Hawaii

The Hawaii Legislature Is Winding Down. Will The Gut-And-Replace Ban Hold Up?

Hawaii lawmakers face a brand new check within the weeks forward as they wrap up this yr’s session: Can they get their enterprise carried out and go dwelling with out stunning the general public with completely new proposals or dramatic, last-minute amendments to the payments they’ve been debating since January?

In that case, that is perhaps a primary.

The state Supreme Court docket final yr banned the much-criticized apply generally known as “intestine and change,” through which lawmakers would strip content material from a invoice and change it with unrelated materials simply earlier than the measure was put to closing votes within the Home and Senate.

However the actuality is the court docket ruling and a subsequent opinion from the state Legal professional Basic’s Workplace gave lawmakers a lot leeway to proceed to make drastic modifications to payments.

That long-standing gut-and-replace apply was usually bitterly criticized by pissed off advocates and activists who would comply with laws all yr, solely to see payments remodeled into one thing completely new and totally different on the final minute.

Frequent Trigger Hawaii was so useless set towards intestine and change that it went as far as to create a particular “Rusty Scalpel Award” in 2014 to assist draw consideration to the apply, however that try at public shaming appeared to do nothing to curb the apply.

Then on Nov. 4 the Hawaii Supreme Court docket issued its 3-2 determination that declared a legislation to be unconstitutional as a result of it was amended throughout session utilizing the gut-and-replace tactic.

The court docket famous the Hawaii Structure requires that every invoice be voted on 3 times on separate days in each the Home and the Senate, a requirement supposed to make sure lawmakers give correct consideration to every invoice, and to permit for a full debate. It’s also supposed to present the general public correct discover and a chance to touch upon every invoice, the opinion stated.

When lawmakers strip out the contents of a invoice and insert completely new “non-germane” materials, the court docket dominated that the requirement for 3 flooring votes in each the Home and Senate begins over. Requiring that extra voting successfully slows the legislative course of, and provides the general public extra time to weigh in earlier than the payments grow to be legislation.

What Is Germane?

Lawmakers consulted with the state Legal professional Basic’s workplace earlier than the session started this yr to find out what modifications the ruling requires them to make, and obtained an opinion that proposed a two-step check to find out if an modification is germane.

Lawmakers ought to ask themselves two questions, Deputy Legal professional Basic Nicholas McLean wrote: Does an modification fall outdoors the scope of its invoice title? And does an modification basically alter a invoice’s “normal objective?”

Most measures clearly go step one. Payments with titles like “Regarding Taxes” have a tendency to stay payments having to do with taxes.

The second step is more durable to reply. McLean wrote that payments will be modified, generally even considerably, so long as the invoice’s authentic objective is stored.

“An modification is germane even when it leaves a invoice’s topic and normal objective intact – even when the modification considerably extends or limits the scope of the invoice or modifications the precise means by which the invoice’s normal objective is achieved,” McLean wrote.

Brian Black, government director of the Civil Beat Regulation Heart for the Public Curiosity and the lawyer who argued the gut-and-replace court docket problem on behalf of Frequent Trigger and the League of Ladies Voters, stated that because the determination final yr he hasn’t seen the type of “blatant and egregious” use of intestine and change.

However the true check will probably be in convention committee conferences over the subsequent two weeks, which is when many payments historically have undergone full transformations, and far political mischief occurs.

Arguing In Circles

The Legislature has drawn complaints from observers who cite radical, late-session amendments to measures similar to Senate Invoice 775 and Home Invoice 510, which have been so dramatically modified that they’re virtually unrecognizable. Aside from their invoice numbers and titles, nothing about these measures is similar as once they had been launched in late January.

HB 510, initially addressing car registration charges, would now present a tax credit score that might put a refund within the pockets of working households that want it essentially the most. SB 775, initially adjusting resort room taxes, would kick tourism tax {dollars} towards environmental efforts, amongst different provisions.

Each measures cruised by means of the Home and Senate this week, with little to no opposition. In any case, who would argue towards more cash for the setting? Or serving to working households?

“Saying one thing is intestine and change doesn’t imply its intent is unhealthy,” Malia Hill, coverage director for the Grassroot Institute of Hawaii, stated. “You could possibly have a invoice that’s doing one thing good, however it might nonetheless be a gut-and-replace invoice.”

In Hill’s view, the AG’s logic circles again to the very argument the courts rejected. “You’re actually coming proper again to the purpose of the intestine and change determination,” Hill stated.

Others query whether or not measures similar to HB 510 match inside the findings within the Supreme Court docket determination.

That invoice started the session in January as a measure to create a tax credit score to offset the price of state car registration charges on lower-income residents. However on April 7, the Senate Methods and Means Committee stripped these contents from the invoice, and remodeled it right into a measure to create a refundable earned earnings tax credit score for low-income households.

Sen. Laura Acasio anxious these dramatic amendments to HB 510 weren’t “germane.” On the Senate flooring on Tuesday, Acasio voted in favor of the invoice “with reservations,” saying she had issues in regards to the constitutional integrity of the measure. In a comply with up interview, she stated amendments want correct vetting by lawmakers.

She stated she helps extending the earned earnings tax credit score and making it refundable, and anxious that any non-germane amendments to the invoice might spell doom for extension of these credit.

When requested in regards to the Supreme Court docket determination and the modifications made to HB 510, Senate President Ron Kouchi stated, “I’m not the legal professional.” Nonetheless, the Senate’s attorneys apparently have given the amendments a thumbs-up.

“Our attorneys have suggested us that it’s to date, so good about what we’re doing within the Senate,” Kouchi stated.

Senate Invoice 775 has raised comparable questions. It began the session as a invoice to regulate the state resort room tax upward or downward relying on the variety of vacationers who visited Hawaii the earlier yr.

However on April 5 lawmakers deleted the unique contents of the invoice and inserted new language to create a fee to distribute $30 million in grants that will be funded by resort room tax revenues. The grants are to guard pure assets, assist deal with local weather change, improve public parks and offset the impression on pure assets by residents and guests.

The newest draft of Senate Invoice 775 would additionally present $60 million a yr to the Hawaii Tourism Authority, which is answerable for advertising Hawaii as a vacation spot.

Home Labor and Tourism Committee Chairman Richard Onishi stated lawmakers needed to swap out the contents of the invoice as a result of there was no different “car” out there with an acceptable title that may very well be used to advance the brand new proposal for distributing resort room tax income.

“We really feel it’s germane to the unique invoice, and that’s why we used this car, as a result of we didn’t produce other autos that addressed this identical problem,” Onishi stated.

When requested why lawmakers don’t merely introduce measures firstly of the session that extra clearly sign their intentions — similar to their plans for distributing resort room taxes — Onishi replied that “payments change on a regular basis.”

“At the start of session, you don’t essentially know what are the vital points that will be moved by means of the session,” he stated.

Testing The Limits?

A specific amount of tinkering and amending of payments is anticipated and even required throughout session, however some say lawmakers look like testing the bounds of the Supreme Court docket determination on this first session after the ruling.

Tom Yamachika, president of the Tax Basis of Hawaii, stated he’s undecided that both HB 510 or SB 775 “crosses the road.”

“We don’t know what the boundaries are,” Yamachika stated. The payments are “pushing it, that’s for positive.”

The Tax Basis and Grassroot Institute each filed court docket motions in assist of the efforts by Frequent Trigger and the League of Ladies Voters to overturn gut-and-replace laws.

However Yamachika stated the general public should still be capable of sniff out cases of intestine and change as they come up.

“It’s like pornography. You don’t actually know the right way to outline it, however when you see it, you’re fairly positive you already know what it’s,” Yamachika stated.

For Hill, the problem is in regards to the public’s capacity to trace laws because it strikes by means of the session. Somebody very desirous about car registration charges could also be confused as to why these provisions are gone from HB 510.

On the flip aspect, somebody who helps the earned earnings tax credit score may not know that essential language creating that credit score has now been added to the invoice.

Certainly, few paid consideration to HB 510 till it was remodeled with the brand new language earlier this month. Then it instantly grew to become vital, and on Monday a gathering of Home lawmakers, progressive tax advocates and low-wage employees known as a press convention to attract consideration to the invoice and urge its passage.

May Extra Payments Face Court docket Challenges?

The state structure units very particular boundaries for the way the Legislature enacts legal guidelines, however lawmakers have a substantial amount of discretion inside these limits to do as they please.

One restriction is that the title of every invoice should match the contents of the measure. Lawmakers have navigated that requirement at occasions by introducing payments with fantastically broad titles similar to “Regarding State Authorities.”

One other requirement is that every invoice “shall embrace however one topic,” in accordance with Article III of the state structure. Black stated that signifies that when lawmakers add new materials to a invoice in mid-session, the unique contents of the invoice and the brand new materials have to be “intently associated to at least one one other.”

That constitutional provision raises a possible problem to what are generally known as “Christmas tree payments,” or measures through which lawmakers instantly slap collectively materials from various unrelated payments close to the shut of a session.

A traditional instance could be Act 1 of the 2021 particular session, which gave every of the counties the authority to levy their very own resort room tax.

Aside from authorizing the controversial county resort room tax, that invoice additionally eradicated particular funding for the Hawaii Tourism Authority, decreased funding for the Hawaii Conference Heart and repealed the HTA’s procurement exemption.

It additionally transferred the Pacific Worldwide House Heart for Exploration Methods from the state Division of Enterprise, Financial Growth and Tourism to the College of Hawaii Hilo.

It additionally abolished the Workplace of Aerospace Growth, the Aerospace Advisory Committee, and the Unmanned Aerial Methods Check Website Advisory Board inside DBEDT, and transferred the Challenger Heart Program and its funds to the Division of Schooling.

It could appear apparent these scattershot provisions are usually not actually about “one topic,” however Gov. David Ige determined to not argue the purpose. Ige cited an array of different issues with numerous provisions of the invoice when he vetoed the measure final yr, however he didn’t declare it was unconstitutional.

The Legislature then overrode Ige’s veto, and the invoice grew to become legislation.

The state structure additionally requires the Home and Senate to every set deadlines throughout session for the introduction of payments, which supplies the general public an opportunity to evaluate all of them. However that invoice introduction deadline now not serves its authentic objective if lawmakers instantly rework payments into completely new measures halfway by means of the session, Black stated.

Black stated there has by no means been a court docket problem on that foundation, so nobody is aware of how the court docket would resolve such a case.

The grounds for potential challenges to the actions of the Legislature might sound easy, however they aren’t. Any problem to the constitutionality of a measure should overcome the deference courts give to acts of a Legislature that they’re presumed constitutional.

That signifies that “there are specific issues which are questionable from a public perspective, however is probably not unconstitutional,” Black stated.

The Civil Beat Regulation Heart for the Public Curiosity is an unbiased group created with funding from Pierre Omidyar, who can be CEO and writer of Civil Beat. Civil Beat Editor Patti Epler sits on its board of administrators.

Join our FREE morning e-newsletter and face every day extra knowledgeable.

Hawaii

Plane crash under investigation on Hawaii Island

WAIMEA (HawaiiNewsNow) – Federal investigators are looking into what caused a plane to crash on Hawaii Island Monday.

The National Transportation Safety Board confirms it is looking into what caused a Cessna to go down at Parker Ranch in Waimea shortly before noon.

Investigators said preliminary information indicated the plane experienced a loss of engine power.

A witness said two people walked away from the aircraft on their own. No one was hurt.

Copyright 2024 Hawaii News Now. All rights reserved.

Hawaii

Hawaii Bowl announcers Tiffany Greene, Jay Walker get rare moment in spotlight

‘Twas the night before Christmas, when all through the house, not a creature was stirring … and the only sports on TV was the Hawaii Bowl on ESPN.

The Christmas Eve game pitting South Florida (6-6) against San Jose State (7-5) didn’t bring the same energy as a major bowl, but when you’re the only live major sporting event on U.S. TV, fans will take notice.

On social media, the matchup generated surprising buzz for a minor bowl game.

People treating the Hawaii bowl tonight like it’s the Super Bowl

— Zlatni Topki (@ZlatniTopki) December 24, 2024

Out in Honolulu, ESPN had play-by-play announcer Tiffany Greene and color analyst Jay Walker on the game, and the pair, who have worked together for years, made the most of their moment in the spotlight.

Greene, who was the first African-American woman to serve as a play-by-play commentator for college football on a major network, had the opportunity to call some big plays, including this kickoff return touchdown by South Florida’s Ta’Ron Keith.

Tiffany Green was VERY amped up about this kick return touchdown and later replay of the big play from USF returner Ta’Ron Keith. pic.twitter.com/FkHDlaYBPK

— Awful Announcing (@awfulannouncing) December 25, 2024

And here’s Greene on a big interception early in the game.

USF forces an interception that would later result in points and a 14-0 lead over San Jose State.

Tiffany Greene and Jay Walker on the call of the Hawai’i Bowl on ESPN. pic.twitter.com/eMyo4aHsXn

— Awful Announcing (@awfulannouncing) December 25, 2024

Unfortunately, everything did not go smoothly for Greene and Walker. Of particular concern, Walker’s audio sounded consistently muddy, as if he were doing the broadcast remotely.

Are they actually there? Her co host literally sounds like he’s on a zoom call

— HuskerJim (@jimtheplumber63) December 25, 2024

Others on social media were even less charitable in their comments on the announcers.

This is a horrible announcing crew. This is not a high profile game, but as the only one on Cmas Eve, likely with a decent audience of folks looking for distractions, why this crew & not a better one? Why not put these guys on one of the midday workday games with less eyes/ears?

— Justin Firesheets (@JFiresheets) December 25, 2024

Yet some fans were left wanting to hear more of Greene and Walker in the future.

Tiffany is awesome! She has the spunk of Gus & a little of Beth Mowins when she announces CFB👍

— Herbie Garcia (@herbieg55) December 25, 2024

[ESPN]

Hawaii

College football's Hawaii Bowl highlights slowest sports day of 2024

Sports fans can breathe easy on Christmas Eve as there will only be one game played on Tuesday before a full buffet of games on Christmas Day.

College football aficionados will be happy to know there is one bowl game on the slate. The Hawaii Bowl between South Florida and San Jose State. The game will start at 8 p.m. ET.

CLICK HERE FOR MORE SPORTS COVERAGE ON FOXNEWS.COM

South Florida Bulls quarterback Israel Carter runs the ball against the Florida Atlantic Owls at FAU Stadium in Boca Raton, Florida, Nov. 1, 2024. (Reinhold Matay-Imagn Images)

The Bulls finished 6-6 on the season and earned a second straight bowl game under head coach Alex Golesh. They had the same record last season before entering and winning the Boca Raton Bowl over Syracuse, 45-0.

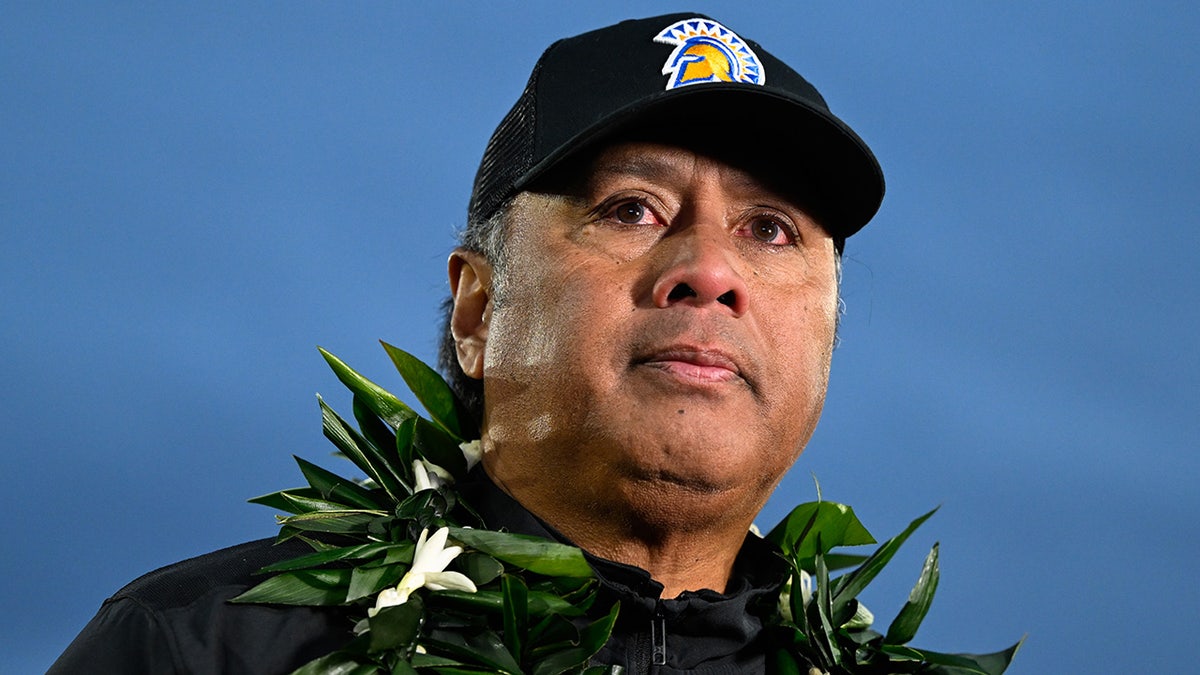

The Spartans finished the season 7-5 overall in Ken Niumatalolo’s first season at the helm. The team is on a three-bowl-game losing streak. They lost the Hawaii Bowl last season and the Famous Idaho Potato Bowl in 2022. The Spartans also lost the Arizona Bowl in 2020.

San Jose State hasn’t won a bowl game since the 2015 Cure Bowl under Ron Caragher.

San Jose State Spartans head coach Ken Niumatalolo after their win over the Stanford Cardinal at CEFCU Stadium in San Jose, California, Nov. 29, 2024. (Eakin Howard-Imagn Images)

TEXAS FOOTBALL MASCOT BEVO BARRED FROM SIDELINES OF UPCOMING CFP GAME, ORGANIZERS SAY

Sports fans looking for some action should take it all in and be able to get some sleep before opening presents and starting Christmas Day at noon ET with NBA games.

The NFL also has games on Christmas Day for the second straight year – a two-game menu featuring the Kansas City Chiefs against the Pittsburgh Steelers at 1 p.m. ET and the Houston Texans hosting the Baltimore Ravens at 4:30 p.m. ET.

Browns defensive tackle Mike Hall Jr. and linebacker Devin Bush rush Kansas City Chiefs quarterback Patrick Mahomes at Huntington Bank Field in Cleveland on Dec. 15, 2024. (Ken Blaze-Imagn Images)

CLICK HERE TO GET THE FOX NEWS APP

College football will return on Dec. 26 and the NHL will be back on Dec. 27.

Follow Fox News Digital’s sports coverage on X and subscribe to the Fox News Sports Huddle newsletter.

-

Business1 week ago

Business1 week agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology1 week ago

Technology1 week agoMeta’s Instagram boss: who posted something matters more in the AI age

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology4 days ago

Technology4 days agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps

-

News5 days ago

News5 days agoNovo Nordisk shares tumble as weight-loss drug trial data disappoints

-

Politics5 days ago

Politics5 days agoIllegal immigrant sexually abused child in the U.S. after being removed from the country five times

-

Entertainment6 days ago

Entertainment6 days ago'It's a little holiday gift': Inside the Weeknd's free Santa Monica show for his biggest fans

-

Lifestyle6 days ago

Lifestyle6 days agoThink you can't dance? Get up and try these tips in our comic. We dare you!

-

Technology7 days ago

Technology7 days agoFox News AI Newsletter: OpenAI responds to Elon Musk's lawsuit