Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Already an overlooked state, New Hampshire has many overlooked towns. If you thought its capital, Concord, was small, all of the following communities have fewer than 7,000 residents as of the last decennial census. Yet, they have magnificent mountains, centuries-old buildings, colorful shops, unbelievable museums, and winsome wilderness that are passed over by in-staters and out-of-staters. Do not miss what they missed; choose these eight neglected New Hampshire towns instead of overrun tourist hot spots elsewhere in the country.

With roughly 6,000 residents, Littleton lives up to its name. This little town is a painted paradise set against the White Mountains. Attractions include Chutters, a pink-hued candy store; Crumb Bum, a rainbow-flag-adorned bakery; and Schilling Beer Co., a brewery in a red 18th-century mill. Aside from Schilling, these buildings line a model Main Street that looks like it was crafted in a workshop. Adding more color to Littleton is greenery, which, nourished by the Connecticut River, contains a scenic covered bridge and numerous nature trails.

Another New Hampshire mountain town but in the southern part of the state, Stoddard is an underrated stunner. Among its little-known wonders are the Stone Arch Bridge, a mortarless 19th-century twin stone bridge that crosses the North Branch River, and the marker for Stoddard Glass, an amalgam of companies that operated from 1842 to 1873 and manufactured glass bottles that are now worth thousands of dollars. But Stoddard’s climax is Pitcher Mountain, a 2,153-foot monadnock (an isolated peak in a relatively flat area) whose summit has views and blueberries for the picking.

To cap off the trip with a busier outdoor excursion, drive 20 minutes south to Granite Gorge Mountain Park, a prime ski area.

South of Stoddard, Peterborough, in Hillsborough County, has been around for almost 300 years. Although none of its 18th-century buildings remain, Peterborough preserves early-19th-century architecture. One example is Peterborough Unitarian Church, which was built in 1825 for a congregation founded in 1752. After checking out that historic chapel, you can visit the site of the Old Bell Factory, which dates to 1808 and is said to have been the first cotton factory in New Hampshire powered by water.

From there, you can explore a symbolic remnant of this former mill town, Bagel Mill, before dining at other eateries like Kogetsu and Harlow’s Pub. It is easy to miss Peterborough, given its lush countryside. Get lost (in a good way) at Miller State Park, Monadnock State Park, and Wapack National Wildlife Refuge.

It turns out that Santa’s Village is not in the North Pole. It is tucked away in the tiny New Hampshire town of Jefferson. The “village” is a Christmas-themed amusement park that opened in 1953 and features rides, shops, and eateries with names like Polar Expresso, Sugar n’ Spice Bake Shop, and the S. S. Peppermint Twist. From frosted treats to frosted peaks, Jefferson straddles the 800,000-acre White Mountain National Forest, which contains the Presidential Range.

Arguably, the best views of Mount Washington, Mount Jefferson, Mount Adams, and other president-christened summits are from Cherry Pond in the Pondicherry Wildlife Sanctuary.

Warner is full of museums you probably did not know existed, at least not in rural New Hampshire. The first is Mt. Kearsarge Indian Museum, a 12.5-acre indoor and outdoor preserve of Indigenous history comprising the only Native American museum in the state. The second is the New Hampshire Telephone Museum, which is exactly how it sounds: a museum showcasing the history of telecommunications with over 1,000 phones and phone-related artifacts. The third is The Nature Discovery Center, a collection of all things natural, from minerals to mounted mammals. You can drive between these museums on historic covered bridges, making the commute its own exhibit.

There are quite a few Sandwiches in the United States, and not just the food. New Hampshire’s Sandwich is a town of roughly 1,500 people in Carroll County. Named after the food’s alleged inventor, John Montagu, 4th Earl of Sandwich, Sandwich is sandwiched between mountain country and lake country, thereby offering scenic sites such as Squam Lake, Hemenway State Forest, and Sandwich Mountain.

Before conquering its greens, you can fuel up on its namesake meat and bread at The Foothills Restaurant in Center Sandwich. Also at the center of Sandwich is a three-day festival held each Columbus Day Weekend. Although it is called the Sandwich Fair, it is less about sandwiches and more about livestock, rides, and parades.

If Sandwich is your entrée, make Sugar Hill your dessert. Just over an hour’s drive northwest, Sugar Hill is a White Mountains retreat with more attractions than people. Some 650 residents and smatterings of tourists needlessly vie for views of Franconia Notch State Park and Sunset Hill. During spring, the latter turns purple as lupines bloom in such abundance that it inspired an early June flower festival.

Spring in Sugar Hill is vibrant, summer is lush, autumn is colorful, and winter is magical. There is no bad season to visit town, especially since Sunset Hill House and Polly’s Pancake Parlor can warm hands and bellies during cold weather.

Hebron is a central New Hampshire town on the banks of Newfound Lake. This lake is the core of Hebron recreation, something that only 630ish people experience year-round. On-lake activities include swimming, fishing, motorboating, canoeing, and kayaking, while lakeside pursuits include hiking, picnicking, and camping in Wellington State Park.

Charles L. Bean Sanctuary is another lakeside preserve. Just a few miles off-lake are more nature preserves like Sculptured Rocks Natural Area and Cardigan Mountain State Park. Downtown Hebron is bereft of hotels and restaurants, but Newfound Lake picks up the slack with Newfound Lake Inn and its Pasquaney Restaurant.

New Hampshire is a rural American shrine. Many of its attractions are spread across the barrens in tiny towns that few have heard of. Shrines get neglected over time, so convert to rural New Hampshirite to see the truth that most people are missing: Littleton, Stoddard, Peterborough, Jefferson, Warner, Sandwich, Sugar Hill, and Hebron are the real prophets of a good time in The Granite State.

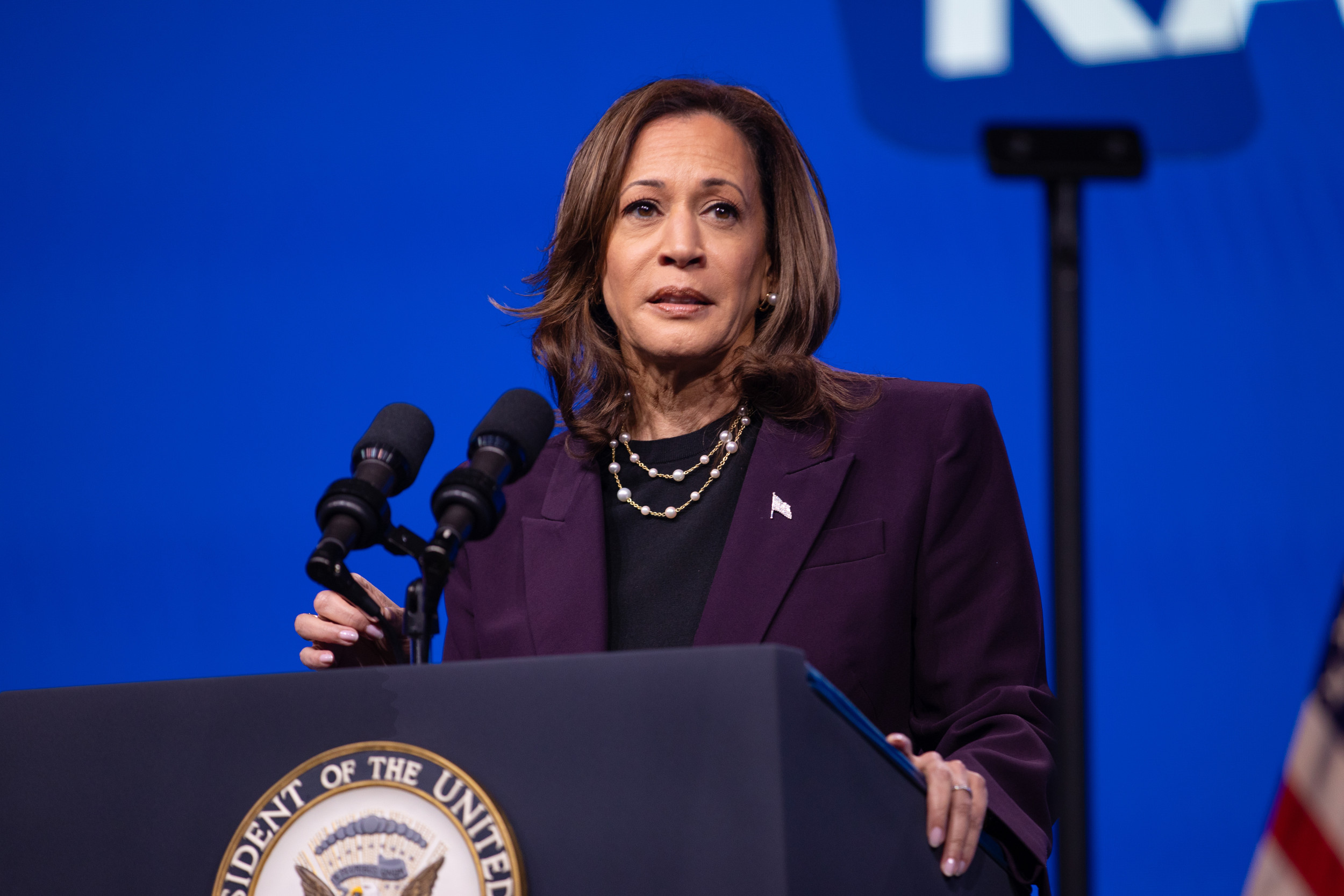

Kamala Harris has a significant lead over Donald Trump in New Hampshire, according to new polling data.

In the first public survey of New Hampshire voters since Joe Biden dropped out of the presidential race, Harris has a lead of 6 points over the former president.

The poll conducted by the University of New Hampshire between July 23 and 25, shows Harris with a 49 to 43 percent lead over Trump. The poll surveyed 3,016 people and had a margin of error of 1.8 percent.

In a Saint Anselm College Survey Center (SASC) poll of 2,083 New Hampshire registered voters conducted between July 24 and 25, Harris had a 50-44 percent margin over Trump. The poll had a 2.1 percent margin of error.

Harris was not previously leading in the state. In a poll conducted by the New Hampshire Journal and Praecones Analytica after the Republican convention but before Joe Biden announced his withdrawal from the 2024 campaign, when Harris was matched up against Trump in a head-to-head, her Republican rival was leading her by one point, on 40 percent to her 39 percent.

In the same poll, Trump and Biden were essentially tied, with Trump on 39.7 and Biden on 39.4 percent.

Montinique Monroe/Getty Images

New Hampshire has voted Democratic in all but one election since 1992, but it is considered a battleground state in most election cycles because control of its state legislature and congressional seats have switched back and forth between Republicans and Democrats.

In 2020, Biden won the state with 52 percent of the vote to Trump’s 45 percent, while in 2016, Hillary Clinton was able to carry the state by around 2,700 votes.

Neil Levesque, Executive Director of the New Hampshire Institute of Politics, noted: “With President Biden’s endorsement and the Democratic campaign’s shift to Harris, she has emerged with a consolidated party support, which enhances her standing against Trump among New Hampshire voters.”

Levesque added: “Harris has achieved a level of partisan enthusiasm that Biden did not, especially among the liberal base: 94 percent of Democratic voters now support Harris, a noticeable increase from Biden’s 82 percent in June. As Harris takes the lead in the campaign, shifts in voter perceptions are expected to continue.”

Multiple polls have put Harris in the lead over Trump since she became the front runner for the Democratic nomination.

In a poll conducted by Morning Consult between July 22 and 24, Harris was leading Trump by one point, with 46 percent supporting Harris to Trump’s 45 percent.

And a Reuters/Ipsos poll conducted on Monday and Tuesday showed Harris with a 2-point lead over Trump, with 44 percent of those polled supporting her in a head-to-head contest with the Republican, while 42 percent backed the former president. The poll had a margin of error of 3 percentage points.

However, not all the polls are favorable to Harris. In the latest poll conducted by the New York Times and Siena College, Trump was leading Harris by 2 points among registered voters and 1 point among likely voters.

Another poll conducted by Morning Consult after Biden ended his reelection campaign showed Trump had a 2-point lead over Harris, with 47 percent supporting the former president compared to 45 percent backing Harris.

The poll also showed that Trump’s margin over the Democrats had decreased. The former president was now only 2 points ahead of Harris, after a previous survey by the same pollsters put Trump four points ahead of Biden—46 percent to the president’s 42 percent.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

NASHUA — Michigan Gov. Gretchen Whitmer said Vice President Kamala Harris “should be bold” when choosing her running mate.

While the two-term governor is one of at least seven Democrats being vetted by the Harris campaign, she has repeatedly said that she not interested in the position. She reiterated that to reporters on Thursday in New Hampshire, saying she’s “not going anywhere” and remains committed to her role as Michigan’s governor.

Whitmer said the current field of vice presidential candidates, which includes Arizona Sen. Mark Kelly, Pennsylvania Gov. Josh Shapiro, and fellow Michigander Secretary of Transportation Pete Buttigieg, are all “wonderful.”

“I am a little biased toward governors because, you know, I think executive experience would be a helpful thing in the White House. But Mark Kelly is fantastic, Josh Shapiro, there’s just a great list of people that I know that they’re talking to,” Whitmer said. “As a governor who handpicks my running mate in Michigan, I just know that having someone that you can trust who shares your values, and that you get along with, I think, is paramount and only she can make that decision.”

While the current field is largely white men, Whitmer said she believes Harris “feels the same way” that they should be “bold” with their choice, adding two women or two people of color on the presidential ticket would be “exciting.”

Whitmer was in New Hampshire on behalf of Harris and in her capacity as a co-chair of Harris’ campaign, a similar role she had with President Joe Biden’s campaign prior to him dropping out of the race and endorsing Harris.

In front of a small crowd at Liquid Therapy in Nashua, she touched on topics ranging from reproductive freedom to Project 2025 in a discussion moderated by former House Speaker Terie Norelli, a Democrat from Portsmouth.

It was Whitmer’s first visit to the Granite State. She said she chose to visit now because “people in New Hampshire matter” and the Harris campaign is taking “no vote, no community for granted.” She emphasized the importance of connecting with those across the country who may find the political news cycle “overwhelming.”

Like New Hampshire, Michigan is a swing state that will be critical for either party to secure victory in the presidential election. New Hampshire has four electoral votes while Michigan has 15 and is considered a key battleground state.

Both states have tended to vote Democratic, but former President Donald Trump, the Republican nominee, won Michigan in 2016, before losing the state to Biden in 2020. Trump led Biden in recent polling in New Hampshire, where Biden won in 2020 and Hillary Clinton won in 2016.

Biden’s exit was a surprise to her, Whitmer said, and she emphasized her gratitude for the “sacrifices he made on behalf of others.” But since he exited the race, Whitmer said she’s seen a renewed sense of energy and excitement, something that she doesn’t normally see this early in an election.

“It is going to be joyous, inclusive, future-forward-looking convention,” Whitmer said of the Democratic National Convention, scheduled to take place from Aug. 19-22 in Chicago. “November 5, then, after polls close, we can have a cocktail and cheers to Madam President.”

BOSTON – The heart-stopping video lasted all of seven seconds — a boat capsized by a whale off the New Hampshire coast Tuesday sending two fishermen flying into the ocean.

But expert Linnea Mayfield says an encounter like this isn’t uncommon. “At least in the New England area, we’ve seen it at least once a year for the past several years,” she said.

Mayfield is a Marine Naturalist at Boston Harbor City Cruises helping the New England Aquarium understand the whales off our coast.

“It does look like a very actively feeding whale,” she said.

The whale was looking for a big gulp of fish by blowing bubbles to the water’s surface. “They’ll drive those to the surface and then they’ll lunge through that school of fish and gather a whole bunch of them in their mouth,” Mayfield said.

She also said the whale landing on the boat was an accident and that their “blind spot” could be to blame.

“There is a blind spot on whales,” she said. “Their eyes are actually located near the corners of their mouth on either side of their head. So right below where that chin area is, they maybe just totally missed that the boat was as close as it was. This was definitely not intentional.”

Mayfield said this is a teaching moment for boaters. If you see a whale nearby, maneuver the boat at least 100 feet behind it and slowly move away from the area.

“These animals are very aware and they are vulnerable to human activity,” she said. “This is not a positive experience interaction for the boaters, it’s not a positive interaction for the whale.”

One dead after car crashes into restaurant in Paris

Michigan rep posts video response to Stephen Colbert's joke about his RNC speech: 'Touché'

Video: Young Republicans on Why Their Party Isn’t Reaching Gen Z (And What They Can Do About It)

In Milwaukee, Black Voters Struggle to Find a Home With Either Party

Fox News Politics: The Call is Coming from Inside the House

Movie Review: A new generation drives into the storm in rousing ‘Twisters’

Video: J.D. Vance Accepts Vice-Presidential Nomination

Trump to take RNC stage for first speech since assassination attempt