Ohio

What comes next for Ohio’s teacher pension fund? Prospects of a ‘hostile takeover’ are being probed

COLUMBUS, Ohio (AP) — A battle is under way for the future of Ohio’s $94 billion teacher pension fund, as would-be reformers’ attempts to deliver long-promised benefits to retirees with the help of an aggressive investment firm touting an untested AI-driven trading strategy face intense scrutiny.

The eyes of Wall Street and the half-million members of the State Teachers Retirement System of Ohio are on the state as the drama unfolds. A special meeting has been called for Thursday of a board nearly paralyzed by infighting whose executive director is on long-term leave over misconduct allegations he denies.

Years of tension at the fund came to a head on May 8, when Republican Ohio Gov. Mike DeWine announced that he had come into possession of an anonymous 14-page memo and other documents containing “disturbing allegations” about the STRS board and was handing them over to authorities.

Republican Attorney General Dave Yost launched an investigation the next day into what he called the fund’s “susceptibility to a hostile takeover by private interests.” He followed up with a lawsuit seeking to unseat two reform-minded board members — Wade Steen and Rudy Fichtenbaum — for backing a plan to turn over $65 billion, or roughly 70% of STRS assets, to a fledgling investment firm called QED. The outfit is co-run by two people, one a former deputy Ohio treasurer, out of a condo in suburban Columbus.

“This isn’t monopoly money; it’s hard-earned income that belongs to teachers,” Yost said in launching his probe. “There is a responsibility to act in their best interests.”

The Ohio Retirement for Teachers Association, a retiree watchdog group, says Steen and Fichtenbaum have been unfairly targeted. The group defends reformers’ push for change as a fight against years of opaque management and greed.

Teachers, who are generally ineligible for Social Security and so rely heavily on the fund in retirement, are particularly upset at the dearth of cost-of-living adjustments and market losses that the fund has seen over the years, even as STRS investment professionals have collected large bonuses. They have called for more transparency into the fund’s investment and pay practices.

“We’ve been calling for an investigation for years,” said Robin Rayfield, the association’s executive director. “So our response to them would be, ‘Where you been?’”

Rayfield said public education in Ohio will be “fully politicized” if DeWine and Yost succeed in shutting down STRS reformers. He described it as the third leg of a stool that also includes approval of a universal school voucher program in last year’s state budget and the transfer of K-12 education oversight from Ohio’s independent state school board into DeWine’s Cabinet. An ongoing lawsuit challenges the latter as unconstitutional.

“Governor DeWine has done more to ruin public education than all the other governors combined,” he said.

The nearly $6 trillion U.S. public pension sector has increasingly swapped stocks for riskier actively-managed alternative investments, such as hedge funds and private equities, in recent years — a trend that David Draine, the Pew Charitable Trust’s principal researcher on public sector retirement systems, says demands the type of transparency that the Ohio reformers have sought.

“As public pensions are taking on both risky and complicated assets, it’s important that they’re being transparent about those investments: what the returns are on their performance, what they’re paying for them, and what the risks are,” he said.

However, detractors say putting the shadowy QED in charge of STRS investments brings even greater danger.

Aristotle Hutras, former director of the Ohio Retirement Study Council, a legislative oversight committee, believes the governor is rightly trying to protect STRS from reformers’ rosy AI-fueled visions for improving the fund, which he dubs “magical thinking.”

“STRS has survived a world war, a major depression, a major recession and a worldwide pandemic, and still paid benefits,” said Hutras, a Democrat. “This notion of QED, and essentially steering a contract, in my humble opinion, is the most serious threat to STRS’s solvency in the last 96 years.”

The fund’s then-board chair issued a statement after DeWine’s referral saying that STRS was cooperating, but reassuring beneficiaries that the fund was safe, secure, well-run and in “sound financial position.”

Among claims in the 14-page memo, whose murky origins one board member said should be investigated, is that QED’s Jonathan Tremmel approached STRS in 2020 with assertions that the fund was improperly calculating performance, benchmarks and investment costs. “He also claimed to have AI-based trading strategies that would fix STRS’s ‘problems,’” the memo said.

Leaders rejected Tremmel’s initial pitch because of QED’s lack of professional registrations, clients or track record. His business partner, Seth Metcalf, who served under former Republican Ohio Treasurer Josh Mandel, returned to STRS asking that QED be given a second look.

Around that time, the memo’s authors contend, Steen, Fichtenbaum and two other then-board members began raising almost identical questions about STRS performance to QED’s and started working behind the scenes to get an affiliated company, OhioAI, pension fund business. The metadata on some letters and memos showed they originated with Tremmel or Metcalf.

The Federal Trade Commission began cautioning businesses around that time to proceed cautiously with automated tools that might have biased or discriminatory impacts. Last year, the commission took its warnings further, putting companies on notice that false or unsubstantiated claims about what AI could do for their clients could lead to enforcement actions.

Neither Metcalf nor Tremmel returned calls seeking comment on their statements to STRS. In his lawsuit, Yost told the court, “The owner of this shell company continues to peddle to STRS a secretive and untested investment scheme while his own condominium is in foreclosure.” The attorney general accuses Steen and Fichtenbaum of ”backdoor ties” to QED.

Steen denies Yost’s claims, including that $65 billion was ever on the table. He argues that reaction to his persistent questioning of STRS’s practices proves that he’s struck a nerve.

“He’s hiding behind litigation that’s defamatory, it’s not true,” Steen said after the board’s May 15 meeting. “I thought there was going to be a fair, impartial investigation. I guess this might be the fastest investigation ever done in Ohio history. But we’re going to defend this vigorously. None of it’s true. It’s all false.”

DeWine called it a “huge red flag” when Aon, a nationally respected consulting firm that had been enlisted to help address management and fiscal performance issues, abruptly exited its contract with the pension fund earlier this month.

“The unstated implication is that the governance issues at STRS are so concerning that Aon could not continue its contract in good faith,” DeWine said in a statement. A spokesperson for Aon declined comment.

STRS reformers have not backed down. Now in control of a majority of votes on STRS’s 11-member board, they pushed ahead during the board’s May meeting to oust rival leadership and elect Fichtenbaum, an emeritus Wright State University economics professor, as board chair.

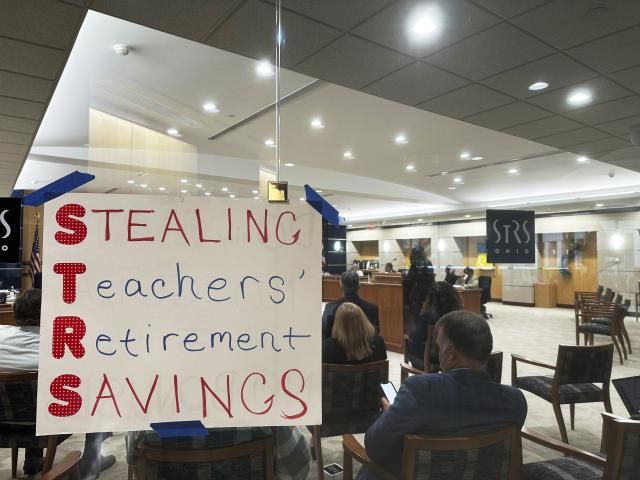

Many of the retired teachers in attendance applauded after the coup. Nearby was a poster with a different STRS acronym: “Stealing Teachers’ Retirement Savings.”

“It’s needed to happen for years,” said Lee Ann Baughman, 82, who taught elementary school in suburban Columbus for 32 years. “It’s been hard for these retirees. A lot of them have a part-time job, and they’re old, and it’s been very hurtful not to get what they were promised.”

Ohio

Ohio florist celebrates Father's Day by delivering flowers

COLUMBUS, Ohio — Father’s Day is a time to honor the dads in our lives, but sending flowers like you do on Mother’s Day may not be the first idea on your list.

One florist in Ohio is trying to change the norm.

What You Need To Know

- Florists across the country team up with the Black Men Flower Project to send flowers to Black dads

- Ayana Crump is the project’s florist in Ohio

- The Black Men Flower Project is all about celebrating Black masculinity

Ayana Crump is the owner of Bloom Boutique 614 in Columbus.

“I always arrange flowers weekly in my home,” she said, “and I would post them on social media and everybody was like, ‘oh, so beautiful. I love them. Can you make me some of them?’ And I’m like, ‘Wait, I can make money off of this, so let’s do it’.”

As a florist, she partners with the Black Men Flower Project, helping Black dads bloom one arrangement at a time.

“The CEO and owner of the nonprofit Robert Washington-Vaughns presented the idea to me of the Black Man Floral Project just to say, ‘give black man their flowers while they’re still alive. You know, so many times it’s not until a funeral or a sad occasion when you actually receive flowers,’” Crump said. “I thought it was like the best idea ever.”

Crump is one of the many florists across the country partnering with the project. She arranges and delivers them herself.

Each delivery is a surprise, and Black fathers can nominate one another for a free flower arrangement. Crump said it’s all about celebrating Black masculinity.

“With the history of Black men in America, it’s more depressing than them being celebrated,” Crump said. “So, I just think that just giving them a little something to brighten up their day or to say, ‘hey, you’re seen, we see you, we hear you, we feel for you,’ that just the disparities that you go through day to day, just being a Black man. I’m all for it!”

Meeting the dads she delivers to tops it all, especially on Father’s Day.

To help donate toward the Black Men Flower Project or to nominate a dad for Father’s Day or any time of the year, go here.

Ohio

Ohio agencies issue warning on alcohol, cannabis and boating laws – The Tribune

Ohio agencies issue warning on alcohol, cannabis and boating laws

Published 5:00 am Sunday, June 16, 2024

Staff report

COLUMBUS — As Ohioans prepare for fun and adventure during the upcoming summer boating season, the Ohio Department of Commerce Divisions of Liquor Control and Cannabis Control and the Ohio Department of Natural Resources (ODNR) are emphasizing the importance of adhering to alcohol, cannabis and boating laws to ensure a safe and enjoyable experience on Ohio’s waterways.

Alcohol consumption and cannabis use while operating a boat pose a serious risk to both the operator and passengers. In Ohio, it is illegal to operate a boat with a blood alcohol concentration (BAC) of 0.08% or higher or be under the influence of marijuana, just as it is illegal to drive a car. The consequences of boating under the influence can be severe, leading to accidents, injuries and even fatalities.

“We make safety a top priority so people can enjoy Ohio’s rivers and lakes,” said ODNR Director Mary Mertz. “We urge every Ohioan and visitor to follow the law by boating sober and wearing a life jacket this summer. Those simple steps will help keep you, your loved ones, and fellow boaters safe.”

The Division of Liquor Control and Division of Cannabis Control emphasize responsible alcohol and cannabis consumption both on land and on the water, and remind Ohioans that open container laws still apply on publicly owned waterways. Boaters are encouraged to designate a sober operator if substances will be consumed during their outing that could cause impairment, ensuring that everyone on board can enjoy the day responsibly.

“Alcohol and boating do not mix,” said Jaqueline DeGenova, superintendent of the Division of Liquor Control. “We urge all boaters to prioritize safety by staying sober while operating a vessel and responsibly enjoying Ohio’s waterways.”

“With the legalization of non-medical cannabis use in Ohio following the passage of Issue 2 last November, it is critically important that individuals who choose to consume cannabis products fully understand the unique impact these products have on them,” said Jim Canepa, superintendent of the Division of Cannabis Control. “Anyone who chooses to use these products are urged to do so in a safe and responsible manner, and should never operate a boat or any other kind of vehicle while under the influence.”

ODNR is highlighting enforcement efforts to crack down on boating while under the influence. Patrols will be vigilant in monitoring watercraft for any signs of impairment and will take swift action to remove impaired operators from the water to prevent accidents and safeguard the public.

The Division of Liquor Control is part of the Ohio Department of Commerce. The department is Ohio’s chief regulatory agency, focused on promoting prosperity and protecting what matters most to Ohioans.

To learn more about what the agency does, visit its website at www.com.ohio.gov.

For more information on Ohio’s alcohol and boating laws, please review the following resources:

Ohio

Helen (Dicu) Guiler, Salem, Ohio

SALEM, Ohio (MyValleyTributes) – Elena “Helen” Guiler, 90, of Salem, went to our Lord’s home on June 14, 2024.

She was born May 20, 1934, in Sibiel, Romania, Europe. She was the daughter of the late John and Maria Dicu.

Helen was a 1954 graduate of Salem High School.

She was a member of First United Methodist Church, where she served as captain of the women’s usher team, was a member of the Home Builder’s Sunday School Class, the Fadley Women’s Group and United Methodist Women. Helen also served on many church operation committees. Her love for her family was her passion in life.

She leaves behind her son, Scott Guiler and daughter-in-law, Diane; grandsons, JP and Scott Jr.; granddaughter-in-law, Sarah; great-granddaughter, Ellie Nicole and great-grandson, Scott Alan III.

She believed in giving back and helping others. She served on the Columbiana County Citizens Welfare Committee as well as the YWCA Board of Directors. Helen was also a member of the Salem Garden Club. She volunteered for over 40 years for A.I.D. (Aid, Information, Direction) for the Salem Regional Medical Center and the Salem Food Pantry. She worked at Mullins Manufacturing in the accounting department, Firestone Health Center and Sanor Insurance Agency.

Her husband, John P. Guiler, whom she married July 2, 1955, and two sisters preceded her in death.

At her request, there will be no calling hours. A private celebration of her life will be held for immediate family only. Arrangements are being made by Stark Memorial Funeral Home. She will be laid to rest at Hope Cemetery.

Memorial donations may be made to First United Methodist Church, 244 S. Broadway, Salem, Ohio.

Arrangements handled by Stark Memorial Funeral Home & Cremation Services.

To send flowers to the family or plant a tree in memory of Helen (Dicu) Guiler, please visit our floral store.

A television tribute will air Monday, June 17 at the following approximate times: 5:17 a.m. on WKBN, 8:39 a.m. on FOX, 5:21 p.m. on WYTV and 6:35 p.m. on MyYTV. Video will be posted here the day of airing.

-

News1 week ago

News1 week agoIsrael used a U.S.-made bomb in a deadly U.N. school strike in Gaza

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 833

-

Politics1 week ago

Politics1 week agoGeorge Clooney called White House to complain about Biden’s criticism of ICC and defend wife’s work: report

-

Politics1 week ago

Politics1 week agoNewson, Dem leaders try to negotiate Prop 47 reform off California ballots, as GOP wants to let voters decide

-

World1 week ago

World1 week ago‘Bloody policies’: Bodies of 11 refugees and migrants recovered off Libya

-

Politics1 week ago

Politics1 week agoEmbattled Biden border order loaded with loopholes 'to drive a truck through': critics

-

World1 week ago

World1 week agoDozens killed near Sudan’s capital as UN warns of soaring displacement

-

Politics1 week ago

Politics1 week agoGun group vows to 'defend' Trump's concealed carry license after conviction