Business

Apple joins the ‘buy now, pay later’ lending trend. Do you know about the downsides?

Beginning this week, Apple is rolling out its model of “purchase now, pay later.”

Utilizing a short-term mortgage to finance a small or medium buy — Apple says Pay Later loans will probably be obtainable in quantities from $50 to $1,000 — is “bought like a no brainer” to customers, private finance knowledgeable Carmen Perez stated. “I’ve heard individuals say it looks like free cash.”

After all, there’s no such factor. In contrast with conventional bank cards, there are few upsides to utilizing any “purchase now, pay later” program. And proof signifies the existence of those loans can facilitate unhealthy client behaviors that may lure individuals in debt.

Apple Pay Later is elbowing right into a crowded area: AfterPay, Klarna, Affirm, Zip and related short-term financing corporations represent a fast-growing market. There have been virtually 10 instances as many “purchase now, pay later” (typically shortened to BNPL) loans issued in 2021 in contrast with 2019, in line with a report from the Client Finance Safety Bureau. The overall worth of these loans grew from $2 billion to $24.2 billion in that point interval.

“The best way that ‘purchase now, pay later’ is positioned, it doesn’t look like debt up entrance,” stated Perez, who’s the creator of the budgeting app A lot and a part of a brand new ladies’s monetary training initiative from Secret Deodorant.

However it’s: “That’s nonetheless debt. You’re nonetheless on the hook for that. And there’s nonetheless destructive penalties for that.”

Budgeting app creator Carmen Perez says “purchase now, pay later” loans are “bought like a no brainer” to customers.

(Diane Bondareff / AP Pictures for Secret Deodorant)

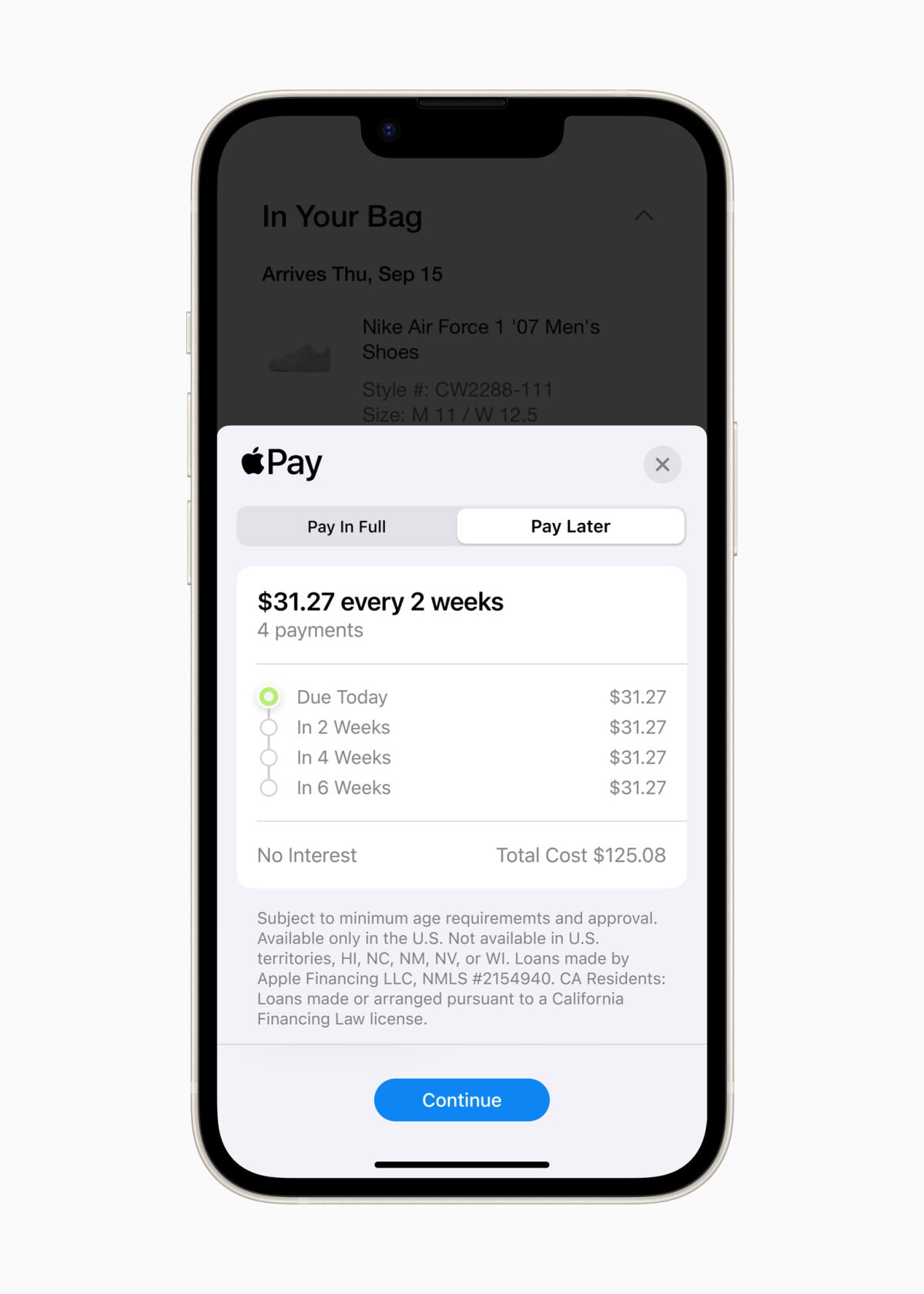

“Purchase now, pay later” loans, often known as point-of-sale financing, sometimes seem as an possibility at on-line checkout. You’re offered with the choice to pay in full, or to separate your buy into installments with zero curiosity. A advertising and marketing professor informed the Atlantic that in her client polling, consumers stated utilizing a bank card makes them really feel responsible, however they made no ethical distinction between utilizing BNPL and swiping their debit card for the total quantity.

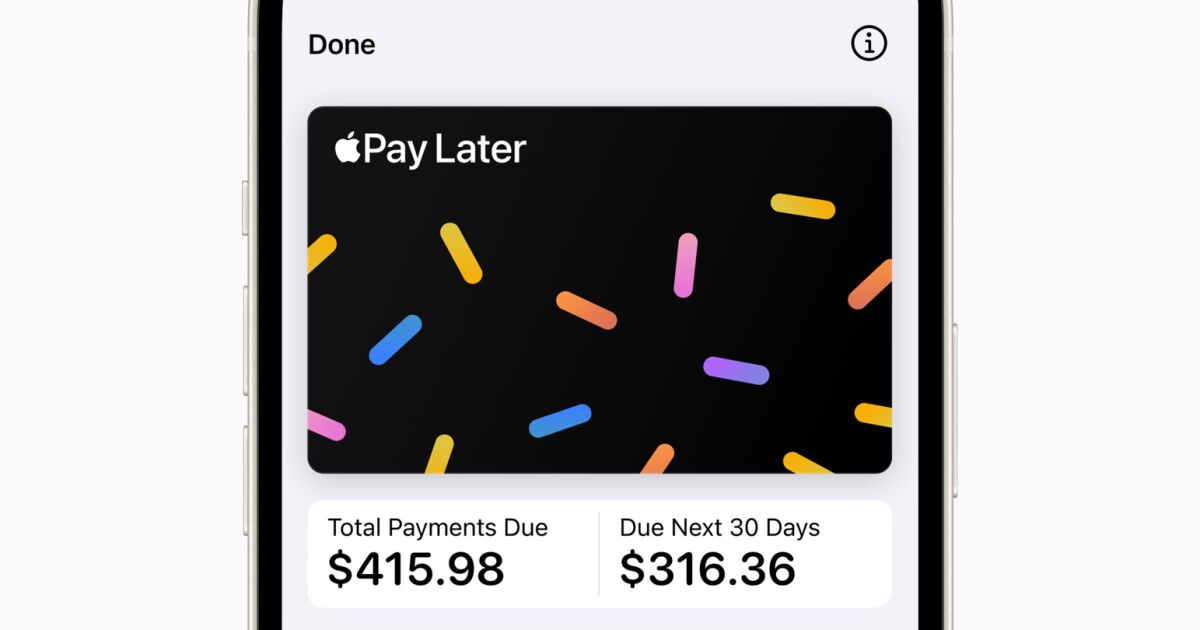

Apple’s announcement of the service touted its advantages: “Apple Pay Later was designed with our customers’ monetary well being in thoughts, so it has no charges and no curiosity, and can be utilized and managed inside Pockets, making it simpler for customers to make knowledgeable and accountable borrowing selections.”

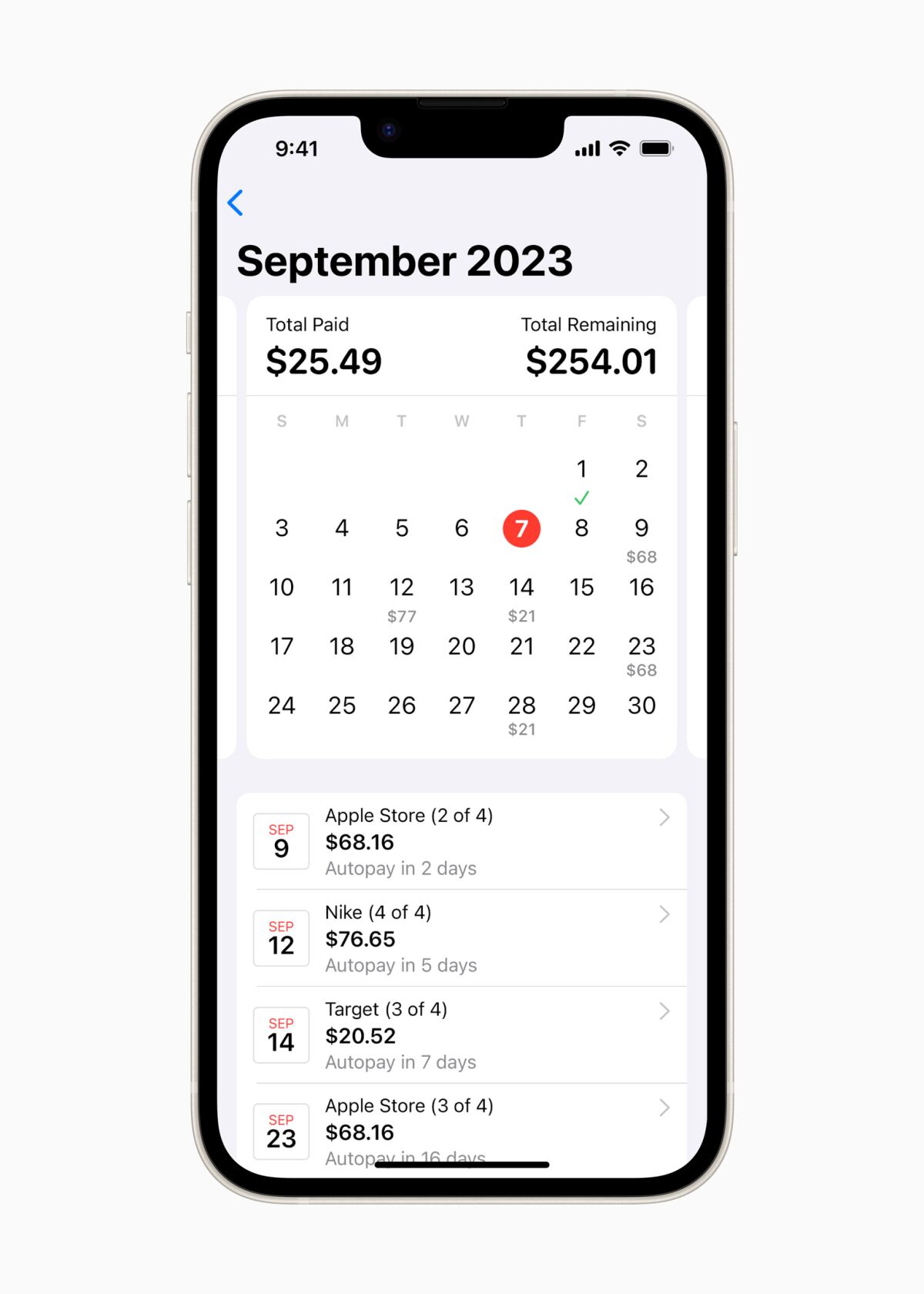

And it does seem to have some advantages over rivals: Apple confirmed off a slick interface that lets customers handle their loans and look at a calendar of upcoming funds. Debtors should hyperlink a debit card to make repayments, to allow them to’t get additional into debt by paying off one mortgage with one other (e.g., a bank card), a criticism the business has confronted. Mortgage recipients will get notifications about upcoming funds, so there’s much less probability of being caught off guard when funds undergo. And the corporate says it plans to start out reporting Apple Pay Later loans to U.S. credit score bureaus beginning this fall, which might assist debtors construct credit score by way of on-time funds.

Like each different lender within the BNPL house, Apple Pay Later loans are unfold out in 4 installments. That quantity isn’t a coincidence, stated Tom Y. Chang, an affiliate professor of finance and enterprise economics on the USC Marshall Faculty of Enterprise.

“It’s all to keep away from the Fact in Lending Act,” he stated. “The Fact in Lending Act kicks in at 5 installments. So all of them put it just under the edge.”

The Fact in Lending Act is a federal legislation that dictates how lenders should deal with prospects, together with making it simple to grasp all of the potential charges and curiosity costs on a mortgage. For those who aren’t topic to it, you may promote individuals on all of the upsides of your mortgage with out having to bum them out with the downsides.

A picture displaying what Apple says the calendar view of Apple Pay Later will appear like on an iPhone.

(Apple)

Permit us to bum you out with the downsides.

A report from the Client Monetary Safety Bureau discovered that in contrast with somebody who didn’t use BNPL financing, the typical BNPL borrower was extra more likely to have a whole lot of debt, extra more likely to have delinquencies on their credit score report, extra more likely to carry a stability on their bank cards, and extra possible to make use of payday loans, pawn retailers and account overdrafts. The bureau stated the concept BNPL extends traces of credit score to individuals who don’t in any other case have that possibility is fake: “The truth is, they had been extra more likely to borrow utilizing credit score and retail playing cards, private loans, scholar debt, and auto loans in comparison with non-BNPL debtors.”

There are different potential downsides, together with how BNPL makes use of client psychology to have an effect on your decision-making.

If you purchase one thing, you face what’s often known as “friction” within the buying expertise — all of the factors within the course of that make you suppose, “Do I actually need to full this transaction?”

Distributors need to scale back that friction as a lot as potential.

On-line buying — now obtainable 24/7 on the supercomputer that lives in everybody’s pocket — lowered the friction of attending to the shop.

When the shopper comes as much as the register and has to tug out their pockets, they face one other friction level. Greg Ward, an authorized monetary planner and the suppose tank director at monetary teaching firm Monetary Finesse, stated the lending business is at all times in search of methods to alleviate the so-called ache of paying.

“Making it simple, ‘making it enjoyable and making it cool, that’s been the sport of the bank card business because the ‘60s,” he stated.

Consider how more likely you’re to purchase one thing from an app or on-line retailer that already has your bank card quantity saved. That’s a friction reducer. Nonetheless, you must confront the checkout display, with that looming whole staring again at you. For those who obtained a pop-up message that stated, “Wish to open a brand new bank card to pay for this?” you’d most likely say no. However while you get a pop-up that splits that whole buy worth into 4 with an on the spot mortgage, you would possibly end up capable of justify it.

Perez stated in her expertise, distributors make utilizing BNPL simple to the purpose that it appears some retailers are pushing the service: “Like, ‘Are you certain you don’t need to AfterPay?’ I feel it’s fairly nefarious.”

The BNPL mannequin doesn’t cost prospects curiosity or charges up entrance. Lenders as a substitute earn money by charging the seller 4 cost processing charges as a substitute of 1. That may drive up costs for everybody, together with non-BNPL consumers. One other means companies profit: It might encourage prospects to spend extra. The proprietor of a restaurant in Malibu informed the New York Occasions that prospects who used BNPL for his or her buy spent 40% greater than different individuals inserting a web-based order and twice as a lot as individuals ordering in particular person.

Are there any extra potential downsides to utilizing BNPL? Sure.

- The concept the mortgage is “no curiosity, no charges” is true solely to an extent. For those who don’t pay the mortgage again on time, you would be topic to all kinds of charges — which, once more, the lender doesn’t should inform you up entrance, as a result of they aren’t topic to the Fact in Lending Act. As an illustration, AfterPay says a late cost might end in a price of as much as $68.

- Apple allows you to see your whole Pay Later loans in a single handy calendar. However should you’ve additionally obtained loans by way of Affirm, Klarna or different lenders, it may possibly get difficult to maintain observe of all of the upcoming funds and due dates in your finances. (You’ve got a finances, proper?)

- Although a comfortable credit score pull doesn’t ding your rating, it nonetheless exhibits up in your credit score report and will have an effect on your means to get different sources of credit score or loans. As an illustration, a mortgage lender might legally take a look at a soft credit check for a microloan in a food delivery app — an more and more widespread conduct — and query whether or not you may afford a mortgage when it is advisable to cut up up a sandwich throughout a couple of paychecks.

- Apple says it plans to report Pay Later loans to U.S. credit score bureaus beginning this fall, so on-time funds might enhance your credit score rating — however that takes away from the concept such a debt in some way exists exterior of your credit score report. The three main credit score bureaus have all introduced plans to incorporate BNPL loans on credit score studies. Late funds reported to the credit score bureaus can positively harm your credit score rating.

- Paying off a mortgage over six weeks means assuming your paychecks would be the similar six weeks from now. In the most effective of instances, you may’t know the longer term; proper now, with layoffs looming in lots of industries and COVID nonetheless a factor, it’s onerous to ensure these installment funds in your new blender will really feel as fiscally palatable in six weeks.

So what are the upsides, past the zing of on the spot gratification? In some instances, it could be higher than the choice, Ward stated: For those who’re utilizing BNPL as a substitute of turning to one thing like a payday lender or a pawn store, or a high-interest bank card you don’t repay each month, it may very well be the fitting transfer.

Consider BNPL as “sort of a ‘break glass in case of emergency’” different to these kinds of high-interest debt, he stated, “as a substitute of it changing into the routine.”

What Apple says the Apple Pay Later checkout display will appear like on an iPhone.

(Apple)

There’s nothing explicitly fallacious with Apple Pay Later in contrast with different BNPL lenders. For those who should tackle debt to make a purchase order and you’re assured you’ll have the ability to afford what you acquire when the funds are due, Apple Pay Later appears to supply some slight benefits over rivals, together with a better technique to preserve observe of funds and, sooner or later, probably serving to construct your credit score.

Perez stated if utilizing BNPL is the distinction between maintaining the lights on or feeding your youngsters, “not less than it’s being utilized in a means that’s productive. Higher than going into debt for jewellery and garments.”

However usually, a conventional bank card is healthier, Chang stated: “When you’ve got a bank card, I don’t see why you’ll ever use this.”

There are literally fairly a couple of benefits to utilizing a bank card in your transaction as a substitute of BNPL, he stated. When you’ve got a bank card that you simply repay in full each month, you could have principally the identical period of time to repay your buy as you do with BNPL — round 4 to 6 weeks, relying on the place you’re in your billing cycle. A bank card presents rewards or factors. And you’re extra protected if it is advisable to dispute the cost or get a refund.

For those who do use BNPL to fund one thing that is likely to be described extra as a “need” than a “want,” it doesn’t imply you’re doomed to debt. Maintain observe of what you owe, make your funds on time, and don’t fall into the behavior of borrowing cash to spend cash. Utilizing BNPL isn’t the top of the world. It’s simply not the neatest monetary transfer.

About The Occasions Utility Journalism Group

This text is from The Occasions’ Utility Journalism Group. Our mission is to be important to the lives of Southern Californians by publishing info that solves issues, solutions questions and helps with choice making. We serve audiences in and round Los Angeles — together with present Occasions subscribers and various communities that haven’t traditionally had their wants met by our protection.

How can we be helpful to you and your group? E mail utility (at) latimes.com or one in all our journalists: Matt Ballinger, Jon Healey, Ada Tseng, Jessica Roy and Karen Garcia.

Business

TikTok said to plan job cuts amid a wave of tech industry layoffs

TikTok is expected to make cuts to its global staff, in another blow for the popular social video app as it faces the threat of a new law that would ban its service in the U.S. if its Chinese owner doesn’t divest.

The layoffs are expected to affect employees in content and marketing and user operations, according to technology-focused news outlet the Information, which first reported on the looming job cuts. TikTok did not immediately respond to a request for comment.

Some U.S. leaders have raised security concerns about TikTok and its parent company ByteDance’s ties to China. ByteDance and TikTok have said the new law “offers no support for the idea” that TikTok’s Chinese ownership poses national security risks.

An unnamed TikTok employee told CNN that the workforce reduction was not related to the potential ban in the U.S.

The cuts come as tech companies have shed their workforce this year to reduce their costs and, in some cases, prepare to hire more people skilled in emerging artificial intelligence tech.

It’s unclear how many layoffs will occur at TikTok’s U.S. headquarters in Culver City. TikTok employs roughly 500 people in Culver City, according to city data.

TikTok has launched legal battles to stop the government from going forward with its ban of the company’s U.S. operations. The firm sued the U.S. government and funded a separate legal challenge led by TikTok creators. Both petitions said the move to ban or force a sale of the app violates 1st Amendment free speech protections.

Business

The 2024 box office is terrible. But Imax's big-screen appeal is a bright spot

When Warner Bros. film executive Jeff Goldstein saw the huge sand dunes and expansive desert vistas of Denis Villeneuve’s first “Dune” movie, he thought to himself, “This was made for Imax.”

Same went for the sandworm sequences of the sequel, “Dune: Part Two,” a box office hit for the studio earlier this year that pulled in nearly 24% of its domestic box office revenue from Imax. The dystopian wasteland of this weekend’s big action tent pole, “Furiosa: A Mad Max Saga,” brings yet more fodder for the big screen format.

Imax’s giant screens are expected to account for a greater-than-typical share of the George Miller-directed prequel’s box office sales. (The film is tracking to gross more than $40 million domestically for the four-day weekend opening, according to analysts.)

“It immerses you, so you’re there,” said Goldstein, president of domestic distribution for Warner Bros. Pictures. “Audiences look at Imax as something special.”

As studios and exhibitors bemoan audiences’ slow return to movie theaters since the pandemic, Imax has been one of the few bright spots. This year’s box office is down 20% compared to last year, when pictures like “Fast X,” “Barbie” and “The Super Mario Bros. Movie” propelled ticket sales, and yet studios are clamoring to get onto Imax screens.

Audience behavior has now changed, and getting people out of their houses and back into theaters requires something special they can’t get at home. That put Imax in a fortuitous spot.

The 57-year-old Canadian company, which operates out of Playa Vista, is coming off one of its best years, with Christopher Nolan’s “Oppenheimer” helping to fuel overall global box office revenue — marking Imax’s second-highest grossing year in its history. Films shown on Imax are reaping bigger box office numbers, helped in part by higher ticket prices, and that’s a powerful allure for studios and filmmakers.

Next year, 13 Hollywood movies slated for release will be shot on Imax digital cameras or film, beating a previous record logged in 2021 when seven so-called filmed for Imax movies came out.

The company hopes its brand awareness eventually looms so large that viewers come to its screens first.

“Instead of saying, ‘What’s happening at the movies?,’ I want them to say, ‘What’s happening at Imax?’” said Imax Corp. Chief Executive Rich Gelfond.

For Imax’s part, its financial performance in the first fiscal quarter of 2024 beat expectations. The company’s net income totaled $3.3 million for the three-month period that ended March 31, up 33% from the previous year, though revenue decreased by about 9%, to $79.1 million. Shares of Imax are up about 10.9% so far this year.

“While there are exceptions like ‘Barbie,’ it is very, very difficult to be a blockbuster without being in Imax,” said Greg Foster, a former Imax Entertainment chief executive who now runs an entertainment consulting business.

Imax’s current mainstream success is what Gelfond and his business partners envisioned when they acquired the company in 1994. At the time, Imax was essentially a museum staple, albeit one that allowed viewers to immerse themselves in the latest nature film or science documentary.

The company adjusted its screens and sound systems to fit in commercial multiplex theaters, allowing its business to grow rapidly while limiting costs (Imax does not own theaters itself, but instead supplies its screening technology to cinema chains). Imax also developed technology to convert movies to Imax’s format to make it more economically attractive for filmmakers and benefited from the advent of digital film, which made it more cost effective.

By 2019, the company had seen year-over-year global box office growth for several years and expanded its global market share to spread its box office almost evenly among North America, China and the rest of the world.

Like its movie theater owner customers, Imax was hit hard by COVID-19 business shutdowns. But because the company has few assets and little debt, it was insulated in part from the financial fallout that the rest of the industry faced. The company used the time to update its technology, including a new laser projection system and sound system, worked on its marketing and leaned more into local language films, Gelfond said.

Now in a post-pandemic world, moviegoers want something premium and special for their time, and they’re willing to pay for it. That’s a bonus for Imax and so-called premium large-format screens operated by the theater chains.

“In an industry that is constantly re-evaluating its present and its future in terms of competing with new media and bringing back audiences, it’s Imax that has been at the heart of the conversation when we talk about sectors of the industry that have recovered,” said Shawn Robbins, founder of analysis site Box Office Theory. “It’s been a way for studios to have reliability in an often volatile theatrical market.”

Walt Disney Co. has leaned hard into Imax and other premium large formats.

Its marketing campaign for “Kingdom of the Planet of the Apes,” released earlier this month, prominently featured the Imax logo on billboards, bus stop signs and other advertisements. During opening weekend, 41% of the movie’s domestic box office came from premium large-format screenings, 13% of which was Imax, Disney said. Typically, a blockbuster that hasn’t been filmed on Imax cameras, like “Apes,” would do about 10% at the box office, Gelfond said.

As an industry, “we need to give audiences a terrific experience every time they go to see a movie,” said Tony Chambers, executive vice president and head of theatrical distribution for Walt Disney Studios. “Going to see a movie in premium large formats helps drive engagement and helps drive frequency.”

From 2022 to 2023, premium large formats made up 19% of Disney’s total domestic business; just before the pandemic, that total was 15%. Some of that came from 3-D screens, which have tapered off in popularity.

The company saw box office success with James Cameron’s 2022 sequel, “Avatar: The Way of Water,” which brought in $1.6 billion in revenue from premium large formats out of a total of $2.32 billion (About 11% of which came from Imax). Marvel’s “Guardians of the Galaxy Vol. 3” last year brought in 31% of its box office revenue from premium large formats.

Especially since the pandemic, there’s now more competition for people’s time and attention from streaming and social media, making it crucial for studios to give audiences a good reason to leave their couches.

“We need a way to cut through some of the clutter and make it clear to people that you cannot wait, you need to see this on the big screen,” Chambers said. “One of the ways to do that, from a marketing perspective, is to lean heavily into the premium large format.”

For a lot of people, he said, that means Imax. In fact, Imax executives bristle when people lump them with the other so-called PLFs, which include Dolby Cinema and ScreenX.

Imax box office makes up 13% of Warner Bros. overall domestic business, compared to an industry wide 5% to 7%, according to the studio. Industry wide, opening weekends are typically 10% to 12% Imax. But some are a bigger draw. The Imax share of “Dune: Part Two’s” domestic box office was 22%.

“It’s this whole notion of how do you hit critical mass,” Goldstein said. “Imax will help you get to critical mass faster.”

Imax’s future hinges on continued growth, especially internationally. As of 2023, the company had 1,772 screens across the globe, including its institutional theaters and museum screens, up slightly from the previous year.

The company also plans to expand, particularly into markets that it thinks are under-served, such as Australia and Japan.

“It has massive growth potential globally, and it’s certainly not at saturation in most of its global markets at this point,” said Alicia Reese, media and entertainment analyst at Wedbush Securities. “They should trade at a higher multiple given their growth potential.”

Business

Ari Emanuel denounces Israeli Prime Minister at Jewish group’s gala

Endeavor Chief Executive Ari Emanuel this week called for Israeli Prime Minister Benjamin Netanyahu’s ouster and denounced his leadership following the Oct. 7 Hamas attack.

The Hollywood power player made the remarks during the Simon Wiesenthal Center’s gala in Beverly Hills, where he accepted the Jewish organization’s Humanitarian Award, its highest honor.

“This is a painful and crucial moment for all of us who are Jews and who love Israel. It is not a moment to stay silent,” Emanuel said Wednesday evening.

“Israel is being led not by a problem solver, but by a problem creator. He is an agent of chaos and hatred and division and destruction. And enough is enough. Bibi Netanyahu is a failure.”

His remarks were met with both cheers and jeers, with some attendees walking out of the Beverly Wilshire Hotel. The audience was filled with members of Emanuel’s family and entertainment industry stalwarts including Larry David, Robert Kraft, Mark Wahlberg and Dwayne “The Rock” Johnson.”

Emanuel, who spoke of his family’s long ties to Israel and who supports a two-state solution, said Netanyahu “doesn’t want a peaceful solution” in the conflict “And it’s become clear that getting to a political solution and Netanyahu remaining in power are irreconcilable paths,” he said.

“As for his responsibilities to keep the people of the state of Israel and Jews across the globe safe, he has obviously failed spectacularly,” Emanuel said. “But he has succeeded wildly in using division to stay in power.”

One of the most powerful executives in Hollywood, Emanuel is also one of the most outspoken. Two years ago he urged businesses to cut ties with the artist formerly known as Kanye West after he made antisemitic remarks. Companies such as Adidas and the Gap stopped working with the rapper and producer.

In 2006, Emanuel wrote an open letter calling on Hollywood to boycott Mel Gibson after his antisemitic rant made during a drunk-driving arrest, saying the actor’s alcoholism “does not excuse racism and anti-Semitism.” Year later, Emanuel accepted an apology from Gibson and supported his return to the film industry.

The Oct. 7 terror attack by Hamas left about 1,200 Israelis dead and more than than 250 kidnapped. Israel’s military retaliation has killed more than 35,000 people and displaced thousands more, according to Gaza health officials. The war has polarized every sector of the U.S., including Hollywood.

Emanuel lamented the civilian casualties and suffering among Palestinians in Gaza. “The loss of even a single innocent child is a tragedy,” he said. But he called Israel’s war “justified” saying “Israel did not start the war in Gaza. Hamas did.”

He also criticized pro-Palestinian protesters using the slogan “from the river to the sea,” which he said means the elimination of Israel. “That’s the definition of genocide,” he said.

-

Movie Reviews1 week ago

Movie Reviews1 week agoIs Coppola’s $120M ‘Megalopolis’ ‘bafflingly shallow’ or ‘remarkably sincere’? Critics can’t tell

-

World1 week ago

World1 week agoTaiwan grapples with divisive history as new president prepares for power

-

Movie Reviews1 week ago

Movie Reviews1 week agoGuruvayoor Ambalanadayil movie review: This Prithviraj Sukumaran, Basil Joseph-starrer is a total laugh riot

-

Politics1 week ago

Politics1 week agoSouthern border migrant encounters decrease slightly but gotaways still surge under Biden

-

World1 week ago

World1 week agoSlovakia PM Robert Fico in ‘very serious’ condition after being shot

-

Crypto1 week ago

Crypto1 week agoVoice of Web3 by Coingape : Showcasing India’s Cryptocurrency Potential

-

News1 week ago

News1 week agoThe NFL responds after a player urges female college graduates to become homemakers

-

Politics1 week ago

Politics1 week agoTrump predicts 'jacked up' Biden at upcoming debates, blasts Bidenomics in battleground speech