World

China’s bad first half gets investors hopeful and interested

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5I4KWSRHFNKALGXIOWALC32V54.jpg)

July 19 (Reuters) – China’s disappointing first half has the economy ripe for some help, and investors are preparing to ride an expected short-term wave of stimulus, even if structural problems look to hold back a sustainable rally.

The latest data this week showed an economy struggling for momentum in the second quarter. A post-COVID recovery is quickly faltering, with exports declining due to cooling demand abroad and a prolonged property market downturn sapping confidence.

The grim readings raised the spectre of China missing its modest 5% growth target for 2023, and spurred hopes of stronger stimulus measures after the upcoming July Politburo meeting of top Chinese officials.

“For China, it is ‘bad news is good news’ at the moment,” said Jun Bei Liu, portfolio manager at Tribeca Investment Partners in Sydney.

Liu expects to see increased stimulus targeting cyclical sectors, such as housing, and is more interested in the services sector in the belief that post-pandemic demand will eventually rise.

“I think the reopening trade remains intact, though slower than before. China is not an ‘avoid’. (A) recovery is coming, albeit taking longer,” said Liu.

Even before the latest disappointing growth data, a slew of soft economic indicators had shown China’s recovery was falling short, slamming the brakes on nascent stock market rallies. The benchmark CSI 300 index (.CSI300) is now down 0.5% for the year, in stark contrast to the 16% rise in world stocks (.MIWD00000PUS).

Foreign money has been leaving, with worries over China’s cyber-security crackdowns and Sino-U.S. flaps over chips and rare metals adding to growth concerns.

Foreign investors sold 2.7 billion yuan ($374.47 million) of Chinese shares in the second quarter, many making an exit after having pumped in a historical 186 billion yuan a quarter before.

The promise of big-bang stimulus, which has hitherto been a stop-go mix of one rate cut and some loan relaxations for the property and state sectors, is now drawing some investors in.

“The weak growth prospects and lack of policy stimulus have already been fully priced in, and any marginal improvement in growth and policy conditions should trigger a turnaround in market sentiment,” said Marcella Chow, global market strategist at J.P. Morgan Asset Management.

“In the near term, cyclical sectors, such as consumer discretionary, materials and property, may be the major beneficiaries.”

REVIEWING CHINA

Goldman Sachs analysts led by Kinger Lau also believe a ‘tactical market recovery’ thesis is compelling, and project a 15% 12-month return for the CSI300.

“In fact, ‘China is a trade’ was a dominant theme in the majority of our meetings across investor types, regardless of their level of cautiousness and pessimism on the long-term growth and geopolitical outlooks”, they said in a note.

JPMorgan cut China’s 2023 growth forecast to 5% from 5.5%. read more , while forecasting a deeper contraction of 20% this year in new construction.

The bank says possible steps the government could take to boost economic growth include another policy rate cut and nationwide housing policy easing, including a relaxation of down-payment requirements.

“Everyone is looking for a big bang Politburo meeting at the end of July, it’s a bit like Fed watching,” said Mike Kelly, head of multi-asset at PineBridge Investments.

But the strength of the policy package is expected to be constrained and targeted, according to some analysts, citing growing debt risks and officials’ recent speeches.

“We are conservative about the extent of the policy support down the road,” said Alicia Garcia Herrero, chief economist, Asia Pacific at Natixis. “Fiscal policies may not be easily implemented, given the already high public debt and the reduced efficiency of these policies.”

Eugenia Victorino, head of Asia strategy at SEB, also reckons Beijing’s emphasis on patience will mean fresh support will be targeted, but is hopeful that recent policy support measures such as June’s rate cuts will begin to make themselves felt in coming months.

Beijing’s recent comments on doing more to support private enterprises, and the apparent end of a years-long regulatory crackdown on the tech sector could also be supportive factors for markets, Victorino added.

Nomura analysts led by Ting Lu say the stimulus “may not turn things around, due to weak confidence, negative sentiment.”

“We believe markets should curb their expectations for a fast, cure-all package and instead embrace expectations of a growth slowdown to below 4.0% in 2024,” they wrote.

($1 = 7.2101 Chinese yuan)

Reporting by Jason Xue in Shanghai and Tom Westbrook; Editing by Kim Coghill

Our Standards: The Thomson Reuters Trust Principles.

World

Top US Senate Democrat to block Trump DOJ nominees over Qatar airplane

World

Self-proclaimed 'king of Germany' arrested in plot to overthrow government

The self-styled “king” of Germany and three of his senior “subjects” were arrested for attempting to overthrow the state, according to media reports.

Peter Fitzek, 59, was taken into police custody during morning raids conducted Tuesday in seven German states, the BBC reported.

Fitzek’s group, the Reichsbürger, or “citizens of the Reich,” has also been banned by the government.

TRUMP CELEBRATES CONSERVATIVE PARTY WIN IN GERMANY

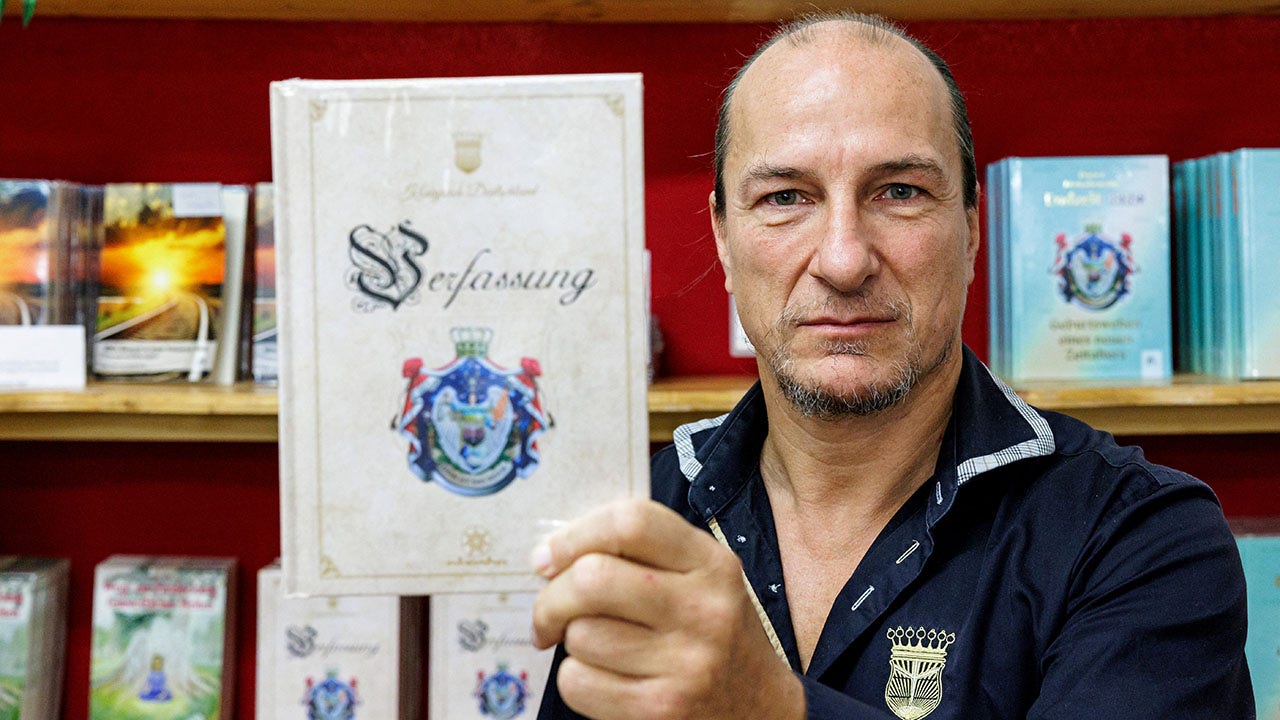

Peter Fitzek, the self-proclaimed head of the so-called “Kingdom of Germany,” poses for a photo with the kingdom’s constitution in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP via Getty Images)

The group’s aim is to establish the Königreich Deutschland, or “Kingdom of Germany.”

“I have no interest in being part of this fascist and satanic system,” Fitzek previously told the news outlet in a 2022 interview.

Reichsbürgers reportedly have their own currency, flag and identification cards and want to set up separate banking and health systems.

The Reichsbürger undermined “the rule of law,” said Alexander Dobrindt, Germany’s interior minister, by creating an alternative state and spreading “antisemitic conspiracy narratives to back up their supposed claim to authority,” the news report states.

GERMANY’S NEW LEADER LOOKS TO DISTANCE EUROPE FROM TRUMP

Peter Fitzek, the self-proclaimed head of the so-called “Kingdom of Germany,” shows the paper currency he created himself in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP)

He said the group finances itself through crime.

Fitzek, who claims to have thousands of “subjects,” denied having violent intentions but also called Germany “destructive and sick.”

In 2022, dozens of people associated with the Reichsbürger were arrested for plotting to overthrow the German government in Berlin. They were accused of planning a violent coup, which included kidnapping the health minister in an effort to create “civil war conditions” to bring down German democracy, according to the BBC.

Self-made identity and banking documents of the so-called “Kingdom of Germany” are pictured in Wittenberg, Germany, Oct. 23, 2023. (Jens Schlueter/AFP via Getty Images)

Once dismissed as eccentric by critics, the group is now seen within Germany as a serious threat as the far right has grown politically over the past decade, the report said.

World

Costa calls for reforms in Bosnia to ensure EU membership progress

After his trip to Belgrade, European Council President António Costa visited Sarajevo on Tuesday as part of his Balkans tour. He was given a warm reception upon his arrival before meeting with Bosnia’s presidency.

In a statement, the European Council chief announced that the EU “remains committed” to the country’s European future. He also praised Željka Cvijanović, Denis Bećirović, and Željko Komšić — members of the Western Balkan country’s three-way presidency — for their role in maintaining stability and security in the country and the region.

Recently, tensions have been brewing domestically over the leader of the entity of the Republika Srpska (RS), Milorad Dodik’s actions, which the state-level authorities denounced for undermining the country’s constitutional order.

Western powers and the EU have condemned Dodik for his provocations after he had suggested that the Dayton Agreement, the peace agreement that formally ended the Bosnian War in 1995, had outlived its purpose.

In his statement, Costa underlined the importance of the Dayton accords, set to mark its 30th anniversary this year.

“And this year, on the 30th anniversary of Srebrenica genocide and the Dayton (and) Paris Agreement, I believe that it is an important message to remember,” said Costa.

Costa also outlined that some reforms are needed to ensure Bosnia remains on the path to EU membership.

“We need the approval of two judiciary laws, the appointment of a chief negotiator, and the adoption of the reform agenda to move towards on the Bosnia and Herzegovina in the European path.”

Bosnia is the only country that does not benefit from the EU’s Growth Plan for the Western Balkans. Costa stressed that implementing these reforms is of paramount importance to ensure that Bosnia’s citizens benefit from the EU plan.

“I would like to see Bosnia and Herzegovina joining the other Western Balkans partners in profiting from all that the European Union has to offer,” the Council president noted.

Costa will next travel to Montenegro and Albania on Wednesday, for meetings with President Jakub Milatović in Podgorica and President Bajram Begaj in Tirana. He’ll conclude his tour with a visit to Skopje in North Macedonia, where he will meet Prime Minister Hristijan Mickoski.

Additional sources • AP

-

Austin, TX4 days ago

Austin, TX4 days agoBest Austin Salads – 15 Food Places For Good Greens!

-

Education1 week ago

Education1 week agoIn Alabama Commencement Speech, Trump Mixes In the Political

-

Technology1 week ago

Technology1 week agoBe careful what you read about an Elden Ring movie

-

Culture1 week ago

Culture1 week agoPulitzer Prizes 2025: A Guide to the Winning Books and Finalists

-

World6 days ago

World6 days agoThe Take: Can India and Pakistan avoid a fourth war over Kashmir?

-

Education1 week ago

Education1 week agoUniversity of Michigan President, Santa Ono, Set to Lead University of Florida

-

Technology6 days ago

Technology6 days agoNetflix is removing Black Mirror: Bandersnatch

-

Politics1 week ago

Politics1 week agoEPA chief Zeldin announces overhauls to bring agency back to Reagan-level staffing