Don Cardinal of Financial Data Exchange (FDX) explores how Open Finance extends beyond Open Banking, revolutionising financial data sharing.

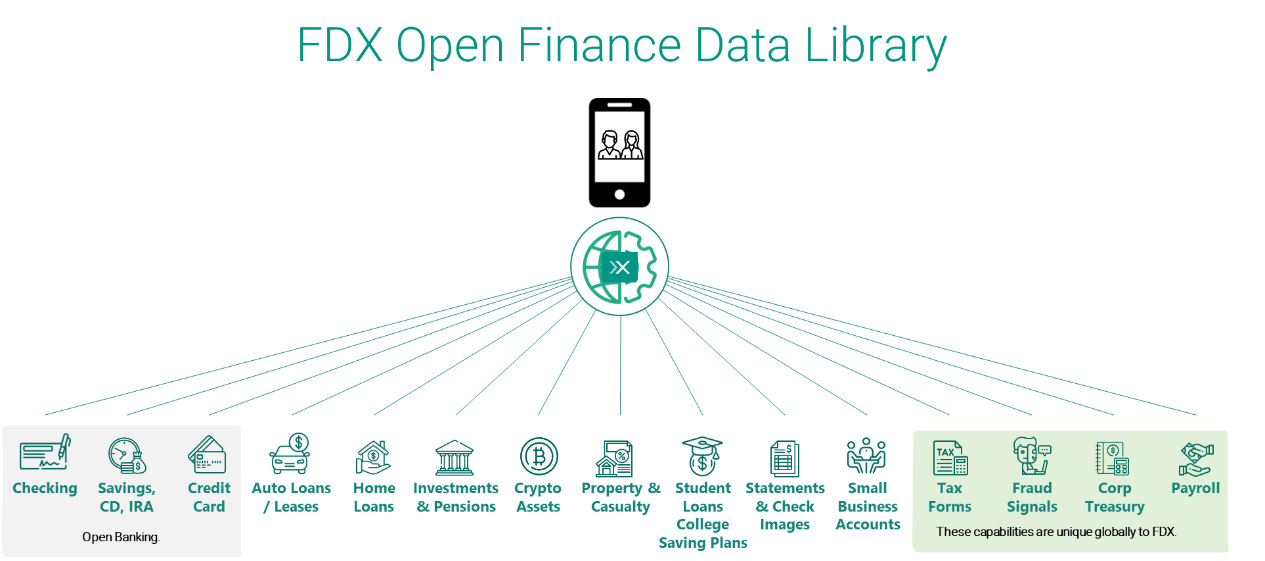

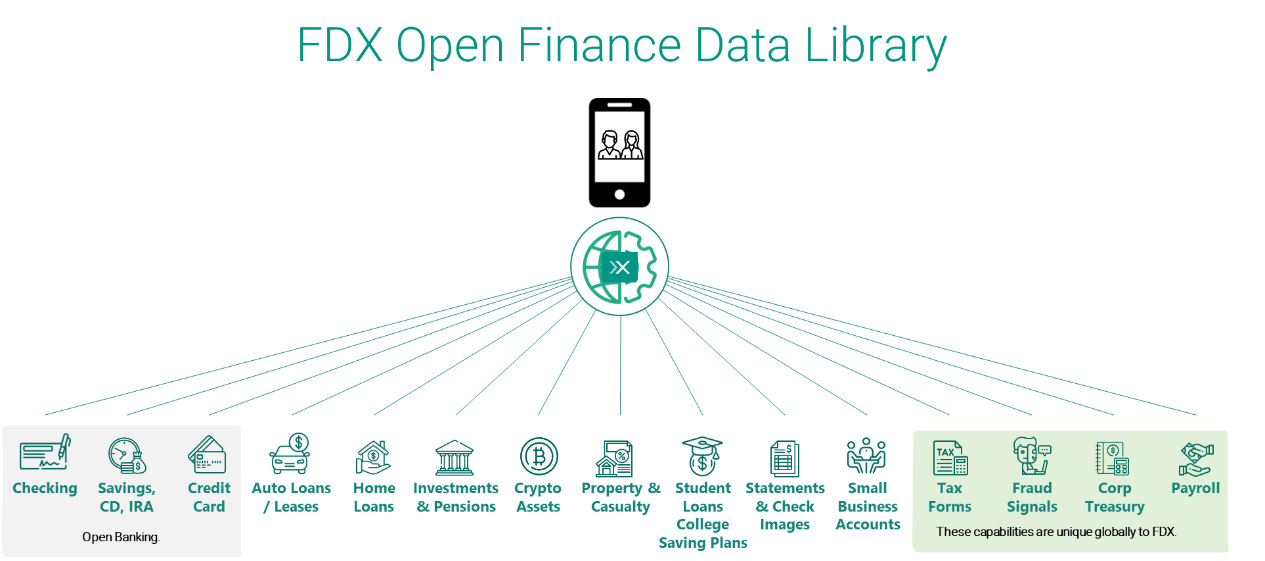

Much ink has been spilt on the topic of Open Banking, but I wanted to take a step today into a larger world of Open Finance. Whereas Open Banking is most commonly associated with current accounts (checking, savings, credit cards), Open Finance is concerned with the totality of your financial world.

While current accounts are important in the personal financial management use case, when you look at more sophisticated needs, liability accounts like auto loans, home loans, and student loans are required to help give context to a personal balance sheet. Finally, the addition of investment and retirement accounts gives the wealth management user a full 360-degree view of the consumer’s financial health.

Additional use cases – such as account and balance verification, bill payment, and payroll needs like verification of income/employment and pay stub retrieval – along with the ability to retrieve tax forms like W2, 1098, 1099, and capital gain statements for tax preparation, round out the most common consumer demands for linking accounts.

These are all important use cases for consumers and small businesses, but it is also important to address why data providers like banks, brokers, and others would benefit from data sharing.

We know that one in three digitally-enabled consumers has shared access to their financial data in the last year and similar polls of financial institutions tell us that at least one-third (if not more) of their online banking traffic was credential-based access (screen scraping) to power these use cases.

Imagine if a data provider could reduce one-third of its entire load on its online infrastructure in favour of a portal 100 times more efficient than screen scraping. The introduction of secure APIs does just that. Lowering costs of hardware overall.

One of the other uses by data providers is data-in, to pre-fill new account applications as well as provide strong signals for Know Your Customer (KYC), including account tenure at a predecessor institution. Better data means faster, more accurate decisions leading to fewer abandons or declines, meaning more revenue for the institution.

As a banker for a number of years, one of the biggest questions we had was ‘What was our share of a given customer’s wallet?’ We often had to try to infer based on monies in and out, but with Open Finance, you can link to other institutions and know in real time what your share of wallet is. This allows you to be almost surgical in your marketing and product offering.

All this is made possible by secure, permissioned data sharing via a common API standard.

Looking forward

Avoid FUD (fear, uncertainty, and doubt). Many jurisdictions have implemented Open Banking (the UK, EU, Australia, Brazil, among others) and there has yet to be a mass exodus of consumers in any of these nations. Why? If you are confident in your product, your pricing, and your service, making data available via an API does nothing to incent consumers to leave, rather the opposite. The largest credit union in Brazil said at the FDX Spring 2024 Summit that they saw a net increase in digital engagement and accounts per customer after Open Banking was introduced.

A last bit of advice: APIs are a net new channel and will be the third leg in the digital stool. Online, Mobile, and API will be the troika. APIs are much more efficient and can deliver data that cannot be displayed visually. As you make your plans for 2025 and 2026 for your digital roadmap, you would be remiss in not including Open Finance APIs in your product mix. Your competitors are.

This editorial piece was first published in The Paypers’ Open Finance Report 2024, the latest comprehensive market overview and analysis focusing on the key players and products within the Open Banking and Open Finance ecosystem. Download the full report to discover more insightful content.

About Don Cardinal

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

About FDX

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

Don Cardinal is Managing Director of Financial Data Exchange (FDX) and has led it since its inception. Previously, he spent over 20 years with Bank of America, serving as head of digital for its Military Bank, VP of Digital Banking & Senior VP of Information Security. Don holds 18 US patents and CPA, CISA, CISM certificates.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

The Financial Data Exchange (FDX) is dedicated to unifying the financial industry around a common, interoperable, royalty-free standard for the secure and convenient access of permissioned consumer and business financial data: the FDX Application Programming Interface (FDX API). FDX is a global 501(c)(6) nonprofit organisation with no commercial interests operating in the US and Canada.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25822586/STK169_ZUCKERBERG_MAGA_STKS491_CVIRGINIA_A.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25821992/videoframe_720397.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935558/acastro_STK103__01.jpg)