Abortion is on the poll in lots of states, each instantly and not directly.

Montana is the newest state to be thought of an abortion island.

It’s not usually folks ask Jenn Banna about her daughter, Anna Louise.

“She solely lived for 5 minutes. And no person asks me nicely, what was that like?,” mentioned Banna.

And now due to a Montana poll measure, she’s speaking about her — quite a bit.

“Thanks for asking me to speak about my daughter, as a result of nobody says, inform me about your daughter that died. Like, that is by no means the top. Individuals are like, oh, that is uncomfortable. They are not certain if they need to ask,” mentioned Banna.

At 23 weeks pregnant, docs informed Banna one thing was fallacious. She and her husband had to decide on: ship the newborn early, which might have been thought of an abortion, or carry to time period realizing the newborn wouldn’t survive.

“The situation is anencephaly. And it signifies that the mind did not develop correctly. I needed to have the ability to maintain her in my arms,” she mentioned.

After 37 weeks, she held Anna Louise for her first and remaining moments — 5 minutes in all.

“If they’d taken her away to attempt to get these physique techniques going, she may need died in one other room utterly with out me and I would not have had the chance to carry her whereas she was alive,” she continued.

Banna worries that might be the brand new actuality for households if a brand new poll measure is handed in Montana: Legislative Referendum 131. 5 states have abortion-related measures on the poll this 12 months, however Montana’s is essentially the most nuanced.

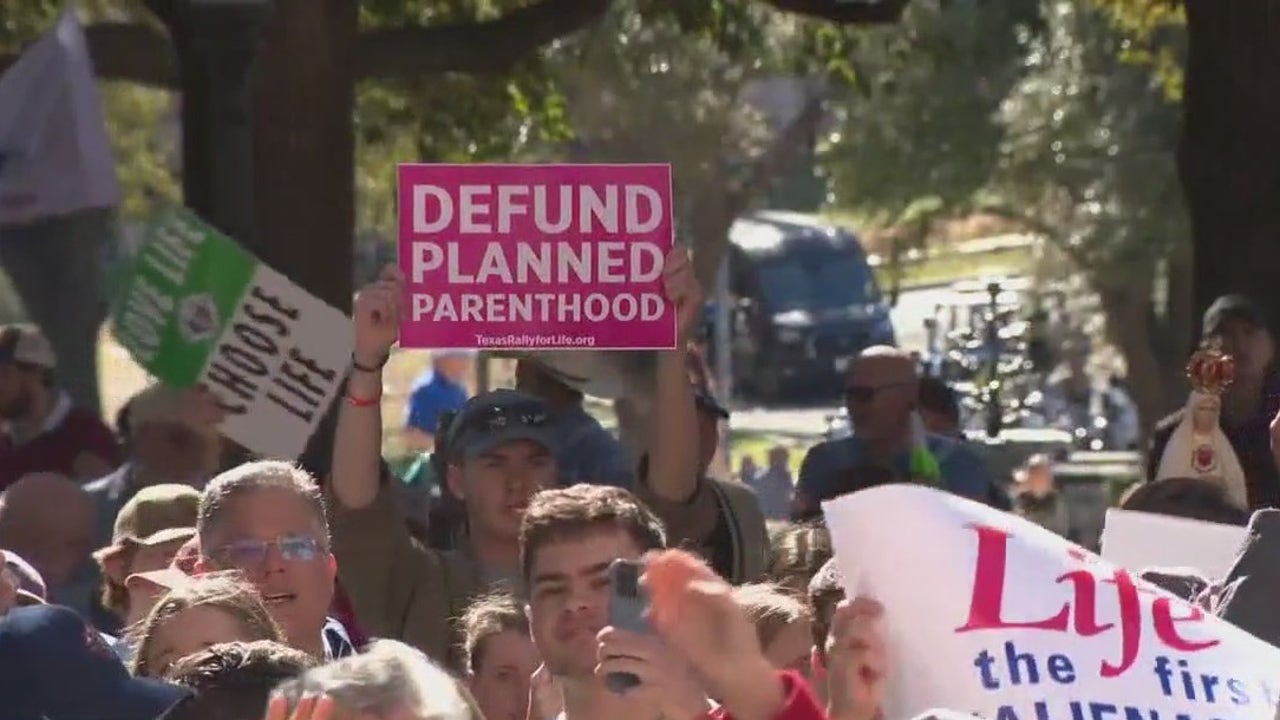

“It was put there by the legislature. They may have simply handed it, however they put it on the poll in order that they may rally anti-abortion voters to prove. After which after the Dobbs resolution, it has become the rallying level for pro-abortion rights voters to prove despite the fact that each side oftentimes will let you know, oh, this is not about abortion,” mentioned Lee Banville, a political journalism professor.

Mainly, Montana’s measure would imply any toddler born respiratory or with a beating coronary heart, should be handled as a authorized particular person. It could require healthcare suppliers to “take all medically acceptable and cheap actions to protect the life and well being of the toddler.”

“To me, that is essentially the most purest type of democracy is letting the folks in Montana resolve how large a difficulty defending born alive infants is,” mentioned State Rep. Matt Regier.

“This invoice simply makes that abundantly clear that an toddler born alive deserves that medical safety that each one of us do, and what’s of their reporting necessities and the penalties,” mentioned Regier.

That features penalties for well being care suppliers, which might be felony prices, with as much as 20 years in jail and a $50,000 positive.

Maternal fetal drugs specialist Dr. Timothy Mitchell is one in every of tons of of Montana healthcare professionals who signed on to an advert opposing the measure. They are saying it might have unintended penalties for “newborns for whom no quantity of medical care will save, and will as an alternative extend struggling.”

“I have been in these rooms quite a few instances, by no means have I assumed that the consolation care that is being supplied to those neonates, in permitting these households to grieve on their very own phrases, can be one thing that would doubtlessly trigger myself or any of my colleagues to finish up in jail for as much as 20 years,” mentioned Mitchell. “Which will seem like the physician is taking the newborn from the room to have the ability to present these resuscitative efforts. Both chest compressions or intubation or, , quite a lot of totally different interventions and, and it should stop these households from having the ability to have some peaceable moments with their youngster, , with the one moments that they’ve.”

“I do not need voters in Montana to be deciding what is going on to occur when I’m going by an expertise of shedding my youngster. And I do not need the federal government to be making that call both,” mentioned Banna.

The invoice’s sponsor, Republican Matt Regier, mentioned the invoice is simple and wouldn’t have an effect on consolation care.

“That is all about if you happen to’re a physician doing the Hippocratic oath, do no hurt. When you’re not deliberately taking the lifetime of an unborn youngster, then this doesn’t have an effect on you. So yeah, if you happen to’re a medical supplier, that’s deliberately taking the life or neglecting the life and letting the toddler deliberately die, that is what this invoice impacts,” mentioned Regier.

“From a medical perspective, there’s actually no want for this invoice, there’s there are legal guidelines already on the books that give protections to any toddler born alive,” mentioned Mitchell.

In Montana, late-term abortions are outlawed, until it’s to save lots of the lifetime of the mom.

“Even when it has by no means occurred, I might nonetheless say an toddler born alive deserves that very same cheap and acceptable medical care that you simply and I are each afforded that deliberately taking of an toddler that is born dwell, it needs to be zero,” mentioned Reiger.

Dr. Mitchell says it’s sophisticated and the invoice’s language leaves quite a bit as much as interpretation.

“Attempting to put in writing laws that’s going to embody all of these totally different situations, is extraordinarily difficult. It is simply you’ll be able to’t do it. As a result of each one in every of these conditions is exclusive,” mentioned Mitchell.

It is a difficulty doubtlessly driving voters on each side to the polls.