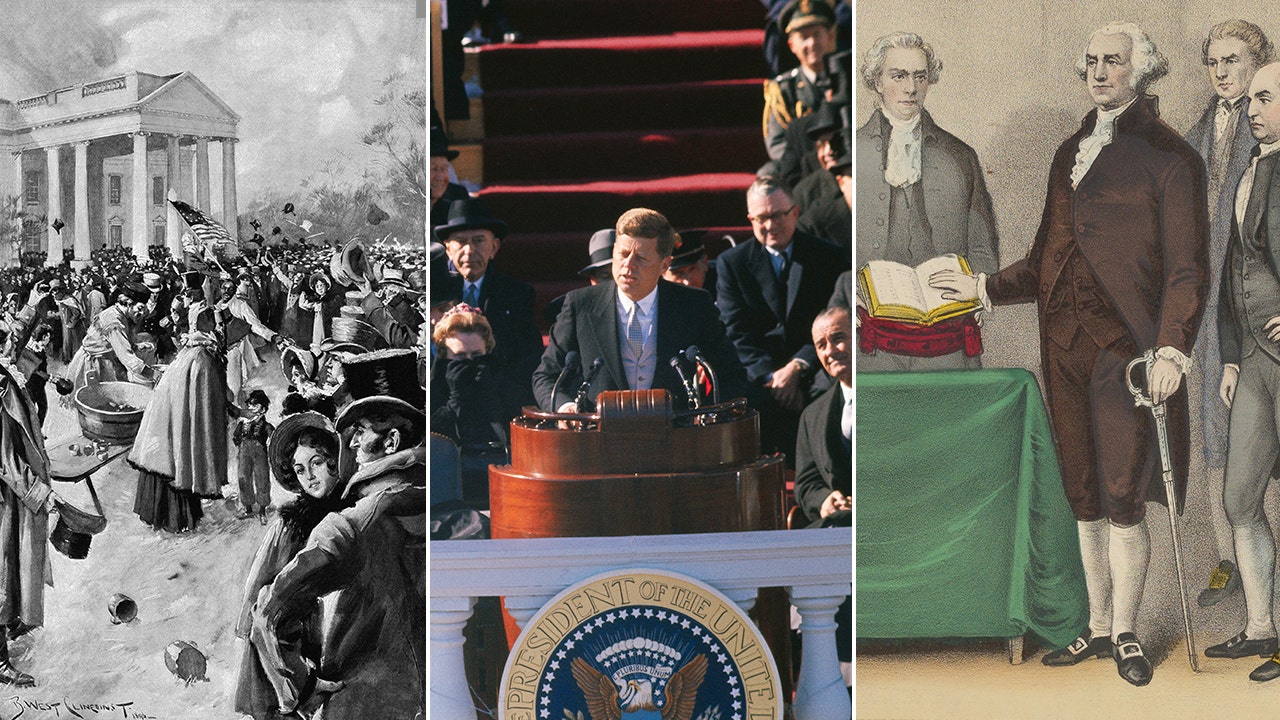

Bitcoin enthusiasm rides high as Trump prepares to take presidential office

Bitcoin adjacent stocks got a substantial lift after the cryptocurrency’s price jumped over $104,000 on Friday.

Bitcoin mining behemoth, Mara Holdings (NASDAQ: MARA) was the biggest and most vocal, climbing by 13 per cent. It was followed closely by Riot Platforms (NASDAQ: RIOT), MicroStrategy Inc (NASDAQ: MSTR) at 7 per cent and Coinbase Global Inc (NASDAQ: COIN) at 5 per cent.

The original cryptocurrency’s good fortunes have been at the behest of Donald Trump’s election victory, based on the optimistic take that the incoming administration will take a more favourable approach to crypto, and Bitcoin in particular.

In December, Trump appointed Paul Atkins to lead the Securities and Exchange Commission. Atkins, who previously served as an SEC commissioner under President George W. Bush, has recently focused on digital assets. He is set to replace Gary Gensler, widely regarded as a crypto critic. Trump will also likely replace several SEC commissioners whose terms are set to expire during his administration.

Furthermore, crypto advocates and holders will soon shape U.S. policy on the emerging technology, following a series of nominations and advisory appointments by President-elect Donald Trump, who takes office on Monday.

The crypto industry, after years of battling lawsuits and enforcement actions by the U.S. government, hopes the Trump administration will signal a policy shift. Officials will vet political appointees for potential conflicts, and some appointees have pledged to sell their interests.

The industry will host a sold-out black-tie ball in Washington on Friday, with ticket prices ranging from USD$2,500 to USD$10,000. David Sacks, serving as Trump’s artificial intelligence and crypto czar, plans to attend.

Read more: BlackRock launches Bitcoin ETF in Canada

Read more: Cryptocurrency fugitive Do Kwon extradited to US

Trump’s tenure will be cryptocurrency friendly

The reasons for the optimism surrounding the cryptocurrency’s future don’t necessarily begin and end with Trump either.

The president-elect has filled his inner-circle with a number of different cryptocurrency friendly personalities, most of whom are well-known and well-respected in the space.

Scott Bessent, a billionare hedge fund manager, is Trump’s pick for Treasury Secretary. He has expressed favourable views on cryptocurrency. According to a financial disclosure filed last month, Bessent holds shares in a BlackRock bitcoin exchange-traded fund valued between $250,001 and $500,000.

“Crypto is about freedom and the crypto economy is here to stay,” he said in July. “I think everything is on the table with bitcoin.” ‘

In a letter to the U.S. Treasury last week, Bessent stated he would divest his interests in the fund and other investments within 90 days of his confirmation.

Further, Trump selected Tesla’s chief and the world’s richest man to lead a government cost-cutting initiative called the Department of Government Efficiency (DOGE).

Elon Musk, a longtime advocate for cryptocurrencies like bitcoin and dogecoin, has significantly influenced their prices through his public comments and the actions of his companies. The acronym for Musk’s cost-cutting agency, DOGE, references dogecoin, now the seventh-largest cryptocurrency with a circulation value of $4.5 billion, according to CoinGecko.

In 2021, Tesla purchased $1.5 billion in bitcoin, making it one of the largest companies to invest in cryptocurrency before selling most of its holdings. By September 2024, Tesla reported holding $184 million in unspecified digital assets, according to a financial statement. Musk did not respond to a request for comment via Tesla regarding his personal cryptocurrency holdings.

Read more: Tether Limited sets up first brick and mortar office in El Salvador

Read more: Cryptocurrency fugitive Do Kwon extradited to US

Trump to encourage leadership in crypto

Vice President-elect J.D. Vance held between USD$250,001 and USD$500,000 in bitcoin as of August 2024, according to a financial disclosure.

Vance co-founded the venture capital firm Narya, which has invested in Strive, Ramaswamy’s asset management company, and the video platform Rumble, as indicated on its website. In November, Rumble announced plans to allocate its excess cash reserves to bitcoin. The company also received a USD$775 million investment from stablecoin firm Tether last year.

When asked for comment on the crypto stances of Vance and Trump’s sons, Trump-Vance transition spokesperson Brian Hughes stated—without providing evidence—that bureaucrats in Washington had attempted to stifle innovation with increased regulation and higher taxes.

“President Trump will deliver on his promise to encourage American leadership in crypto and other emerging technologies,” he said in a statement.

Finally, set to collaborate with Musk at DOGE, former presidential candidate and entrepreneur Vivek Ramaswamy is the founder of Strive Asset Management.

Strive reported managing over USD$1 billion in assets as of September, and filed last month to launch an exchange-traded fund (ETF) that invests in corporate bonds for bitcoin investments.

In November, the company launched a wealth management arm aimed at integrating bitcoin into Americans’ investment portfolios, according to a press release from Ramaswamy.

In June 2023, Ramaswamy disclosed holding between $100,001 and $250,000 in bitcoin and between $15,001 and $50,000 in ether, a smaller cryptocurrency.

.

Like Mugglehead on Facebook

joseph@mugglehead.com

Crypto

'Wild west of finance': Why are there cryptocurrency ATMs?

The Canberra region has about 39 cryptocurrency ATMS, but for locals who haven’t engaged with digital currency before their presence can be confusing.

Cryptocurrencies, or cryptos, are digital tokens that allow people to make payments directly to each other through an online system.

The ATMS were created as an alternative payment method to remove the middleman of banks through a de-centralised system.

When transferring crypto, thousands of computers worldwide verify the transfer, instead of one bank.

Bought and sold on digital marketplaces called exchanges, cryptocurrencies don’t have any intrinsic monetary value — they are worth whatever people are willing to pay for them at the market on a given day.

Currently, Bitcoin is both the most popular crypto and the crypto with the highest monetary value, at about $150,000 per coin.

So if the main purpose of crypto is to be digital, why do crypto ATMs exist, and are they useful?

How do they work?

There is no tangible data on how many Australians are accessing the ATMs, however as of last July, according to YouGov, about 1.3 million NSW residents, 801,000 Victorians, 850,000 Queenslanders, 294,000 South Australians, and 462,000 WA residents said they currently owned crypto.

Award-wining technology journalist and founder of technology publication Pickr, Leigh Stark, told ABC Radio Canberra the primary function of a crypto ATM is to turn real money into digital money, or vice versa.

In order to use a crypto ATM a person must already have a crypto wallet that can generate a QR code.

At a crypto ATM the digital currency can be bought, sold, or both, but Mr Stark said most only offer access to between five and 10 of the major cryptocurrencies — almost always including Bitcoin.

Selling cryptocurrency through a crypto ATM means swapping it for its current market value in cash or with a debit card.

You can also buy cryptocurrency with cash or a debit card at a crypto ATM.

Mr Stark said he didn’t know “if there’s necessarily a need” for cryptocurrency ATMs.

“I can understand why some people might want to take some of their money out of it, so effectively turning a digital coin that only exists on the internet into hard money, that kind of makes some sense to me,” he said.

“But buying crypto through it, I’m not entirely sure I understand that — largely because of the amount of exchanges that exist online.

“I feel like they would be a better approach for actually buying crypto, not even just because of the money transfer, but also because there are a lot more options for what you invest in on an online exchange.”

Loading…

Mr Stark warned taking money out from some crypto ATMs was taxable, and it was up to a user to remember and file.

“So the ATMs, effectively, they still have to abide by Australian government regulation regarding how they work,” he said

“But the whole thing about crypto and managing to take your money out of it, it qualifies as part of the capital gains tax.

“Not all crypto ATMs work that way, but if you take your money out, you have to remember what you did as a form of event, and file that information later on.”

Are Canberrans using Bitcoin ATMs?

Mr Stark said because a Bitcoin ATM usually only offered access to a selection of major cryptocurrencies, their usefulness depends on what exchanges a person invests in.

And they don’t all support selling, which is how a person can get money from them.

“Not every Bitcoin ATM works as a form of exchange, that’s for selling currency and they don’t all do that.

“In fact, far fewer support selling than they do buying.”

A Localcoin branded Bitcoin ATM in Canberra. (ABC News: David Sciasci)

Mr Stark said crypto ATMs in the Canberra region typically accepted a maximum of $25,000 in cash, but he suspected the majority of users wouldn’t be carrying that much cash with them.

But he said much smaller amounts were not uncommon.

“I mean the reality is, if you put in 20 bucks, that’s 0.000013 of a single Bitcoin,” he said.

“[But] you absolutely could buy that small amount of crypto, and that’s quite normal.”

Mr Stark said often people begin buying crypto in these very small amounts and then decide whether to buy more depending on whether its value increases.

“Crypto is kind of the wild wild west of finance, depending on what type of coin you get, whether it’s one of the big ones like Bitcoin or one of the small ones like Shiba Inu or Ethereum, or anything like that, you might end up with a small amount that spirals into a big one,” he said.

“You might be one of those success stories, it seems highly unlikely, but you could be just waiting for it to get higher and higher.”

Are they used for scams or crime?

In order to use the financial proceeds of crime, or ‘dirty money’, it first needs to be laundered to hide its illegal origins.

Cryptocurrency offers a sophisticated way to do this by turning it into digital currency.

However, every crypto transaction is recorded on a blockchain — essentially a publicly available, online ledger — so to make the dirty money truly clean, the crypto is then put through a mixer service.

These services mix cryptocurrency together from a number of different users, which obscures the transaction trails and makes it very difficult to trace the original source.

Leigh Stark says if someone is asking you to buy them Bitcoin, it’s most likely a scam. (ABC News: David Sciasci)

Mr Stark said it wouldn’t shock him if Bitcoin ATMs were being used for criminal enterprises like money laundering or money mule activities.

“I’ve not seen it, but likewise, I’ve also never seen anyone actively use a Bitcoin ATM before,” he said.

“I’ve never had a reason to, and that’s kind of the point.

“But maybe I’m coming at the wrong times, maybe there are people coming through with $25,000 at 1am and I just have no idea.”

As for using them in scams, Mr Stark said that was less about the ATMs and more about cryptocurrency as a whole.

He said if someone is asking you to get Bitcoin for them “it’s probably a scam”.

“There are a lot of different scams out there, and Australians lose billions every year, but yes, if somebody has asked you to buy them crypto or said that you need to give them crypto in order to get something in return, it’s very likely a scam,” Mr Stark said.

“Some of the Bitcoin ATMs have been used for things like that, and so now the Australian government is effectively trying to track and work out how those actually work in relation.”

Crypto

Trump to designate cryptocurrency as a national priority

As President-elect Donald Trump begins a second term on Monday, he plans to issue an executive order making cryptocurrency a national priority, Bloomberg reports.

The order is meant to guide government agencies to work with the industry and possibly pause crypto-related litigation, according to Bloomberg, which cited unnamed people familiar with the matter. Trump also plans to create a crypto advisory council to advocate for the industry’s policies, per Bloomberg, and has suggested creating a national bitcoin stockpile.

This would mark a new era for crypto, an industry that collapsed two years ago after prices crashed. The period was marked by the fall of FTX, a leading exchange that went bankrupt that year. Its founder, Sam Bankman-Fried, was convicted of defrauding customers and sentenced to 25 years in prison.

The industry resurged in 2024, boosted by Trump, a former skeptic who pledged to turn the U.S. into the crypto capital of the world. Eager for a clear governing framework and a friendlier watchdog, donors poured tens of millions of dollars into pro-crypto candidates’ campaigns.

Dogecoin, a cryptocurrency with a dog mascot and billionaire Elon Musk as a fan, surged in value after Trump won and announced a non-governmental cost-cutting group nicknamed DOGE.

Trump then nominated crypto ally Paul Atkins to lead the Securities and Exchange Commission, the federal agency that led a crackdown under the Biden administration. Bitcoin surged to $100,000 for the first time following the announcement. “CONGRATULATIONS BITCOINERS!!! $100,000!!!” Trump wrote on Truth Social. “YOU’RE WELCOME!!!”

Crypto companies and investing platforms like Coinbase, Robinhood, Kraken and Ondo Finance Inc. have made $1 million donations to his inauguration. Ripple plans to donate $5 million in the form of its own digital token, and the industry is holding an “Inaugural Crypto Ball” to support Trump, Bloomberg reports.

Trump’s business interests include World Liberty Financial, a crypto platform he and his sons launched last year with Steve Witkoff, a friend and inaugural committee co-chair who has been named special Middle East envoy. The Trumps are not employees of the business but promote it, and an entity affiliated with Trump, DT Marks DEFI LLC, is entitled to receive 75% of the revenues.

In mid-November, the Financial Times reported that Trump Media — the parent company of Trump’s social media platform, Truth Social — was in talks to buy Bakkt, a crypto trading firm previously led by Kelly Loeffler, another co-chair of his inaugural committee.

Trump’s 2024 financial disclosures show he owned as much as $5 million worth of the crypto token ethereum, a crypto token that has surged in value since the election, according to The New York Times.

Read more

about cryptocurrency

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology1 week ago

Technology1 week agoMeta is highlighting a splintering global approach to online speech

-

Science7 days ago

Science7 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg) Technology6 days ago

Technology6 days agoAmazon Prime will shut down its clothing try-on program

-

News1 week ago

News1 week agoMapping the Damage From the Palisades Fire

-

News1 week ago

News1 week agoMourners Defy Subfreezing Temperatures to Honor Jimmy Carter at the Capitol

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25826211/lorealcellbioprint.jpg) Technology6 days ago

Technology6 days agoL’Oréal’s new skincare gadget told me I should try retinol

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25832751/2192581677.jpg) Technology3 days ago

Technology3 days agoSuper Bowl LIX will stream for free on Tubi

-

Business4 days ago

Business4 days agoWhy TikTok Users Are Downloading ‘Red Note,’ the Chinese App

/cdn.vox-cdn.com/uploads/chorus_asset/file/25530683/Screenshot_2024_07_14_at_6.17.45_PM.png)