Finance

SVB collapse: Will 2008 Financial crisis repeat? Here’s what experts say

Billionaire hedge fund supervisor Invoice Ackman has in contrast the autumn of SVB to “bear Stearns”–the first financial institution to break down at first of the 2007-2008 world monetary disaster.

Taking to Twitter, Ackman wrote, “The chance of failure and deposit losses right here is that the following, least well-capitalised financial institution faces a run and fails, and the dominoes proceed to fall”.

Nevertheless, some analysts suppose that the SVB collapse is extra company-specific for now. Joe Biden administration has additionally argued that safeguards enacted after the 2008 monetary disaster would defend the nation’s financial system amid the shuttering of Silicon Valley Financial institution.

US Treasury Secretary Janet Yellen has expressed full confidence in banking regulators to take applicable actions in response and famous that the banking system stays resilient and regulators have efficient instruments to deal with any such occasion.

Indian-American Vivek Ramaswamy who’s working for the 2024 US Presidential ballot questioned whether or not SVB used ESG elements to cost its loans, and in contrast the “key trigger” of the 2008 monetary disaster. In a video message, Ramaswamy wrote, “A key explanation for the 2008 monetary disaster was using social elements to make loans (again then, fostering house possession). After we don’t study classes, historical past repeats itself: did Silicon Valley Financial institution use ESG elements to cost its loans? Roll that log over & see what crawls out”.

US Monetary commentator Robert Armstrong in his newest opinion piece mentioned that “SVB’s collapse isn’t a harbinger of one other 2008”.

Armstrong in Monetary Occasions wrote that “The chance of contagion throughout the banking system seems to be restricted. However on the finish of each central financial institution rate-increase cycle,there comes a part the place issues within the monetary system start to interrupt. These breakages, minor or main, erode the arrogance of traders and customers, rising the chances of recessions. The failure of SVB doesn’t herald one other 2008, however it does mark the start of the breakage part”.

The chance of contagion throughout the banking system seems to be restricted. However on the finish of each central financial institution rate-increase cycle, there comes a part the place issues within the monetary system start to interrupt. These breakages, minor or main, erode the arrogance of traders and customers, rising the chances of recessions. The failure of SVB doesn’t herald one other 2008, however it does mark the start of the breakage part”.

Economist Stephanie Pomboy advised FOX NEWS, “we’re getting ready to a 2008-style monetary disaster and I am not attempting to be hyperbolic… We have got some main penalties coming at us, and I believe it should devolve very quickly due to all of the leverage”.

Mike Mayo, Wells Fargo senior financial institution analyst advised cnn.com, mentioned the SVB disaster may very well be “an idiosyncratic scenario.”

“That is evening and day versus the worldwide monetary disaster from 15 years in the past,” he advised CNN’s Julia Chatterly on Friday. Again then, he mentioned, “banks have been taking extreme dangers, and other people thought every part was effective. Now everybody’s involved, however beneath the floor, the banks are extra resilient than they’ve been in a era.”

What was the 2007-2008 monetary disaster?

In 2007, the most important monetary disaster because the Nice Melancholy rippled throughout the globe after mortgage-backed securities tied to ill-advised housing loans collapsed in worth. The panic on Wall Road led to the demise of Lehman Brothers, a agency based in 1847. As a result of main banks had intensive publicity to 1 one other, the disaster led to a cascading breakdown within the world monetary system, placing tens of millions out of labor.

How did SVB’s disaster occur?

The decline of Silicon Valley Financial institution partly stems from the Federal Reserve’s aggressive rate of interest hikes over the previous yr.

When US Fed charges have been close to zero, banks loaded up on long-dated, seemingly low-risk treasuries. And with the incessant rise of the US Fed hike since 2022 to combat in opposition to inflation, the worth of these belongings has decreased, leaving banks sitting on a pile of unrealised losses.

The high-interest charges hit the tech startups principally, in accordance with Moody’s report. That prompted a number of tech companies to attract down the deposits that they held at SVB to fund their operation.

Moreover, with the hike in charges, the worth of treasuries, in addition to different securities additionally lowered.

As larger rates of interest brought about the marketplace for preliminary public choices to close down for a lot of startups and made personal fundraising extra pricey, some Silicon Valley Financial institution purchasers began pulling cash out to fulfill their liquidity wants. This culminated in Silicon Valley Financial institution on the lookout for methods this week to fulfill its prospects’ withdrawals. The SVB bought a $21 billion bond portfolio.

SVB introduced on Thursday it might promote $2.25 billion in frequent fairness and most popular convertible inventory to fill its funding gap. Some SVB purchasers pulled their cash from the financial institution on the recommendation of enterprise capital companies similar to Peter Thiel’s Future Fund.

This spooked traders similar to Normal Atlantic that SVB had lined up for the inventory sale, and the capital elevating effort collapsed late on Thursday.

About Silicon Valley Financial institution (SVB)

Based in 1983, SVB supplied financing for nearly half of US venture-backed know-how and healthcare corporations. It’s America’s Sixteenth-largest financial institution and was not too long ago ranked “America’s Finest financial institution” on Forbes 2023 checklist. FSB acquired this title from Forbes for fifth consecutive yr.

The financial institution served principally know-how employees and enterprise capital-backed corporations, together with a few of the trade’s best-known manufacturers.

Almost half of the US know-how and healthcare corporations that went public final yr after getting early funding from enterprise capital companies have been Silicon Valley Financial institution prospects, in accordance with the financial institution’s web site.

The financial institution additionally boasted of its connections to main tech corporations similar to Shopify, ZipRecruiter, and one of many prime enterprise capital companies, Andreesson Horowitz.

Obtain The Mint Information App to get Every day Market Updates.

Extra

Much less

Finance

Logan Ridge Finance Corporation Schedules Fourth Quarter and Full Year 2024 Earnings Release and Conference Call

Call Scheduled for 11:30 am ET on Friday, March 14, 2025

NEW YORK, Jan. 16, 2025 (GLOBE NEWSWIRE) — Logan Ridge Finance Corporation (Nasdaq: LRFC) (“LRFC,” “Logan Ridge” or the “Company”) to release its financial results for the fourth quarter and full year ended December 31, 2024, on Thursday, March 13, 2025, after market close. The Company will host a conference call on Friday, March 14, 2025, at 11:30 a.m. ET to discuss these results.

By Phone: To access the call, please dial (646) 968-2525 approximately 10 minutes prior to the start of the conference call and use the conference ID 1779602.

A replay of this conference call will be available shortly after the live call through March 21, 2025.

By Webcast: A live audio webcast of the conference call can be accessed via the Internet, on a listen-only basis at https://edge.media-server.com/mmc/p/h9fj5e3y. The online archive of the webcast will be available on the Company’s website shortly after the call at www.loganridgefinance.com in the Investor Resources section under Events and Presentations.

About Logan Ridge Finance Corporation

Logan Ridge Finance Corporation (Nasdaq: LRFC) is a publicly traded, externally managed investment company that has elected to be regulated as a business development company under the Investment Company Act of 1940. Logan Ridge invests primarily in first lien loans and, to a lesser extent, second lien loans and equity securities issued by lower middle market companies. Logan Ridge Finance Corporation is externally managed by Mount Logan Management, LLC, a wholly owned subsidiary of Mount Logan Capital Inc. Both Mount Logan Management, LLC and Mount Logan Capital Inc. are affiliates of BC Partners Advisors L.P.

Logan Ridge’s filings with the Securities and Exchange Commission (the “SEC”), earnings releases, press releases and other financial, operational and governance information are available on the Company’s website at loganridgefinance.com.

Contacts:

Logan Ridge Finance Corporation

650 Madison Avenue, 3rd floor

New York, NY 10022

Brandon Satoren

Chief Financial Officer

Brandon.Satoren@bcpartners.com

(212) 891-2880

The Equity Group Inc.

Lena Cati

lcati@equityny.com

(212) 836-9611

The Equity Group Inc.

Val Ferraro

vferraro@equityny.com

(212) 836-9633

Finance

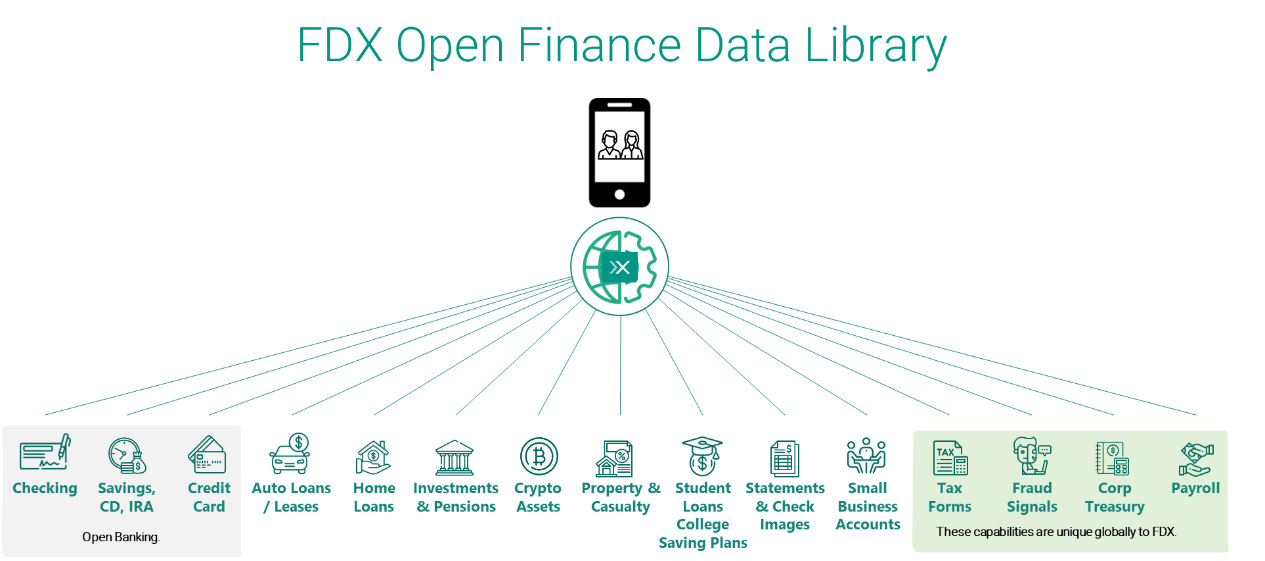

The brave new world of Open Finance

Don Cardinal of Financial Data Exchange (FDX) explores how Open Finance extends beyond Open Banking, revolutionising financial data sharing.

Much ink has been spilt on the topic of Open Banking, but I wanted to take a step today into a larger world of Open Finance. Whereas Open Banking is most commonly associated with current accounts (checking, savings, credit cards), Open Finance is concerned with the totality of your financial world.

While current accounts are important in the personal financial management use case, when you look at more sophisticated needs, liability accounts like auto loans, home loans, and student loans are required to help give context to a personal balance sheet. Finally, the addition of investment and retirement accounts gives the wealth management user a full 360-degree view of the consumer’s financial health.

Additional use cases – such as account and balance verification, bill payment, and payroll needs like verification of income/employment and pay stub retrieval – along with the ability to retrieve tax forms like W2, 1098, 1099, and capital gain statements for tax preparation, round out the most common consumer demands for linking accounts.

These are all important use cases for consumers and small businesses, but it is also important to address why data providers like banks, brokers, and others would benefit from data sharing.

We know that one in three digitally-enabled consumers has shared access to their financial data in the last year and similar polls of financial institutions tell us that at least one-third (if not more) of their online banking traffic was credential-based access (screen scraping) to power these use cases.

Imagine if a data provider could reduce one-third of its entire load on its online infrastructure in favour of a portal 100 times more efficient than screen scraping. The introduction of secure APIs does just that. Lowering costs of hardware overall.

One of the other uses by data providers is data-in, to pre-fill new account applications as well as provide strong signals for Know Your Customer (KYC), including account tenure at a predecessor institution. Better data means faster, more accurate decisions leading to fewer abandons or declines, meaning more revenue for the institution.

As a banker for a number of years, one of the biggest questions we had was ‘What was our share of a given customer’s wallet?’ We often had to try to infer based on monies in and out, but with Open Finance, you can link to other institutions and know in real time what your share of wallet is. This allows you to be almost surgical in your marketing and product offering.

All this is made possible by secure, permissioned data sharing via a common API standard.

Looking forward

Avoid FUD (fear, uncertainty, and doubt). Many jurisdictions have implemented Open Banking (the UK, EU, Australia, Brazil, among others) and there has yet to be a mass exodus of consumers in any of these nations. Why? If you are confident in your product, your pricing, and your service, making data available via an API does nothing to incent consumers to leave, rather the opposite. The largest credit union in Brazil said at the FDX Spring 2024 Summit that they saw a net increase in digital engagement and accounts per customer after Open Banking was introduced.

A last bit of advice: APIs are a net new channel and will be the third leg in the digital stool. Online, Mobile, and API will be the troika. APIs are much more efficient and can deliver data that cannot be displayed visually. As you make your plans for 2025 and 2026 for your digital roadmap, you would be remiss in not including Open Finance APIs in your product mix. Your competitors are.

This editorial piece was first published in The Paypers’ Open Finance Report 2024, the latest comprehensive market overview and analysis focusing on the key players and products within the Open Banking and Open Finance ecosystem. Download the full report to discover more insightful content.

About Don Cardinal

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

About FDX

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

Finance

Boost your finances in 2025: Experts share top New Year's money resolutions

Boost your finances: Experts share top 2025 money resolutions

With holiday credit card bills starting to roll in, you might want to shift your New Years resolution from your waistline to your wallet.

CHICAGO – With holiday credit card bills starting to roll in, you might want to shift your New Year’s resolution from your waistline to your wallet.

In a Fox 32 money saver special report, we asked the experts for a little help on how to boost your finances in 2025.

SMART MONEY MOVES

Why you should care:

“Some of the resolutions, some of the tips we would recommend for your New Year resolutions, financially, is to plan for retirement,” said Chip Lupo, a writer and analyst at WalletHub.

Lupo said it’s critically important that you begin to build an emergency fund to avoid relying on high-interest credit cards during life’s unexpected moments.

“We’re in a situation now where, because of the inflationary economy, people are now relying on credit cards for everyday expenses when the primary objective of a credit card for most people is to have basically an emergency fund,” Lupo said.

Lupo said that wages aren’t keeping up with the rate of inflation, and people are turning to credit cards for the essentials such as food and gas, which leads to significant debt by the end of the year.

“I think a big area that lot of consumers can agree on was the rising living costs,” said consumer finance expert Andrea Woroch. “Inflation impacting how much they’re spending on housing, transportation, groceries as well as even health care.”

MAKE A GAME PLAN

What you can do:

Woroch said you need to get back to the basics – set a budget this year and follow it.

“A lot of people think of a budget as being really restrictive and while it does cap you on spending in certain areas, a budget allows you to see where you are potentially wasting money on things you don’t need,” Woroch said.

If you think setting up a budget can be overwhelming, Woroch said going into debt and having no money in savings can be even worse.

Not to mention, there are digital tools and apps to help you set a budget, like the “You Need a Budget” app, or YNAB.

“Saying you are going to pay off debt is not enough. You have to be specific with how much debt you are going to pay off and set a realistic goal,” Woroch said.

When you take on this financial resolution, Woroch said it’s important to have a plan in place. Use a balance transfer credit card or pay off the smallest balance first.

If you don’t have a plan, Woroch said you will likely just continue your cycle of debt.

Another tip from our experts, they both recommended taking advantage of the high interest rates being offered with online bank accounts or CD’s.

The Source: For this story, the Fox 32 Chicago Special Projects team spoke with leading personal finance experts Chip Lupo from WalletHub and Andrea Woroch.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg) Technology1 week ago

Technology1 week agoMeta is highlighting a splintering global approach to online speech

-

Science5 days ago

Science5 days agoMetro will offer free rides in L.A. through Sunday due to fires

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png) Technology1 week ago

Technology1 week agoLas Vegas police release ChatGPT logs from the suspect in the Cybertruck explosion

-

Movie Reviews1 week ago

Movie Reviews1 week ago‘How to Make Millions Before Grandma Dies’ Review: Thai Oscar Entry Is a Disarmingly Sentimental Tear-Jerker

-

News1 week ago

News1 week agoPhotos: Pacific Palisades Wildfire Engulfs Homes in an L.A. Neighborhood

-

Business1 week ago

Business1 week agoMeta Drops Rules Protecting LGBTQ Community as Part of Content Moderation Overhaul

-

Politics1 week ago

Politics1 week agoTrump trolls Canada again, shares map with country as part of US: 'Oh Canada!'

-

Education1 week ago

Education1 week agoFour Fraternity Members Charged After a Pledge Is Set on Fire