Crypto

CoinFlip expands cryptocurrency trading service to Washington state

Might 11—CoinFlip has expanded its on-line cryptocurrency buying and selling service to Washington state.

The Chicago-based cryptocurrency funding companies firm introduced Tuesday it launched CoinFlip Commerce Desk in Washington as half of a bigger enlargement that features 4 different states: Alabama, Alaska, New Mexico and Rhode Island.

“Bringing our companies to almost each state within the U.S. is integral for us as we proceed to construct a complete platform for the digital economic system,” Ben Weiss, CEO and co-founder of CoinFlip, stated in an announcement. “It’s important that we increase our assets so we will finest serve our communities at a grassroots degree, a main goal as we glance forward.”

Commerce Desk, established in 2020, connects prospects with account managers who’re capable of reply questions and supply assist. Clients are capable of buy cryptocurrency by way of wire or checking account transfers on the buying and selling platform.

CoinFlip was based in 2015 by Daniel Polotsky, Kristoffer Dayrit, Alan Gurevich and Benjamin Weiss. The corporate operates greater than 3,500 cryptocurrency kiosks in 49 states, along with its on-line buying and selling platform.

Crypto

Bitcoin rally loses steam in final days of record-breaking year

The largest token changed hands at US$96,200 as of 2pm Friday in Hong Kong, partly paring a retreat of almost 3 per cent from a day earlier. Smaller rivals including ether and dogecoin, a favourite of the meme crowd, oscillated in tight ranges.

The crypto market is also braced for the expiry of a substantial quantity of bitcoin and ether options contracts on Friday – one of the biggest such events in the history of digital assets, according to prime broker FalconX.

The notional value of the bitcoin contracts on the Deribit exchange – one of the largest for digital-asset derivatives – exceeds US$14 billion, while the equivalent figure for ether is about US$3.8 billion.

Sean McNulty, director of trading at liquidity provider Arbelos Markets, flagged the risk of a “choppy market” amid the expiry of the derivatives positions.

Crypto

Russian Companies Reportedly Using Crypto for International Payments | PYMNTS.com

Russian businesses are reportedly using bitcoin and other cryptocurrencies to make international payments.

It’s a trend that comes in the wake of legislative changes that permitted these types of payments to get around western sanctions, Reuters reported Tuesday (Dec. 26), citing comments from Russian Finance Minister Anton Siluanov.

As the report noted, the sanctions — issued following Russia’s invasion of Ukraine in 2022 — have made it tougher for Russia to trade with partners like China and Turkey. But this year, Russia began allowing crypto for foreign trades, and is working on legalizing the mining of crypto such as bitcoin.

“As part of the experimental regime, it is possible to use bitcoins, which we had mined here in Russia (in foreign trade transactions),” Siluanov told Russia 24 television channel.

“Such transactions are already occurring. We believe they should be expanded and developed further. I am confident this will happen next year,” he said, adding that using digital currencies to make international payments represent the future.

PYMNTS explored this idea earlier this week in a report on events in the cryptocurrency/blockchain world in the past year.

“Cross-border payments, historically plagued by high fees and slow transaction times, underwent a significant transformation in 2024,” that report said. “Blockchain technology emerged as a key enabler, offering transparency, speed and cost efficiency.”

Stablecoins play a key role, PYMNTS added, letting businesses bypass traditional correspondent banking networks and settle transactions almost instantly.

“Blockchain technology and public blockchains in particular, are opening up a number of new use cases, one of which is to transfer value — such as remittances — from one country to another,” Raj Dhamodharan, executive vice president, blockchain and digital assets at Mastercard, told PYMNTS.

Research by PYMNTS Intelligence has found that cryptocurrency use in making cross-border payments could be the winning use case that the sector has been searching for. The research shows that blockchain-based cross-border solutions, especially stablecoins, are being increasingly used by firms looking for better ways to transact and expand internationally.

“Blockchain solutions and stablecoins — I don’t like to use the term crypto because this is more about FinTech — they’ve found product-market fit in cross-border payments,” Sheraz Shere, general manager of payments and commerce at Solana Foundation, said in an interview here earlier this year. “You get the disintermediation, you get the speed, you get the transparency, you get extremely low cost.”

Crypto

Markets Show Resilience Ahead of End-of-Year Options Expirations: Bybit x Block Scholes Crypto Derivatives Report

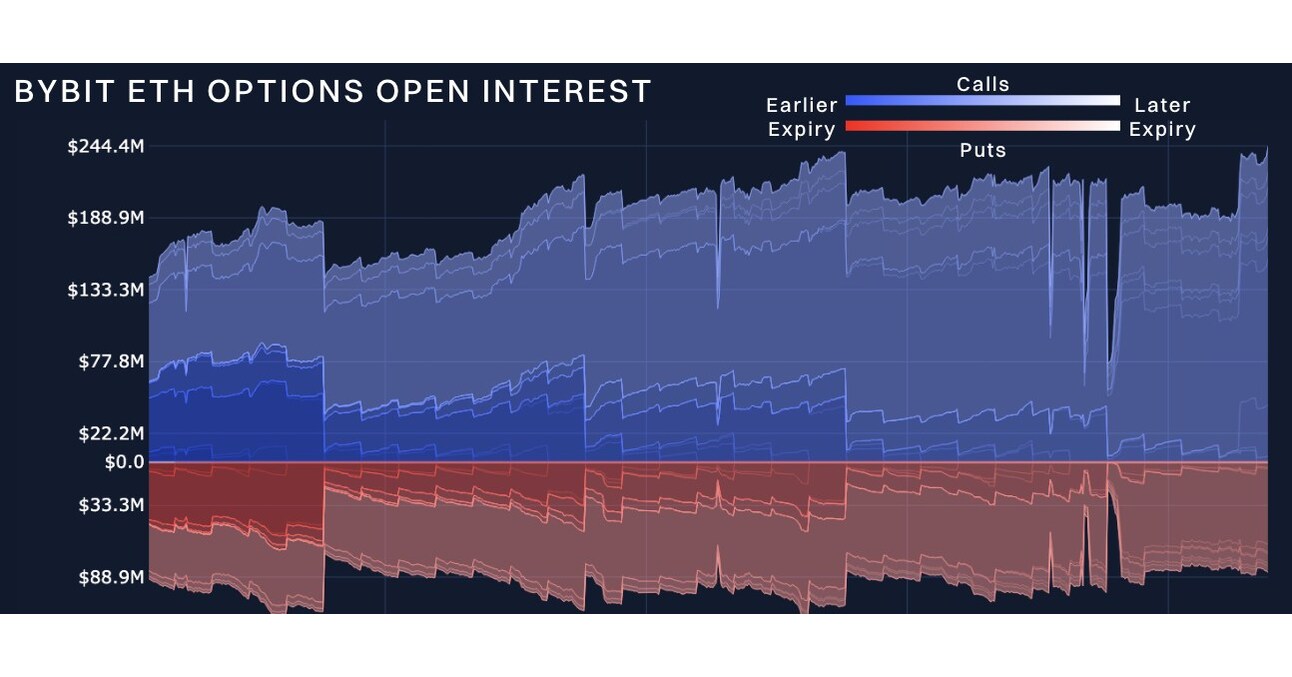

DUBAI, UAE, Dec. 26, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released the latest Crypto Derivatives Analytics Report in collaboration with Block Scholes, highlighting the muted market volatility despite major options expirations on Friday. BTC and ETH’s realized volatility has increased, but short-term options haven’t adjusted to this change. This indicates that while spot prices are fluctuating, the options market is not fully reacting to these shifts, although BTC and ETH volumes have displayed slightly different patterns.

Sources: Bybit, Block Scholes

With more than $525 million in BTC and ETH options contracts expiring on Dec 27, 2024’s end-of-year options expiration looks set to be one of the biggest yet, yet expectations for volatility have remained subdued. The report highlights an unusual inversion in ETH’s volatility structure, but BTC has not mirrored the reaction. Additionally, a change in funding rates—sometimes turning negative as spot prices drop—signals a new market phase. Notably, BTC’s volatility structure has been less responsive to changes in spot prices, whereas ETH’s short-term options are exhibiting more noticeable fluctuations.

Key Findings:

BTC Options Expirations:

In the past month, BTC’s realized volatility has been higher than implied volatility on three occasions, each time reaching a relatively calm equilibrium. Open interest in BTC options remains high, contributing to potential increased volatility as we near the end of the year. Around $360 million worth of BTC options (both puts and calls) are set to expire soon, which can affect price movement.

ETH Options: Calls Dominate

Despite a mid-week inversion, ETH’s volatility term structure has flattened, maintaining levels similar to those seen over the past month. In the final week of 2024, calls overwhelmed puts in open interest in ETH options, although market movements and trading activities are more on the put side.

Access the Full Report:

Gain deeper insights and explore the potential impacts on your crypto trading strategies by downloading the full report here: Bybit X Block Scholes Crypto Derivatives Analytics Report (Dec 24, 2024)

#Bybit / #BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2587821/Sources_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology6 days ago

Technology6 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News7 days ago

News7 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics7 days ago

Politics7 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment1 week ago

Entertainment1 week ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle1 week ago

Lifestyle1 week agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology2 days ago

Technology2 days agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

News4 days ago

News4 days agoFrance’s new premier selects Eric Lombard as finance minister