Alaska

Dunleavy’s dividend dilemma

Few politicians have backed themselves right into a nook the best way Governor Mike Dunleavy (R – Alaska) has since being elected governor in 2018. Dunleavy, who served 5 years within the State Senate earlier than resigning to run for governor, ran on a platform of a “full statutory Everlasting Fund Dividend (PFD)” plus “back-pay.” The “full statutory PFD” implies that Alaskans ought to be paid the total quantity per a system put into statute in 1982.

“Again-pay” would have paid again the quantity Dunleavy believed was owed to Alaskans since former Governor Invoice Walker vetoed a part of the PFD in 2016. After Walker vetoed a part of the PFD, a lawsuit difficult the veto was filed. In 2017, the Alaska Supreme Courtroom dominated that the PFD is topic to legislative appropriation. Because of this–in line with Alaska’s highest court docket–PFD funds don’t must observe the statutory system. They are often decided by the Legislature on a year-to-year foundation and are topic to gubernatorial vetoes, identical to another appropriation. And that’s precisely what has occurred since 2016.

On condition that the state had nowhere close to sufficient cash to pay for its funds with out utilizing Everlasting Fund earnings and dwindling financial savings (or with out enacting substitute sources of income), most political observers appropriately noticed Dunleavy’s “full PFD” and “back-pay” idea as nothing greater than a marketing campaign tactic. However the tactic labored. Dunleavy obtained greater than 51% of the vote in 2018, beating Democrat Mark Begich by greater than 7%. Walker dropped out after a scandal induced his lieutenant governor to resign, however he remained on the poll as a result of he bowed out after the withdrawal deadline.

As soon as Dunleavy was elected, nonetheless, actuality set in. Dunleavy proposed huge cuts in his first funds with the intention to pay a full PFD. The Legislature, which appropriates cash, balked. So did many members of the general public. In 2019, a recall was launched in opposition to Dunleavy. The recall was nominally justified by a number of questionable actions taken by the Dunleavy administration, however most politicos appropriately considered it as a referendum on Dunleavy’s funds cuts. The Recall Dunleavy group simply obtained sufficient signatures to certify the recall. They wanted simply over 28,000 however turned in additional than 49,000 in September 2019. They had been within the means of acquiring the greater than 71,000 signatures required to get the recall query earlier than voters, however the COVID-19 pandemic all however ended the hassle.

Dunleavy continued to push for the “full statutory PFD” in 2020, however the pandemic, coupled with collapsing oil costs, resulted within the Legislature approving a meager $992 PFD – properly under the statutory quantity.

Then, in 2021, Dunleavy switched course and got here out in favor of a “50/50 PFD.” The “50/50” idea splits the annual draw of the Everlasting Fund equally between dividends and state spending. On Could 12, 2021 Dunleavy held a press convention in Juneau and was joined by greater than a dozen legislators, together with Home Speaker Louise Stutes (R – Kodiak), Senate President Peter Micciche (R – Soldotna), and Senator Lyman Hoffman (D – Bethel). Even Senator Mike Bathe (R – Wasilla), an avid supporter of a “full statutory dividend” was there. This place swap on the PFD by Dunleavy represented a watershed second on a difficulty that had crippled the state for 5 years.

On June 28, 2021 – simply six weeks after Dunleavy’s “50/50 PFD” press convention – the Legislature established a bipartisan Fiscal Coverage Working Group made up of members from each the Home and Senate majorities and minorities. A number of of its members had stood behind Dunleavy at his press convention on the “50/50 PFD.” Of their remaining report, the working group really helpful the “legislature work in the direction of a 50%-of-POMV-draw PFD system as part of a complete answer.” It appeared a grand compromise on the PFD problem had been reached. Nevertheless it solely appeared that means.

For almost a yr, the “50/50” idea was accepted by Dunleavy, most legislators, and the general public. However in March, the Spring Income Forecast projected greater revenues as a consequence of hovering oil costs after Russia invaded Ukraine. Dunleavy then deserted the “50/50 PFD” identical to he deserted the “full statutory PFD” a yr earlier by saying he now supported a $3,700 PFD – $1,100 greater than the “50/50” quantity for this yr. Like many Alaska politicians earlier than him, Dunleavy noticed excessive oil costs and began salivating. However issues had been about to take an much more weird flip.

In Could, the Senate majority misplaced management of the funds on the ground and ended up approving a $5,500 PFD – a $4,200 statutory PFD plus a $1,300 power rebate that the Home had beforehand handed. The modification handed 10-9 solely as a result of Senator Natasha von Imhof (R – Anchorage) was absent for the vote. However Dunleavy began drooling on the prospect of a mega dividend in an election yr. He quietly inspired the Home to concur with the Senate’s funds and keep away from a convention committee – one thing so uncommon the final time it occurred was 1982.

The Home initially had the votes, which induced Speaker Stutes to delay the concurrence vote 4 days. Dunleavy, and the Legislature, didn’t discuss to the press or make any significant statements throughout this four-day interval. In the meantime the general public was repeatedly instructed that the Senate had authorised a $5,500 PFD. However Dunleavy, who was quietly assembly with Home members, secretly pledged to veto the $1,300 power rebate to alleviate the issues of those that thought paying a $5,500 PFD was loopy. The Home ended up not concurring with the Senate’s funds, falling three votes shy. The Legislature ended up agreeing to a $3,250 PFD – a $2,600 “50/50” quantity plus a $650 power rebate. However the harm had been performed.

To recap, in a interval of lower than 4 years Dunleavy has gone from supporting a “full statutory PFD” plus “back-pay,” to only a “full PFD,” to a “50/50 PFD,” to a “50/50 PFD plus $1,100,” to a “full PFD plus $1,300 power rebate” (that he secretly pledged to veto if the Home concurred with the Senate’s funds). The teetering and lack of management by Dunleavy on this important problem dealing with the state is profound.

Final Tuesday, Dunleavy held a press convention on the funds and his vetoes. I famous his wavering positions on the PFD and requested him if he helps a “full PFD,” a “50/50 PFD,” or a variable PFD based mostly on no matter is occurring throughout any given yr. I additionally requested whether or not the uncertainty is unfair to Alaskans. He acknowledged that it has been unfair, however wouldn’t state what he helps. Moderately, he blamed the “earlier administration” for breaking the system and stated he was attempting to determine a method to repair it. He then stated he helps a constitutional modification so the folks can weigh in on the problem. When pressed about what he helps, he reverted to going again to the “folks of Alaska” weighing in, and refused to say what he helps.

Throughout the press convention, Dunleavy famous a number of instances that the present funds, which features a $3,250 PFD, doesn’t embrace any new taxes. The truth is, no taxes has been one in all Dunleavy’s speaking factors since being elected governor. However this has created one other dilemma. When Dunleavy’s first funds got here out in December 2018 (inherited from former Governor Invoice Walker), the entire state spend was $4.7 billion. That was an almost 20% lower from Walker’s first funds of $5.9 billion in 2015 (inherited from former Governor Sean Parnell). However the present funds is $6 billion, almost equivalent to Walker’s 2015 funds, and represents a 26.9% improve from Dunleavy’s first funds in 2019. Greater than $2 billion of the present funds is for PFDs. By aiming for the very best PFD doable, and pledging no new taxes, Dunleavy has boxed himself into an inescapable place. When, not if, oil costs go down, Dunleavy, assuming he wins re-election, can be pressured to decide on between chopping the PFD or pushing new taxes – two issues he’s adamantly in opposition to.

A number of years again I learn Nelson Mandela’s autobiography “Lengthy Stroll to Freedom.” One of many fundamental themes of the guide is management. Mandela defined that after apartheid resulted in South Africa, many black South Africans needed to have interaction in rating settling and violence in opposition to their white oppressors. Mandela knew this could finish in catastrophe. He defined that management typically requires explaining to the folks why they’re unsuitable on a difficulty. Whereas the PFD problem is nothing like apartheid, it’s the single largest problem dealing with the state. And the management required to repair the problem would require that political leaders put emotion and politics apart and get real looking with Alaskans.

The overwhelming majority of Alaskans don’t perceive the state’s funds. We elect folks to do this, and so they haven’t performed a terrific job recently. Many citizens, thanks to speak radio and misinformation on social media and sure web sites, assume the funds might be lower in half or that ending per diem for legislators will repair the issue. Each ideas are ridiculous. Confronted with a vote on the quantity of the PFD, after all many citizens will vote for the biggest PFD doable. And a vote wouldn’t be a “decide a brand new system for the PFD” from a listing, it will be do you approve “x new system.” For that to occur, the governor and Legislature must agree on and suggest a brand new system to the voters. That may require management.

The one means this problem will get solved is with honesty in management. And there’s a massive lack of that as of late. There can be a lot of new legislators subsequent yr, which means any significant decision on this problem would require much more management. The worth of oil will drop sooner or later. Historical past tells us that may be a certainty. What if it occurs between now and subsequent yr’s session? If Dunleavy is re-elected, which is probably going, what’s going to he do? Will he proceed to alter his positions or punt this problem to the voters? Or will he lead?

That is the dilemma he, and all of us, face.

Alaska

Canada’s LNG industry set to take flight as interest reignites in Alaska megaproject

CALGARY — Hundreds of kilometres up the Pacific coast from where Canada’s first liquefied natural gas export terminal is set to start up this summer, a monster lays dormant.

Alaska has long had ambitions to ship its natural gas to international markets, but the cost and scale of such an undertaking has held it back for decades.

But there’s been renewed interest in the megaproject since U.S. President Donald Trump issued an executive order on his first day in office devoted to Alaska resource development. State officials, including Gov. Mike Dunleavy, have been busy in recent weeks trying to woo potential Asian buyers of the gas under long-term contracts.

Industry experts have doubts the Alaska behemoth will awaken this time, but they say Canada must be mindful of the threat it could pose to its own nascent LNG industry.

“If there’s a time to build it, now would probably be your best bet,” Enverus senior analyst Josephine Mills said of the Trump administration’s keenness on Alaska gas and the Republicans’ control of Congress.

“But then again, this has been being talked about for the past 30, 40 years. It’s by no means a new project. So definitely I think it would be faced with a lot of hurdles to come.”

With an estimated price tag of US$44 billion, Alaska LNG would see a 1,300-kilometre pipeline traverse the state from north to south, passing through treacherous terrain to deliver an average of 3.5 million mmBTU a day of gas to a liquefaction plant in Nikiski, south of Anchorage. The project also includes a carbon capture plant by the gas fields on Alaska’s North Slope.

Some of the gas would be for Alaskans’ needs, but most would be loaded onto tankers and sold across the Pacific, the same markets Canadian LNG developers want to tap.

“It would be beneficial to Canada to not have Alaska LNG be built,” said Mills.

But if it did go ahead — and that’s a big if — it would be after 2030, she added.

Late last month, the state corporation behind the massive endeavour, Alaska Gasline Development Corp., signed Glenfarne Group as lead developer on the project. Glenfarne, a U.S. builder of energy infrastructure, now owns 75 per cent of the project, AGDC holding the rest.

A final investment decision on Alaska LNG is expected some time this year.

Kent Fellows, an economist with the University of Calgary’s School of Public Policy, said contracts to buy LNG are signed before plants start up and usually span several years.

So the trade chaos Trump has unleashed with a bevy of tariffs against one-time allies does the Alaska project no favours.

“It can be really costly to make some of these investments if you’re not sure that trade relationship is going to be stable going forward,” Fellows said.

“One of the huge advantages that the United States had up until about 12 months ago (is) they had a reputation for being a very stable economy, being an economy that believed in global free trade.”

If Alaska LNG is somehow successful in sewing up contracts with Asian buyers, it makes it harder for B.C. projects further behind in development to secure enough demand to justify their own plants.

“With an LNG market, that competition happens at the time the facility is built, so timing the market can end up really, really important,” said Fellows.

However, the CEO of Canada’s biggest natural gas producer said there should be plenty of interest to go around.

Mike Rose, who heads up Tourmaline Oil Corp., foresees worldwide demand soaring by up to 50 million mmBTU by 2035.

“We won’t be oversupplying because there might be a project that comes on in Alaska,” he said. “We need all of them.”

In a speech to Canadian Club Toronto last week, TC Energy chief executive François Poirier said he’d like to see a “Team Canada” approach to developing LNG.

TC Energy built the pipeline that ships gas across B.C. to the LNG Canada terminal in Kitimat.

“In Alaska, the U.S. administration is today working toward signing (memorandums of understanding) for LNG with countries like Japan and South Korea,” Poirier said.

“The governor of Alaska has travelled himself to Asia to line up customers and investors for Alaskan LNG, and guess what? He returned from his trip with an agreement from Taiwan.”

Poirier said no matter which party wins the April 28 federal election, it will be key for the prime minister, premiers, businesses and Indigenous leaders to show a degree of alignment similar to the U.S..

“Collectively, we’ll have to travel to Asia and market ourselves and underscore that Canada is back in business and is a good risk to take.”

This report by The Canadian Press was first published April 14, 2025.

Lauren Krugel, The Canadian Press

Alaska

Federal employment and budget turmoil affects monitoring of Alaska’s Barry Arm landslide

The Trump administration’s mass firings of federal workers and funding restrictions has affected the monitoring of a landslide-prone slope that could create a dangerous tsunami in Alaska’s Prince William Sound.

The Alaska Division of Geological and Geophysical Surveys, in a recent update, alerted the public about the problems affecting the multiagency team monitoring Barry Arm. The site is a fjord where an unstable rocky slope could collapse into the water, potentially creating a tsunami affecting the community of Whittier and a variety of Prince William Sound mariners and visitors.

Administrative changes affecting federal agencies that are part of the Barry Arm monitoring program “have resulted in delays in equipment repairs and service renewals essential to maintaining full operational readiness,” the Division of Geological and Geophysical Surveys update said.

Those delays “may have temporary impacts on tsunami hazard awareness and response efforts in the region,” the update said.

The slope at Barry Arm has been moving gradually, and its movements are recorded through an array of instruments at the site and elsewhere in the sound.

Barry Arm is one of dozens of sites in Prince William Sound where landslide risks have increased as glaciers that buttress mountain slopes retreat. The sound and surrounding parts of Southcentral Alaska are considered vulnerable because of rapid glacial loss.

Because of Barry Arm’s potential for a catastrophic collapse, the site has received special focus from agencies trying to track slope movement. A key goal is to provide early warnings to people in the area, if those become necessary.

Federal agencies involved in the Barry Arm program include the U.S. Geological Survey; the National Weather Service and its National Tsunami Warning Center; the U.S. Coast Guard; and the U.S. Forest Service. Nonfederal partners include the Division of Geological and Geophysical Surveys and the University of Alaska Fairbanks’ Alaska Earthquake Center, and the cities of Whittier and Valdez.

Dennis Staley, of the USGS and Alaska Volcano Observatory, said that changes to federal agency priorities and protocols for travel, purchasing and contracting have affected the Barry Arm Landslide and Tsunami Hazard Monitoring System.

“These have resulted in some rather sizeable changes in the way we approach the logistics to conducting fieldwork in recent months. We also have to plan for and adapt to changes in workforce composition as our staff members are laid off, or offered, contemplate, and sometimes accept offers for early retirement, paid administrative leave, etc.,” he said by email.

Weather conditions have also affected operations, team members said.

USGS scientists went to Barry Arm on April 2 and did maintenance work on radar equipment used to measure landslide movement and transmit that data, Staley said.

National Weather Service crews also got out to the area earlier this month and restored service at a Whittier site that was recording water-level data, said Dave Snider of the service’s Tsunami Warning Center. Crew members were able to restore service there, but more trips will be needed “as time, weather, and funds allow,” he said by email.

No more field work is planned for this month, Staley said. Annual spring maintenance is planned for May, he said.

Originally published by the Alaska Beacon, an independent, nonpartisan news organization that covers Alaska state government.

Alaska

In turnaround, median rental cost in Alaska is now down to the national median

Alaska residential rental costs used to be the highest in the nation.

Now the typical rent in Alaska is about the same as the national median for the first time on record, and 19 states have higher rental prices, according to an analysis by state economists.

That is a dramatic turnaround from the past.

In the first decades of statehood, rental prices in Alaska were far higher than those in any other state. In 1980, for example, Alaska’s median rent was about 50% above the national level and 18% higher than Hawaii, which then had the second-most expensive rental costs. Even in 2016, Alaska’s median rent was the nation’s sixth-highest, about the same as that in New York and Massachusetts, the analysis found. In a group of numbers, the median refers to the one in the middle, with half higher and half lower.

The analysis is published in Alaska Economic Trends, the monthly magazine of the Department of Labor and Workforce Development’s research section. It uses information from 2023, which is the most recent data available.

The study compares states’ gross rents, as defined by the U.S. Census Bureau, which include utilities.

Alaska’s median gross rent was $1,373 in 2023, the analysis said. California had the highest median rent of $1,992 that year, followed by Hawaii at $1,940 and the District of Columbia at $1,904.

Rental prices have risen over the years in all states, but the increase in Alaska over the past decades has been slower than that elsewhere.

That is not necessarily good news or bad news for Alaskans, and it does not necessarily mean that rents are cheap in Alaska, said Rob Kreiger, a state labor economist and co-author of the Trends article.

“Clearly, rents are moving up at a faster rate in the rest of the country than they are here. But we don’t know whether they are more affordable here than there,” he said. Affordability depends on how much renters are able to spend, he said. “You could have situations where wages are quite low and rent is less affordable,” he said.

Alaska’s rent trends roughly track the ebbs and flows of the state’s economy and demographic changes and the way Alaska conditions have compared to those in the Lower 48 states.

Twelve consecutive years of net outmigration — with more people leaving the state than moving in — was one factor that pushed Alaska’s rent-price ranking lower, the analysis said. So were the job losses related to an oil price slump from 2015 to 2018. The COVID-19 pandemic affected all states’ economies and rental prices, but Alaska had a slower post-pandemic recovery, the researchers note.

The inclusion of utilities as part of gross rents is a factor that may have slowed the increase in Alaska costs. Natural gas provided by utilities is much cheaper than the heating oil that Alaskans relied on in past decades, the report notes.

The findings include information about rental vacancy rates, which are now higher in Alaska than in the nation as a whole. That is a switch in recent years; from 2005 to about 2012, Alaska had a tighter rental market, with vacancy rates that were lower than the national rate, but since then Alaska’s rates have been higher or about the same as the national rate, according to the analysis. That is despite home construction activity that has been consistently lower in recent years than in the past, Kreiger said.

Still, it is difficult to calculate a statewide vacancy rate “because it varies so much from place to place,” he said. Parts of rural Alaska have dire housing shortages, for example.

While the comparison to national rates is new, the department’s research section does regular analysis of rental costs differences within Alaska.

The researchers, in cooperation with the Alaska Housing Finance Corp., publish annual reports on rental costs at different state locations, based on costs each March.

The most recent report found that among 10 regions, median rents in 2024 for two-bedroom apartments were lowest in the Wrangell-Petersburg area, at $1,081 a month, and highest in the Kodiak Island Borough, at $1,713 a month.

Originally published by the Alaska Beacon, an independent, nonpartisan news organization that covers Alaska state government.

-

Politics1 week ago

Politics1 week agoDems slam Elon Musk, Melania Trump with xenophobic attacks: ‘Go back to South Africa!’

-

News1 week ago

News1 week ago‘White Lotus’ Takes On Touchy Subjects. The Southern Accent Is One of Them.

-

News1 week ago

News1 week agoFiring of National Security Agency Chief Rattles Lawmakers

-

News1 week ago

Trump goes all in with bet that the heavy price of tariffs will pay off for Americans

-

Politics1 week ago

Politics1 week agoUS revokes all South Sudan visas, bars future issuance until deportees accepted

-

News1 week ago

News1 week agoAnti-Trump Protests Get Underway Across the Country

-

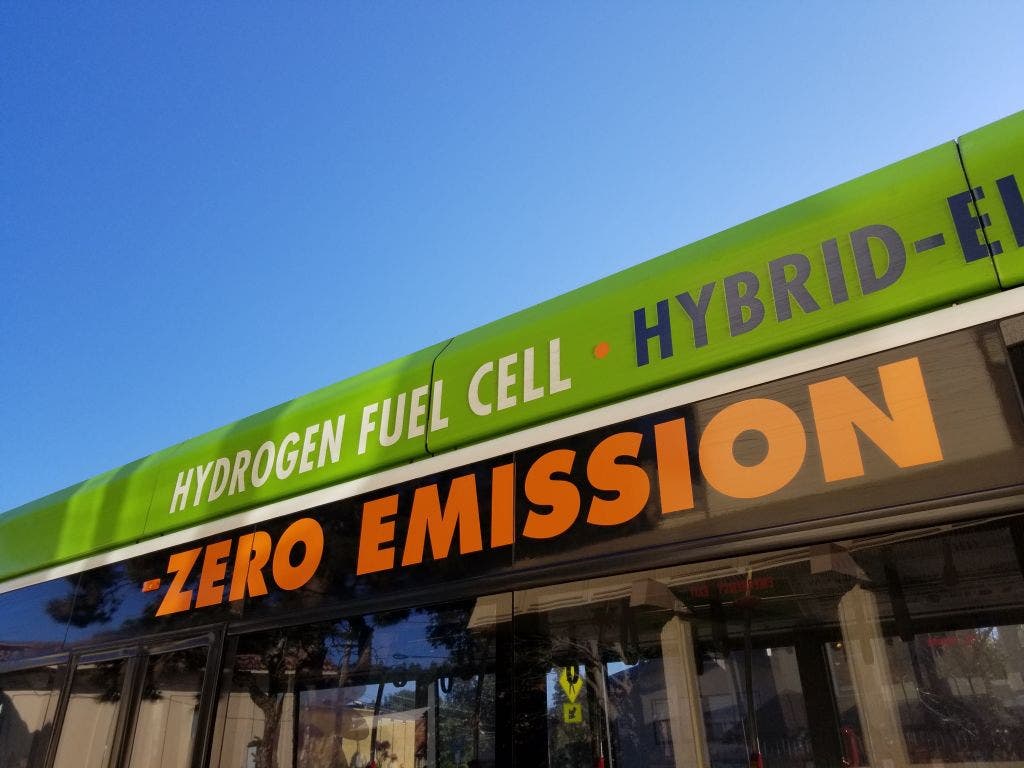

Politics1 week ago

Politics1 week agoH2Go: How experts, industry leaders say US hydrogen is fuel for the future of agriculture, energy, security

-

News1 week ago

News1 week agoAmericans Wrestle With How Trump’s Tariffs May Change Shopping Lists