Crypto

Cathie Wood is still a Bitcoin evangelist but she’s getting candid about what she got wrong: ‘We tempered a few assumptions’

The founder and CEO of ARK Funding Administration stated Thursday that she and her crew misjudged the uptake of the cryptocurrency—or a minimum of the timing of it—by corporations and governments. Her agency has invested closely in Bitcoin and continues to wager on its eventual rise to meteoric heights.

“We tempered a couple of assumptions,” she informed Bloomberg Radio on Thursday. “We thought that—led by Tesla, Block (previously Sq.), and MicroStrategy—extra firms would put Bitcoin on their steadiness sheets. We’ve dialed that one down significantly. And the identical factor with nation states.”

Bitcoin misplaced practically 65% of its worth over 2022, ending the yr at about $16,500. It at the moment stands at simply over $23,500.

Corporations holding Bitcoin, not surprisingly, took a beating final yr. Tesla for instance stated in a regulatory submitting this week that it registered a $204 million impairment loss on its Bitcoin holdings in 2022. Because the cryptocurrency plunged, it offered 75% of its holdings final yr.

In the meantime few governments have been wanting to comply with the lead of El Salvador, which in 2021 grew to become the primary nation to undertake Bitcoin as authorized tender. A Bloomberg article in November final yr carried the headline, “El Salvador’s $300 Million Bitcoin ‘Revolution’ Is Failing Miserably.”

“Different international locations will most likely not transfer as shortly as they could have if El Salvador had had a grand swoosh proper off the bat,” stated Wooden. “We do suppose it would occur, it’s simply we’ve pushed it out a bit.”

As for why it would occur, she famous the inflation and financial crises folks have suffered as a result of governments’ financial responses to the pandemic. “Properly, the place do these folks go for an insurance coverage coverage in opposition to an implosion of their buying energy and wealth? It’s in one thing like Bitcoin. Bitcoin is an insurance coverage coverage,” she stated.

Wooden acknowledged that 2022 was a “horrible yr for all the things crypto.” However she stated it was “the centralized, opaque gamers” like crypto alternate FTX that went bankrupt. Bitcoin, against this, “is a rules-based digital financial system, and it’s international, and there’s no human intervention,” she stated.

FTX founder Sam Bankman-Fried didn’t like Bitcoin as a result of “it’s clear and decentralized. He couldn’t management it,” Wooden stated in December.

Wooden is sticking to her prediction that Bitcoin will see a fast rise in worth within the coming years. In 5 years, she stated, it would hit “roughly $670,000, one thing like that, after which by 2030, as we see extra use instances and extra of those insurance coverage insurance policies taken out in opposition to fiscal and coverage regimes that aren’t wholesome, we expect it may go a $1 million.”

Loads of doubters have questioned her prediction. As Bloomberg host Carol Massar famous to Wooden, “Persons are saying to me, ‘Actually? Does she actually keep on with this?’”

Mark Mobius, the billionaire co-founder of Mobius Capital Companions, predicted in December that Bitcoin would fall to $10,000 sooner or later this yr.

And this week, Warren Buffett’s right-hand man Charlie Munger argued in a Wall Avenue Journal op-ed {that a} “cryptocurrency will not be a foreign money, not a commodity, and never a safety. As a substitute, it’s a playing contract with an almost 100% edge for the home.”

Munger, who as soon as referred to as Bitcoin “rat poison,” stated the U.S. ought to comply with China’s lead and go legal guidelines that forestall each crypto buying and selling and the formation of latest cryptocurrencies.

Learn to navigate and strengthen belief in your enterprise with The Belief Issue, a weekly publication analyzing what leaders have to succeed. Join right here.

Crypto

Markets Show Resilience Ahead of End-of-Year Options Expirations: Bybit x Block Scholes Crypto Derivatives Report

DUBAI, UAE, Dec. 26, 2024 /PRNewswire/ — Bybit, the world’s second-largest cryptocurrency exchange by trading volume, released the latest Crypto Derivatives Analytics Report in collaboration with Block Scholes, highlighting the muted market volatility despite major options expirations on Friday. BTC and ETH’s realized volatility has increased, but short-term options haven’t adjusted to this change. This indicates that while spot prices are fluctuating, the options market is not fully reacting to these shifts, although BTC and ETH volumes have displayed slightly different patterns.

Sources: Bybit, Block Scholes

With more than $525 million in BTC and ETH options contracts expiring on Dec 27, 2024’s end-of-year options expiration looks set to be one of the biggest yet, yet expectations for volatility have remained subdued. The report highlights an unusual inversion in ETH’s volatility structure, but BTC has not mirrored the reaction. Additionally, a change in funding rates—sometimes turning negative as spot prices drop—signals a new market phase. Notably, BTC’s volatility structure has been less responsive to changes in spot prices, whereas ETH’s short-term options are exhibiting more noticeable fluctuations.

Key Findings:

BTC Options Expirations:

In the past month, BTC’s realized volatility has been higher than implied volatility on three occasions, each time reaching a relatively calm equilibrium. Open interest in BTC options remains high, contributing to potential increased volatility as we near the end of the year. Around $360 million worth of BTC options (both puts and calls) are set to expire soon, which can affect price movement.

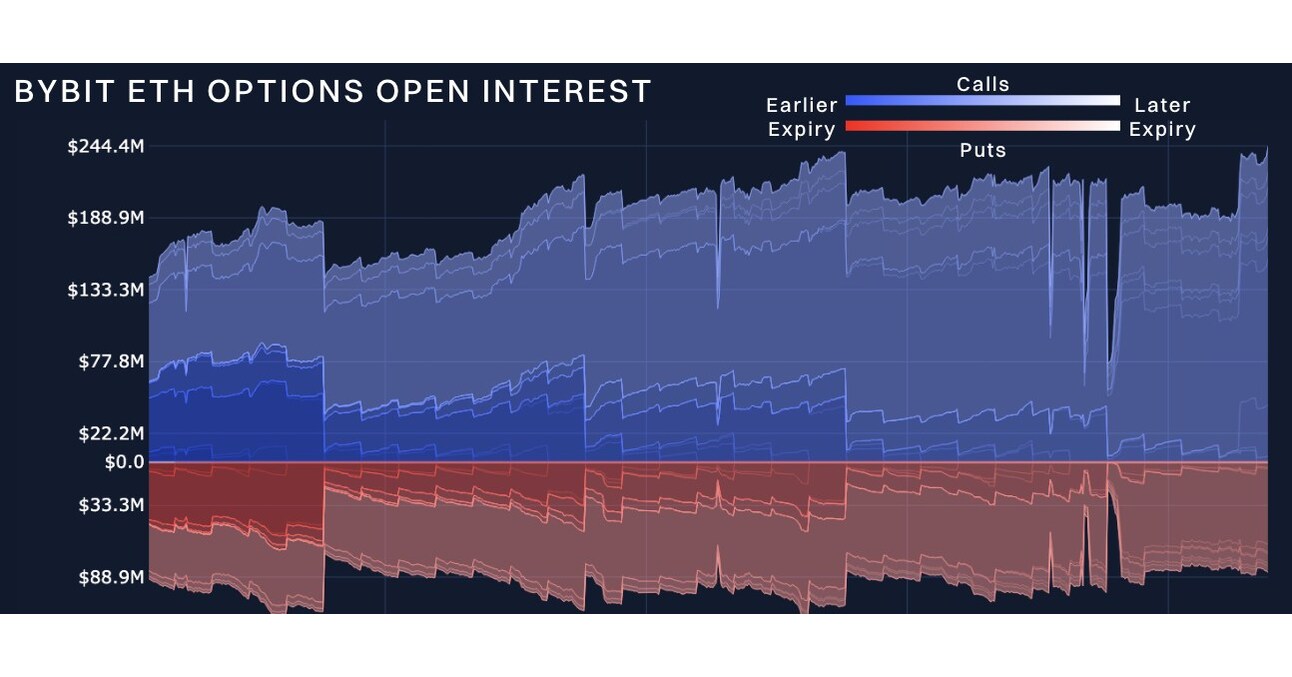

ETH Options: Calls Dominate

Despite a mid-week inversion, ETH’s volatility term structure has flattened, maintaining levels similar to those seen over the past month. In the final week of 2024, calls overwhelmed puts in open interest in ETH options, although market movements and trading activities are more on the put side.

Access the Full Report:

Gain deeper insights and explore the potential impacts on your crypto trading strategies by downloading the full report here: Bybit X Block Scholes Crypto Derivatives Analytics Report (Dec 24, 2024)

#Bybit / #BybitResearch

About Bybit

Bybit is the world’s second-largest cryptocurrency exchange by trading volume, serving a global community of over 60 million users. Founded in 2018, Bybit is redefining openness in the decentralized world by creating a simpler, open and equal ecosystem for everyone. With a strong focus on Web3, Bybit partners strategically with leading blockchain protocols to provide robust infrastructure and drive on-chain innovation. Renowned for its secure custody, diverse marketplaces, intuitive user experience, and advanced blockchain tools, Bybit bridges the gap between TradFi and DeFi, empowering builders, creators, and enthusiasts to unlock the full potential of Web3. Discover the future of decentralized finance at Bybit.com.

For media inquiries, please contact: [email protected]

For more information, please visit: https://www.bybit.com

For updates, please follow: Bybit’s Communities and Social Media

Discord | Facebook | Instagram | LinkedIn | Reddit | Telegram | TikTok | X | Youtube

Photo – https://mma.prnewswire.com/media/2587821/Sources_Bybit_Block_Scholes.jpg

Logo – https://mma.prnewswire.com/media/2267288/Logo.jpg

Crypto

WSJ “Trump's Emphasis on Cryptocurrency and AI Highlights Need for Renewable Energy”

There is a prospect that the renewable energy industry could be revitalized due to President-elect Donald Trump’s proactive stance on cryptocurrency and artificial intelligence (AI).

On the 25th (local time), the Wall Street Journal (WSJ) highlighted the power consumption involved in AI and cryptocurrency mining businesses, predicting a need for more power sources. Senator Kevin Cramer told the Wall Street Journal, “We don’t have enough electricity for servers used in AI or cryptocurrency,” emphasizing the need for as much energy as possible, including not only fossil fuels but also renewable energy.

President-elect Trump has so far taken a negative stance on the ‘climate crisis’ and its solution, renewable energy, but it is explained that this position could change. The media noted, “Trump has previously criticized electric vehicles, but he shifted his stance after getting closer to Elon Musk, CEO of Tesla. Trump’s stance on renewable energy could also be relaxed.”

Crypto

1 Top Cryptocurrency to Buy Before It Soars 1,500%, According to Cathie Wood | The Motley Fool

Is Cathie Wood onto something huge with her latest crypto forecast? Find out why she expects unstoppable growth ahead.

It’s no secret that growth investing mastermind Cathie Wood expects big things from Bitcoin (BTC 0.05%). The Ark Invest fund manager started talking about crypto before she was a household name, and has recently doubled down on her bullish projections again.

In a Bloomberg TV interview last Thursday, Wood reiterated a Bitcoin price target of $1.0 to $1.5 million by the year 2030. But that’s not the whole story. The cool part of Cathie Wood’s Bitcoin coverage is that she keeps explaining her investment thesis in greater detail over time.

Last week’s interview was no exception. So let’s check out Cathie Wood’s latest nuggets of Bitcoin-friendly economic theory.

Why Cathie Wood sees Bitcoin as a bargain buy at $100,000

First, Wood noted that the probability of reaching her existing Bitcoin price targets has increased in 2024. Institutional investors are finally taking digital assets seriously, assisted by new tools like the spot Bitcoin exchange-traded funds (ETFs) that launched in January. Their Bitcoin investments should make a big difference to the asset’s price and stability over the next few years.

“[Large investors] must consider an allocation” these days, because there is a hard cap on Bitcoin production in the long run.

94.3% of all Bitcoin that will ever exist has already been produced and is sitting in crypto wallets around the world. You can’t grab a large slice of the total Bitcoin pie by making or finding more of it as one might do with physical assets such as gold or oil. The iron-fisted law of supply and demand should inevitably drive the price of this limited asset higher, so financial institutions should start building their Bitcoin portfolios before it gets expensive.

In this context, $100,000 per coin doesn’t qualify as “expensive.” Remember, the long-term target price is measured in millions of dollars. Cathie Wood is playing the long game here.

Bitcoin is a valuable accounting tool

Wood also explained that Bitcoin is more than a speculative asset. Rather than the next value-free “tulip bulb craze,” Bitcoin is serving a significant purpose for people who aren’t just expecting it to gain value over time.

“It’s a global monetary system that is rules-based,” she said. “It is private, it is digital, it is decentralized, and it is backed by the largest [computer system] in the world. It’s the most secure network in the world.”

Bitcoin is similar to a global and very detailed accounting system that tracks all the gold in the world, assigning an owner to every sliver of a gold nugget and protects the data with several layers of cryptography. You can’t cancel or change any transactions or ownership records without essentially breaking Bitcoin’s transaction-recording platform. The asset being tracked in this case is not a physical chunk of noble metal, but the computing work that went into generating a unique digital token.

There is an unknown but very real limit to the amount of physical gold in the world, until entrepreneurs find additional sources on asteroids or other planets. At the same time, there will simply never be more than 21 million Bitcoin tokens, and 19.6 of them are already in circulation. In the long run, this system is almost free from inflation — assuming its security holds up against new attack ideas such as quantum computing algorithms.

Cathie Wood is taking the mystery out of her investment thesis for Bitcoin. Image source: Getty Images.

Bitcoin vs. Gold: Different inflation effects

Cathie Wood also highlighted how this inflation-proofing approach differs from gold.

“When the gold price goes up, production goes up — the rate of increase in the supply goes up,” she said. “That cannot happen with Bitcoin. It is mathematically metered to go up 0.9% per year for the next four years, and then the supply growth will be cut in half again.”

Indeed, physical gold mining tends to become more common when the metal’s price is high. Miners want to take advantage of this valuable asset when it makes the most economic sense. The equation is different for Bitcoin miners, who will produce smaller and smaller chunks of the digital asset over time. So the cost of minting new Bitcoins will increase while the number of new coins introduced to the market slows down.

So it’s smarter to put in a maximum production effort as quickly as possible, because the return on your mining machinery and electric power investment will only shrink over the years. The same logic suggests that buying Bitcoin early will be more profitable in the long run. Waiting for a lower buy-in price or easier Bitcoin mining environment almost never makes sense.

Why Bitcoin may deserve a spot in your portfolio

So Cathie Wood underscored her 5-year Bitcoin target of at least $1 million per coin, and she offered more detail on her underlying investment thesis.

Other Bitcoin investors may work with different assumptions that result in various target prices, but the overall market tenor is pretty consistent. Bitcoin looks ready to rise from the recent $100,000 pricing milestone. From major banks to ordinary nest-egg builders, most investors should pay serious attention to these newfangled cryptographic tokens.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology5 days ago

Technology5 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News6 days ago

News6 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics6 days ago

Politics6 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment1 week ago

Entertainment1 week ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle7 days ago

Lifestyle7 days agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

Technology1 week ago

Technology1 week agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png) Technology2 days ago

Technology2 days agoThere’s a reason Metaphor: ReFantanzio’s battle music sounds as cool as it does

-

News3 days ago

News3 days agoFrance’s new premier selects Eric Lombard as finance minister

![[Analysis] “Cryptocurrency Holders Surge Over the Past Two Years” [Analysis] “Cryptocurrency Holders Surge Over the Past Two Years”](https://media.bloomingbit.io/prod/news/0eb0e2f0-759d-451b-9469-9e34bbdfbd33.webp)