Outside the town of Yongin, 40 kilometres south of Seoul, an army of diggers is preparing for what South Korea’s president has described as a global “semiconductor war”.

The diggers are moving 40,000 cubic metres of earth a day, cutting a mountain in half as they lay the foundations for a new cluster of chipmaking facilities that will include the world’s largest three-storey fabrication plant.

The 1,000-acre site, a $91bn investment by chipmaker SK Hynix, will itself only be one part of a $471bn “mega cluster” at Yongin that will include an investment of 300tn won ($220bn) by Samsung Electronics. The development is being overseen by the government amid growing anxiety that the country’s leading export industry will be usurped by rivals across Asia and the west.

“We will provide full support, together with SK Hynix, to ensure that our companies won’t fall behind in the global chip cluster race,” South Korea’s industry minister Ahn Duk-geun told SK Hynix executives during a meeting at the Yongin site last month.

Most industry experts agree the investments at Yongin are required for South Korean chipmakers to maintain their technological lead in cutting edge memory chips, as well as to meet booming future demand for AI-related hardware.

But economists worry that the government’s determination to double down on South Korea’s traditional growth drivers of manufacturing and large conglomerates betrays an unwillingness or inability to reform a model that is showing signs of running out of steam.

Having grown at an average of 6.4 per cent between 1970 and 2022, the Bank of Korea warned last year that annual growth is on course to slow to an average of 2.1 per cent in the 2020s, 0.6 per cent in the 2030s, and to start to shrink by 0.1 per cent a year by the 2040s.

Pillars of the old model, such as cheap energy and labour, are creaking. Kepco, the state-owned energy monopoly that provides Korean manufacturers with heavily subsidised industrial tariffs, has amassed liabilities of $150bn. Of the other 37 OECD member countries, only Greece, Chile, Mexico and Colombia have lower workforce productivity.

Park Sangin, professor of economics at the graduate school of public administration at Seoul National University, notes that South Korea’s weakness in developing new “underlying technologies” — as opposed to its strength in commercialising technologies like chips and lithium-ion batteries invented in the US and Japan respectively — is being exposed as Chinese rivals close the innovation gap.

“Looking from the outside, you would assume that South Korea is extremely dynamic,” says Park. “But our economic structure, which is based on catching up with the developed world through imitation, hasn’t fundamentally changed since the 1970s.”

Worries about future growth have been exacerbated by an impending demographic crisis. According to the Korea Institute of Health and Social Affairs, the country’s gross domestic product will be 28 per cent lower in 2050 than it was in 2022, as the working age population shrinks by almost 35 per cent.

“The Korean economy will face big challenges if we stick to the past growth model,” finance minister Choi Sang-mok told the Financial Times earlier this month.

Some hope that the expected global boom in AI will rescue the Korean semiconductor industry, and perhaps even the Korean economy at large, by offering solutions to the country’s productivity and demographic problems.

But sceptics point to the country’s poor record in addressing challenges ranging from its plummeting fertility rate to its outdated energy sector to its underperforming capital markets.

That is unlikely to improve in the near future. Political leadership is split between a leftwing-controlled legislature and an unpopular conservative presidential administration, with the victory of leftwing parties in parliamentary elections earlier this month raising the prospect of more than three years of gridlock until the next presidential election in 2027.

“Korean industry is struggling to move on from the old model,” says Yeo Han-koo, a former South Korean trade minister now at the Peterson Institute for International Economics. “It hasn’t worked out what comes next.”

One of the reasons why it is proving so hard to reform the “old model”, say economists, is because it has been so successful.

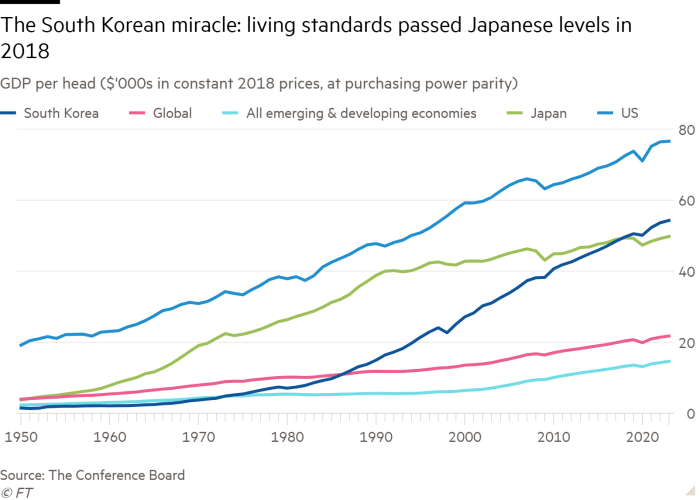

The achievements of South Korea’s state-guided capitalism, which took it from an impoverished agrarian society to a technological powerhouse in less than half a century, have come to be known as the “miracle on the Han River”. In 2018, South Korea’s GDP per capita measured at purchasing power parity surpassed that of its former colonial occupier, Japan.

Seungheon Song, managing partner of consultancy McKinsey’s practice in Seoul, notes that South Korea made two great leaps — one between the 1960s and the 1980s, when the country moved from basic goods to petrochemicals and heavy industry, and the second between the 1980s and 2000s, when it moved to high-tech manufacturing.

Between 2005 and 2022, however, only one new sector — displays — entered the country’s list of top ten export products. Meanwhile, South Korea’s lead in a range of critical technologies has dwindled. Having led the world in 36 of 120 priority technologies identified by the Korean government in 2012, by 2020 that number had dropped to just four.

Park says the country’s leading conglomerates, or chaebol, many of which are now overseen by the third generation of their founding families, have drifted from a “growth mindset” born of hunger towards an “incumbent mindset” born of complacency.

He argues that the present model reached its apogee in 2011, after a decade during which Korean tech exports were driven by the related twin demand shocks of the rise of China and the global technology boom, as well as by massive investments by Samsung and LG to seize control of the global display industry from their Japanese counterparts.

Since then, however, Chinese tech companies have caught up with their Korean competitors in almost every area except the most advanced semiconductors, meaning that Chinese companies that were once customers or suppliers have become rivals. Samsung and LG are fighting for survival in the global display industry they dominated just a few years ago.

Park adds that many of the headline-grabbing gains made by the leading conglomerates have come at the expense of their domestic suppliers, who are subjected to price squeezing through exclusive contractual relationships.

The result is that small and medium enterprises, which employ more than 80 per cent of the South Korean labour force, have less money to invest in their employees or infrastructure, exacerbating low productivity, slowing innovation and stifling growth in the services sector.

“The rationale used to be that the chaebol should be sheltered from disruption at home so they can focus on disrupting rivals abroad,” says Park. “But now they are the incumbents, they are both stifling innovation at home and highly vulnerable to disruption themselves.”

The country’s two-tier economy, in which according to Park almost half of the country’s GDP was delivered by conglomerates that employed just 6 per cent of South Koreans in 2021, also feeds social and regional inequalities, which in turn feeds spiralling competition among young South Koreans for a small number of elite university places and high-paying jobs in and around Seoul.

That competition is helping drive down the country’s fertility rate even further as young Koreans wrestle with mounting academic, financial and social burdens. The country has the widest gender pay gap and the highest suicide rate in the OECD.

South Korea also has one of the highest rates of household debt as a proportion of GDP in the developed world, according to the Institute of International Finance. The average newly-wed couple in South Korea has combined debts of $124,000.

While South Korea’s government debt to GDP is relatively low by western standards, at 57.5 per cent, the IMF forecasts that it will triple over the next 50 years in the absence of drastic pension reforms. Forty-six per cent of South Koreans are projected to be over the age of 65 by 2070, and the country already has the highest rate of elderly poverty in the developed world.

“Slowing growth has fed the declining birth rate, which will lead to even slower growth,” says Song of McKinsey. “We are in danger of getting stuck in a vicious circle.”

The Yongin mega cluster illustrates South Korea’s challenge in sustaining an economic model that was first developed at a time when the country was much poorer and less democratic.

The project was announced in 2019, but was delayed for several years due to wrangles over construction permits and the site’s water supply. Once the first cluster is completed in 2027 — more are planned for later — it will face a shortage of qualified labour. Without a sufficient supply of renewable energy, and without a bipartisan consensus on building new nuclear power plants, it is unclear how the cluster will be powered.

Despite the uncertainties that surround it, the plan reflects confidence that an expected boom in demand for AI-related hardware, including the Dram memory chips needed for large language models, will justify the titanic investments. Shares in SK Hynix have more than doubled over the past year amid investor excitement over its “high bandwidth memory” chips used with Nvidia’s cutting edge processors.

Ahn Ki-hyun, executive director of the Korea Semiconductor Industry Association, says the country needs to press on with the Yongin project as potential rivals are making their own large investments.

He singles out the US and Japan’s efforts to revive their own chipmaking capabilities with generous subsidies. “We could lose our status as a chipmaking powerhouse if our companies continue to build plants abroad, but if facilities are concentrated in our own country, our competitiveness will increase,” he says.

Last week, Samsung announced a $45bn investment in Texas to meet expected AI-related chip demand, while SK Hynix is building a high bandwidth memory facility in Indiana.

In the long term, however, executives worry about US rivals absorbing Korean knowhow, as well as the risk that the proliferation of chip clusters around the world will lead to chronic oversupply and inefficiencies that could further undermine profitability.

Samsung’s Texan investments, which have benefited from up to $6.4bn in federal subsidies from Washington, also highlight how the Korean government is struggling to match the incentives on offer in other countries.

Some see in the coming AI era an opportunity for South Korea to lift its sights beyond manufacturing and the preservation of its biggest players.

Sunghyun Park, chief executive of AI chip design start-up Rebellions, notes the country already has capabilities in three of the four pillars needed for AI — logic, memory, and cloud service providers — and now has the opportunity to secure reciprocal access to the world’s most sophisticated AI algorithms, the fourth pillar.

“Our strength in hardware is important, but if we are to progress we need to move up the value chain into design and software,” says Park. “That means investing our money in strategic partnerships with the makers of the world’s leading large language models.”

Park’s argument resonates with those who worry that South Korea’s continued emphasis on manufacturing and hardware — both in the chip sector and beyond — will prove unsustainable as costs continue to rise.

But Inseong Jeong, a former SK Hynix engineer and author of The Future of Semiconductor Empires, a book about the Korean chip industry, says the country should focus on its existing strengths. “The world will always need hardware, and the world will always need chips.”

He adds that by remaining at the cutting edge of chip production, Korean companies will be more likely to benefit from future breakthroughs in AI.

“The moat between hardware and software is hard to cross, but it works both ways,” says Jeong. “For example, our memory chip companies would be the main beneficiaries of a breakthrough whereby AI chips would more closely resemble the workings of a human brain. There are no guarantees that AI will run on Nvidia GPUs forever.”

Some observers regard warnings about South Korea’s economic future as overblown, noting that many western countries bitterly regret abandoning the kind of advanced manufacturing base that Seoul has managed to preserve.

The “tech war” between the US and China, they argue, is playing into Korean hands as Chinese rivals in the chip, battery and biotech sectors are restricted or barred from entry into growing western markets, while concern about Taiwan’s security feeds demand for Korean alternatives.

South Korean companies in areas ranging from defence and construction to pharmaceuticals, electric vehicles and entertainment, have shown themselves to be more adept than many of their western counterparts in reducing their exposure to the Chinese market and seeking out growth in south-east Asia, India, the Middle East, Africa and Latin America.

The Bank of Korea has also said that the most doom-laden scenarios regarding the country’s demographic crisis and growth prospects can be alleviated by bringing the country up to the OECD average on a range of metrics, including urban population concentration and youth employment.

But others argue that while there is much that South Korea could and should do to alleviate its problems, its record on reform is poor.

Spending on private tuition continues to climb as competition for university places grows fiercer, while the fertility rate continues to fall. Pension, housing and medical sector reforms have stalled, while long-standing campaigns to curb the country’s dependence on the conglomerates, boost renewables, raise corporate valuations, close the gender pay gap, and make Seoul a leading Asian financial centre have all made little headway.

But finance minister Choi retains his faith that the country’s economy can be reformed, insisting that “dynamism is embedded in the Korean DNA”.

“We need to redesign policies to unleash that economic dynamism again,” says Choi. “But the miracle isn’t over.”

Additional reporting by Song Jung-a

Data visualisation by Keith Fray