Finance

This money coach gets pro athletes into top financial shape. Here are his 5 training tips for people who come into sudden wealth.

There’s a monetary literacy disaster in the US — and it’s not precisely stunning. Private finance topics aren’t broadly taught in colleges, and plenty of People attain maturity with out the essential and requisite data to successfully save, borrow or make investments cash.

At present, simply seven U.S. states require a stand-alone monetary literacy course as a highschool commencement requirement, lacking an enormous alternative to assist younger folks make extra knowledgeable monetary decisions later in life.

So it’s additionally no shock that younger athletes or those that have come right into a monetary windfall because of an inheritance, the sale of a enterprise and even profitable the lottery, battle with their new monetary actuality. The statistics are significantly troubling. The American Chapter Institute stories {that a} majority {of professional} athletes face monetary hardships quickly after retirement, whereas economists have estimated that from 10 years post-windfall, lottery winners have managed to save lots of simply 16 cents of each greenback.

These monetary follies may be linked again to the truth that too few People have a grounding in monetary literacy. With that in thoughts, listed here are 5 essential concerns for anybody who experiences sudden wealth.

1. Create a sensible funds: Budgets are the identical, whether or not you’re an expert sports activities star or have been working a 9-to-5 job. To create a sound funds, attempt for steadiness however don’t be too inflexible. It is best to account for bills, financial savings and investments, whereas incorporating spending for private pursuits or hobbies and charitable donations. As your monetary state of affairs adjustments, revisit your funds. All the time pay your self first and embrace a line merchandise for financial savings to make sure a constant earnings stream.

Put the plan in movement earlier than receiving the funds so that you just’re already fascinated about fiscal self-discipline relating to your newfound wealth. The purpose right here is to stay off the curiosity or earnings your investments generate, relatively than having to dip into the principal. Marshawn Lynch, a retired NFL working again, is a superb instance. He earned about $56 million over the course of his taking part in profession however used his endorsement cash to fund day-to-day bills, diligently setting his wage apart.

“ Individuals will strategy you with myriad concepts about the best way to make investments your cash — lots of them questionable. ”

2. Study to say ‘no’: Monetary success and sudden wealth can carry disingenuous and dishonest folks out of the woodwork. Start getting ready for the inevitable onslaught of financial requests from acquaintances and even strangers, whereas emphasizing inventive and empowering methods of supporting family members, equivalent to paying off their debt. This frees these near you to enhance poor spending habits and stay out of debt, versus shopping for them a luxurious car or home that in actual fact could handcuff them additional financially.

Spend time figuring out who you wish to assist, the way you’ll achieve this and the way a lot you’ll allocate to household and pals. Work with a group of execs, together with accountants, legal professionals and monetary planners, to find out precisely how a lot you may give away with out harming your nest egg. In my very own apply, I encourage these experiencing sudden wealth to assist household and pals but additionally to be cognizant of their very own monetary well being, not simply now however into the long run. Set boundaries, using your assembled group of professionals as a possible buffer ought to requests turn into burdensome.

Additionally, beware and anticipate that individuals will strategy you with myriad concepts about the best way to make investments your cash — lots of them questionable. When introduced with these requests, leverage your group’s experience to objectively vet funding and enterprise alternatives earlier than making commitments.

3. Develop capital and broaden funding data: Simply as athletes ought to attempt to broaden their monetary data as they notch bigger contracts, the identical is true for these with newfound wealth. Take an energetic position in understanding what funding choices can be found. Your portfolio can mature by shifting from conventional allocations, equivalent to shares and bonds, to extra complicated investments, together with enterprise capital, actual property or non-public fairness.

Whereas a standard funding mixture of shares and bonds equivalent to a 60/40 portfolio could have been acceptable previous to receiving the windfall or inheritance, it might make sense to diversify into various investments or different enterprise ventures with the help of your group. Lean into the experiences of some other prosperous household, pals or acquaintances to be taught methods and habits that enabled them to protect and construct their very own wealth. They’re doubtless to offer firsthand perception into the potential pitfalls related to new wealth, serving to you to keep away from most of the similar errors they made.

Work to turn into educated about your investments, together with the related prices and annual most contributions. By doing so, you’re extra more likely to meet your objectives. The large takeaway right here is to be arms on. When you’ve assembled your group of economic professionals, be current and inquire about why they’re recommending sure investments.

“Newly rich ought to put together for ‘sudden wealth syndrome.’”

4. Put together financially and mentally for all times past work: Anybody approaching retirement, whether or not through sudden wealth or because the product of many a long time of prudent saving, ought to take the time to ponder how they’ll spend time not working. This transition may be fraught with challenges. It may be laborious to regulate to shifting from a regimented schedule to having ample free time.

Learn: I’m 57 and can quickly have greater than $3 million from a enterprise sale. My wealthy boss trusts his monetary adviser, however he inherited his thousands and thousands. Nonetheless, ought to I strive his adviser?

It’s essential to thoughtfully construct an id and function outdoors of your former profession. Simply as athletes could be sensible to interact former teammates who’ve efficiently navigated the shift from sports activities to a second profession or retirement by constructing an income-replacement plan, recipients of an inheritance ought to comply with an analogous path.

Those that are newly rich also needs to put together for “sudden wealth syndrome.” Coming into a big sum of cash can carry on emotions of tension and confusion. Don’t really feel ashamed to hunt counsel from a licensed therapist who might help you navigate troublesome feelings.

5. Pay it ahead: A poor grasp of on a regular basis monetary ideas may be devastating to anybody’s pecuniary well being, however the influence on athletes and different high-net-worth people may be significantly pronounced. Many make unhealthy selections and are sick geared up to protect and construct upon their successes and windfalls for long-term monetary stability.

After you have grown comfy together with your newfound wealth, personal the duty of passing on that data to your heirs, creating generational wealth and a sound basis for preserving it.

Justin McCurdy isan government director and monetary adviser at funding agency Manhattan West, specializing in working with entertainers and athletes.

Extra: You simply received the Mega thousands and thousands $1.35 billion jackpot — what must you do subsequent?

Plus: On Bobby Bonilla Day, listed here are different retired baseball gamers who obtain enormous deferred funds yearly

Finance

Financial conditions turn negative amid risks of trade war

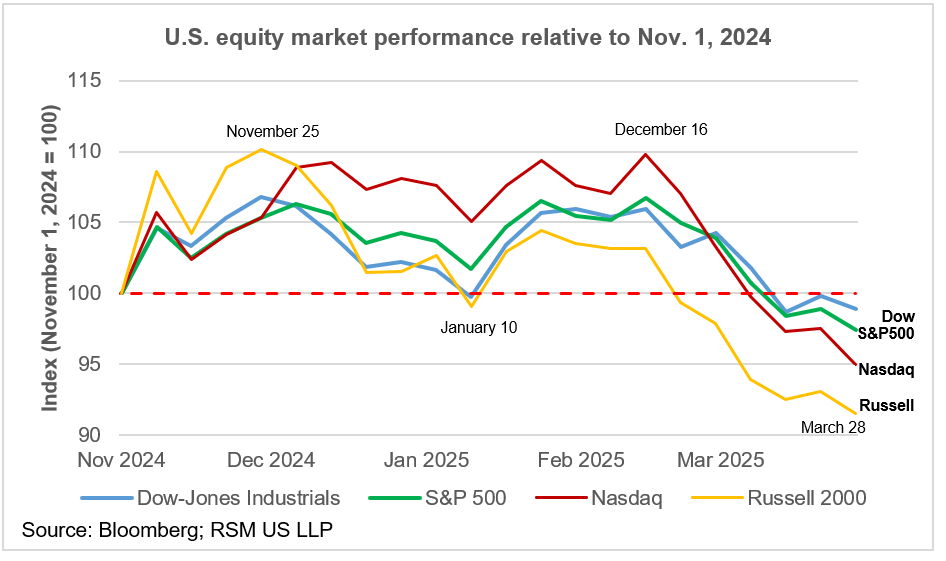

Friday was another in the series of dramatic losses in the equity markets as investors pushed financial conditions into negative terrain because of mounting concerns around the costs linked to an expanding trade war.

Given the ever-widening scope of U.S. tariffs, with the next round set to take effect on April 2, the risks to the economic outlook through the financial channel are elevated and rising.

We anticipate that the economies targeted by the tariffs will retaliate in-kind. investors, firm managers and policymakers should also anticipate that retaliation will most likely include the tradeable services sector and not just agriculture, goods and politically sensitive industries like transportation.

Read more of RSM’s insights on the economy and the middle market.

The S&P 500 equity index peaked on Feb. 19 and has since lost 9% of its value with losses in seven of the past nine weekly sessions. On Friday alone, roughly $1.25 trillion in equity valuations were wiped away.

Interestingly, the Russell 2000 index of small cap corporations—a proxy for the health of privately held small and medium-sized businesses—has lost the most ground among the major stock indices.

The RTY index has now lost 17% of its value since peaking on Nov. 25, suggesting a loss of confidence in economic growth that will result in a slower pace of hiring and outlays on capital expenditures that will show up in hard data in the near term.

It is not just the equity market showing excessive levels of risk. Volatility in the Treasury market remains above its long-term average and corporate yield spreads are widening, offering more evidence of the concern over the direction of the economy.

While not yet significantly different than neutral, our RSM US Financial Conditions Index fell below zero on the last Friday of March.

Our index is designed such that negative values indicate increased levels of risk being priced into financial assets. Higher risk implies a higher cost of credit, which will affect the willingness to borrow or to lend that will hamper economic growth.

Finance

WashTec Full Year 2024 Earnings: EPS Beats Expectations

-

Revenue: €476.9m (down 2.6% from FY 2023).

-

Net income: €31.0m (up 11% from FY 2023).

-

Profit margin: 6.5% (up from 5.7% in FY 2023). The increase in margin was driven by lower expenses.

-

EPS: €2.32 (up from €2.09 in FY 2023).

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

All figures shown in the chart above are for the trailing 12 month (TTM) period

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 2.0%.

Looking ahead, revenue is forecast to grow 5.1% p.a. on average during the next 3 years, compared to a 5.0% growth forecast for the Machinery industry in Germany.

Performance of the German Machinery industry.

The company’s share price is broadly unchanged from a week ago.

It is worth noting though that we have found 1 warning sign for WashTec that you need to take into consideration.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Finance

Study: Latino Students Use Practical Strategies to Finance College Education

The report, “How Latinos Pay for College: 2025 National Trends,” builds on two decades of research and reveals that while Latino students demonstrate high financial need, they are employing effective cost-saving measures to make higher education affordable.

“Latinos are representative of a post-traditional student profile and changes in policy will be more impactful if made with the strengths and opportunities to serve this profile of students,” write Deborah A. Santiago, CEO, and Sarita E. Brown, President of Excelencia in Education, in the report’s foreword.

The study found that Latino students, who represent one in five postsecondary students nationwide, are more likely to be first-generation college-goers (51% compared to 22% of white students), come from lower-income households (70% have family incomes below $50,000), and have an expected family contribution (EFC) of zero (45%).

“Latino students make pragmatic choices with what they can control to make college affordable,” said Cassandra Arroyo, a research analyst at Excelencia and co-author of the report.

To manage costs, Latino students employ multiple strategies: 56% work 30 or more hours weekly while enrolled, 55% attend part-time or mix their enrollment, 81% choose public institutions, and 89% live off-campus or with parents. These tactics represent a clear departure from the traditional college student profile and align with what Excelencia calls “post-traditional” learners.

The data reveals that Latinos rely more heavily on federal financial aid (58%) than state (30%), institutional (23%), or private aid (13%). Perhaps most significantly, Latino students are more than twice as likely to receive grants (67%) than take out loans (27%), indicating a strong preference for aid that doesn’t require repayment.

Yet despite high application rates for aid (85%), Latinos receive the lowest average financial aid among all racial/ethnic groups at $11,004, compared to $15,850 for Asian, $12,937 for White, and $12,365 for African American students.

“Twenty years later, we are revisiting what has changed and what has stayed the same. There has clearly been some progress, but the need to expand access to opportunity remains,” noted Santiago in the report’s foreword, referencing Excelencia’s initial study on Latino financial aid patterns from 2005.

The report also examines differences in aid receipt by institution type. Latino students at public two-year institutions are less likely to receive financial aid (57%) than those at other sectors, especially private institutions (87%). Furthermore, undergraduate Latinos attending private for-profit institutions are more likely to borrow federal loans (60%) compared to those at public two-year institutions (5%).

Another key finding reveals that Latino students are more likely to receive need-based aid rather than merit-based aid. For state grants, 16% of Latino students received need-based grants compared to only 2% who received merit-only grants.

The report highlights innovative approaches implemented by institutions certified with the Seal of Excelencia. These 46 certified institutions represent less than 1% of all colleges and universities but enroll 17% and graduate 19% of all Latino students nationwide.

Among these institutions, several standout examples emerged. The University of Texas at Austin’s Texas Advance Commitment fully covers tuition for students with family incomes up to $65,000, while Miami Dade College provides “Last Mile Scholarships” for students who left with 13 or fewer credits remaining. Other institutions, like Metropolitan State University of Denver, created emergency retention funds to support students experiencing unexpected financial challenges.

“Leading institutions make choices with what they can control to make college more affordable,” said Emily Labandera, director of research at Excelencia and co-author of the report. “The institutions highlighted in this brief represent a select group of trendsetters that make up the Seal of Excelencia certified institutions that strive to go beyond enrollment to intentionally serve Latino students.”

The report concludes with policy recommendations at institutional, state, and federal levels. These include investing in guaranteed tuition plans by family income, including basic needs in financial aid calculations, prioritizing Pell Grants, and revising the Federal Work-Study distribution formula to better support students with high financial need.

“Excelencia believes that good policy is informed by good practice,” the authors note, emphasizing that intentionally serving Latino students at scale requires understanding what works to accelerate their success.

With Latino enrollment in postsecondary education projected to increase by 31% by 2030, the findings provide critical insights for institutions and policymakers seeking to create more affordable pathways to degree completion for this growing demographic.

“We firmly believe that disaggregating our data and knowing how Latinos are participating in financial aid informs opportunities to compel action that can more intentionally serve other students as well,” write Santiago and Brown. “And understanding how institutions committed to intentionally serving Latino, and all, students are leveraging financial support to recruit, retain, and advance them to degree completion and connect them to the workforce is an opportunity to leverage and scale their innovation.”

-

News1 week ago

News1 week agoMusk Offers $100 to Wisconsin Voters, Bringing Back a Controversial Tactic

-

News1 week ago

News1 week agoHow a Major Democratic Law Firm Ended Up Bowing to Trump

-

Technology1 week ago

Technology1 week agoThreads finally lets you set the following feed as default

-

News1 week ago

News1 week agoWere the Kennedy Files a Bust? Not So Fast, Historians Say.

-

World1 week ago

World1 week agoDonald Trump signs executive order to ‘eliminate’ Department of Education

-

News1 week ago

News1 week agoDismantling the Department of Education will strip resources from disabled children, parents and advocates say | CNN

-

Education1 week ago

Education1 week agoICE Tells a Cornell Student Activist to Turn Himself In

-

News1 week ago

News1 week agoTaliban Frees an American, George Glezmann, Held in Afghanistan Since 2022