Finance

Latitude Group forecasts steep drop in 2023 earnings, shares tumble

May 26 (Reuters) – Australia’s Latitude Group (LFS.AX) on Friday forecast a steep fall in fiscal 2023 earnings due to higher credit losses and provisions associated with a recent cyber attack, sending its shares nearly 10% lower.

The company, which provides credit cards and personal loans for some of Australia’s biggest retailers, said in March hackers stole nearly 8 million Australian and New Zealand drivers’ licence numbers.

New account originations and collections were closed or severely restricted for nearly five weeks as the group responded to the cyber attack.

“Latitude had anticipated some normalisation in loss ratios across its portfolio, however the cyber-attack has materially worsened this trend due to lost collections activity,” the group said in a statement.

The consumer finance firm said it expects to recognise about A$53 million after tax in provisions for the first half, adding that the cost does not include the potential for regulatory fines or class actions.

Earlier this month, the privacy regulators of Australia and New Zealand began a joint investigation into the company’s practices of handling personal information.

Latitude expects cash net profit after tax (NPAT) in the range of A$5 million to A$10 million ($3.39 million – $6.78 million) for the half year to June 30, compared with a cash NPAT of A$93 million in the year-earlier period.

It also expects a statutory loss after tax from continuing operations in the range of A$95 million to A$105 million for the half year, compared to a profit of A$30.6 million a year ago.

Full-year cash NPAT is likely to be in the range of A$15 million to A$25 million, with statutory result expected to be a loss, Latitude said, adding that it was unlikely that it would declare a dividend for the six months.

Shares of the company fell as much as 9.7% to A$1.170, hitting their lowest level since March 30.

($1 = 1.4743 Australian dollars)

Reporting by Himanshi Akhand in Bengaluru; Editing by Subhranshu Sahu

Our Standards: The Thomson Reuters Trust Principles.

Finance

Government finance statistics: net financial worth

The general government financial accounts cover transactions in financial assets and liabilities as well as the stock of financial assets and liabilities. The difference between the stock of financial assets and the stock of liabilities is called net financial worth.

At the end of the first quarter of 2025, the EU net financial worth stood at -€8 948 billion or -49.4% of the gross domestic product (GDP). Compared with the end of the fourth quarter of 2024, the EU net financial worth increased by €72 billion. Compared with the end of the first quarter of 2024, the EU net financial worth decreased by €213 billion.

This information comes from data on quarterly government finance published by Eurostat today. This article presents a handful of findings from the more detailed Statistics Explained article.

Source dataset: gov_10q_ggfa

The net financial worth can change due to transactions or due to other economic flows (mainly price changes, also known as holding gains or losses). The main liabilities on the EU general governments’ balance sheets are debt securities. As these instruments are traded on the financial markets, their value changes over time and can be volatile.

At the end of the first quarter of 2025, the continued EU general government deficit (net financial transactions, measured as transactions in financial assets minus the transactions in liabilities, -€166 billion) contributed negatively to the evolution of net financial worth. However, at the EU level, compared with the fourth quarter of 2024, the net financial worth improved due to the financing of the deficit being off-set by positive revaluation of financial assets (+€137 billion), notably equity, as well as negative revaluations of liabilities (-€101 billion), notably debt securities.

Finance

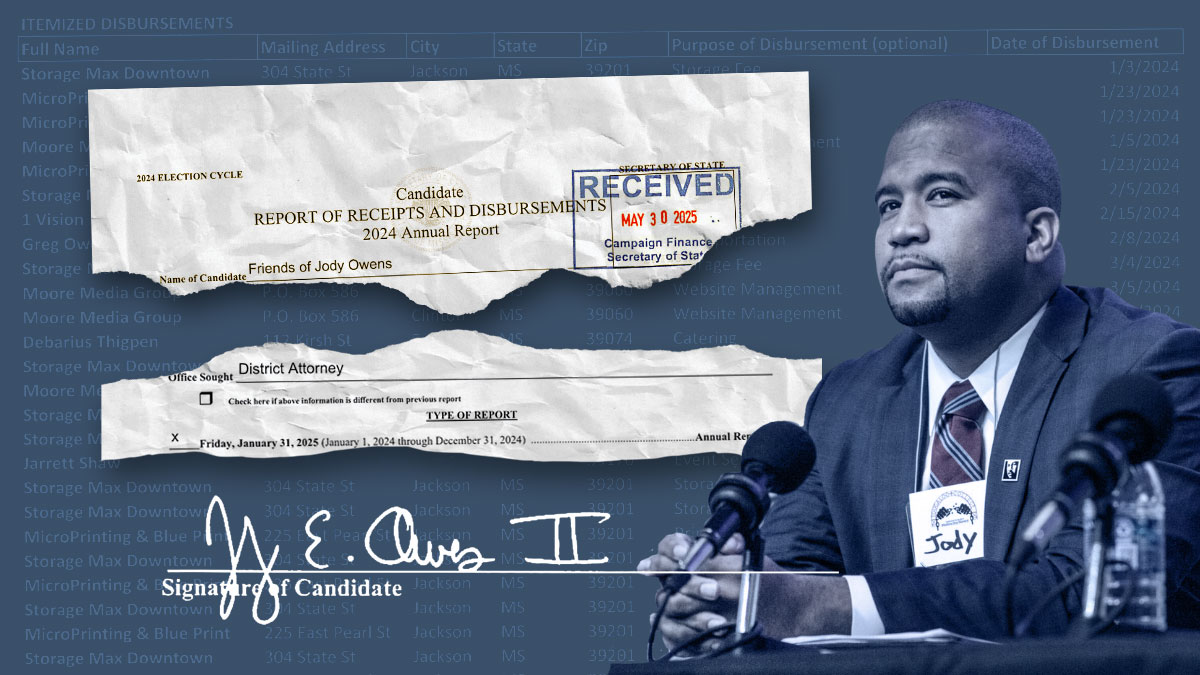

Indicted Jackson prosecutor's latest campaign finance report rife with errors

Finance

Fed independence faces a ‘showdown’ between Trump & the market

00:00 Speaker A

I also want to ask about what’s going on with economic data and the Federal Reserve, guys. Um, Ed, what are you hearing there in D.C.? Right? There is now some reporting out there that Kevin Hassett is kind of the front-runner to potentially take Jay Powell’s place at the Federal Reserve. What are you hearing and what’s the kind of vibe in Washington around this decision?

00:43 Ed

So, Julie, the way I’d view this is that President Trump always loves competition. You know, he came to some of his most recent national prominence by having the Apprentice show. And so, my expectation is that President Trump is going to keep multiple people in the running. Kevin Hassett certainly is in there. Kevin Warsh is in there. I’d put Christopher Waller, who’s already on the Fed board, as well as Treasury Secretary Bessant. I’m watching to see if there’s an opening on the Fed. If a governor steps down, like Michael Barr, now that he’s no longer vice chair for supervision, does one of these individuals get onto the board? I’m also watching for Waller as there are rate decisions here in July and September. Is there going to be a dissent? You generally don’t see dissents among Fed governors, but as you’re auditioning for that role, showing that you would be much more dovish is something that President Trump is going to be looking for and could move him up the list of potential Fed chairs come May of next year.

02:26 Speaker A

Yeah, I think the Apprentice Federal Reserve edition is something that no one asked for, uh, guys. I don’t know, Dory, like, in terms of market reaction to all of this, um, you know, we’ve seen rates kind of remain range-bound here as we get numbers like CPI yesterday and PPI today. But do you think at some point that this competition is going to start to really come to bear in the bond market?

03:25 Dory

Uh, yeah, I think we have a showdown coming. Uh, most people in the marketplace want to preserve the independence of the Fed, and when I say that, I mean that both ways, not just from Trump’s standpoint, but from the Fed’s standpoint. I’ve always said the Fed is, in my mind, Powell being a little political in some of his rate cuts early last year. Having said that, the market has always anticipated for the last couple of years anyway, uh, more rate cuts than actually should have happened or did happen. And I think we’re falling into that trap, and so is Trump as well. I’m kind of a wait-and-see kind of guy right now. I do think the next Fed chair is going to be one of those type of interviews, hey, I’m Donald Trump and I believe this, and if you believe this, I’d like to have you as Fed chair. That points to Hassett being the, uh, being, being there. And, uh, I think that’s going to get some criticism from the market. I think we need that independence. We need good independent valuation. Uh, and, and, you know, I think cutting too soon, soon could be, uh, extremely dangerous when we all know that our deficit is out of control, our debt is out of control, and we don’t want to become a Venezuela.

-

Politics1 week ago

Politics1 week agoConstitutional scholar uses Biden autopen to flip Dems’ ‘democracy’ script against them: ‘Scandal’

-

Politics1 week ago

Politics1 week agoDOJ rejects Ghislaine Maxwell’s appeal in SCOTUS response

-

Health1 week ago

Health1 week agoNew weekly injection for Parkinson's could replace daily pill for millions, study suggests

-

News1 week ago

News1 week agoSCOTUS allows dismantling of Education Dept. And, Trump threatens Russia with tariffs

-

Culture1 week ago

Culture1 week agoTest Your Knowledge of French Novels Made Into Musicals and Movies

-

Business1 week ago

Musk says he will seek shareholder approval for Tesla investment in xAI

-

Business1 week ago

Business1 week agoShould You Get a Heat Pump? Take Our 2-Question Quiz.

-

Sports1 week ago

Sports1 week agoEx-MLB pitcher Dan Serafini found guilty of murdering father-in-law