Suspected Russian menace actors have been focusing on Jap European customers within the crypto business with faux job alternatives as bait to put in information-stealing malware on compromised hosts.

The attackers “use a number of extremely obfuscated and under-development customized loaders as a way to infect these concerned within the cryptocurrency business with Enigma stealer,” Pattern Micro researchers Aliakbar Zahravi and Peter Girnus mentioned in a report this week.

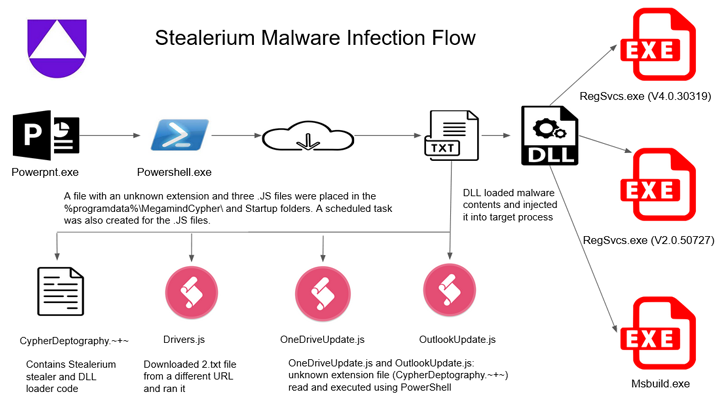

Enigma is claimed to be an altered model of Stealerium, an open supply C#-based malware that acts as a stealer, clipper, and keylogger.

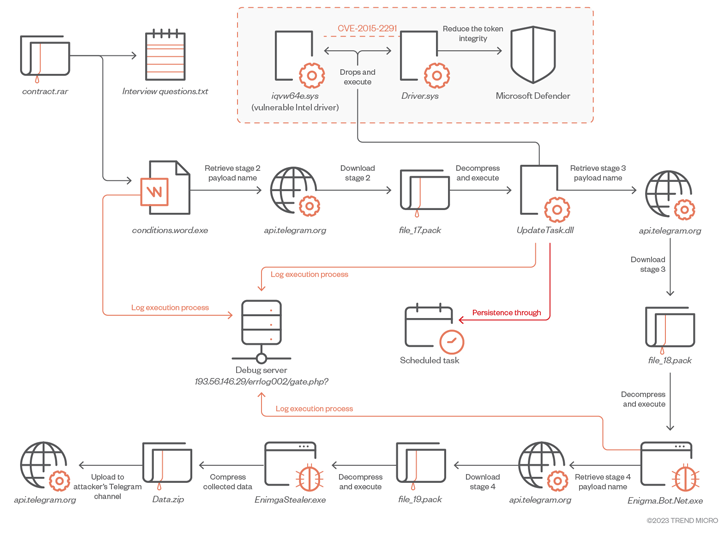

The intricate an infection journey begins with a rogue RAR archive file that is distributed through phishing or social media platforms. It incorporates two paperwork, one in all which is a .TXT file that features a set of pattern interview questions associated to cryptocurrency.

The second file is a Microsoft Phrase doc that, whereas serving as a decoy, is tasked with launching the first-stage Enigma loader, which, in flip, downloads and executes an obfuscated secondary-stage payload by means of Telegram.

“To obtain the following stage payload, the malware first sends a request to the attacker-controlled Telegram channel […] to acquire the file path,” the researchers mentioned. “This strategy permits the attacker to constantly replace and eliminates reliance on mounted file names.”

The second-stage downloader, which is executed with elevated privileges, is designed to disable Microsoft Defender and set up a third-stage by deploying a legitimately signed kernel mode Intel driver that is susceptible to CVE-2015-2291 in a method referred to as Deliver Your Personal Susceptible Driver (BYOVD).

It is price noting that the U.S. Cybersecurity and Infrastructure Safety Company (CISA) added the vulnerability to its Identified Exploited Vulnerabilities (KEV) catalog, citing proof of lively exploitation within the wild.

The third-stage payload finally paves the way in which for downloading Enigma Stealer from an actor-controlled Telegram channel. The malware, like different stealers, comes with options to reap delicate data, document keystrokes, and seize screenshots, all of which is exfiltrated again by the use of Telegram.

Bogus job presents are a tried-and-tested tactic employed by North Korea-backed Lazarus Group in its assaults focusing on the crypto sector. The adoption of this modus operandi by Russian menace actors “demonstrates a persistent and profitable assault vector.”

The findings come as Uptycs launched particulars of an assault marketing campaign that leverages the Stealerium malware to siphon private information, together with credentials for cryptocurrency wallets reminiscent of Armory, Atomic Pockets, Coinomi, Electrum, Exodus, Guarda, Jaxx Liberty, and Zcash, amongst others.

Becoming a member of Enigma Stealer and Stealerium in focusing on cryptocurrency wallets is one more malware dubbed Vector Stealer that additionally comes with capabilities to steal .RDP recordsdata, enabling the menace actors to hold out RDP hijacking for distant entry, Cyble mentioned in a technical write-up.

Assault chains documented by the cybersecurity companies present that the malware households are delivered by means of Microsoft Workplace attachments containing malicious macros, suggesting that miscreants are nonetheless counting on the tactic regardless of Microsoft’s makes an attempt to shut the loophole.

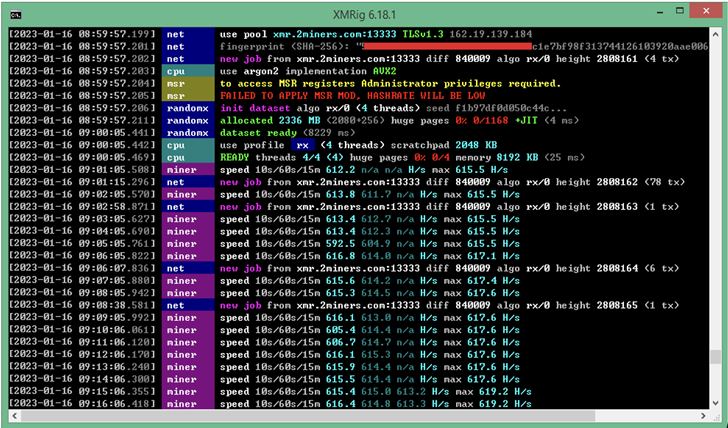

An identical technique has additionally been put to make use of to deploy a Monero crypto miner in opposition to the backdrop of a cryptojacking and phishing marketing campaign aimed toward Spanish customers, in accordance with Fortinet FortiGuard Labs.

The event can also be the most recent in a protracted record of assaults which are aimed toward stealing victims’ cryptocurrency belongings throughout platforms.

This contains a “quickly evolving” Android banking trojan known as TgToxic, which plunders credentials and funds from crypto wallets in addition to financial institution and finance apps. The continuing malware marketing campaign, lively since July 2022, is directed in opposition to cell customers in Taiwan, Thailand, and Indonesia.

“When the sufferer downloads the faux app from the web site given by the menace actor, or if sufferer tries to ship a direct message to the menace actor by means of messaging apps reminiscent of WhatsApp or Viber, the cybercriminal deceives the person into registering, putting in the malware, and enabling the permissions it wants,” Pattern Micro mentioned.

The rogue apps, apart from abusing Android’s accessibility providers to hold out the unauthorized fund transfers, can also be notable for abusing reliable automation frameworks like Easyclick and Auto.js to carry out clicks and gestures, making it the second Android malware after PixPirate to include such workflow IDEs.

However social engineering campaigns have additionally gone past social media phishing and smishing by organising convincing touchdown pages that imitate common crypto providers with the objective of transferring Ethereum and NFTs from the hacked wallets.

This, in accordance with Recorded Future, is achieved by injecting a crypto drainer script into the phishing web page which lures victims into connecting their wallets with profitable presents to mint non-fungible tokens (NFTs).

Such ready-made phishing pages are being bought on darknet boards as a part of what’s referred to as a phishing-as-a-service (PhaaS), allowing different actors to lease out these packages and swiftly enact malicious operations at scale.

“‘Crypto drainers’ are malicious scripts that operate like e-skimmers and are deployed with phishing strategies to steal victims’ crypto belongings,” the corporate mentioned in a report revealed final week, describing the scams as efficient and rising in recognition.

“Using reliable providers on crypto drainer phishing pages could improve the chance that the phishing web page will move an in any other case savvy person’s ‘rip-off litmus take a look at.’ As soon as crypto wallets have been compromised, no safeguards exist to forestall the illicit switch of belongings to attackers’ wallets.”

The assaults come at a time when felony teams have stolen a record-breaking $3.8 billion from crypto companies in 2022, with a lot of the spike attributed to North Korean state-sponsored hacking crews.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)