Rhode Island

Education, housing and health care come out on top in lawmakers’ revised fiscal 2025 budget • Rhode Island Current

Good news for transit riders, Medicaid providers and public school students, all of whom stand to benefit from the revised fiscal 2025 budget given first passage by a panel of House lawmakers Friday night.

The $13.9 billion spending plan unveiled late Friday falls just shy of the $14 billion high water mark that characterized fiscal 2024’s approved spending plan, but is $271 million more than what Gov. Dan McKee proposed in January.

The updated spending plan includes enough money to stave off service cuts at the financially struggling Rhode Island Public Transit Authority while offering Medicaid providers long-awaited reimbursement rate hikes in a single year, rather than the three-year incremental uptick McKee proposed. Meanwhile, a nearly $33.8 million boost in state aid to K to 12 schools, above what McKee called for, will offset a steep drop in federal funding, along with more dollars for multilingual learners.

“Through this budget, we are emphasizing education at every level and supporting children,” House Speaker K. Joseph Shekarchi said in a statement Friday afternoon.

Shekarchi stressed the changes as the result of a “truly collaborative process” including lawmakers in both chambers as well as Gov. Dan McKee.

However, lawmakers have axed several components of Gov. Dan McKee’s original, $13.7 billion spending proposal, including $60 million in bonds to help pay for a new, dedicated state archives and a proposed rewrite of state income taxes for banks intended to stop Citizens Bank from shifting its investments, and employee base, outside the state.

“It has been a difficult budget because we feel the pain of Rhode Islanders,” Shekarchi said, speaking to reporters Friday night. “We tried to do the most good for the people that need it most.”

The House Committee on Finance’s 13-1 vote Friday sends the updated spending proposal to the full House of Representatives for consideration on June 7, with Rep. George Nardone, a Coventry Republican, casting the sole vote in opposition. Lawmakers must approve a final spending plan before the new fiscal year begins July 1.

Top priorities: Housing and Washington Bridge

Acknowledging the skyrocketing cost to demolish and replace the I-195 Washington Bridge, the spending plan includes $80 million to cover the state’s share of the estimated $400 million cost. This includes repurposing unspent pandemic aid, as McKee suggested, but replaces the governor’s proposal to borrow against future gas tax revenue by instead allotting $40 million in long-term capital spending for the cost.

Combating the housing crisis, a top priority for Shekarchi, takes an even bigger role in the revised spending plan, with a historic $120 million bond to stimulate housing production, including authorization for a state public housing developer. This is $20 million more than the borrowing amount requested by Housing Secretary Stefan Pryor and included in McKee’s budget.

“We need to increase production, production, more production at every single level,” Shekarchi said.

Medicaid reimbursements, new health care initiatives

The updated budget also adds $40 million in state funding to the proposed increase in fee-for-service rates for Medicaid providers who work in behavioral health, community care and with infants and toddlers with developmental disabilities. The increase allows the state to meet the $100.3 million cost to offer rate hikes in a single year, as recommended by the Office of the Health Insurance Commissioner.

Meanwhile, the understaffed Department of Children, Youth and Families will see a $21 million funding boost to cover workforce expansion, foster care and congregate services, among others.

A new $1 million restricted receipts account, to be managed by the treasurer, will help residents pay off medical debt, one of the proposals in a 25-bill health package put forth by the Rhode Island Senate. A separate bill funding a scholarship program for doctoral and nursing students who stay and work in the state was also added to the updated spending plan.

Help for RIPTA’s fiscal cliff, green economy bond

Amid outcries over service cuts to the embattled transit system, lawmakers allotted an extra $5 million to RIPTA – still $3 million shy of closing the agency’s funding deficit but enough to stave off any reduction in bus route locations or schedules, Shekarchi said.

Also heeding advocates’ calls to preserve and protect forest and farmland, a $53 million green economy bond now includes $13 million for the cause, while money to help rebuild the Newport Cliff Walk was trimmed from $8 million to $3 million to account for a newly awarded federal grant.

Retirees

Retired state workers and teachers clamoring to reinstate the compounded cost-of-living adjustments that ended under a series of pension reforms enacted in 2012 still won’t get exactly what they asked for. Rather than reinstatement and retroactively applying COLAs — an estimated $169 million cost according to a legislative review that ended earlier this year —the revised budget includes new COLAs effective July 1 for retirees who stopped working before the pension reforms took effect.

“These people are the oldest, the people who have been retired the longest,” Shekarchi said. “They didn’t have the opportunity work longe into the system.”’

For other retirees, the budget preserves McKee’s proposal to raise the minimum income that retired workers from any job can earn without being taxed – from $20,000 to $50,000 (or double for joint filers).

Higher ed bonds

Two separate bond proposals supporting a Biomedical Sciences Building for the University of Rhode Island, and a separate Institute for Cybersecurity and Emerging Technologies at Rhode Island College were increased above McKee’s recommendation to reflect full funding requested by each school: $87.5 million and $73 million, respectively.

A fifth borrowing proposal, borrowing $10 million for three specific arts projects as well as grant money administered by the state arts council, was also added to the lawmakers’ version of the budget.

New state archives is out

No longer in the borrowing list: a $60 million bond that would have covered a portion of the $100 million price tag for a new state archives, a top priority for Secretary of State Gregg Amore.

Shekarchi cited lack of details on where the archive would go or a funding partner to cover the rest of the cost as reason why the revised budget does not include any borrowing for the project.

No tax rewrite for Citizens

The need for more information and time is also why Shekarchi said a proposed tax rewrite intended to benefit Citizens Bank was nixed from the updated spending plan.

“I don’t want to be the speaker who loses Citizens Bank,” Shekarchi said in a statement Friday. “I will roll up my sleeves and get to work with them over the summer so we can prefile legislation that can be vetted early in the year, but right now, we don’t have enough information to know whether this plan is the right move for our state.”

Rory Sheehan, a spokesperson for the bank, issued an emailed response Friday.

“We are disappointed that Budget Amendment 19 was not included in the State Budget,” Sheehan said. “This decision will make it difficult for the state to compete on a level playing field with Massachusetts and other states and is not in the best interest of Rhode Islanders. We urge the Rhode Island General Assembly to address the issue before the end of the session. We are committed to working diligently to achieve a positive outcome.”

No sales tax cut

McKee’s budget proposal offered a wishlist of extra spending items if state revenue beat expectations, including trimming the state sales tax. Senate President Dominick Ruggerio has also pushed for reducing the state sales tax to remain competitive with neighboring states.

Shekarchi’s response to a prospective sales tax cut?

“Absolutely not,” he said Friday.

The revised budget maintains the existing 7% sales tax while striking McKee’s proposal to cut the corporate minimum tax. However, McKee’s proposed 25-cent tax increase on cigarette packs survived, as did a slightly different version of the governor’s recommendation to tax vaping products.

Unlike years past, McKee and Ruggerio did not attend a press briefing on the budget held Friday night at the State House. Each indicated general support for the revised spending plan in prepared statements.

“I am pleased that the budget will invest in many Senate priorities, particularly in the areas of health care, child care, education and providing some needed relief to retirees,” Ruggerio, a North Providence Democrat, said.

“The Speaker and I are aligned in our priorities of improving the education, housing, and health of all Rhode Islanders, and this budget makes key investments in all those areas,” McKee said. “Like the Speaker, I too appreciate the collaborative spirit in which this budget was shaped.”

GET THE MORNING HEADLINES DELIVERED TO YOUR INBOX

Rhode Island

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

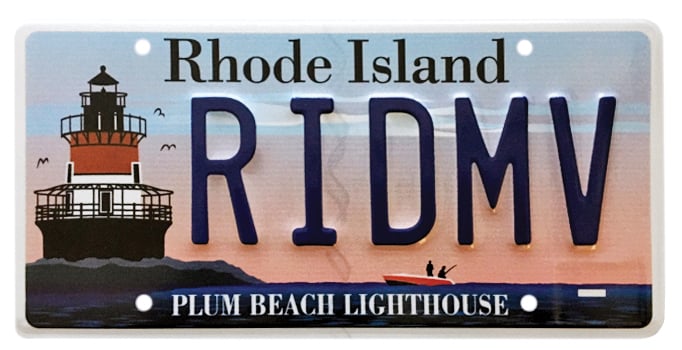

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

Rhode Island

Rhode Island AG to unveil long-awaited report on Diocese of Providence clergy abuse

PROVIDENCE, R.I. — Rhode Island Attorney General Peter Neronha will release on Wednesday findings from a multiyear investigation into child sexual abuse in the Diocese of Providence.

According to the attorney general’s office, the report will detail the diocese’s handling of clergy abuse over decades.

While the smallest state in the U.S., Rhode Island is home to the country’s largest Catholic population per capita, with nearly 40% of the state identifying as Catholic, according to the Pew Research Center.

Neronha first launched the investigation in 2019, nearly a year after a Pennsylvania grand jury report found more than 1,000 children had been abused by an estimated 300 priests in that state since the 1940s. The 2018 report is considered one of the broadest inquiries into child sexual abuse in U.S. history.

Neronha’s investigation involved entering into an agreement with the Diocese of Providence to gain access to all complaints and allegations of child sexual abuse by clergy dating back to 1950. Neronha’s office said in 2019 that the goal of the report was to determine how the diocese responded to past reports of child sexual abuse, identify any prosecutable cases, and ensure that no credibly accused clergy were in active ministry.

Rhode Island State Police also helped with the investigation.

Rhode Island

St. Patrick’s Day 2026: Your Guide To Fun In Rhode Island

Rhode Islanders who plan to join in the global celebration of Irish culture can choose from big and small events, including a parade in Providence.

The March 17 holiday falls on a Tuesday this year, and many big events will be held the weekend of March 14-15. Originally a modest, religious feast day honoring the patron saint of Ireland, St. Patrick’s Day today is a vibrant, boisterous holiday observed by millions of people regardless of their heritage.

The Providence parade is March 21.

We’ve rounded up 10 more events to help you celebrate St. Patrick’s Day. But first, are you planning an event this spring? Feature it, so nearby readers see it all across Patch — including in roundups like this!

Here’s your guide to St. Patrick’s Day fun in Rhode Island:

-

World7 days ago

World7 days agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin3 days ago

Wisconsin3 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Louisiana1 week ago

Louisiana1 week agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Oregon5 days ago

Oregon5 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling