Mississippi

Mississippi legislators: Education, infrastructure, healthcare, income tax break among top priorities for 2023 – Mississippi’s Best Community Newspaper

Mississippi legislators: Schooling, infrastructure, healthcare, revenue tax break amongst prime priorities for 2023

Printed 9:14 am Saturday, December 31, 2022

- State Sen. Melanie Sojourner sits at a desk with different state legislators throughout the annual legislative breakfast sponsored by the Natchez-Adams Chamber of Commerce. (File photograph)

NATCHEZ — The 2023 Common Session of the Mississippi Legislature begins very shortly after the New Yr vacation, at midday on Tuesday, January 3, 2023.

With the session so shut on the horizon, we requested legislators representing Adams County their tackle just a few hot-button subjects, beginning with what their priorities are for this session.

One factor on every of their minds is directing $300 million left within the American Rescue Plan Act fund and a $1.4 billion surplus in state funds to assist Mississippi residents in the very best means, however their concepts differ on what these methods ought to be.

Earnings Tax

District 97 Home Rep. Sam Mims V, R-McComb, mentioned he plans to make use of his place as a member of the appropriations committee to concentrate on methods to assist Mississippi residents who’re struggling as a consequence of inflation.

“Our economic system is doing very nicely. Nonetheless, we now have to be very conscious of what’s on the horizon,” Mims mentioned. “I’ve by no means seen extra of a disconnect between what is occurring at Jackson and what’s occurring in Washington, D.C. Now we have to know individuals are nonetheless struggling as a consequence of inflation. Gasoline costs and mortgages are greater, and there are provide chain disruptions that have an effect on everybody. I plan to focus quite a lot of my time on appropriations as a member of that committee on how we spend our regular state price range.”

Mims mentioned he helps the elimination of the state’s revenue tax, which might each assist these fighting inflation and make Mississippi extra enticing to these on the fence about shifting right here.

“In 2022, We handed the 4% revenue tax fee by 2026. It’s a begin,” he mentioned. “We had been in a position to get a $240 million per yr instructor pay increase and nonetheless lower our revenue tax. Our eco is in nice form. I believe it’s time we begin our state’s revenue tax additional. I assist eliminating the revenue tax and I believe we’ll proceed to have some good discussions on that in 2023. I believe we do want to present our taxpayer’s a reimbursement.”

District 37 State Sen. Melanie Sojourner, R-Natchez, agreed with Mims on the elimination of the state’s revenue tax.

“Greater than something the folks of Mississippi deserve a significant long-term tax lower,” she mentioned. “We will do this by eliminating our state revenue tax. Our state is on strong monetary footing and now could be the time to make this transfer. Sadly, Lt Gov Hosemann is the one statewide official who hasn’t supported this coverage so we haven’t been profitable in getting it handed. Now’s the time to present hardworking Mississippians a break and permit them to maintain extra of their hard-earned cash.”

On the flip aspect, District 94 Home Rep. Robert Johnson III, D-Natchez, mentioned there are a number of points in Mississippi — significantly in healthcare and infrastructure — that can require some huge cash to repair. These ought to take precedence over slicing out the state revenue tax, he mentioned.

“I believe we must always maintain our wants first,” Johnson mentioned of additional decreasing the revenue tax. “Hospitals take cash.”

District 96 Home Rep. Angela Cockerham, I-Magnolia, mentioned she feels the state’s revenue tax will likely be a sizzling matter this session.

“One of many main causes we pay taxes is to offer companies, via authorities businesses, for our residents. The state presently has a income surplus,” she mentioned. “We should be sure that our state businesses, in addition to the companies supplied, will likely be sustained. There will likely be continued discussions relating to the elimination of state revenue tax and a evaluation by

committees within the upcoming session.”

Infrastructure and Healthcare

Johnson mentioned he hopes to direct ARPA funds to infrastructure wants, significantly towards drainage points in Natchez and Adams County.

“Natchez and Adams County have a number of quick wants that I wish to tackle,” he mentioned. “That’s excessive on my precedence record. One other is to handle pressing wants going through hospitals, particularly rural hospitals in Natchez and Fayette which are near closing. Not solely these however we now have to handle the emergency wants of hospitals throughout the state.”

When Mississippi voted down Medicaid enlargement, Johnson mentioned, “We turned down $1 billion federal {dollars} a yr, 100% funding from the federal authorities to verify working folks have entry to healthcare protection in our state.”

Johnson mentioned the “most everlasting” factor Mississippi might do to enhance healthcare entry — and create jobs as a state with one of many “lowest doctor-per-patient ratios within the nation” — is to simply accept these federal {dollars}. Johnson additionally helps including 12-month postpartum protection for girls on Medicaid.

Cockerham agrees with Johnson on the Medicaid subject.

“I assist rising Medicaid protection for 12-month postpartum care for girls and Medicaid enlargement,” she mentioned. “The well being care of ladies, particularly moms, ought to be prioritized. Extending the protection for postpartum care would offer further assist for moms in our state.

“The Mississippi Financial Council has studied the impact of Medicaid enlargement on our state. Medicaid enlargement would be sure that Mississippians have entry to well being care, assist in holding rural hospitals open and enhance enterprise growth in Southwest Mississippi. Moreover, a long-term funding answer for rural hospitals is required.”

Mims, a member of the Medicaid committee and in addition the chairman of Public Well being and Human Providers, mentioned he’s additionally extremely involved with the low doctor-patient ratio within the state however believes Medicaid enlargement will not be the reply.

“Sixty-five p.c of births are on Medicaid right now,” he mentioned. “I believe we are able to have a look at different methods to enhance healthcare.”

Mims mentioned he’s engaged on laws that may assist the state retain and rent nurses and docs.

“Now we have round $300 million left ARPA. We spent about 1.1 billion in 2022. I wish to discover methods to ship a few of that cash to our hospitals to help them. Like the remainder of us, they too have been coping with greater wages, greater materials prices and provide chain points. Their reimbursements aren’t following the identical fee of enhance as the associated fee. Lastly, I believe we have to discover methods to encourage nurses in rural components of our state in positions that can proctor residents in nursing faculty or med faculty. We want extra nurses and physicians in Mississippi.”

Sojourner mentioned, “Now will not be the time to develop Medicaid and push for brand new welfare packages that can solely rob Mississippi households of extra of their revenue.

“To develop the economic system we should give taxpayers a break, reduce the scale of presidency and push again on the federal overreach that’s limiting particular person liberty and stifling small enterprise development in Mississippi.”

Response to Supreme Court docket rulings

Mims mentioned he has been assembly with the Fee on Life and discussing methods to assist moms and new infants in mild of the Roe v. Wade Supreme Court docket ruling.

“Due to that, we estimate an extra 5,000 infants to be born in Mississippi,” Mims mentioned. “Now we have 19-20 Federally Certified Well being Facilities. They will present avenues to help these mothers and infants proper now. We have to applicable to these FQHCs. We additionally must make foster care and adoptions simpler. There may be typically purple tape on each. We have to have a look at methods to make it cheaper and scale back the purple tape and discover methods to verify fathers are paying baby assist. We expect they’re however want to verify everyone seems to be.”

Mims additionally challenged the religion communities who’ve been praying for the Roe v. Wade choice for many years.

“I consider that they should step and be part of the answer,” he mentioned.

One factor Johnson mentioned he’s keen about is giving Mississippians again the power to handle points with poll initiatives.

On Might 14, 2021, the Mississippi Supreme Court docket overturned Initiative 65, the 2020 medical marijuana initiative, as a result of the petition didn’t adjust to the signature distribution necessities within the Mississippi Structure, which states, “The signatures of the certified electors from any congressional district shall not exceed one-fifth of the full variety of signatures required to qualify an initiative petition for placement upon the poll.”

Throughout 2001 redistricting after the 2000 census, nonetheless, the variety of congressional districts within the state was decreased from 5 to 4, making a mathematical impossibility to comply with the state’s constitutional necessities regarding poll initiatives.

To right this, the state’s structure would must be amended.

“The Supreme Court docket dominated that we would have liked to make a change within the regulation and it is vitally vital we achieve this,” Johnson mentioned. “That’s how we had been in a position to ratify the change within the flag and move the medical marijuana invoice. Now we have taken that away and we have to get it again.”

Schooling

Within the final session, a historic instructor pay enhance handed. Cockerham mentioned consideration ought to now be turned to highschool district assist workers, certainly one of her prime priorities this session along with infrastructure, and assist for judges and “the judicial system’s assist for judges and regulation enforcement to deal with their circumstances in a well timed method, in addition to guaranteeing that drug, veterans, and psychological well being courts proceed to thrive in Mississippi.”

One suppose being mentioned by state officers is modifying the college calendar in order that summer season breaks are shorter and extra breaks are added throughout the faculty yr.

Most really feel that call ought to take within the opinion of these most affected by it.

“The summer season break is utilized by our lecturers and directors to plan and for college kids to refresh for the upcoming faculty yr,” Cockerham mentioned. “The inhabitants that can most be impacted, together with lecturers, dad and mom, directors, and the Mississippi Affiliation of Educators, have to be an integral a part of any discussions to change the college calendar to shorten summer season breaks and add further breaks throughout the faculty yr.”

Mims mentioned, “Earlier than COVID we had been seeing excellent enhancements in training. We noticed our third graders rating excessive on the nationwide stage. I believe our present calendar is smart. I’m not in favor of adjusting our calendar except I see one thing that modifications my thoughts.”

Sojourner mentioned training must be addressed on the college stage.

“We should do one thing to dam the ‘woke’ tradition that’s crippling our society by indoctrinating our younger people who find themselves making an attempt to additional their training,” she mentioned. “There are steps we are able to take to do that and there’s no higher time than 2023. We’re going to begin by introducing laws to get rid of tenure for college professors. We will need to have the power to take away facility members who’re extra all in favour of pushing their private cultural beliefs onto college students as a substitute of merely instructing their course subject material.”

Mississippi

Report shows Mississippi Legislature retirement reforms this year aren’t effective. See why

Lawmakers, PERS director agree they must work together in the future

How to plan for retirement using an online calculator

Retirement calculators can give you an idea of when you’ll financially be able to retire.

Problem Solved

State lawmakers will need to readdress concerns about the Public Employment Retirement System of Mississippi in 2025 if it is to remain viable long term, according to a July study.

Legislative actions in the 2024 Session to reduce public employer contribution rate hikes and increase state funding are not enough to address billions in unfunded future benefits to retirees, according to a report released by the Legislature’s third-party watchdog group, the Performance Evaluation and Expenditure Review Committee.

Projections show the state’s retirement plan being less than 50% fully funded by 2047 and having $25 billion in liabilities. According to several municipal leaders who spoke to the Clarion Ledger earlier this year, the legislative move from lawmakers in the past session should save public employers from cutting positions and raising taxes to keep and hire more public employees.

“Change in approach for increasing the employer contribution rate, in addition to the one-time funds transfer, reduces the plan’s projected future funded ratio from 65.5% to 49.9%,” the report reads. “…The PERS plan is currently expected to be at a lower-funded level in the future than it currently is today.”

PERS Executive Director Ray Higgins told the Clarion Ledger he wasn’t surprised by the report’s findings.

“The PEER analysis seems to be an accurate report and generally reconciles with our information,” Higgins said. “Also, the legislative action from last session appears to be a short-term solution.”

While the report does not list out any specific recommendations for lawmakers this coming year, it says continued work will be necessary to fix the retirement system that has 118,000 retirees receiving benefits and 147,000 active members paying into the system.

In 2023, the PERS governing board, made up of mostly elected members, as advised by financial actuaries who watch over the state’s retirement plan, passed a rate increase on public employers, such as cities, counties and school districts from 17.40% to 19.90% that was to take effect July 1. The rate would have continued to increase to 22.4% by 2027.

In the 2024 Session, the Legislature passed two bills. Senate 3231, prohibits the PERS Board’s plan to gradually increase the employer contribution rate and replaces it with a plan to increase to 19.90% over the next five years in 0.5% annual increases. SB 3231 also takes the board’s only regulatory power to increase rates and puts it in the hands of the Legislature.

SB 2468 enacts a one-time transfer of $110 million of capital expense funds into the PERS trust.

More on PERS bill MS Legislature passes bill restricting state retirement board’s authority

Lt. Gov. Delbert Hosemann’s Deputy Chief of Staff Leah Rupp Smith told the Clarion Ledger efforts Hosemann helped push forward that resulted in those bills’ passage led to a potentially more stable retirement system.

“To avoid this calamity while developing a future solution, the Legislature adopted a less-aggressive employer increase,” Smith wrote via email. “We are now informed the plan has a projected future funding ratio of 65.5% as of 2047, as compared to 48.6% projected one year ago.”

Republican House Speaker Jason White’s Communications Director Taylor Spillman did not reply to several emails requesting White’s comments on the report.

What are the big problems?

Higgins previously said the ratio of retirees to active members has seen a reverse trend since 2013, when there were 93,000 retirees and 162,000 active members. This increases the unfunded liability of the system as fewer people take jobs in government, reducing active members and more people retire, increasing the funding obligation of PERS.

The other issue lies with projections for the retirement plan’s future if state lawmakers decide not to take action in the years to come.

“While the ($110 million) funding for the first year is comparable, each year in the future could potentially see a greater deviation in expected employer contribution revenues for the PERS plan,” the report reads. “This deviation does not immediately constitute a problem for the PERS plan; however, careful evaluation of the plan’s future liabilities and funding needs will be necessary to ensure the sustainability of the PERS plan.”

Are there any solutions?

Higgins and Smith both said future work on PERS is still a top priority.

Higgins specifically mentioned a new retirement benefits package that could be offered to new public sector employees, which the PERS board has called tier 5.

“The Board has previously recommended a tier 5 for new employees to help better sustain PERS in the future and is currently considering what may be included or resubmitted in next year’s legislative package,” Higgins said.

Read about new Medicaid program Mississippi Medicaid prenatal care access program still awaiting federal approval. Why?

Earlier this year, Hosemann told the Clarion Ledger he wanted to see evidence that a new tier of benefits could help maintain the retirement system long term. Smith did not confirm whether Hosemann’s office is currently studying that idea in the legislative off season, but she did say the Legislature is looking at several ideas.

“The Legislature is exploring any option for a more viable plan,” Smith said. “The Lt. Governor continues to be committed to fulfilling current employee and retiree benefits, including the cost-of-living adjustment for these individuals.”

Grant McLaughlin covers state government for the Clarion Ledger. He can be reached at gmclaughlin@gannett.com or 972-571-2335.

Mississippi

Mississippi votes conservative. Are we going to see more conservative policies?

Waiting for my suitcase in the arrivals hall at Jackson airport the other evening, it occurred to me that the luggage carrousel was a pretty good metaphor for Mississippi politics.

Like suitcases on a carrousel, many leaders simply sit on the conveyor belt of state politics, waiting their turn to get moved along to the next role.

Too often leaders are carried along by time and process, rarely offering any vision as to what our state should do differently. That explains why Mississippi conservatives have achieved less in 12 years than Arkansas, Louisiana and Alabama have accomplished in the past 12 months. Louisiana did not even have a Republican governor this time last year, yet they’ve already passed universal school choice.

Things could be about to change if House Speaker Jason White has his way. This week, White announced that he will be hosting a Tax Policy Summit on Sept. 24 to take a deep dive into the prospects for tax reform.

My friend, Grover Norquist, will be speaking, as will Gov Reeves, as well as leading conservative figures from the state Legislature.

Having a conversation in public matters because in the past the leadership in our state Senate has done what it can to head off tax cuts. Bringing the facts of what can and cannot be done into the open makes it far harder for anyone to keep finding new excuses to oppose actual conservative policy.

Sunshine is the best disinfectant against the putrid politics of backroom deals. We have seen far too many backroom maneuvers used to kill off good conservative policy in this state. Back in 2022, Mississippi passed a law to cut the state income tax to a flat 4 percent. This $525 million tax cut, driven forward by Speaker Philip Gunn and Gov Reeves, benefited 1.2 million taxpayers and their families. But we must not forget how some in the Senate fought against it — not in the open, of course.

Weak Senate leadership has a history of opposing conservative proposals in our state. Seldom do they have the courage to come out and explicitly kill off conservative measures. Instead, they do it on the sly. The Senate leadership maneuvered to stop anti-DEI legislation in 2024. I don’t recall anyone coming out and explaining why they opposed anti-DEI law. They just killed it in committee with a nudge and wink.

For three years in a row, the Senate leadership has killed off attempts to restore the ballot initiative. Again, those against resorting the ballot lack the courage to say they are against it. They killed that, too, on the sly.

Rep Rob Roberson’s excellent school funding reform bill, perhaps the only big strategic achievement of this year’s session, passed despite attempts to scupper it by some in the Senate. (Part of the backroom deal to get the bill passed was to change its name. It really was that petty.) When the Senate leadership wants to oppose an authentically conservative policy, they follow a now familiar pattern.

A reason is cited as to why what is being proposed can’t be done. School choice, we were once told, would be unconstitutional. An anti-DEI law, it was implied, was unnecessary because there was no DEI on campus.

Once that excuse is shown to be nonsense (there is no constitutional bar to school choice, DEI is rampant on campus), another excuse is promptly conjured up. And on it goes.

Each time the Senate leadership opposes conservative policy this way, I wonder what their alternatives are. The answer is that most of the time there are none. It is pretty low grade to oppose ideas simply because they are not your own. Eventually, of course, a suitcase that sits on the carousel for too long ends up in lost luggage.

As a direct consequence of the 2022 Reeves-Gunn tax cuts, Mississippi is now starting to see a flood of inward investment into the state.

Every time you hear about a new factory opening up in our state, remember who and what helped make it happen. I am very optimistic that this tax summit could see further progress to make our state more competitive.

— Douglas Carswell is the president and CEO of the Mississippi Center for Public Policy.

Mississippi

Ex-official in Mississippi is treated for gambling addiction amid embezzlement charge, lawyer says

JACKSON, Miss. (AP) — A former tax assessor and collector in north Mississippi checked into a residential treatment center for a gambling addiction after he called the state auditor’s office and confessed to misusing more than $300,000 in public money, his attorney said Tuesday.

Shannon Wilburn, 49, resigned in April from the elected office he had held in Benton County since 2016, and he began the 12-week addiction treatment in late July, his attorney Tony Farese told The Associated Press.

“I’ve known Shannon all of his life,” Farese said. “We are shocked that he finds himself in this situation.”

Mississippi Auditor Shad White announced Tuesday that Wilburn has been charged with one count of embezzlement. The announcement came days after Wilburn was indicted. Farese said Wilburn turned himself in to the sheriff’s office Friday, then posted bond and returned to the treatment program.

Wilburn is accused of taking $327,055 paid to the Benton County Tax Collector’s office and using the money for personal expenses, Farese said. He said Wilburn confessed to the auditor’s office before hiring legal representation and has continued to cooperate with investigators.

“He apologizes for disappointing the citizens of Benton County and the state of Mississippi,” Farese said.

If convicted, Wilburn would face up to $5,000 in fines and 20 years in prison.

White said Wilburn’s employment as a Benton County elected official was covered by $200,000 in surety bonds to protect taxpayers from losses from corruption. The county also has an insurance policy that covers theft.

“The dedicated team at the State Auditor’s Office will continue to work closely with prosecutors to get record results, one case at a time,” White said in a statement.

-

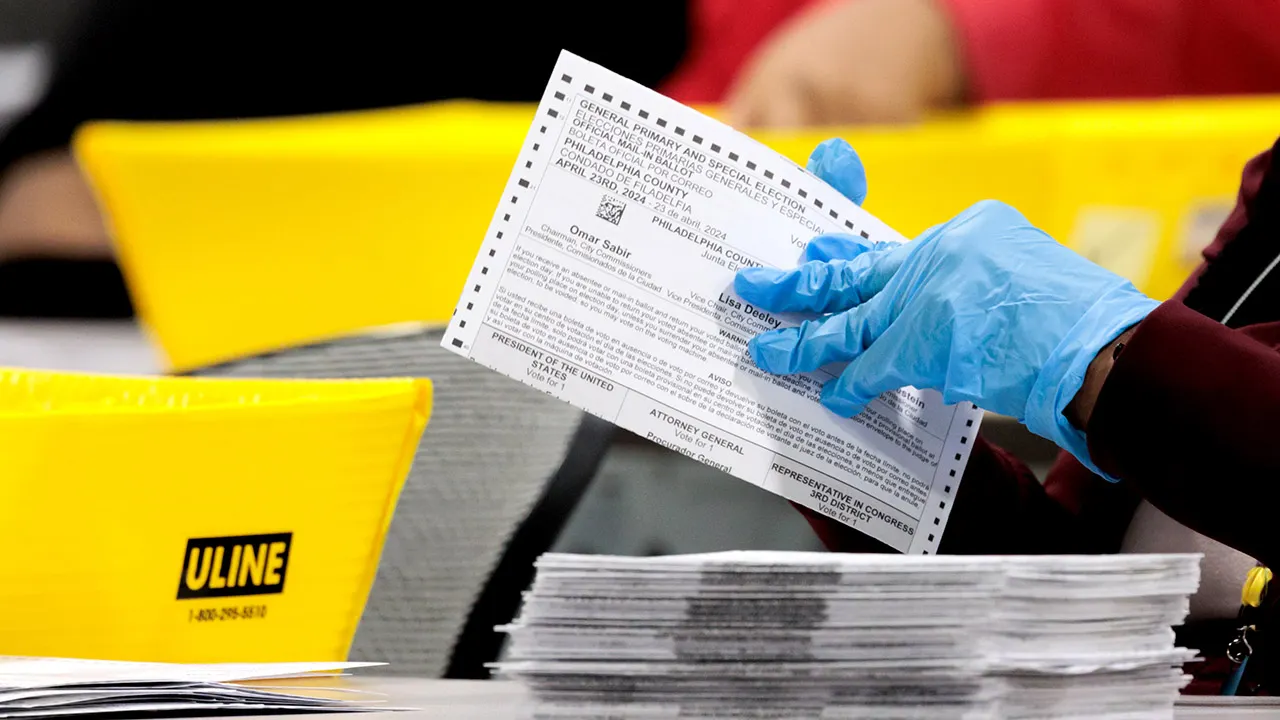

Politics1 week ago

Politics1 week agoWhy won't Pennsylvania voters have results on Election Night?

-

Politics1 week ago

Politics1 week agoTrump sets intense pace with campaign events as questions swirl about Harris' policy positions

-

World1 week ago

World1 week agoPortugal coast hit by 5.3 magnitude earthquake

-

News1 week ago

News1 week agoFormer national security adviser McMaster says he won’t work for Trump again

-

World1 week ago

World1 week agoWho is Telegram CEO Pavel Durov? What to know about his arrest in France

-

Science1 week ago

Science1 week agoHow much more water and power does AI computing demand? Tech firms don't want you to know

-

World1 week ago

World1 week agoCommission mandarin flags convergence of digital with industry

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 915