Impact of 2022 Florida insurance reforms

Florida lawmakers made it harder to sue home insurance companies and offered those companies additional state-backed reinsurance in 2022. How is that impacting the market now, after the 2024 hurricanes? FOX 13’s Craig Patrick reports.

TAMPA, Fla. – As Florida’s homeowners dispute insurance denials from last year’s hurricanes, state reforms intended to improve service and bring down our bills are coming under scrutiny.

The backstory:

In 2022, the Florida Legislature and Gov. Ron DeSantis made it harder to sue home insurance companies and offered those companies additional state-backed reinsurance – state money to subsidize the private market.

Before this passed, some lawmakers doubted subsidies for the insurance companies and making it harder for consumers to sue them would help consumers.

“It’s corporate welfare. It’s only helping big businesses, and my constituents are not going to feel any relief as a result of it,” said Michael Grieco, who served as a Democratic state representative from 2018-22.

READ: Home insurance nightmares continue months after 2024 hurricanes

Then in 2023, then-presidential candidate Donald Trump claimed DeSantis delivered the biggest insurance bailout in history and crushed Florida homeowners whose houses were destroyed. Trump claimed Florida’s insurance commissioner did nothing, while Floridians’ lives were ruined.

For context, Trump and DeSantis were running against each other at the time.

Dig deeper:

State lawmakers said it would take more time for their changes to pay off. They said we would need to wait a year and a half to see the results.

However, homeowners reported their premiums continued to rise through 2023.

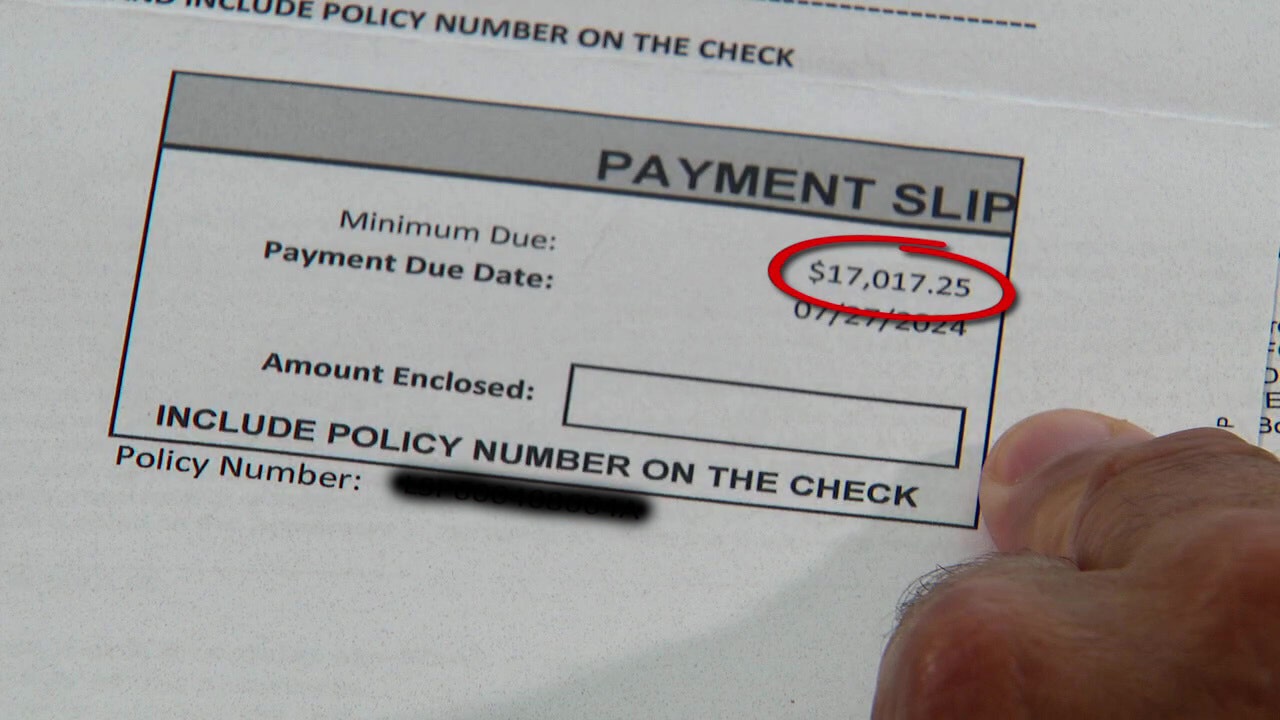

For example, in Pinellas County, Dave Lesko’s home insurance bill increased from $5,500 to $7,500 in 2023, after he had renovated and bolstered it with stronger windows. Then in 2024, his bill rose to $17,000.

Dave Lesko says his insurance bill rose to $17,000 in 2024. It was $5,500 in 2022 and $7,500 in 2023.

“I thought so at first I read the number wrong. I had to get my glasses and double-check, but it’s correct and it’s actually a 120% increase from last year,” Lesko said.

Then Florida took hits from Hurricanes Debby, Helene, and Milton.

And Weiss Ratings found a sharp increase in damage claim denials compared to prior storms in prior years.

“Some of the bigger providers in the state have denial rates close to 50%, so half of the claims are being denied,” said Weiss Ratings founder Dr. Martin Weiss.

Weiss Ratings shows 14 property insurers in Florida closed more than half their claims in 2024 with no payments. Weiss notes that does not include claims that fall outside the policy’s coverage (like mistakenly filing flood claims on a home policy).

Florida home insurance: Reviewing the impact on state reforms

In Washington, U.S. Republican Senator Josh Hawley flagged the rise in denial rates in calling for a congressional investigation.

The Republican Governor of Louisiana, Jeff Landry, cited Florida’s reforms as a model for what not to do.

“They tried wholesale tort reform that insurance companies said would lower rates in Florida and today, policyholders in Florida struggle to get the very claims paid on the policies they paid for,” Gov. Jeff Landry said.

Follow FOX 13 on YouTube

The other side:

Florida’s insurance commissioner disagrees. Michael Yaworsky notes more insurance companies are doing business in Florida. He said rates have leveled off in Florida, and some are going down.

“We are seeing that stability has emerged throughout the marketplace,” Yaworsky said.

The Source: Information for this story was gathered by FOX 13’s Craig Patrick.

STAY CONNECTED WITH FOX 13 TAMPA: