Business

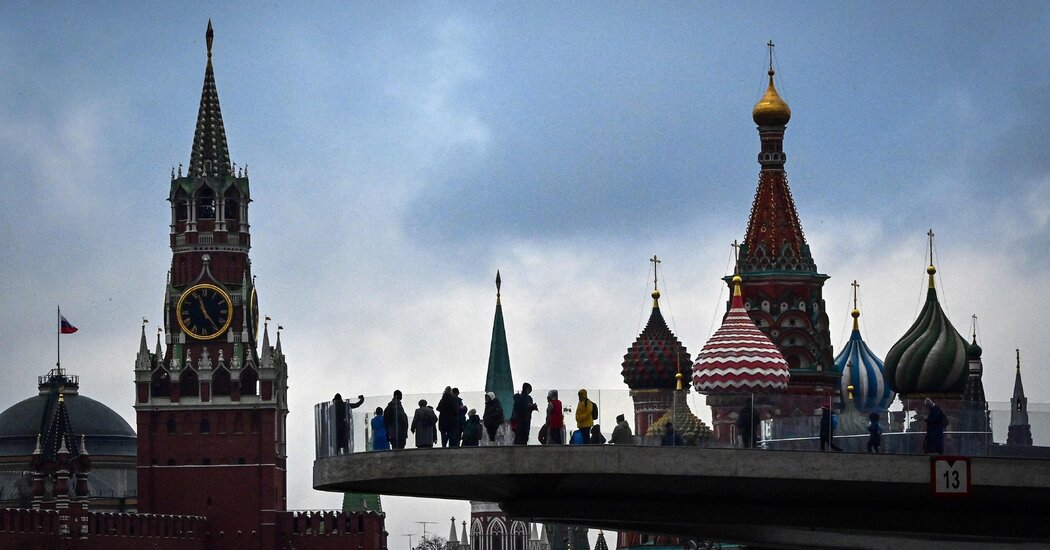

Here’s how much it is costing companies to leave Russia.

A slew of corporations have introduced plans to cease enterprise in Russia over the past a number of weeks, and plenty of of them are actually sharing what these selections could price them.

Some corporations had restricted publicity to Russia and signaled that the anticipated losses weren’t vital. JPMorgan Chase’s chief govt, Jamie Dimon, instructed shareholders that the financial institution wasn’t “fearful” in regards to the impacts from leaving Russia. For trade giants like Shell, the monetary hit — whereas massive — accounts for only a fraction of their general income.

On Monday, Société Générale, France’s third-largest financial institution, stated it will take a success of $3.3 billion in a deal to promote the corporate’s controlling stake in Rosbank, a Moscow-based lender, to Interros Capital. The deal would permit the financial institution to “exit in an efficient and orderly method from Russia, guaranteeing continuity for its workers and shoppers,” the corporate stated.

Listed below are a number of the anticipated impacts that corporations have disclosed:

-

BNY Mellon stated it might lose as a lot as $200 million in income — about $100 million this quarter and an extra $80 million to $100 million over the remainder of the yr. It has ceased new enterprise with Russia and “suspended funding administration purchases of Russian securities,” a spokesman for the corporate stated.

-

JPMorgan Chase’s chief govt, Jamie Dimon, stated in an annual letter to shareholders that the financial institution may lose $1 billion “over time” due to its publicity to Russia. Final month, the financial institution introduced that it was winding down enterprise in Russia and wouldn’t be pursuing new ventures there.

-

Shell stated in an replace to shareholders that its choice to go away Russia would price the corporate $4 billion to $5 billion on this quarter alone. The oil large started slicing ties with Russia in February and stated final month that it will cease shopping for oil and fuel from Russia and shutter its service stations within the nation in a “phased withdrawal.”

-

Société Générale stated it will take a monetary hit of $3.3 billion in a deal to promote the corporate’s controlling stake in Rosbank, a Moscow-based lender, to Interros Capital.

-

Volvo stated it was setting apart about $423 million to make up for losses it anticipated within the first quarter due to Russian publicity. The carmaker has suspended “all gross sales, service and manufacturing” within the nation, the corporate stated.

Business

Inflation’s Wild Ride

“The signal that we’re taking is that it’s likely to take longer for us to gain confidence that we are on a sustainable path down to 2 percent inflation,” Mr. Powell said in May, after price increases had stalled for months. Inflation has recently cooled again, and policymakers are waiting to see if the trend lasts.

The question now is just how much continued progress on lowering inflation Fed officials will need to see to feel comfortable lowering interest rates.

Investors still think it is possible that the central bank will cut rates in September, based on market pricing. Fed officials themselves predicted one reduction this year and four in 2025, as of their June economic forecasts.

For politicians, that means that the November election will almost certainly happen against a backdrop of high interest rates that are making car leases, credit card borrowing and new mortgages pricey for consumers.

After years of elevated inflation, Americans are also still seeing much higher price levels at the grocery store, on car repair bills and at hotels than before the pandemic.

Price increases have slowed, but getting used to new price levels could take time for consumers.

Business

Irvine-based EV maker Rivian gets $5-billion lifeline from Volkswagen

Irvine-based Rivian Automotive got a big financial boost on Tuesday, as Volkswagen agreed to invest up to $5 billion in a joint venture with the struggling manufacturer of electric trucks.

Under a partnership announced by the companies, the German automaker will provide $1 billion initially and as much as $4 billion more over time.

The infusion will give VW the ability to tap the company’s technology to develop “next generation” battery-powered vehicles and software.

The surprise investment comes during a tough time for the electric vehicle market, which has posed economic headwinds for Rivian and other EV makers.

With their sleek design, Rivian trucks and sport utility vehicles initially drew plenty of interest among investors, fueling a massively successful initial public offering of stock in 2021; the company ended its first day of trading valued at nearly $88 billion. Amazon.com is Rivian’s largest shareholder.

But analysts said some car buyers were put off by the high price of Rivian’s latest offering of vehicles — the company’s R1T electric pickup truck starts at nearly $70,000, while its R1S SUV starts at almost $75,000.

Rivian reported a net loss of $1.52 billion for the three-month period that ended Dec. 31, compared with $1.72 billion during the same period a year earlier.

Signs of stress mounted. In March, Rivian postponed plans to build a new $5-billion manufacturing plant in Georgia to save money amid heavy losses.

A month earlier, Rivian announced a 10% cut to its workforce and lower production expectations.

Last week another local EV manufacturer — Fisker Group Inc. of Manhattan Beach — filed for Chapter 11 bankruptcy protection after it failed to secure financing from undisclosed automakers.

Early this year, Apple pulled the plug on its self-driving electric vehicle program, reportedly after spending $10 billion over a decade.

And Lucid Motors, a maker of luxury electric vehicles in the Bay Area city of Newark, received a $1-billion infusion last month from an affiliate of the Saudi sovereign wealth fund — the kind of big backer that Fisker didn’t have.

Rivian’s shares, which were pummeled earlier this year, jumped 30% in extended trading on Tuesday. The shares closed at $11.96.

Tesla Inc., the biggest player in the business, also has been squeezed by weak sales and declining profits. The company said in April that it would lay off more than 10% of its workforce.

Bloomberg News contributed to this report.

Business

McDonald's plant-based burger fizzles out — even in San Francisco, company says

McDonald’s had high hopes for its signature plant-based burger when it rolled out in California and Texas two years ago, but it turns out customers just weren’t lovin’ it.

Joe Erlinger, the president of McDonald’s USA, said during this week’s Wall Street Journal Global Food Forum that the meatless burger had fizzled rather than sizzled. The McPlant, he put it bluntly, “was not successful” in the San Francisco Bay Area or Dallas.

Consumers in the United States aren’t “looking for McPlant or other plant-based proteins from McDonald’s now,” Erlinger said Wednesday. “It’s a trend that we’ll continue to monitor.”

At the heart of McPlant was a patty co-developed with Beyond Meat, which featured vegetarian ingredients like peas, rice and potatoes.

The plant patties cropped up in eight McDonald’s across the country in late 2021, including locations in El Segundo and Manhattan Beach. By January 2022, 600 restaurants across the Bay Area and Dallas-Fort Worth metropolitan area were slinging the meat-free sandwiches.

At the time, the fast-food giant tempted customers by suggesting they take a road trip to try the McPlant — available only “for a limited time, while supplies last,” the company wrote in a news release.

But an analysis done in March 2022 by the research firm BTIG indicated demand had withered, with consumers underwhelmed by the culinary creation.

Participating restaurants in the Bay Area and Dallas-Fort Worth were selling 20 McPlants per day, less than the 40 to 60 they had expected. Only three to five sandwiches per day were being sold in more rural East Texas, Marketwatch reported at the time.

That July, the company ended the meatless burger’s test run without disclosing plans for a nationwide rollout. The desire for meat alternatives climbed rapidly between 2019 and 2021 in the United States, but lessened in 2022 and declined in 2023, according to the Good Food Institute, a nonprofit that promotes alternatives to animal proteins.

That’s not necessarily the case across the Atlantic, however, where McDonald’s plant-based offerings have apparently found greener pastures. In European markets, you can find the McPlant patty on a sesame bun with lettuce, tomato, ketchup, mustard, vegan sandwich sauce, vegan cheese, pickles and onions.

Erlinger said the company is focusing in the U.S. on chicken options, which are more popular with consumers.

-

Movie Reviews1 week ago

Movie Reviews1 week agoFancy Dance (2024) – Movie Review

-

News1 week ago

News1 week agoRead the Ruling by the Virginia Court of Appeals

-

Politics1 week ago

Politics1 week agoJohn Kerry used government email alias as secretary of state, whistleblowers say

-

News1 week ago

News1 week agoNYC pastor is sentenced to 9 years for fraud, including taking a single mom's $90,000

-

Politics1 week ago

Politics1 week agoTrump targets House Freedom Caucus chair in intra-party Republican primary feud

-

News6 days ago

News6 days agoTracking a Single Day at the National Domestic Violence Hotline

-

World1 week ago

World1 week agoWorld's largest arms expo in Paris marred by ongoing conflicts

-

News1 week ago

News1 week agoGeorge Strait sets a new record for the largest ticketed concert in U.S. history