“Economic giant, political dwarf” — the epithet so often used about Japan and Germany — has been used about the EU, too. Many of its leaders nowadays see their challenge as finding the political influence to match the bloc’s economic heft.

But even in economic terms, the EU still punches below its weight. That, in essence, is the warning issued last week by two former Italian prime ministers: Enrico Letta, who presented his report on the single market, and Mario Draghi, who in a speech gave the first hints of his forthcoming report on European competitiveness.

Both underline that the EU’s economic institutions were built for a different world, with less international interdependence and fewer geopolitical threats. The forms of integration adopted in the 1980s and 1990s are no longer sufficient — and can even turn into a brake on growth.

Europe still fails to make enough of its size. As Letta notes, some sectors were left out of the single market for political reasons; others — services and data especially — neglected because they were a less important part of cross-border trade than they have since become.

As a result, some of today’s most vital sectors remain in effect national, hopelessly small when rivals enjoy the continent-sized markets of the US and China. Letta and Draghi zoom in on defence, telecoms and energy infrastructure as sectors that need to become truly European markets. Many other industries are not as “single” as all that. And all sectors suffer from the lack of a seamless banking and capital market.

What to do? One of Letta’s punchiest proposals is for a “28th regime” in corporate law — an EU-level business code European companies could opt in to that would make it easier to scale up and attract investors from the whole EU (and beyond), without navigating 27 sets of rules on everything from licensing to creditor rights. This could be the rare policy that offers profound change while sidestepping the political thicket of harmonising national rules. A well-designed, minimally bureaucratic EU business code could be a game-changer for the ability of small businesses and start-ups to expand fast.

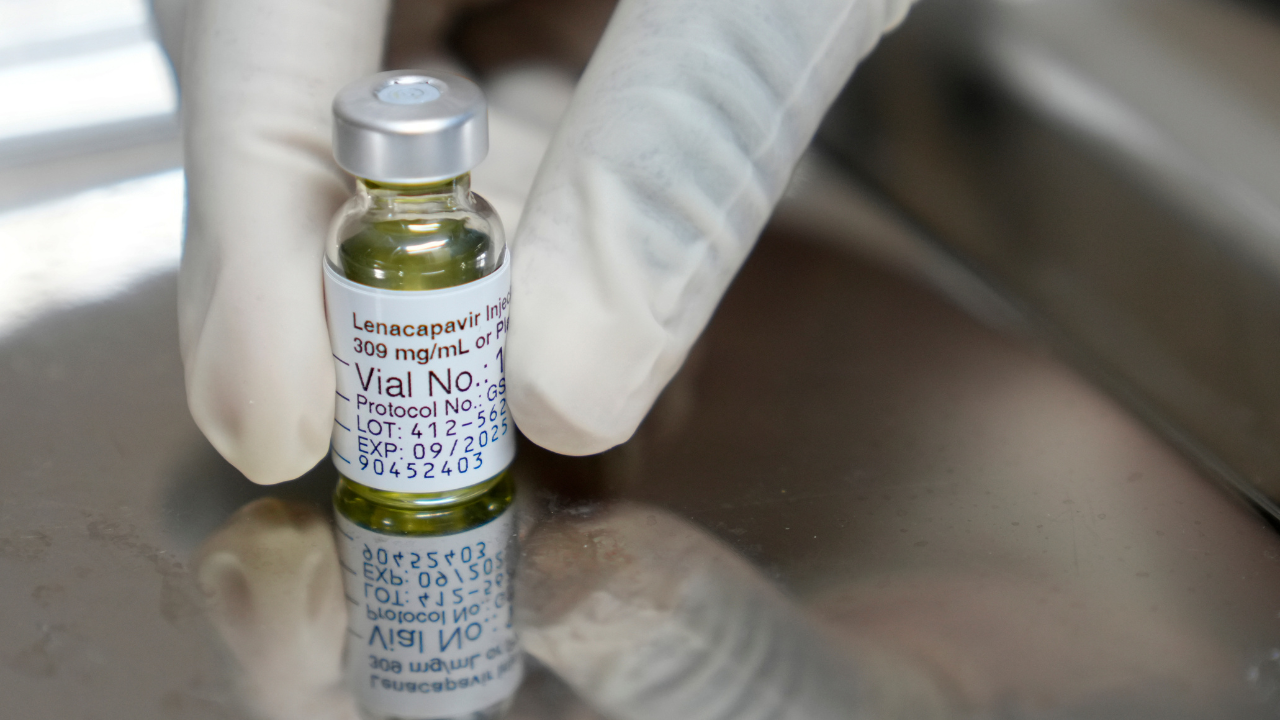

Other ideas include a “fifth freedom” (on top of those for people, goods, services and capital) for education, innovation and research to facilitate, for example, data processing at a European scale — with strong consumer protection. Letta also wants a much more integrated European health sector.

Beyond specific policies, there is the politics. To fulfil the single market’s potential, there is no way around more EU-level governance. Letta recommends a greater use of regulations (which are identical for all, unlike directives, which member states implement as they see fit) and stronger EU regulators. He rightly wants more effective enforcement of single market rules.

It is also unavoidable to manage more public spending jointly — through joint procurement, harmonised subsidy systems or more common debt for common public goods. Equally important is to harness private capital. Letta takes aim at an EU sacred cow — its structural trade surplus — by lamenting “the annual diversion of around €300bn of European families’ savings . . . primarily to the American economy”. His solution is a “savings and investment union” where households can easily invest in promising EU companies.

Politicians must be prepared for consolidation in sensitive industries, from telecoms (where Draghi counts at least 34 operators against the US and China’s handful) to finance, rail transport and utilities. Caution is required here not to throw out the baby of Europe’s level playing field with the bathwater of fragmentation. Europe could no doubt have fewer telecoms operators, but each consumer in every country must have a genuine choice of supplier.

All this is politically demanding, and leaders last week shrank from the challenge. But a key message from Letta is the need to see two things as flip sides of the same coin: on the one hand, the deepening of the single market, and on the other, the strategic goals of Europe’s green and digital transformation and securing the bloc from dependence on geopolitical adversaries. Doubling down on economic integration is a prerequisite for achieving anything else.

That connection is too rarely made. Single market deepening risks death by boredom — a technical matter with little political reward. There is no popular clamour for it and plenty of special interests keen to preserve narrow advantages.

But the same was true of the original single market programme. It took all the political efforts of leaders as strong and as different as Jacques Delors and Margaret Thatcher to make it a reality. The leaders who listened to Letta last week must prove they can do the same.

martin.sandbu@ft.com