Nevada

Franco-Nevada: A Better Q3 Outlook With Rebound In Energy Prices (NYSE:FNV)

francisblack

It’s been a tough four-month stretch for the Gold Miners Index (GDX), with the sector reverting from a brief period of outperformance vs. the S&P 500 (SPY) with a double-digit year-to-date gain to a negative year-to-date return, with several developers down over 30% year-to-date. Fortunately, the royalty/streaming names have provided somewhat of a sanctuary from the selling pressure, with Franco-Nevada (NYSE:FNV) up 4% for the year while Royal Gold (RGLD) has been relatively flat. The outperformance can be attributed to these companies being shielded from the sticky inflationary pressures because of their superior business model and also being immune to the recent rise in oil prices which could once again pinch margins in Q3 (albeit not to the same effect as Q2 through Q4 2022). In this update, we’ll look at Franco-Nevada’s upcoming Q3 results and any recent developments, and whether the ~20% correction has offered a low-risk entry point in the stock.

Cobre Panama Operations – First Quantum Minerals Website

All figures are in United States Dollars unless otherwise noted.

Upcoming Q3 Results

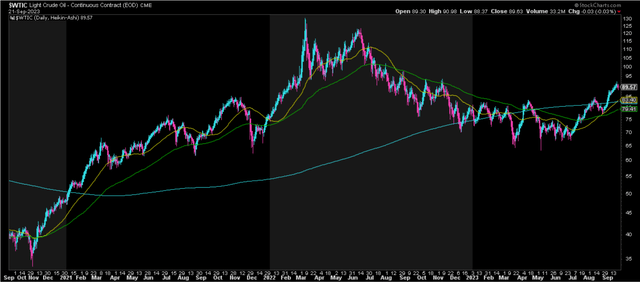

Franco-Nevada will its Q3 results by the first week of November, and while the setup still wasn’t great heading into the quarter with weaker palladium (PALL), natural gas (UNG), and oil prices (USO) offsetting the strength in precious metals, the company has got some help from oil prices, which have soared ~35% off their Q2 lows and traded up to new yearly highs. This has left Franco-Nevada in a unique position, given that while some miners will have to work against higher energy prices in the quarter, Franco-Nevada is insulated from these costs and simultaneously a beneficiary of higher oil prices (oil made up ~12% of revenue in 2022) because of its energy segment. Notably, these prices are now back above its $80/barrel WTI assumption for 2023 and its five-year outlook, reverting to a slight tailwind from a headwind in the first half of the year amid the downside volatility in oil prices.

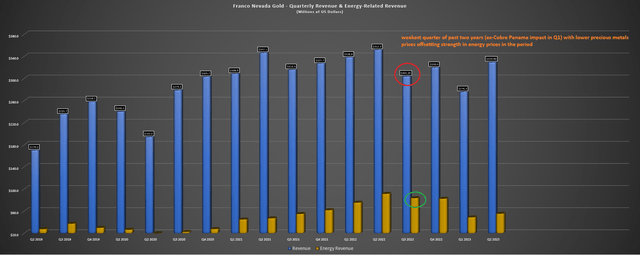

Light Crude Oil Price – 3-Year Chart – StockCharts.com

As for the precious metals front which makes up ~75% of its total revenue, the company has the opposite setup, lapping very easy year-over-year comps on gold and silver. This is because gold and silver prices correctly sharply in Q3 2022 and averaged $1,728/oz and $19.22/oz, respectively, but prices should average closer to $1,930/oz and $23.40/oz in Q3, assuming they don’t collapse to finish quarter-end. The result would be a 12% higher gold price and a 22% higher silver price, translating to a meaningful improvement in the company’s revenue from the $304.2 million reported in Q3 2022. And based on consensus estimates of ~$332 million for Q3 2023, we should see revenue up 9% year-over-year, a significant improvement sequentially from [-] 15% in Q1 and [-] 7% in Q2.

Franco-Nevada – Quarterly Revenue & Energy Related Revenue – Company Filings, Author’s Chart

So, is there any bad news?

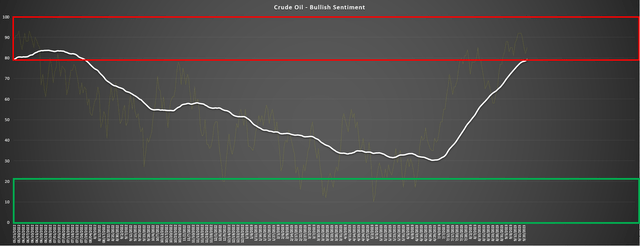

While the recovery in oil prices is a positive for this portion of Franco-Nevada’s business, sentiment for oil is heading back towards nosebleed territory, with four bulls for every one bear over the past two months. As shown in the below chart, this has typically led to a correction in oil prices, with the most recent sell signal occurring on May 26th, 2022 at ~$114.00/barrel, just one week before oil would peak at ~$122.00/barrel, with a two-month and four-month forward return following the signal of [-] 17% and [-] 32%, respectively. Obviously, this time could be different, but this suggests that while Franco-Nevada will benefit from higher oil prices in Q3, we could see some giveback in Q4 2023 and Q1 2022 given that sentiment sell signals typically result in at least four months of selling pressure to adequately reset sentiment levels. To summarize, while the tailwind in Q3 is certainly a positive, I’m less optimistic about oil staying above $90.00/barrel sustaining the $90.00/barrel level short-term.

Oil Long Term Sentiment – Daily Sentiment Index Data, Author’s Chart

Recent Developments

Moving over to recent developments, it’s been a relatively quiet quarter for Franco-Nevada in terms of deal-making, but the company continues to see progress at construction-stage or recently completed royalty assets. These include a scope change and solid progress at the Valentine Project in Newfoundland that could pull ounces forward in the mine plan (3.0% NSR), the imminent declaration of commercial production at Magino (2.0% NSR) in Ontario, the declaration of commercial production at Seguela (2.0% NSR) in Cote d’Ivoire, and solid progress at Greenstone (2.0% NSR) and Posse (1.0% NSR), which are set to reach commercial production within 12-18 months. While none of these projects are massive in scale from an attributable ounce standpoint to Franco-Nevada, they combine for a meaningful contribution, and are expected to lift Franco-Nevada’s attributable production to ~800,000 gold-equivalent ounces [GEOs] in FY2027.

Tocantinzinho Site Progress – G Mining Ventures

Among larger projects, Gold Fields noted that it is confident in its ability to pour first gold in Q4 of this year at Salares Norte, with the 1.0% NSR (assumes buyback is exercised) representing an incremental ~$8.5 million per annum in contribution based on the asset’s ~450,000 GEO production profile in its first seven years. Meanwhile, construction at Tocantinzinho is also progressing on schedule (51% complete), with the project expected to reach commercial production in H2 2024. And while this asset may not rival Salares Norte in scale with ~196,000 ounces in the first five years, the deliveries are expected to be much more significant due to the large streaming deal on this asset, with ~12.5% of gold produced or ~24,500 GEOs per annum at 20% of spot until 300,000 ounces have been delivered.

Elsewhere among organic growth projects, Island Gold is inching closer towards doubling its production in 2026 (0.62% NSR), and Agnico Eagle (AEM) continues to work on increasing production from its Kirkland Lake Camp (#4 Shaft integration and Amalgamated Kirkland) where Franco-Nevada holds a 1.5% NSR, with an additional 2.0% NSR at Amalgamated Kirkland and other areas west of the Macassa Mine. As noted in Agnico’s most recent update, the Macassa mill is expected to reach full capacity of 1,650 tonnes per day by mid-2024, with the asset no longer mine-constrained given the graduation to a more productive shaft (6.5 meter in diameter with two skips). Notably, this shaft in addition to de-risking the operation and increasing hoisting capacity also allows for better underground working conditions (improved ventilation), but lower unit costs and more effective exploration east of the South Mine Complex, benefiting Agnico Eagle and also those holding royalties on the mine, like Franco-Nevada.

#4 Shaft Construction – Kirkland Lake Gold

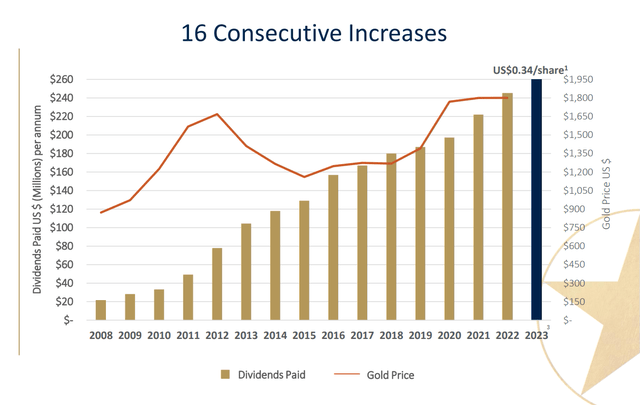

To summarize, while it’s been a volatile year for commodity prices which has created some noise in Franco-Nevada’s attributable ounce production and financial results, there is a path to much higher production from key assets, with other opportunities including a potential expansion to 950,000+ ounces per annum at Detour Lake (higher throughput + underground), and meaningful production from other assets in the development pipeline yet to begin construction like Eskay Creek, Stibnite, and Copper World. So, while Franco-Nevada may have had a tough H1 which was impacted further by a temporary rift between the Panamanian Government and First Quantum at Cobre Panama, organic growth in stages over the next several years should allow Franco-Nevada to continue reporting record financial results on an annual basis going forward and increasing its dividends to shareholders.

Franco-Nevada – Dividend Track Record – Company Presentation

Let’s dig into the valuation below and see whether investors are getting a margin of safety for this growth:

Valuation

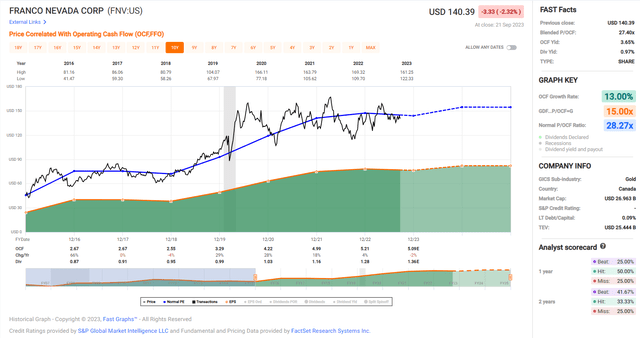

Based on ~193 million fully diluted shares and a share price of US$142.00, Franco-Nevada trades at a market cap of ~$27.4 billion. This is one of the highest market capitalizations sector-wide and it’s certainly justified with the company having ~116 producing assets (47 precious metals), making it the most diversified precious metals royalty/streaming company globally. That said, the company continues to trade at a premium multiple, trading at over 28x FY2023 cash flow per share estimates, a slight premium to its historical multiple. And even if we use a premium multiple of 30.0x cash flow given the company’s unrivaled position (greater scale and superior diversification across assets and jurisdictions) and FY2024 estimates of US$5.45, this translates to a fair value of US$163.50.

Franco-Nevada Historical Cash Flow Multiple – FASTGraphs.com

This upside case may interest some investors given that Franco-Nevada is arguably the lowest-risk name in the sector with industry-leading margins, diversification, and a rock-solid balance sheet. However, I am looking for a minimum 25% discount to fair value to justify buying large-cap names in commodity sectors, pointing to an ideal buy zone of US$122.65 or lower. This suggests that there still isn’t a margin of safety in place for the stock. And from a relative value standpoint, Sandstorm Gold Royalties (SAND) may not match Franco-Nevada’s quality, but it has significantly improved its portfolio with better diversification, an increased weighted-average mine life, and larger scale, yet trades at one-third of Franco-Nevada’s valuation at less than 10x FY2024 cash flow per share estimates. So, given that I prefer to buy hated companies trading at deep discounts to fair value, I continue to see SAND as the better reward/risk setup, even if it carries a higher risk (weaker balance sheet).

Summary

Franco-Nevada was on track to lap much easier comps in Q3 given the softness in gold and silver prices in Q3 2022, but it was still going to come up against an elevated oil price for its energy segment with prices sitting below $70.00/barrel heading into the quarter. However, the rebound in energy prices has improved this outlook, with oil averaging ~$79.00/barrel in Q3 vs. $73.78/barrel in Q2, and gold and silver prices are also much higher year-over-year. That said, while the outlook is better, sentiment on oil is now overheated short-term, and while FNV may positioned for a better Q3 than expected at the onset, I don’t see nearly enough margin of safety at current levels to justify owning the stock. In summary, while I see FNV as a top-5 name from a quality standpoint sector-wide, I continue to see better bets elsewhere in the sector.

Nevada

Penn State Football Opens As 43.5-Point Favorites Over Nevada

With more preseason hype than seemingly any other Penn State Football team in this century, the Nittany Lions will open the season with three out-of-conference opponents, starting with Nevada from the Mountain West.

The hype, combined with Nevada’s 3-10 record in 2024, has the Nittany Lions as 43.5-point favorites per DraftKings, with an over/under not listed yet. Penn State’s last win by more than 43 points came in week three of the 2024 season against Kent State, as the game finished 56-0.

Over the past five seasons, Penn State has been one of the best teams against the spread in the country. With the 12-team college football playoff, taking care of every team on your schedule is even more important.

DraftKings has also set the Nittany Lions’ win total to 10.5 games this season, which is tied for the highest win total with Oregon and Ohio State. There is no team in the country with an 11.5 win total.

Please choose an option below.

OR

Nevada

Second annual Silver & Black Gala raises $3 million for youth mental health services in Nevada

LAS VEGAS, NEVADA – The Raiders Foundation proudly hosted the second annual Silver & Black Gala on May 17 at Allegiant Stadium, raising an impressive $3 million to benefit youth mental health initiatives across Nevada. Building on the success of its inaugural year and seeing considerable growth, the Gala once again spotlighted the Foundation’s commitment to uplifting communities through access, awareness, and action.

Presented by Intermountain Health, the evening gathered nearly 1,000 attendees, including local business leaders, public officials, and a contingent of Raiders, including alumni, current players, and front office staff for a powerful night of giving. One-hundred percent of the proceeds from the Gala will directly fund mental health services, programs, and resources for youth in Southern Nevada.

The evening began with an impassioned speech from Raiders Owner Mark Davis, who lit the Al Davis Memorial Torch in honor of Elaine Wynn, followed by a surprise $1 million donation from the Raiders Foundation to four Nevada-based organizations delivering critical mental health support to young people: Boys Town Nevada, Community Counseling Center of Southern Nevada, Solutions for Change, and Campus for Hope.

“Mental health is a critical pillar of well-being, especially for our youth,” said Sandra Douglass Morgan, President of the Las Vegas Raiders. “The Raiders are proud to leverage the power of this organization and the generosity of our community to help remove the stigma and expand access to essential resources. The Silver & Black Gala represents more than a night of giving — it’s a statement of our long-term commitment to the health and future of Nevada’s youth.”

“The overwhelming support we received at this year’s Gala reflects how deeply our community cares about the mental health of our young people,” said Kari Uyehara, Executive Director of the Raiders Foundation. “It’s an honor to channel that generosity directly into programs making an immediate and lasting impact. We’re especially proud to recognize and support organizations doing the hard work on the ground every day to lift up Nevada’s youth.”

Each of the four nonprofit recipients expressed deep gratitude for the unexpected investment:

“We’re incredibly grateful to the Raiders Foundation for recognizing the importance of early mental health intervention,” said Executive Director of Boys Town Nevada John Etzell. “This support enables us to expand vital programs that help young people develop resilience, heal from trauma, and build brighter futures.”

“This gift is truly transformational for the young clients we serve,” said Community Counseling Center of Southern Nevada Executive Director Patrick Bozarth. “Mental health care should never be a luxury, and with the Raiders Foundation’s investment, we can reach more youth with the timely, compassionate support they deserve.”

“The Raiders Foundation’s leadership in mental health advocacy is inspiring,” said Danisha Mingo, Founder and Executive Director of Solutions for Change. “This funding allows us to continue our mission of empowering youth through education, therapeutic care, and community engagement — all essential tools in breaking the cycle of trauma and adversity.”

“This generous support from the Raiders Foundation strengthens our ability to meet youth where they are — with empathy, safety, and resources,” said Campus for Hope CEO Kim Jeffries. “Together, we’re building a healthier Nevada where no young person feels invisible or alone.”

The evening also featured the presentation of the “Commitment to Excellence Award” to Gary and Debbie Ackerman from Gaudin Ford and Dan Reynolds from Imagine Dragons in recognition of their outstanding philanthropic and community leadership.

Among the night’s highlights:

- A Ford Shelby F-250, donated by Gaudin Motor Company, was auctioned for $250,000.

- A private dinner with Mark Davis, Tom Brady, and Charles Woodson sold for $300,000.

- Raiders: The Opus, Silver Torch Edition, a 936-page book infused with the first 60 years of the Silver and Black, sold for $1M during the live auction.

- Stevie Wonder thrilled the audience with an unforgettable 1.5-hour performance.

Notable guests included Owner Mark Davis, President Sandra Douglass Morgan, Head Coach Pete Carroll, and General Manager John Spytek, along with Raiders Alumni Charles Woodson, Jim Plunkett, Eric Allen, and Marcus Allen. More than 40 current Raiders players attended, including Maxx Crosby, Geno Smith, Daniel Carlson, and Jackson Powers-Johnson.

For more information about the Raiders Foundation and future events, visit raiders.com/foundation.

Nevada

What will Nevada do with two weeks left in the Legislature?

The end is near. Don’t worry, it’s not the apocalypse. It’s just the Nevada Legislature.

Legislators are burning the midnight oil pushing through hundreds of bills. Last week marked the major second committee passage deadline, and there is one more major deadline between now and the final day of session on June 2.

Bills without exemptions must pass out of the second house by Friday, May 23, to get the governor’s consideration.

That means there are roughly two weeks for committees to consider some of the most talked-about legislation of the session. Lombardo’s remaining four priority pieces of legislation still need to have their first hearings. At least one of the bills is scheduled to go in front of the Assembly Ways and Means committee this week. Assembly Bill 584, his education package, will be heard Tuesday morning.

But beware: a deadline failure does not mean a piece of legislation is doomed. Policies can be revived or amended into existing bills, prolonging their discussions until sine die, when this session ends.

Here’s what’s been going on in Nevada’s capital.

Recapping the recent deadline

Last week was eventful for the biennial Legislature. It pushed bills through the second committee passage deadline, and advanced some major bills that had been exempt from the deadline.

First, the bid to stop Nevada’s clocks from changing twice a year failed. AB 81, which would have exempted Nevada from daylight saving time, didn’t make it out of the second committee passage.

An amended version of the governor’s AB 540, called the Nevada Housing Access and Attainability Act, passed out of the Assembly Committee on Commerce and Labor on Friday – the first of the governor’s priority bills to make through committee.

It was amended to decrease the amount put into the proposed Nevada Attainable Housing Fund from $200 million to $150 million, and to remove a portion that would have allowed attainable housing projects to be exempt from prevailing wage requirements.

In other news from deadline day, an amended version of the SB 179, which would allow the Nevada Equal Rights Commission to investigate claims of antisemitism in housing, public accommodations and employment, passed out of committee.

During bill’s discussion May 13, Jewish advocacy groups called for the bill to be amended to use the widely recognized definition of antisemitism from the International Holocaust Remembrance Alliance.

Other dead bills

In addition to the death of the daylight saving time bill, 30 other measures failed to advance the Friday deadline.

Those bills include:

- AB 156 would have increased the salary of Clark County School District trustees to the base salary of a county commissioner.

- AB 291 would have automatically sealed criminal records for defendants who had their charges dismissed or who were acquitted.

- SB 143 would have required a study on artificial turf and synthetic grass during the 2025-2026 interim.

- SB 324 would have prohibited the sale of most water bottles in communities abutting Lake Tahoe.

It’s far less than the 281 measures that failed the first committee passage deadline on April 11. But there are still 414 bills and resolutions as of Monday that are exempt from all deadlines, most often because they contain an appropriation or would have a fiscal or revenue impact to the state.

Monday updates

That brings us to Monday. Agendas have grown longer for money committees where lawmakers are hearing bills with significant fiscal impact to the state, some for the first time. The Senate approved SB 89, a bill preventing someone convicted of a misdemeanor hate crime from purchasing or owning firearms for up to 10 years after the conviction. The bill passed 12-8 and still must be considered by the Assembly.

The Democrats’ answer to education policy — SB 460 sponsored by state Sen. Majority Leader Nicole Cannizzaro – was heard for the first time Monday afternoon.

Contact McKenna Ross at mross@reviewjournal.com and Jessica Hill at jehill@reviewjournal.com. Follow @mckenna_ross_ and @jess_hillyeah on X.

-

Technology1 week ago

Technology1 week agoMexico is suing Google over how it’s labeling the Gulf of Mexico

-

Politics1 week ago

Politics1 week agoDHS says Massachusetts city council member 'incited chaos' as ICE arrested 'violent criminal alien'

-

Education1 week ago

Education1 week agoA Professor’s Final Gift to Her Students: Her Life Savings

-

Education1 week ago

Education1 week agoVideo: Tufts Student Speaks Publicly After Release From Immigration Detention

-

Politics1 week ago

Politics1 week agoPresident Trump takes on 'Big Pharma' by signing executive order to lower drug prices

-

Culture1 week ago

Culture1 week agoTest Yourself on Memorable Lines From Popular Novels

-

News1 week ago

News1 week agoAs Harvard Battles Trump, Its President Will Take a 25% Pay Cut

-

News1 week ago

News1 week agoWhy Trump Suddenly Declared Victory Over the Houthi Militia