Rhode Island

As the budget gets closer, it’s getting louder at the RI State House. What advocates want.

Volume rising at RI Statehouse as budget demands mount

Inside the Rhode Island State House: Video tour

In 2024, tour guides gave more than 550 tours to more than 12,000 visitors from all over the world.

Journal Staff

PROVIDENCE – You can tell the behind-the-scenes budget negotiations are at a critical point when the noise level at the State House reaches a fever pitch.

And that volume rose to its highest point yet on May 29 as megaphone-amplified voices chanted “tax the rich!” to raise a potential $190 million in new state dollars that would be used to, according to advocates:

Save RIPTA by closing the $32 million funding shortfall. Plug whatever cuts Congress makes to SNAP, Head Start and Medicaid. Pour many more millions into multilingual education for non-English speaking students. And fix the state’s health care crisis.

And it’s not just chanting, sign-carrying advocates rallying and making noise.

A day earlier, Attorney General Peter Neronha spelled out his proposal for fixing Rhode Island’s teetering health care system, including a multimillion dollar legislative increase in Medicaid reimbursements to primary care doctors.

A bill to do that was introduced at his behest the same day: H6373.

It would have the Executive Office of Health and Human Services allocate “sufficient state revenue to increase Medicaid payment rates for primary care services to … no less than 100% of Medicare rates … effective beginning July 1, 2025.”

“Let’s do a poll of Rhode Islanders and ask them, what should be at the center of our budget planning?” Neronha asked rhetorically during his press conference. “I guarantee you, health care will be in the top five, maybe in the top three. So that’s where we should start.”

What do RI’s ‘tax the rich’ advocates want?

The advocates leading Thursday’s rally had an even longer list of demands, starting with passage of legislation creating a 3% income tax surcharge on high earners to raise an estimated $190 million in new state revenue.

They included the RI AFL-CIO, Climate Action Rhode Island, the National Education Association of Rhode Island − headed by new Senate President Valarie Lawson – the Economic Progress Institute, the Revenue for Rhode Islanders Coalition, RI Working Families Party, SEIU-1199, Indivisible RI and Reclaim RI.

The focus of the event, according to the media advisory: “To demand leadership make the richest 1% pay their fair share in taxes to protect what’s on the chopping block – Medicaid, hospitals, food stamps, school funding, RIPTA and more.”

Their argument: That the richest 1% of Rhode Islanders pay just 8.6% of their income in taxes, while the lowest income Rhode Islanders pay over 13%.

“In Massachusetts, a similar tax that brought in $2.4 billion in the first year has helped fund free school meals for students and school repairs, free bus service and expanded public transit routes; seven thousand more child care seats, road and bridge improvements in every city and town and more,” the advisory said.

Will it actually pass?

Legislative leaders have made it known that “everything is on the table,” but a tax hike would not be their first choice.

“As we approach the final weeks of the session, there is no shortage of meritorious proposals that affect state resources,” House Speaker K. Joseph Shekarchi told The Journal.

“The magnitude of the uncertainty of the federal funding picture, and the numerous holes in the governor’s proposed budget, complicate both balancing this year’s budget and planning for the unknown,” he said.

The “holes” include: the McKee administration’s quiet withdrawal of a “cost-saving” proposal to close the minimum security prison that, on closer look, could cost $67 million to $92 million more; a $15 million under-estimate of the cost of his contract settlement with state troopers and prison guards and an unpopular McKee move to divert $26 million from the pension fund.

“I continue to keep many options on the table for this challenging task,” said Shekarchi, who tops the House budget negotiating team.

‘The top 1% are still going to be okay’

The rally was timed the same day the Senate Finance Committee is scheduled to hold a hearing on Sen. Melissa Murray’s version [S329] of the “Tax-The-Rich” bill the House Finance Committee considered earlier this session.

And it’s a fair guess the senators will hear most of the same arguments their counterparts in the House heard early in May for and against the bill to create a new 3% surcharge on income above $625,000 – in practice, $750,000 in pre-tax total income

According to an estimate from the Center on Budget and Policy Priorities, the top 1% of households in the country (starting at $743,000 a year) would get a $61,000 reduction in federal taxes a year if the federal tax cuts adopted during the first Trump Administration are extended. (The estimate comes from a January report from the Department of the Treasury.)

Under the proposed bill, a household making $1 million a year would pay an extra $10,500 in state taxes.

“The top 1% are still going to be okay,” said Rep. Teresa Tanzi.

But there are two buckets of people in the 5,700 estimated Rhode Island taxpayers who would have slightly higher taxes – the very wealthy and small business owners who are incorporated as limited liability companies or corporations.

Might they forgo a new hire or not buy a new piece of equipment? Might they flee the state?The Rhode Island Public Expenditure Council has warned that the wealthiest Rhode Islanders will likely flee the state if the income tax is increased.

In written testimony, Jon Duffy, of the advertising and public relations firm Duffy & Shanley, wrote that one of the partners in his business “has already become a Florida resident” to avoid paying Rhode Island’s state taxes.

But the Economic Progress Institute in March put out a paper that said: “There is simply no evidence – not in Rhode Island and not anywhere in the United States – linking changes in top tax rates with large-scale net migration of higher-income residents or of interstate migration in general.”

At the May 29 rally, the EPI’s police director Nina Harrison said Rhode Island has enough for everyone, but it’s not being shared fairly.

“Right now, people earning less than $23,000 a year are paying a larger portion of their income in state and local taxes than millionaires do in this state,” she said.

“That’s not only backwards, it’s unjust and it’s unacceptable.” Her argument:

- “Rhode Island has crisis level shortage of child care. Nine out of 10 families cannot afford quality childcare. The time to act is now.”

- “Rhode Island has a crisis level shortage of primary care doctors. I’m losing mine next month with the closure of Anchor Medical. The time to act is now.”

- “Public schools are failing too many of our children and they deserve better. The time to act is now and if we don’t act now, not only are we failing our children, we’re going to feel that in our state economy later when we need workers to do the essential jobs in this state.”

- “People and businesses and essential workers will leave this state. If we don’t have good schools, affordable housing, good public transportation, or enough doctors. The time to act is now.”

“If we want to stop having budget deficits and meet the needs of Rhode Islanders, we need to fix our tax system and have everyone pay their fair share. The time to act is now,” she finished.

Rhode Island

RI Lottery Powerball, Numbers Midday winning numbers for March 4, 2026

The Rhode Island Lottery offers multiple draw games for those aiming to win big.

Here’s a look at March 4, 2026, results for each game:

Winning Powerball numbers from March 4 drawing

07-14-42-47-56, Powerball: 06, Power Play: 4

Check Powerball payouts and previous drawings here.

Winning Numbers numbers from March 4 drawing

Midday: 2-7-4-4

Evening: 7-6-0-2

Check Numbers payouts and previous drawings here.

Winning Wild Money numbers from March 4 drawing

08-11-12-18-24, Extra: 15

Check Wild Money payouts and previous drawings here.

Winning Millionaire for Life numbers from March 4 drawing

12-13-36-39-58, Bonus: 03

Check Millionaire for Life payouts and previous drawings here.

Feeling lucky? Explore the latest lottery news & results

Are you a winner? Here’s how to claim your prize

- Prizes less than $600 can be claimed at any Rhode Island Lottery Retailer. Prizes of $600 and above must be claimed at Lottery Headquarters, 1425 Pontiac Ave., Cranston, Rhode Island 02920.

- Mega Millions and Powerball jackpot winners can decide on cash or annuity payment within 60 days after becoming entitled to the prize. The annuitized prize shall be paid in 30 graduated annual installments.

- Winners of the Millionaire for Life top prize of $1,000,000 a year for life and second prize of $100,000 a year for life can decide to collect the prize for a minimum of 20 years or take a lump sum cash payment.

When are the Rhode Island Lottery drawings held?

- Powerball: 10:59 p.m. ET on Monday, Wednesday, and Saturday.

- Mega Millions: 11:00 p.m. ET on Tuesday and Friday.

- Lucky for Life: 10:30 p.m. ET daily.

- Millionaire for Life: 11:15 p.m. ET daily.

- Numbers (Midday): 1:30 p.m. ET daily.

- Numbers (Evening): 7:29 p.m. ET daily.

- Wild Money: 7:29 p.m. ET on Tuesday, Thursday and Saturday.

This results page was generated automatically using information from TinBu and a template written and reviewed by a Rhode Island editor. You can send feedback using this form.

Rhode Island

Ranking Rhode Island’s Most Popular Charity License Plates – Rhode Island Monthly

When it comes to expressing ourselves, Rhode Islanders have elevated license plates to an art form. You might not be able to get a new vanity plate — the state suspended applications in 2021 after a judge ruled a Tesla owner could keep his FKGAS plates — but you can still express your Rhody pride with one of seventeen state-approved charity plates. The program has funded ocean research, thrown parades, saved crumbling lighthouses and even provided meals for residents. About half of the $43.50 surcharge goes to the associated charity, while the other half covers the production cost.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Atlantic Shark Institute

Year first approved: 2022

Plates currently on road: 7,007

Total raised: $269,530

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

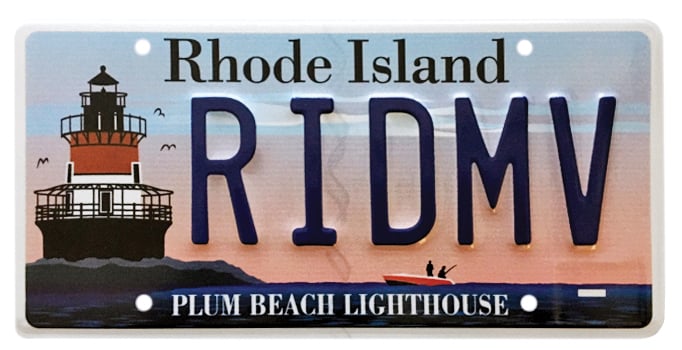

Friends of Plum Beach Lighthouse

Year first approved: 2009

Plates currently on road: 5,024

Total raised: $336,890

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Wildlife Rehabilitators Association of Rhode Island

Year first approved: 2013

Plates currently on road: 2,102

Funds raised: $32,080

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rocky Point Foundation

Year first approved: 2016

Plates currently on road: 1,616

Funds raised: $50,450

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rhode Island Community Food Bank

Year first approved: 2002

Plates currently on road: 765

Funds raised since 2021: $11,060*

*Prior to 2021, customers ordered plates directly through the food bank, and total revenue numbers are not available.

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

New England Patriots Charitable Foundation

Year first approved: 2009

Plates currently on road: 1,472

Funds raised: $136,740

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Audubon Society of Rhode Island and Save the Bay

Year first approved: 2006

Plates currently on road: 1,132

Funds raised: $61,380 for each organization (proceeds split evenly)

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Boston Bruins Foundation

Year first approved: 2014

Plates currently on road: 1,125

Funds raised: $36,880

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Beavertail Lighthouse Museum Association

Year first approved: 2023

Plates currently on road: 1,105

Funds raised: $37,610

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Bristol Fourth of July Committee

Year first approved: 2011

Plates currently on road: 1,104

Funds raised: $17,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Red Sox Foundation

Year first approved: 2011

Plates currently on road: 860

Funds raised: $88,620

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Gloria Gemma Breast Cancer Resource Foundation

Year first approved: 2012

Plates currently on road: 1,510

Funds raised: $33,360

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Providence College Angel Fund

Year first approved: 2016

Plates currently on road: 693

Funds raised: $23,220

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Rose Island Lighthouse and Fort Hamilton Trust

Year first approved: 2022

Plates currently on road: 383

Funds raised: $10,640

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Friends of Pomham Rocks Lighthouse

Year first approved: 2022

Plates currently on road: 257

Funds raised: $7,580

________________________

License plate images courtesy of the Rhode island division of motor vehicles.

Day of Portugal and Portuguese Heritage in RI Inc.

Year first APPROVED: 2018

Plates currently on road: 132

Funds raised: $3,190

Rhode Island

Rhode Island AG to unveil long-awaited report on Diocese of Providence clergy abuse

PROVIDENCE, R.I. — Rhode Island Attorney General Peter Neronha will release on Wednesday findings from a multiyear investigation into child sexual abuse in the Diocese of Providence.

According to the attorney general’s office, the report will detail the diocese’s handling of clergy abuse over decades.

While the smallest state in the U.S., Rhode Island is home to the country’s largest Catholic population per capita, with nearly 40% of the state identifying as Catholic, according to the Pew Research Center.

Neronha first launched the investigation in 2019, nearly a year after a Pennsylvania grand jury report found more than 1,000 children had been abused by an estimated 300 priests in that state since the 1940s. The 2018 report is considered one of the broadest inquiries into child sexual abuse in U.S. history.

Neronha’s investigation involved entering into an agreement with the Diocese of Providence to gain access to all complaints and allegations of child sexual abuse by clergy dating back to 1950. Neronha’s office said in 2019 that the goal of the report was to determine how the diocese responded to past reports of child sexual abuse, identify any prosecutable cases, and ensure that no credibly accused clergy were in active ministry.

Rhode Island State Police also helped with the investigation.

-

World1 week ago

World1 week agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts1 week ago

Massachusetts1 week agoMother and daughter injured in Taunton house explosion

-

Wisconsin3 days ago

Wisconsin3 days agoSetting sail on iceboats across a frozen lake in Wisconsin

-

Maryland4 days ago

Maryland4 days agoAM showers Sunday in Maryland

-

Denver, CO1 week ago

Denver, CO1 week ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Florida4 days ago

Florida4 days agoFlorida man rescued after being stuck in shoulder-deep mud for days

-

Oregon6 days ago

Oregon6 days ago2026 OSAA Oregon Wrestling State Championship Results And Brackets – FloWrestling

-

Massachusetts2 days ago

Massachusetts2 days agoMassachusetts man awaits word from family in Iran after attacks