San Diego, CA

Nick Canepa: Hard to believe AJ Preller’s on the hot seat given the work he put into ’24 club

Sez Me …

Baseball was founded on two things: Failure and rumor.

Gossip is much more fun, although in this era of Unsocial Media, the grapes from the vine can be stupid-bitter and much more toxic than anything Louella Parsons and Hedda Hopper came up with during Hollywood’s golden age.

Anyway, as the second half of the MLB season begins, one has caught my eye, the snowballing rumor that Padres GM A.J. Preller’s seat is white-hot, that he will be out if his team doesn’t make the playoffs (a distinct possibility) and spend his time scouting Latin America, where he can find players to trade away.

It’s not surprising. But I’ve heard this all before, and I remain hard to convince.

It’s not a Manhattan Project secret that I’m not a fan of Preller, nor him of me. That’s fine. I have managed to get by without his bon mots during his time in charge, and somehow — thanks largely to late owner Peter Seidler’s loyalty to his GM — so has he.

He’s working on his fourth manager (Mike “Rose Colored Glasses” Shildt), and has yet to do much of anything more than spend hundreds of millions of Seidler’s money. His record is almost 100 games below .500. I can think of no GM — outside of Cowboys owner Jerry Jones — who could get away with losing for so long.

But, I have been thinking this team may be Preller’s best work. As it is at this moment, it isn’t even a good club, terribly uneven, with awful elevator moments of good, just enough, and zilch.

While I’m certain the current ineptitude of the game as a whole has helped them remain hovering at .500, they have managed to remain in playoff contention despite their foibles.

Consider:

• The Pads’ top two starters — Yu Darvish and Joe Musgrove — have been absent forever. Yu, citing personal issues, may be gone for the season. Joe could be back in a month. What Preller has done with the starting unit during their absence has provided enough buoyancy to keep their heads above the waves.

• Fernando Tatis Jr., their best player, the game’s best right fielder and up there among the most gifted athletes, has a stress reaction in his right femur and hasn’t played since June 21. There remains no timeline for his return.

• Manny Machado’s offseason elbow surgery damaged him at the plate for many weeks and he’s just now coming around to being a threat with the bat.

• Preller’s signing of left fielder Jurickson Profar prior to the season seemed like a $1-million afterthought to most (not me). He’s been their best player and his enthusiasm brings fun to the dreary.

• Expensive Xander Bogaerts hasn’t been near what he was in Boston, but he missed a lot of time with a busted shoulder and has just returned. Maybe he’s not as advertised, but there is threat there. He isn’t a stiff and you start because you’re better than your replacements.

• Robert Suarez has been a find as the closer.

• Ha-Seong Kim is a fine fielding shortstop with a Gold Glove, and yet through most of the first half he was far too unreliable. He’s improved, but he’s been a run-saver in the past. Saving runs can mean wins.

• Preller drafted Jackson Merrill as a shortstop, and lacking a center fielder — so important in Petco — he put Jackson out there. Success. He’s a Rookie of the Year candidate and an All-Star.

• Preller made a trade with Miami for Luis Arraez, a batting champion in both leagues. He can hit a baseball with great regularity, although he isn’t very good at doing anything else. His production has dropped recently due to a jammed thumb, which makes me wonder why the hell he’s been playing with it.

I can just guess how much weight baseball managers carry. Shildt, who doesn’t seem to believe the media and fans have eyes, is a strong candidate for World Optimist Hall of Fame, who all too often sprays cologne on crap. But somehow he’s been a captain managing to throw enough lifesavers to keep his team afloat.

If Preller holds to form, he will buy, not sell, at the trade deadline — even if his team doesn’t appear playoff-worthy.

Alas, if the Padres play into October, the fishes will be sleeping alongside the rumors. …

Nerds say home plate umps blew nearly 17,000 ball-and-strike calls during the first half. So I don’t want to hear the blue men aren’t getting better. …

A Dodger won Home Run Derby. Now I like it even less. …

Derby TV ratings were the lowest since 2014. America (partially) wising up. …

Baseball’s All-Star Game is the only one of its kind that can do it. Players should wear their team uniforms. The ones they wore last week were designed by people who were asked by MLB fashion geniuses to come up with something swell after spending their entire lives in caves. …

Great news for the rest of the AFC East. Dolphins owner Stephen Ross is dumping his other business interests to focus on the team. …

Billions of dollars are being spent on quarterbacks. And yet Patrick Mahomes is the only active NFL QB under 35 who has won a Super Bowl. …

Caleb Williams wanted more money from the Bears than he got in NIL at USC. Barely exceeded it — $39 million over four years. …

Baseball sign: “Nobody cares how hard you throw ball four.” …

San Diego sign on a car: “Dodging potholes. Not drunk.” We have so much to be proud of. …

RIP, brilliant Bob Newhart. When he arrived at Johnny Carson’s palatial Malibu home: “Where’s the front desk?” When asked why he never corrected his stammer: “What do you think got me my home in Beverly Hills?” …

RIP, Abner Haynes. There are backs in the Hall of Fame who weren’t Abner. …

RIP, Dr. Ruth Westheimer. Unfortunately, I’ve forgotten everything you taught me. …

RIP, Richard Simmons. I never tried to do anything you taught me. …

RIP, Joe Bryant. I liked Jelly a lot, a marvelous talent who, unlike son Kobe, couldn’t consistently put it to use. …

Princess Kate went to Wimbledon and a big deal was made of it. Just because she had to pay for tickets. …

Rafael Devers home-runned so hard it broke a seat in Fenway. Know what that means? Bad seat. …

Fans broke through security prior to the Copa America finale when they heard it was possible a goal might be scored. …

Ingrid Andress admits she was drunk during her All-Star Game butchering of “The Star-Spangled Banner.” There’s never been a clear explanation as to why it’s sung prior to our sporting events. But, patriotic as I am, I have to say that, if it were not, anthem problems would be few. …

I don’t know how many people go into work anymore, but if you do, does the anthem play before you sit down at your desk? …

If you “almost” did something, you didn’t do something. …

I know enough about politics to believe that, if you’re passing the torch, you’d better be sure the person you’re passing it to can grab it.

Originally Published:

San Diego, CA

Funding for San Diego startups tumbles to smallest quarterly investment total in 8 years

San Diego County startups raised only $590 million in the third quarter, a 60% drop compared to a year ago and the smallest quarterly investment total in eight years.

The number of deals told a similar sluggish story. The county saw 48 venture capital deals inked in the three months ended Sept. 30, according to a report by PitchBook, an industry research firm, and the National Venture Capital Association. That’s a decrease from 61 deals in the third quarter of last year and the lowest quarterly count in seven years.

Nizar Tarhuni, executive vice president of research and market intelligence at PitchBook, said: “Fundraising continues to lag amid ongoing market hesitancy, driven by years of capital influx the industry was ultimately unable to absorb.”

Mike Krenn, managing director for Prebys Ventures, offered additional insight: “Both early-stage money and growth capital is increasingly difficult to raise, both for tech and life science companies. And we’re seeing the hottest sector of the day, AI investment, is largely concentrated in the Bay Area, with billion-dollar funds deploying large amounts of capital at very rich valuations. That, too, is affecting all regions, not just San Diego.”

Krenn added that while the total dollar investment for San Diego County is “certainly low, that’s attributable to the fact that we didn’t have any large rounds. We already have one $200 million round logged for Q4.”

He’s talking about San Diego-based Crystalys Therapeutics, which Krenn’s fund invested in. Crystalys is a clinical-stage biopharmaceutical company that recently announced a $205 million Series A financing. It was co-founded by James Mackay, a veteran biotech leader with 40 years of drug development experience and six drug approvals.

Its drug — a pill called dotinurad — has been approved in Japan and China and is providing “meaningful relief for people living with gout,” a common inflammatory arthritis, said Crystalys CEO Mackay. “Our experienced team is now well-positioned to accelerate dotinurad’s development in the U.S. and Europe as a much-needed second-line therapy for patients who do not respond adequately to first-line treatments.”

AI focus

“AI’s rapid momentum continues to reshape the U.S. venture landscape, driving deal count growth and capturing the majority of capital deployed in Q3,” Tarhuni said:

Nationally, top AI investments went to Anthropic in San Francisco, which raised $13 billion in September, and xAI in Palo Alto, which raised $10 billion in July, according to PitchBook.

Locally, three of the top 10 deals went to AI startups.

Alvys, a Solana Beach transportation management system using artificial intelligence and automation to transform freight operations, said in September that it raised $40 million in Series B funding.

Founded in 2020, Alvys said its customers achieve a 30% increase in monthly loads, a 10% sales boost, 90% faster accounting, 80% reduction in data entry, and savings of hours weekly in dispatch and administrative tasks.

“We’re scaling enterprise-grade solutions with AI at the core,” said Nick Darman, Alvys founder and CEO. “That means using AI, automation, and integrations to remove wasted steps, give teams smarter decision-making in real time and help carriers and brokers grow their operations and their profit margins without adding overhead. This funding helps us push toward that goal even faster.”

Turnout, which was founded about a year ago in San Diego, is an AI-powered consumer service that streamlines complex government and financial processes such as tax debt relief and Social Security Disability claims. It said in September that it raised $21 million in seed funding.

Its AI automates nearly 60% of tasks by pulling transcripts, checking eligibility, pre-filling and filing applications, gathering medical and wage records, tracking deadlines and sending status updates.

“Turnout is using AI to transform the lives of everyday Americans, helping them navigate their finances, secure the benefits they are entitled to,” said Mo Koyfman, founder and general partner of Shine Capital.

GigaIO, a Carlsbad scalable infrastructure designed for AI inferencing, said in July that it raised $21 million in Series B financing.

The new funding allows the company to expand production of its flagship products: SuperNODE, a cost-effective and energy-efficient infrastructure designed for AI inferencing at scale, and Gryf, a carry-on suitcase-sized AI inferencing supercomputer.

“As enterprises and cloud providers race to deploy AI at scale, GigaIO delivers a uniquely flexible, cost-effective and energy-efficient solution that accelerates time to insight,” said Jack Crawford, founding general partner at Impact Venture Capital.

In a PitchBook report, J.P. Morgan experts noted that while implications of investors’ love affair with AI “will take time to play out, history tells us significant market concentration carries risks.”

Defense

In addition to artificial intelligence, Bobby Franklin, president and CEO at NVCA, said U.S. deal values are climbing across other key sectors, including robotics. “This momentum isn’t just encouraging; it’s essential. Startups are the engine of U.S. job creation and the cornerstone of long-term economic growth.”

J.P. Morgan experts added that investment activity in sectors such as defense tech and robotics reflects prevailing geopolitical considerations and national security priorities.

A local example is San Diego’s Firestorm Labs, which was founded in 2022. The expeditionary manufacturing company said in July that it secured $47 million in Series A funding. The investment will help Firestorm add engineers and open a larger production facility to meet the evolving needs of U.S. and allied defense organizations.

“Our military needs technology it can trust to be ready when the circumstances demand it,” said Chris Moran, vice president and general manager of Lockheed Martin Ventures. “Deployable, on-site 3D drone printing is a powerful tool that further extends the warfighter’s ability to secure the battlespace, while advancing U.S. leadership on the frontiers of defense technologies.”

Retired U.S. Army Gen. Richard D. Clarke, who recently toured Firestorm’s San Diego facilities, said: “Firestorm’s innovation is really helping that logistics chain to operate more efficiently.”

Exit deals

Carly Roddy, co-head of venture capital relationships for J.P. Morgan, said nationally, “Strong performance of the latest wave of tech IPOs is bolstering confidence for others in the pipeline, and M&A activity is also rebounding. While there is still a long way to go in some areas of the market, recent developments are encouraging to see.”

Locally, Carlsmed went public in July. The Carlsbad company has developed a patented, machine learning technology that taps a patient’s X-ray and CT scans to design a digital surgical plan to achieve the best spinal alignment and then 3-D print titanium implants.

Company revenue for the six months ended June 30 was $22.3 million, nearly double from the same period a year ago. The company has a market cap of about $315 million.

Inmagene Biopharmaceuticals in July completed a reverse merger with Ikena Oncology and $75 million private placement with new and existing investors. The combined company in San Diego publicly trades under the name ImageneBio and has a market cap of about $82 million. The clinical stage biotech business develops treatments for autoimmune and inflammatory diseases.

Also, AbbVie in August completed the purchase of San Diego-based Capstan Therapeutics for up to $2.1 billion.

Founded in 2021, Capstan develops therapies that modulate unhealthy cells inside the body — rather than editing the cells outside of the body — through RNA delivery methods. Capstan encodes mRNA and packages it in a lipid nanoparticle that is “decorated” with an antibody, which directs the body’s T-cells to attack problematic cells.

“AbbVie and Capstan aim to transform the care of those living with autoimmune diseases by developing treatments that have the potential to reset the immune system,” said Dr. Roopal Thakkar, executive vice president of research and development and chief scientific officer at AbbVie.

In late October — after the close of the third quarter, Boston Scientific announced another local acquisition. The Massachusetts company said it will pay about $533 million for the portion it doesn’t already own of Nalu Medical, a Carlsbad company that develops a minimally invasive system to treat chronic nerve pain in areas such as the shoulder, lower back and knee. Boston Scientific has invested in Nalu since 2017.

Earlier this year, Boston Scientific said it bought another Carlsbad company called Bolt Medical, which develops intravascular lithotripsy that treats coronary and peripheral artery disease.

Nalu’s therapy uses mild electrical impulses to interrupt pain signals before they reach the brain. The system uses a miniaturized, battery-free implantable pulse generator powered wirelessly by a small externally worn therapy disc and controlled via a smartphone app.

Boston Scientific expects Nalu to generate sales of more than $60 million this year and to post year-over-year growth of about 25% next year.

Jim Cassidy, Boston Scientific’s neuromodulation president, said: “Peripheral nerve stimulation is an exciting field with significant unmet patient need.”

Nguyen is a freelance writer for the U-T.

San Diego, CA

Their dog vanished during a trip to San Diego. They found her swimming a half mile offshore.

A couple visiting San Diego was treated to a Thanksgiving miracle when San Diego lifeguards located and rescued their missing dog from the ocean Sunday.

The couple were in town watching football when they realized their black labrador mix, Sadie, was missing, the San Diego Fire-Rescue Department wrote in a statement.

Using an AirTag on the dog’s collar, the couple tracked Sadie’s location and began walking down the beach.

Two miles away in Ocean Beach, a surfer alerted the lifeguard tower that a dog had been swept into a rip current and was drifting out to sea. “I just had a surfer run up to the truck,” a lifeguard said on dispatch audio, “he’s saying there’s a dog that’s on the jetty.”

Lifeguards and the U.S. Coast Guard searched the area but could not find the wayward pup.

The search lasted more than an hour, said Garrett Smerdon and Jack Alldredge, San Diego Fire Deparment lifeguards credited with the rescue. They felt that given black labs’ ability to swim and Sadie’s age — 5 years old — she was likely still alive and swimming, or paddling.

“After an extensive search with no sightings, lifeguards began making their way back in—until a miracle happened,” the fire department wrote. A rescue Jet Ski had spotted Sadie a half mile offshore near South Mission Beach. The rescuer loaded Sadie onto a boat and brought her back to shore.

“She was super happy to see us, for sure,” Smerdon said. “She was tired.”

Sadie’s parents said in a video that they were with rescuers when the radio call came in that she had been found alive, bringing them to tears.

“We just really wanted a happy ending,” Smerdon said, “and we’re glad that Sadie got to go back home and, you know, survive this pretty traumatic event.”

San Diego, CA

More than $130M lost to elder scams in San Diego in one year

Scams targeting the elderly in San Diego County resulted in losses of more than $130 million over the course of a single year, San Diego County’s multi-agency Elder Justice Task Force announced Tuesday.

Officials released the statistics Tuesday as part of an ongoing outreach campaign regarding increasingly sophisticated internet and phone scams that are leading to escalating losses for victims.

The county’s Elder Justice Task Force, which was formed in 2020, says it has identified more than 4,600 local victims and more than $325 million in losses since its inception, resulting in state and federal prosecutions of over 70 defendants.

San Diego County District Attorney Summer Stephan said the true numbers of victims and losses are likely higher due to an under-reporting by victims who feel ashamed or embarrassed that they’ve fallen prey to scammers.

“The only people that need to be ashamed are the criminals who are bilking these good people out of their hard-earned money, and we want everyone to know no one is immune,” Stephan said.

The San Diego County District Attorney’s Office said in a statement that seniors can protect themselves by remembering the mantra of “Stop. Hang Up. Tell Someone” and by:

- Remembering that legitimate agencies will not ask someone to move their money elsewhere to “keep it safe”

- Hang up and call back using a number you know is real — never the one they give you

- Use call-blocking tools to reduce scam attempts

Common scams involve phone calls from people posing as authority figures or internet pop-up ads warning of supposed issues that require urgent resolution. Scammers have impersonated law enforcement, banking officials and even used AI-generated voices that mimic family members. Many of the schemes involve claims that victims’ identities have been compromised and that their money must now be transferred elsewhere in order to safeguard it.

“We’ve had enough of criminals aggressively targeting some of the most vulnerable people in San Diego County and, in some cases, bilking them out of their life savings,” Stephan said. “We want to educate senior citizens and their families about how to recognize scams and what specific actions they should take if they suspect they are being targeted.”

More examples of scams and scam prevention techniques can be found here.

-

World1 week ago

World1 week agoFrance and Germany support simplification push for digital rules

-

Science6 days ago

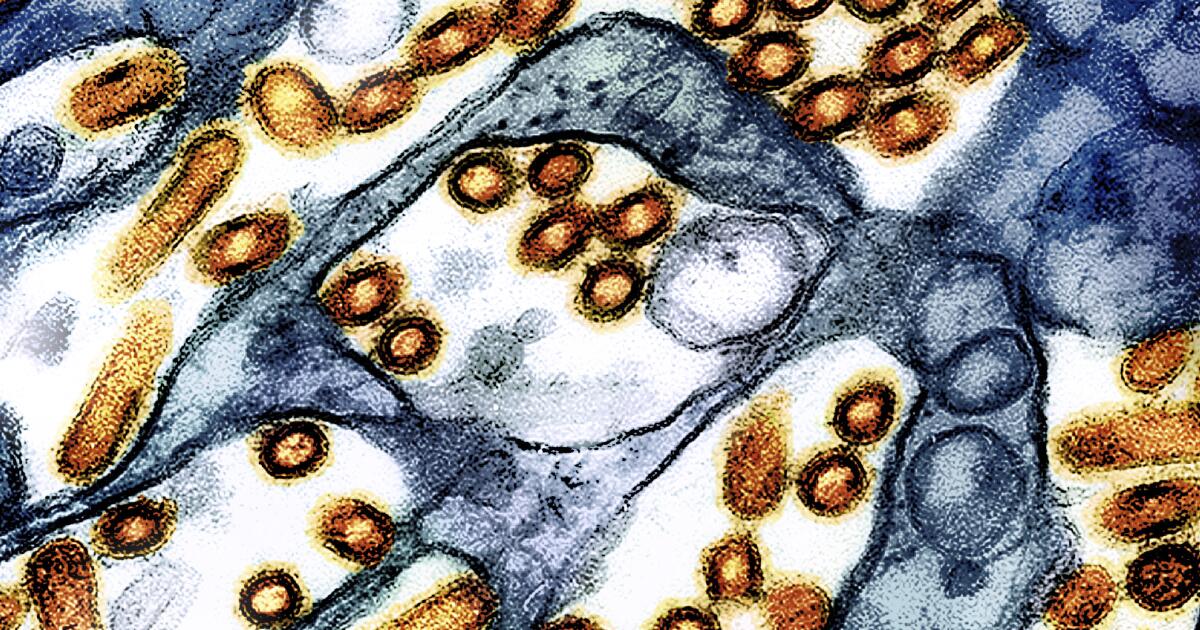

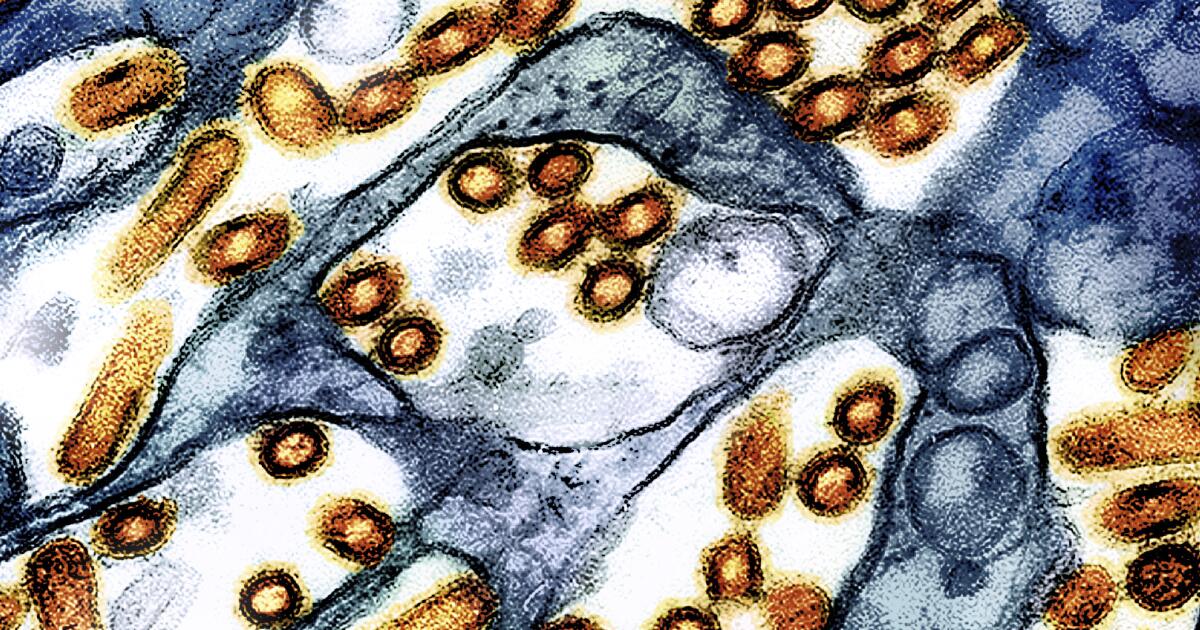

Science6 days agoWashington state resident dies of new H5N5 form of bird flu

-

News1 week ago

News1 week agoHow Every House Member Voted to Release the Epstein Files

-

Politics1 week ago

Politics1 week agoLawmakers warned PennDOT of illegal immigrant-CDL crisis before bust; GOP demands answers from Shapiro

-

World1 week ago

World1 week agoPoland to close last Russian consulate over ‘unprecedented act of sabotage’

-

News1 week ago

News1 week agoAnalysis: Is Trump a lame duck now? | CNN Politics

-

Business1 week ago

Amazon’s Zoox offers free robotaxi rides in San Francisco

-

Technology1 week ago

Technology1 week agoThe best early Black Friday deals we’ve found so far on laptops, TVs, and more