Connecticut

CT leaders say they'll counter swiftly if Trump cuts more federal aid

Gov. Ned Lamont and the General Assembly’s highest-ranking leaders drew a political line in the sand late Friday.

If President Donald Trump continues to withhold huge blocks of federal aid for health care, education or other core programs, Connecticut’s done waiting to see if Congress or the courts will reverse the damage, leaders here wrote in a joint statement.

Connecticut’s piggy banks are large, and officials won’t hesitate to crack them immediately if vital programs are damaged, they indicated.

“Sound fiscal practices have positioned us better than most states in the nation,” Lamont wrote late Friday afternoon in a joint statement with House Speaker Matt Ritter, D-Hartford, and Senate President Pro Tem Martin M. Looney, D-New Haven. “If this pattern of devastating cuts continues, we will be prepared to exercise emergency powers. Although we hope that Washington reverses course, we must plan for the inevitable or unpredictable.”

Officials here also had expected to see deep cuts in aid from Washington, but not until late summer or fall with the congressional adoption of the next federal budget. Since taking office in January, though, Trump has used executive orders on several occasions to suspend grants, reclaim unspent dollars from states, or attach controversial new conditions to federal assistance.

The comments came hours after state Senate Democrats completed a closed-door caucus during which members vented frustrations about Trump’s latest unilateral move, the cancellation of $12 billion in public health grants to states this week, including $155 million for infectious disease management, genetic screening of newborns and substance abuse prevention in Connecticut.

“What no one could anticipate was how severe these cuts would be and how quickly they would occur to vital programs, sometimes without warning,” Lamont and legislative leaders wrote, adding decisions on when to restore funding would be made in the coming weeks on a case-by-case basis.

Their statement didn’t say, though, whether the fiscally moderate-to-conservative governor and his fellow Democrats in legislative leadership see eye-to-eye on which piggy banks are OK to shatter, and which can’t be touched.

Connecticut holds a record-setting $4.1 billion budget reserve, commonly known as its rainy day fund, an amount equal to 18% of annual operating costs.

But an aggressive series of budget caps, labeled “fiscal guardrails” by Lamont and other supporters, have generated roughly triple that $4.1 billion mark since their enactment in 2017. And what wasn’t deposited into the reserve, another $8.5 billion, was used to whittle down the state’s massive pension debt.

One “guardrail” alone, a provision that restricts lawmakers’ ability to spend certain income and business tax receipts, has forced them to save an average of $1.4 billion annually since 2017. Analysts say it will capture another $1.4 billion before this fiscal year ends on June 30, and closer to $1.3 billion in each of the next three years.

Though the governor and legislative leaders all have cited the rainy day fund as one coffer Connecticut may need to tap to mitigate impending cuts in federal aid, scaling back the budget caps that helped fill this reserve is another matter.

Lamont has been reluctant to tamper with this system, though he did express a willingness in February to scale back this savings mandate modestly by about $300 million per year.

Ritter and Looney, though, have been more direct about the need to reform this “guardrails” system, save less, and pour more dollars into core programs like health care, education and social services.

And the House speaker said Friday he believes these saved income and business tax receipts should be the first line of defense against Trump cuts.

It’s been 14 years since Connecticut has failed to make the full contributions recommended by pension analysts for its retirement benefits for state employees and municipal teachers, and Ritter noted the full $3.2 billion owed this fiscal year already has been budgeted.

And any “guardrails” savings Connecticut doesn’t need to reverse cuts in federal funding still could be sent into the pensions as well, Ritter added.

But cracking this piggy bank first would leave the larger, $4.1 billion rainy day fund available for later this summer or fall, when potentially more damage could occur.

With Congress aiming to find more than $880 billion in cuts to Medicaid — a cooperative health care program that sends $6.1 billion to Connecticut this year alone — officials here fear revenues that support nursing homes, federally qualified health clinics, hospitals and insurance programs for poor adults and children, could be in grave jeopardy.

And with recent tariffs ordered by the president increasing many economists’ fears of a looming recession, Connecticut may need its rainy day fund later this year or next to mitigate the big drops in tax receipts that often accompany a sharp national economic downturn, legislative leaders say.

Looney echoed Ritter’s comments, calling the president’s latest health care funding cuts “irresponsible, reckless and possibly disastrous” and showing Connecticut must have all resources ready to offset damage to its most vital programs.

“We can’t draw a line anywhere,” Looney added.

The Lamont administration opted not to elaborate on Friday’s statement after its release.

But the governor has warned on several occasions that Connecticut must understand it ultimately can’t offset all losses in federal funding if the cuts go as deep as some fear they will.

Connecticut will receive more than $10 billion in federal funding this fiscal year, a total that equals roughly 40% of the entire state budget.

“No state can restore every cut that comes from Washington,” the joint statement from Connecticut leaders adds.

Connecticut

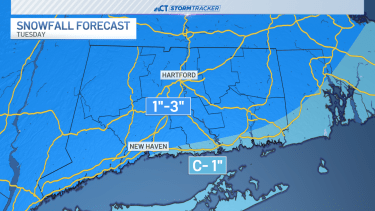

Cooler Monday ahead of snow chance on Tuesday

Slightly less breezy tonight with winds gusting between 15-25 mph by the morning.

Wind chills will be in the 10s by Monday morning as temperatures tonight cool into the 20s.

Monday will see sunshine and highs in the 30s with calmer winds.

Snow is likely for much of the state on Tuesday, with some rain mixing in over southern Connecticut.

1-3″ should accumulate across much of the state. Lesser totals are expected at the shoreline.

Christmas Eve on Wednesday will be dry with sunshine and temperatures in the upper 30s and lower 40s.

Connecticut

Ten adults and one dog displaced after Bridgeport fire

Ten adults and one dog are displaced after a fire at the 1100 block of Pembroke Street in Bridgeport.

The Bridgeport Fire Department responded to a report of heavy smoke from the third floor at around 3:30 p.m. on Saturday.

Firefighters located the fire and quickly extinguished it.

There are no reports of injuries.

The American Red Cross is currently working to help those who were displaced.

The Fire Marshal’s Office is still investigating the incident.

Connecticut

Woman suffers life threatening injuries in Rocky Hill house fire

A woman was rushed to the hospital after being seriously hurt in a fire Saturday in Rocky Hill.

This all unfolded during the late morning hours at a home on Main Street.

Fire officials say they had to rescue the woman from the home and her injuries are considered life threatening.

Hoarding conditions did a play a factor in the fire, according to the fire department.

No other injuries were reported. Further details pertaining to the fire weren’t immediately available.

The cause of the fire is under investigation.

-

Iowa7 days ago

Iowa7 days agoAddy Brown motivated to step up in Audi Crooks’ absence vs. UNI

-

Iowa1 week ago

Iowa1 week agoHow much snow did Iowa get? See Iowa’s latest snowfall totals

-

Maine5 days ago

Maine5 days agoElementary-aged student killed in school bus crash in southern Maine

-

Maryland7 days ago

Maryland7 days agoFrigid temperatures to start the week in Maryland

-

South Dakota1 week ago

South Dakota1 week agoNature: Snow in South Dakota

-

New Mexico5 days ago

New Mexico5 days agoFamily clarifies why they believe missing New Mexico man is dead

-

Detroit, MI6 days ago

Detroit, MI6 days ago‘Love being a pedo’: Metro Detroit doctor, attorney, therapist accused in web of child porn chats

-

Education1 week ago

Education1 week agoOpinion | America’s Military Needs a Culture Shift