Hawaii

Active El Niño pattern delivers with surf as high as 50 feet in Hawaii

Large surf kept many onlookers at bay over the Thanksgiving Day holiday along beaches of the country’s fiftieth state as a combination of storm systems over the Pacific produced gigantic swells.

Forecast models showed waves reaching between 20-30 feet, but heights likely reached much higher, as forecasters said 50-foot waves were possible on some north and west-facing beaches of Hawaii.

Photos taken on Friday along Waimea Bay on the island of O’ahu showed plenty of surfers taking advantage of possibly the largest waves of the year.

Surf experts say the existence of a weather pattern known as El Niño can lead to an increased frequency of events that produce large surf.

“While every El Niño is a little bit different, and it can’t guarantee enhanced surf, it does tend to produce larger-than-normal surf in the North Pacific,” Kevin Wallis, a forecasting director at Surfline, previously told FOX Weather. “So, areas like Hawaii and California tend to see larger-than-normal surf, especially during moderate-to-strong El Niño.”

The National Weather Service issued High Surf warnings and High Surf advisories for many coastal communities.

Meteorologists warned of 20 to 30 feet surf on north-facing shores and 18 to 22 feet on west-facing beaches through the weekend.

“Expect very strong breaking waves and powerful currents. Waves breaking in channel entrances may make navigating the channels dangerous,” NWS meteorologists said.

The large waves were credited for overwash that led to coastal flooding during periods of high tide.

Authorities also reported that a 42-year-old swimmer from California disappeared during the week of rough surf.

The Maui Fire Department said it made the difficult decision to suspend search operations after finding no signs of the man who disappeared in the area of the “Cliff House” in Kapalua on November 20.

Crews searched by both air and water for the swimmer after he jumped from rocks into the ocean, which was considered to be “very rough” at the time.

Several other rescues are reported to have occurred during the Thanksgiving week, but there were no other reports of missing individuals.

The NWS anticipates wave heights will drop below advisory levels by Tuesday.

Hawaii

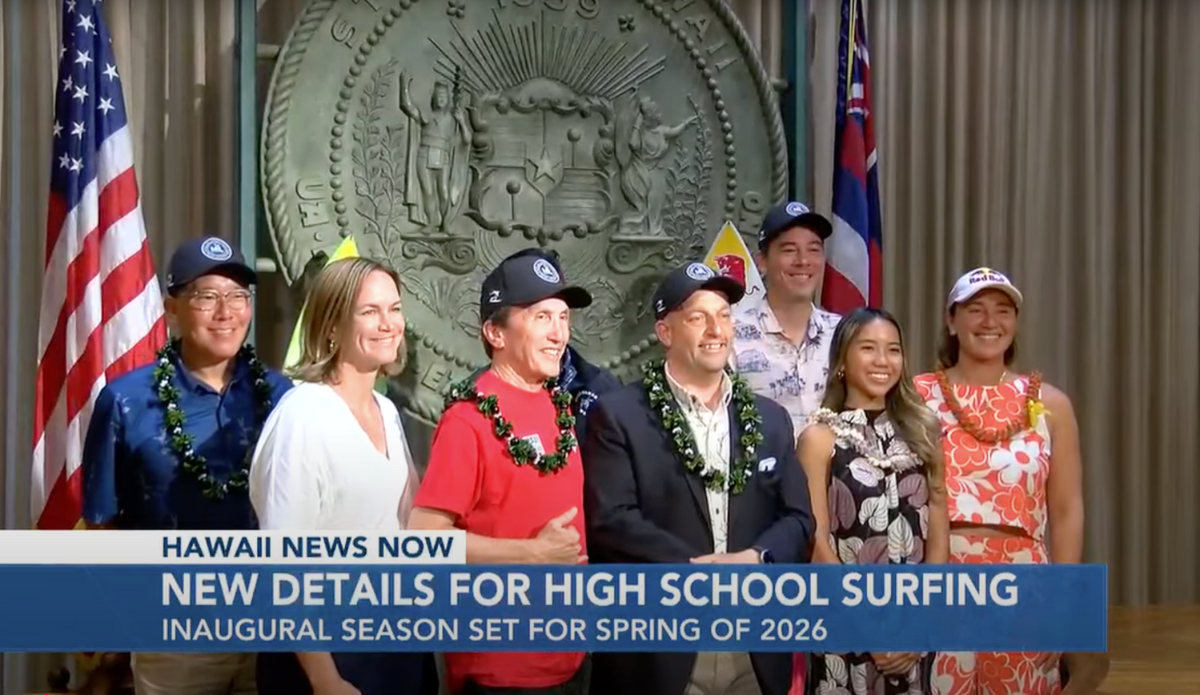

Hawaii Set to Host First State Surfing Championship in 2026

Hawaii Governor Josh Green was joined by Carissa Moore Monday to announce the 2026 Hawaii High School Athletic Association (HHSAA) surfing competition. The contest will be held at Hookipa Beach on Maui’s north shore on May 1 and May 2 and will cap off the first school year in which surfing is an official team sport at the prep level in the Aloha State.

HHSAA announced that surfing would be added to its spring 2026 schedule back in July after Gov. Green signed a bill providing $685,000 in funding for the state’s interscholastic leagues. Prior to that, athletes like Carissa Moore were left with traveling to compete as individuals representing their schools in NSSA events.

“It would’ve been cool to have a few more of my peers alongside me competing and doing it together, and representing something bigger than ourselves,” Moore told the media on Monday. She joked about the complications it created as a student, making up missed P.E. credits with laps around the track at Punahou School. “Surfing is a very individual sport, and I think this team aspect is so important and something that I missed out on as a young person.”

The May 2026 event will include competition categories for both boys and girls in three different disciplines: shortboard, longboard, and bodyboard.

“The Maui high schools have competed for 19 years as an unofficial club sport and then from 10 years ago, we’ve been competing as an official MIL sport,” said Maui Interscholastic League surfing co-coordinator Kim Ball. “So you can imagine the enthusiasm and excitement after 29 years that we’re finally going to have a state championship. The county of Maui and our MIL surf crew will do all we can to make it a memorable event.”

The news is being celebrated around Hawaii for the sport’s importance within the state’s culture and history. Beyond that, however, it makes Hawaii the first state in the U.S. to recognize surfing as a state champion team event.

Hawaii

Shohei Ohtani’s lawyers claim he was victim in Hawaii real estate deal

HONOLULU — Dodgers star Shohei Ohtani and his agent, Nez Balelo, moved to dismiss a lawsuit filed last month accusing them of causing a Hawaii real estate investor and broker to be fired from a $240-million luxury housing development on the Big Island’s Hapuna Coast.

Ohtani and Balelo were sued Aug. 8 in Hawaii Circuit Court for the First Circuit by developer Kevin J. Hayes Sr. and real estate broker Tomoko Matsumoto, West Point Investment Corp. and Hapuna Estates Property Owners, who accused them of “abuse of power” that allegedly resulted in tortious interference and unjust enrichment.

Hayes and Matsumoto had been dropped from the development deal by Kingsbarn Realty Capital, the joint venture’s majority owner.

In papers filed Sunday, lawyers for Ohtani and Balelo said Hayes and Matsumoto in 2023 acquired rights for a joint venture in which they owned a minority percentage to use Ohtani’s name, image and likeness under an endorsement agreement to market the venture’s real estate development at the Mauna Kea Resort. The lawyers said Ohtani was a “victim of NIL violations.”

“Unbeknownst to Ohtani and his agent Nez Balelo, plaintiffs exploited Ohtani’s name and photograph to drum up traffic to a website that marketed plaintiffs’ own side project development,” the lawyers wrote. “They engaged in this self-dealing without authorization, and without paying Ohtani for that use, in a selfish and wrongful effort to take advantage of their proximity to the most famous baseball player in the world.”

The lawyers claimed Hayes and Matsumoto sued after “Balelo did his job and protected his client by expressing justifiable concern about this misuse and threatening to take legal action against this clear misappropriation.” They called Balelo’s actions “clearly protected speech “

In a statement issued after the suit was filed last month, Kingsbarn called the allegations “completely frivolous and without merit.”

Ohtani is a three-time MVP on the defending World Series champion Dodgers.

“Nez Balelo has always prioritized Shohei Ohtani’s best interests, including protecting his name, image, and likeness from unauthorized use,” a lawyer for Ohtani and Balelo, said in a statement. “This frivolous lawsuit is a desperate attempt by plaintiffs to distract from their myriad of failures and blatant misappropriation of Mr. Ohtani’s rights.”

Lawyers for Hayes and Matsumoto did not immediately respond to a request for comment.

Hawaii

Hawaii justices offer mixed ruling on Green’s housing proclamation | Honolulu Star-Advertiser

-

World1 week ago

World1 week agoTrump and Zelenskyy to meet as Poland pressures NATO on no fly zone over Ukraine

-

Technology1 week ago

Technology1 week agoNew Evite phishing scam uses emotional event invitations to target victims

-

Health1 week ago

Health1 week agoDiabetes risk quadruples with use of popular natural remedy, study finds

-

Politics1 week ago

Politics1 week agoHouse plans Thursday vote on government funding bill to extend spending through November

-

Business1 week ago

Business1 week agoDisney, Universal and Warner Bros. Discovery sue Chinese AI firm as Hollywood's copyright battles spread

-

Health1 week ago

Health1 week agoWho Makes Vaccine Policy Decisions in RFK Jr.’s Health Department?

-

Finance3 days ago

Finance3 days agoReimagining Finance: Derek Kudsee on Coda’s AI-Powered Future

-

Lifestyle1 week ago

Lifestyle1 week agoBobbi Brown doesn’t listen to men in suits about makeup : Wild Card with Rachel Martin