The dysfunction in the majority party in the US House of Representatives was as clear as Saturday’s final vote on $60bn in military aid for Ukraine: of the 218 Republicans in the House, most (112) voted against desperately needed funding.

That meant Mike Johnson, the accidental Republican Speaker, had to rely on the opposition Democrats to get the aid legislation passed. And so he did: Although there was no indication that Johnson actually worked in concert with the House Democratic leader, Hakeem Jeffries, all 210 Democrats who were present in Washington on Saturday backed the bill.

After nearly 18 months of legislative ineptitude on Capitol Hill, it is worth pausing to celebrate a rare moment of bipartisan normality. The aid is months overdue — and may yet be too late, with reports of nearly 40 per cent of Ukraine’s electrical generation capacity destroyed by Russian munitions that could have been stopped by American-supplied anti-missile systems.

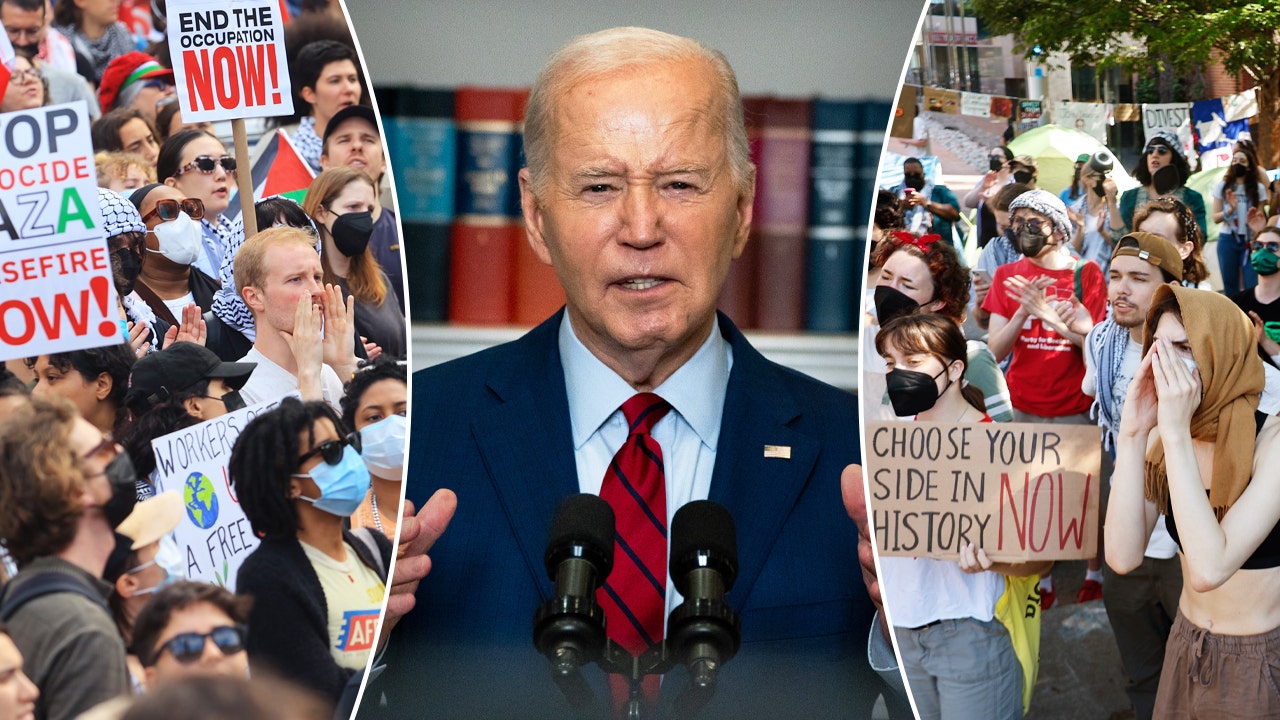

Regardless, for a moment the centre held, and those who hoped that old fashioned legislative horse-trading would eventually triumph — particularly the legislative horse trader-in-chief, Joe Biden — have been vindicated.

But is there any hope that Saturday’s victory is a sign of reason regaining the upper hand in Washington at long last? There are some indications that Johnson’s conversion on the road to Mar-a-Lago could mark a break from the recent past.

Most importantly, Donald Trump, who had vocally opposed any new aid to Ukraine for months, was unable — or at least unwilling — to stop Johnson. The Republican Speaker has sworn fealty to the former president, but Johnson struck at a moment of maximum weakness for the party’s standard bearer, stuck as he is in a dingy Manhattan courtroom for days on end, distracted by his own finances and legal jeopardy.

Johnson was also able to placate congressional Democrats, who proved unwilling to do deals with his backslapping predecessor, Kevin McCarthy. McCarthy’s prevarications on the biggest issues of the day — condemning Trump after the January 6 riots, for example, only to reverse course when it became clear he could not become Speaker without him — infuriated even Democrats inclined towards bipartisanship.

And perhaps most importantly, Johnson himself is an ideologue — but not a cynical partisan. Ideological opponents have been known to get on famously in Washington as long as there is trust across the aisle. Boston liberal Tip O’Neill, who held the House speakership for much of the 1980s, developed a modus vivendi with Ronald Reagan, his fierce ideological opponent, that allowed Reagan to get much of his conservative agenda through Congress during his presidency.

But keeping the bipartisan peace asks too much of both Republicans and Democrats, I fear. Democrats would have to agree to vote repeatedly and consistently to keep Johnson in his job — the first test of which could come in the next few days.

Under current House rules, the small band of Republican arsonists who brought down McCarthy are poised to do the same with Johnson because of his Ukraine apostasy. Jefferies, the Democratic leader, has indicated he could come to Johnson’s rescue this time. But does anyone believe a Republican House Speaker can stay in power for long without a majority comprised of members of his own caucus? That is too much to ask of Jefferies, particularly in an election year.

Similarly, political Washington underestimates Trump at its peril. After January 6, most of the Republican establishment gave up the former president for dead. And yet a year later, he regained a singular power over his party that may have briefly dissipated while he is distracted in court, but is in no way gone.

Indeed, it is a power that even his opponents must admire: sitting presidents can rarely control legislators in their own party in the way the ex-president can. Trump has no record of allowing his party to do deals with Biden and the Democrats — and he’s not about to start now.

So let us celebrate a rare victory for the reasonable on Capitol Hill. But let’s also realise it’s unlikely to happen again any time soon.