Business

L.A. Times Executive Editor Terry Tang solidifies leadership position

Terry Tang, who has been leading the Los Angeles Times newsroom since late January on an interim basis, has been formally named executive editor.

The Times’ owners, Dr. Patrick and Michele Soon-Shiong, made the announcement Monday.

Since being tapped as interim executive editor, Tang moved rapidly to reorganize the newsroom, form her own leadership team and put a heavier emphasis on traditional news gathering.

Tang is the first female editor in The Times’ 142-year history.

“Terry in short order has demonstrated the capability of building on our legacy of excellence in journalism with stories that matter,” the Soon-Shiongs said in a statement. “She understands our mission to be a thriving pillar of democracy and the critical role that the L.A. Times’ voice plays — to our city, and to the world — in bringing attention to issues that matter most, especially for those whose voices are often unheard.”

The Soon-Shiongs acquired The Times in June 2018 and embarked on an expensive revitalization, which saw the paper’s newsroom swell to more than 550 journalists, the launch of a TV show in partnership with Charter’s Spectrum cable service and a new Times campus built in El Segundo near Los Angeles International Airport.

But the ambitious turnaround plan encountered turbulence amid shifts in advertising, accelerated by the COVID-19 pandemic, print circulation losses and last year’s Hollywood strikes.

The family’s financial losses mounted.

Soon-Shiong and his family have covered more than $100 million in operational losses and capital expenses since the acquisition, the owner has said. The family has reiterated its commitment to The Times, including subsidizing its operations and covering its losses.

But layoffs and cutbacks were ordered, and during the last year the newsroom shrank by nearly 200 journalists to about 400.

The cuts come at a challenging time in the news industry as traditional outlets struggle against economic head winds. The Washington Post, CNN, NBC News and NPR all have shed hundreds of journalists in the last year. Local news outlets have been hit particularly hard; a recent report found that more than 2,500 journalism jobs were eliminated in 2023.

In January, Soon-Shiong called for a new direction and a new leader to settle a newsroom that had been roiled by two rounds of substantial layoffs, a one-day strike by the newsroom guild and the loss of its top editors.

In turning to Tang, a respected journalist who earlier in her career worked at the New York Times, Soon-Shiong selected a leader with whom he had already established trust.

Tang promoted longtime editor Hector Becerra to managing editor, and he tapped city editor Maria L. La Ganga to be deputy managing editor for California and Metro.

Before becoming interim editor, Tang led the Opinion section for nearly two years after joining The Times in 2019 as deputy op-ed editor. Tang will continue to oversee Opinion. She will work with Deputy Editorial Page Editor Mariel Garza, who leads the editorial board; and Deputy Op-Ed Editor Susan Brenneman, who oversees the op-ed page.

Tang, 65, has deep roots in Southern California. She was born in Taipei, Taiwan, and her family spent a few years in Japan before immigrating to Los Angeles when she was 6. Her father worked in administration for Continental Airlines, and the family settled near LAX in Gardena, where Tang and her sister attended public schools.

She graduated from Yale University with a bachelor’s degree in economics and earned her law degree from the New York University School of Law. She served as a Nieman Fellow at Harvard University in the early 1990s.

Before joining The Times, she worked two years at the American Civil Liberties Union, where she served as director of publications and editorial. Before that, she worked at the New York Times for 20 years in a variety of roles in opinion and on the news side of the operation, including as deputy technology editor; metro desk major beats editor; and co-founder of a previous online platform for commentary.

She replaces Kevin Merida, who left in January.

“The Los Angeles Times and its superb journalists make a difference every day in the life of California and this nation,” Tang said Monday in a statement. “It’s an honor to have the opportunity to lead an institution that serves our community and to make our work indispensable to our readers.”

Tang’s elevation comes less than two weeks before the Los Angeles Times Festival of Books, one of the signature events the organization hosts for the community.

Tang “understands how vital it is that we connect the community with our journalism, better engage with our readers and build new audiences as we seek to transform The Times into a self-sustaining institution,” the Soon-Shiongs said in the statement.

Business

Column: Exxon Mobil is suing its shareholders to silence them about global warming

You wouldn’t think that Exxon Mobil has to worry much about being harried by a couple of shareholder groups owning a few thousand dollars worth of shares between them — not with its $529-billion market value and its stature as the world’s biggest oil company.

But then you might not have factored in the company’s stature as the world’s biggest corporate bully.

In February, Exxon Mobil sued the U.S. investment firm Arjuna Capital and Netherlands-based green shareholder firm Follow This to keep a shareholder resolution they sponsored from appearing on the agenda of its May 29 annual meeting. The resolution urged Exxon Mobil to work harder to reduce the greenhouse gas emissions of its products.

Exxon has more resources than just about anybody; ‘overkill’ doesn’t begin to describe the imbalance of power.

— Shareholder advocate Nell Minow

The company’s legal threat worked: Days after the lawsuit was filed, the shareholder groups, weighing their relative strength against an oil behemoth, withdrew the proposal and pledged not to refile it in the future.

Yet even though the proposal no longer exists, the company is still pursuing the lawsuit, running up its own and its adversaries’ legal bills. Its goal isn’t hard to fathom.

“What purpose does this have other than sending a chill down the spines of other investors to keep them from speaking up and filing resolutions?” asks Illinois State Treasurer Michael W. Frerichs, who oversees public investment portfolios, including the state’s retirement and college savings funds, worth more than $35 billion.

In response to the lawsuit, Frerichs has urged Exxon Mobil shareholders to vote against the reelection to the board of Chairman and Chief Executive Darren W. Woods and lead independent director Joseph L. Hooley at the annual meeting.

He’s not alone. The $496-billion California Public Employees’ Retirement System, or CalPERS, the nation’s largest public pension fund, is considering a vote against Woods, according to the fund’s chief operating investment officer, Michael Cohen.

“Exxon has gone well beyond any other company that we’re aware of in terms of suing shareholders for trying to bring forward a proposal,” Cohen told the Financial Times. “There doesn’t seem to be anything other than an agenda of sending a message of shutting down shareholders’ ability to speak their mind.”

California Treasurer Fiona Ma, a CalPERS board member, backs a vote against Woods. “As the largest public pension fund in the country, we have a responsibility to lead on issues that threaten to undermine shareowners,” she says.

The proxy advisory firm Glass Lewis & Co., which helps institutional investors decide how to vote on shareholder proposals and board elections, has counseled a vote against Hooley, citing Exxon Mobil’s “unusual and aggressive tactics” in fighting activist investors.

Exxon Mobil’s action against Arjuna and Follow This opens a new chapter in the long battle between corporate managements and shareholder gadflies.

Fossil fuel companies have been especially touchy about shareholder resolutions calling on them to take firmer action on global warming and to be more transparent about the effects their products have on climate.

In part that may be the result of some significant victories by activist shareholders. In 2021, nearly 61% of Chevron shareholders voted for the company to “substantially” reduce its greenhouse gas emissions — a shockingly large majority for a shareholder vote on any issue. That same year, the activist hedge fund Engine No. 1 led a campaign that unseated three Exxon Mobil board members and replaced them with directors more sensitive to climate risk.

Exxon Mobil also subjected the San Diego County community of Imperial Beach to a campaign of legal harassment over the city’s participation in a lawsuit aimed at forcing the company and others in the oil industry to pay compensation for the cost of global warming, which stems from the burning of the companies’ products.

Even in that context, Exxon Mobil’s campaign against Arjuna and Follow This represents a high-water mark in corporate cynicism.

The lawsuit asserts that the investment funds’ proposed resolution violated standards set forth by the Securities and Exchange Commission governing the propriety of such resolutions — it was related to “the company’s ordinary business operations” and closely resembled resolutions on similar topics that had failed to exceed threshold votes at the company’s 2022 and 2023 annual meetings. Both standards allow a company to block a resolution from the meeting agenda, or proxy.

That may be so, but the conventional practice is for managements to seek approval from the SEC to exclude such resolutions through the issuance of what’s known as an agency “no action” letter.

Exxon Mobil hasn’t taken that step. Instead, it filed its lawsuit in federal court in Forth Worth, where the case was certain to be heard by one of the only two judges in that courthouse, both conservatives appointed by Republican presidents — a crystalline example of partisan “judge shopping.” The case came before Trump appointee Mark T. Pittman, who has allowed it to proceed.

The company hasn’t said why it followed that course. “The U.S. system for shareholder access is the best in the world,” company spokeswoman Elise Otten told me by email. “To make sure it stays that way, the rules must be enforced or the abuse by activists masquerading as shareholders will continue threatening the system.”

In practice, however, the SEC has been quite strict about requiring that shareholder proposals meet its standards. “There can only be one reason” for the lawsuit, says shareholder advocate Nell Minow — “it’s to crush the shareholder. Exxon has more resources than just about anybody; ‘overkill’ doesn’t begin to describe the imbalance of power.”

The company accused Arjuna and Follow This of aiming not “to improve ExxonMobil’s business performance or increase shareholder value,” but of pursuing the goal of “disrupting ExxonMobil’s investments and development of fossil fuel assets and causing ExxonMobil to change its business model, regardless of the benefits, costs, or the world’s needs.”

The company maintained that the shareholder groups aimed to “force ExxonMobil to change the nature of its ordinary business or to go out of business entirely.”

That’s flatly untrue. The resolution observed that the company’s “cost of capital may substantially increase if it fails to control transition risks by significantly reducing absolute emissions.”

That judgment is shared by many institutional investors and government regulators, and points to a path for preserving Exxon Mobil’s business prospects, not destroying them.

In any case, what Exxon Mobil failed to note is that shareholder resolutions are always advisory — they can’t require management to do anything.

In its lawsuit, the company whined about the sheer burden of handling an increase in shareholder resolutions, especially those on fraught topics such as the environment and social issues. Using what it described as an SEC estimate that it costs corporations $150,000 to deal with every submitted resolution, its annual meeting statement calculated that it has spent $21 million to manage 140 submitted resolutions.

A couple of points about that. First, the SEC didn’t estimate that every resolution costs $150,000 to manage. The SEC actually cites a range of $20,000 to $150,000 each.

Second, a quick look at the company’s financial statements gives the lie to its claim that shareholder resolutions are some sort of cataclysmic burden. Its statistics applied to the entire 10-year period from 2014 through 2023, not just a single year.

Over that decade, Exxon Mobil reported total profits of $204.3 billion. In other words, processing those 140 proposals — using the SEC’s highest estimate to arrive at $21 million — cost Exxon Mobil one one-hundredth of a percent of its profits, at most, to deal with shareholder proposals.

And it’s not as if those proposals clog up the annual meeting proxy — for this year’s meeting, only four proposals will be submitted to shareholder votes. Management opposes all four, big surprise.

As for whether companies such as Exxon Mobil have better uses for their money, the proxy statement doesn’t make a great case for every expenditure.

Last year, for instance, the company paid nearly $1.5 million in relocation expenses for its top executives, including about $500,000 for Woods, in connection with the move of its headquarters from the Dallas suburbs to the Houston suburbs, about a three-hour drive away. Over the last three years, Woods collected more than $81 million in compensation, so one can see why moving house would leave him strapped.

“As a shareholder, the one thing you ask for is to look at every expenditure in terms of its return on investment,” Minow told me. “It’s unfathomable that the return on investment of this lawsuit is in any way beneficial to the company.” She’s right: It’s certain that Exxon’s legal fees on this case already exceed the putative $150,000 expense it incurred dealing with the withdrawn proposal.

Exxon Mobil’s punitive lawsuit only hints at the lengths that the fossil fuel industry will go to preserve a business model facing an inexorable decline. The companies haven’t been shy about enlisting politicians to rid them of their turbulent shareholders (to paraphrase the medieval King Henry II).

In February, Sen. Bill Hagerty (R-Tenn.) introduced a measure dubbed the “Rejecting Extremist Shareholder Proposals that Inhibit and Thwart Enterprise for Businesses Act, or “RESPITE.” The act would overturn an SEC rule stating that resolutions dealing with “significant social policy issues” can’t be excluded from the annual proxy under the traditional “ordinary business” limitation.

Don’t expect them to be shy about demanding more latitude from a reelected President Trump. The Washington Post reported last week that Trump pledged to roll back Biden administration environmental policies if the oil executives meeting with him at Mar-a-Lago would raise $1 billion for his campaign. An Exxon Mobil executive was present, the Post reported.

Business

Wonderful Co. sues to halt California card-check law that made it easier to unionize farmworkers

The Wonderful Co. is escalating its battle against unionization of its job sites, looking to halt a new state law intended to streamline the farmworker unionization process. The move comes two months after the United Farm Workers utilized the provision to become the collective bargaining representative for employees of the company’s massive grapevine nursery in Kern County.

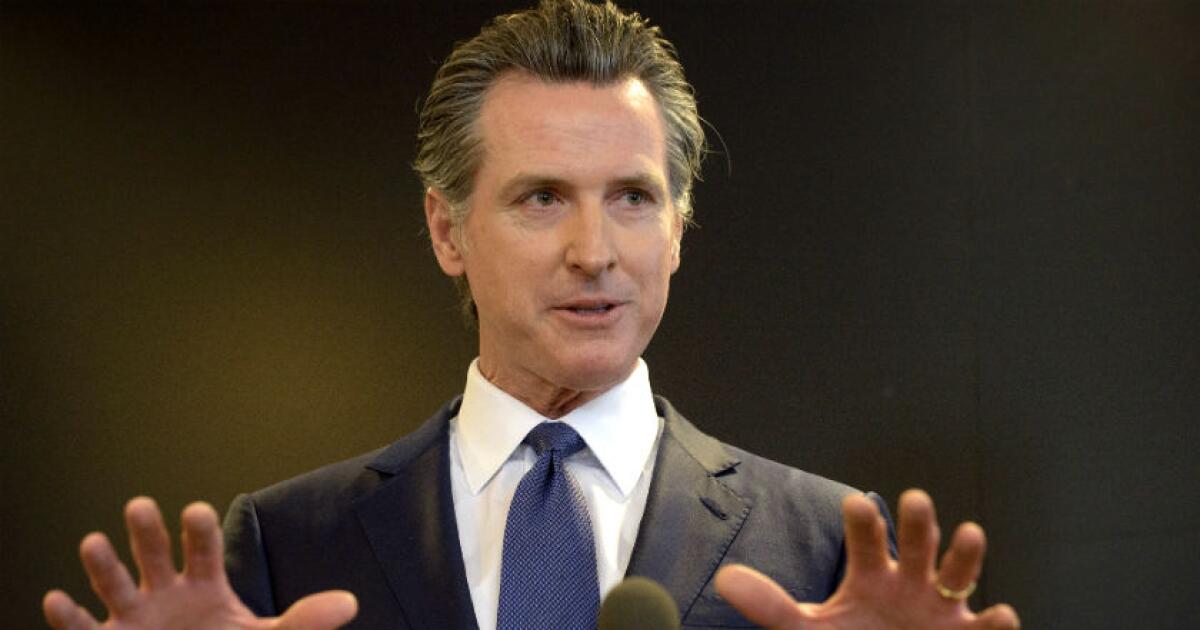

Wonderful, the $6 billion agricultural powerhouse owned by Stewart and Lynda Resnick, said Monday it is suing the state Agricultural Labor Relations Board, challenging the constitutionality of the state’s so-called card-check system, which Gov. Gavin Newsom signed into law in 2022. Under its provisions, a union can organize farmworkers by inviting them to sign authorization cards at off-site meetings, without notifying an employer, rather than voting by secret ballot at a designated polling place.

The company, whose portfolio includes such well-known brands as FIJI Water, Wonderful Pistachios and POM Wonderful, alleges in its lawsuit that the law deprives employers of due process on multiple fronts. Among them: forcing a company to enter a collective bargaining agreement even if it has formally appealed the ALRB’s certification of a union vote and presented what it believes is evidence that the voting process was fraudulent.

Wonderful said it was compelled to file its lawsuit now because, under the card-check law, the company faces a June 3 deadline to reach a collective bargaining agreement or have one dictated by the ALRB.

“Having been compelled into a constitutionally unlawful procedure that imposes a constitutionally illegitimate certification, Wonderful has no meaningful way to obtain plain, speedy or complete relief other than through an order of this Court declaring that, on its face, [this section of the labor code] is unconstitutional,” the lawsuit said.

The lawsuit, to be heard in Kern County Superior Court, seeks to enjoin the ALRB from enforcing the card-check law’s provisions.

The ALRB did not immediately respond to the The Times’ request for comment.

A spokesperson for Newsom’s office said staff members were still reviewing the complaint, but included in the response Newsom’s comments when he signed the legislation. “California’s farmworkers are the lifeblood of our state, and they have the fundamental right to unionize and advocate for themselves in the workplace,” his statement said in part.

UFW spokesperson Elizabeth Strater said the union was not surprised by Wonderful’s move.

“This is an unfortunate tactic, but it’s not surprising,” Strater said. “They’ll do pretty much anything to prevent workers from being empowered.”

William B. Gould IV, a professor of law emeritus at Stanford Law School, described the card-check system as “an excellent statute to challenge” because of the confusion and ambiguity surrounding some of its provisions and the “potential for contacts between organizers and employees” that could raise questions about whether workers were acting with free choice.

While he predicted Wonderful would have a “difficult time” making its case in California, he said the company could be aiming to take its argument to the conservative-leaning U.S. Supreme Court.

“To paraphrase Frank Sinatra, now we’re in a situation where anything goes,” said Gould, who served as chair of the ALRB from 2014 to 2017.

The lawsuit is the latest salvo in what’s been a tumultuous dispute over the UFW’s unionization campaign at the nation’s largest grapevine nursery.

In late February, the union filed a petition with the labor relations board, asserting that a majority of the 600-plus farmworkers at Wonderful Nurseries in Wasco had signed authorization cards and asking that the UFW be certified as their union representative.

Within days, Wonderful hit back with an explosive allegation: The company accused the UFW of baiting farmworkers into signing the authorization cards while helping them apply for $600 in federal relief for farmworkers who labored during the pandemic. And it submitted nearly 150 signed declarations from nursery workers saying they had not understood that by signing the cards they were voting to unionize.

The ALRB acknowledged receiving the worker declarations; nonetheless, the regional director of the labor board moved forward three days later to certify the union’s petition. She has said in subsequent hearings that she felt she had to move quickly under the timeline laid out in the card-check law, and that at the time she did not think the statute authorized her to investigate allegations of misconduct.

Wonderful appealed the certification, alleging the UFW engaged in fraud to obtain employee signatures on authorization cards. The UFW countered that Wonderful had intimidated workers into making false statements and had brought in a labor consultant with a reputation as a union buster to manipulate their emotions in the weeks that followed.

A hearing on Wonderful’s objections has been playing out before an independent hearing examiner for the past three weeks. The lawsuit seeks to pause the hearing, pending the outcome of the card-check suit.

The UFW, meanwhile, is pursuing its own complaint against Wonderful. The union has filed a formal complaint of unfair labor practices with the ALRB, alleging Wonderful held mandatory meetings where company leaders urged employees to reject the union, circulated an anti-union petition and misrepresented the union’s intentions.

Business

Gov. Newsom seeks faster review of insurance rate hikes. What to know

With insurers continuing to pull back from the California’s homeowners’ market, Gov. Gavin Newsom wants to speed up the process by which the companies have their requests for rate hikes reviewed.

The governor said Friday that he is backing a bill that would require the Department of Insurance to complete reviews of proposed premium increases within 60 days to halt any more exits from the market. Here’s what to know:

What exactly did the governor say?

Newsom said that immediate steps need to be taken to stabilize the market, which has seen insurers not renew existing policyholders, stop writing new policies or pull out of the market entirely — sending many homeowners to the insurer of last resort, the state’s FAIR Plan, which is now on the hook for more than $300 billion in payouts. Newsom said he was “deeply mindful” of the burdens placed on the plan.

The governor said he had considered issuing an executive order, but instead is proposing a bill that would require the Insurance Department to speed up its review process of premium rate-hike requests.

“We need to stabilize this market. We need to send the right signals. We need to move,” he said.

Isn’t there already an insurance reform package being hashed out in Sacramento?

Insurance Commissioner Ricardo Lara is holding hearings on his Sustainable Insurance Strategy, a set of comprehensive regulations intended to stabilize rates and make it more attractive for insurers to write homeowners policies, especially in wildfire areas such as hillsides and canyons.

However, these regulations won’t become law until the end of the year — a deadline sought by the governor, assuming it can be met.

“It should not take this long for emergency regulations,” Newsom said. “We can’t wait until December.”

How would this bill fit into the larger set of reforms?

Lara has reached a grand bargain with the insurance industry to make the market more attractive, though details are still being worked out.

The plan would allow insurers to include the cost of reinsurance they buy to protect themselves from large fires and other catastrophes into premium costs. It also would allow them to set rates using sophisticated algorithms to predict the risk and cost of future fires, rather than just base them on past events. It’s unclear how an insurer’s application for an expedited rate approval this year would fit into the proposed reforms.

Has Lara reacted to the governor’s proposal?

The commissioner tweeted Friday that his department has taken “significant steps forward” to implement his planned reforms but more needs to be done — and that his department is working with the governor and the Legislature “on critical budget language that keeps us on track to get the job done.”

What do consumer groups have to say?

Jamie Court, president of Consumer Watchdog, said he didn’t understand the proposal, worrying that it would be a “rubber stamp” on proposed rate increases.

He noted that Proposition 103, the landmark 1988 initiative that gives the insurance commissioner authority to review rate hikes, already mandates that they are conducted within 60 days except in certain circumstances. Those circumstances include requests for rate increases exceeding 7% for homeowners insurance, which allow consumers to seek a hearing, or the commissioner’s own decision to conduct a hearing.

What is the insurance industry’s reaction

Rex Frazier, president of the Personal Insurance Federation of California, a trade group of property and casualty insurers, said despite the promise of 60-day rate reviews under Proposition 103, they are taking longer. He said the Insurance Department will often request that insurers waive their rights to a speedy decision or face an administrative hearing, which can lead to extensive delays. However, Frazier withheld comment on the governor’s proposal until the draft language is released.

What are the next steps?

Newsom’s office will release the draft bill, which will be carried by a member of the Legislature and be included in the process for adopting the state budget, which the Legislature must approve by June 15. Newsom made his remarks Friday in outlining plans for a revised $288-billion budget, which calls for a series of cutbacks to close a nearly $45-billion shortfall.

-

Politics1 week ago

Politics1 week agoHouse Dems seeking re-election seemingly reverse course, call on Biden to 'bring order to the southern border'

-

World1 week ago

World1 week agoSpain and Argentina trade jibes in row before visit by President Milei

-

World1 week ago

World1 week agoGerman socialist candidate attacked before EU elections

-

Politics1 week ago

Politics1 week agoAnti-Israel groups accuse Chicago, DNC of trying to ‘protect’ Biden from protests at 2024 Dem convention

-

Politics1 week ago

Politics1 week agoFetterman says anti-Israel campus protests ‘working against peace' in Middle East, not putting hostages first

-

News1 week ago

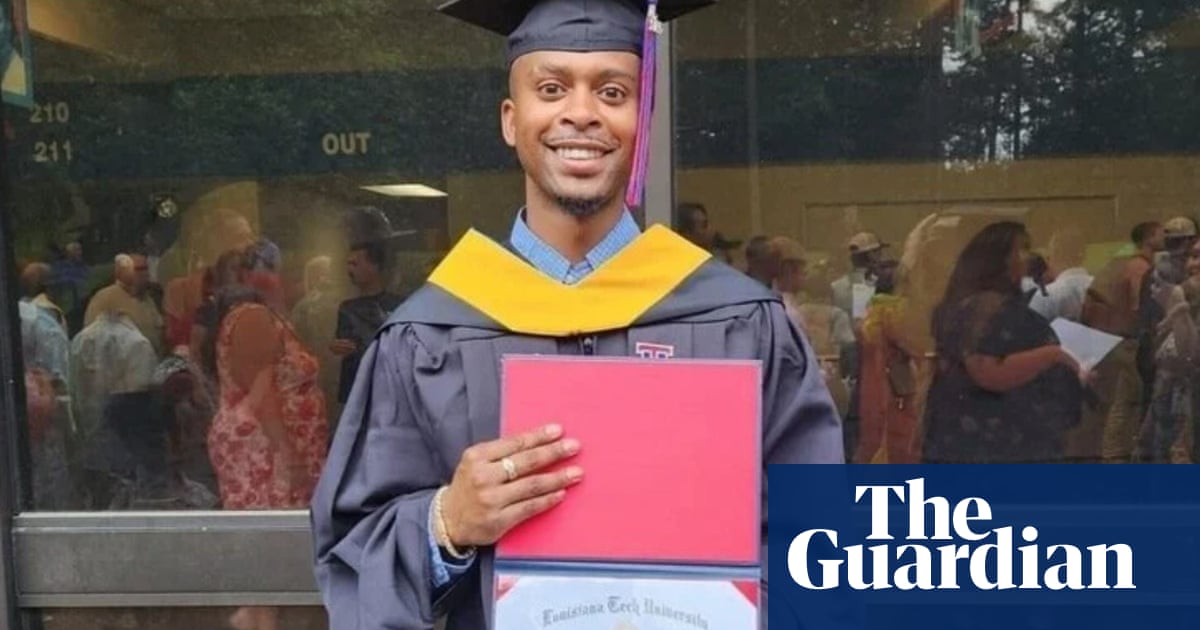

News1 week agoUS man diagnosed with brain damage after allegedly being pushed into lake

-

World1 week ago

World1 week agoGaza ceasefire talks at crucial stage as Hamas delegation leaves Cairo

-

Politics1 week ago

Politics1 week agoRepublicans believe college campus chaos works in their favor