Finance

Japan to chair G-7 finance chiefs’ meeting on Feb. 23.: minister

Japanese Finance Minister Shunichi Suzuki. (Kyodo)

Japan will host a gathering of finance chiefs from the Group of Seven nations on Thursday to debate their response to Russia’s struggle in Ukraine, together with sanctions, on the fringes of a broader Group of 20 gathering in India, Finance Minister Shunichi Suzuki stated Tuesday.

Suzuki will chair the assembly of finance ministers and central financial institution governors as Japan holds the G-7 presidency this yr. It comes forward of the one-year anniversary of the beginning of Russia’s aggression in Ukraine that has led to a slew of sanctions on Moscow imposed by the member nations.

“We might wish to reaffirm G-7 solidarity in supporting Ukraine and sustaining our stress on Russia and focus on the affect (of the struggle) on the worldwide economic system,” Suzuki advised reporters after a Cupboard assembly.

The G-7 leaders are additionally scheduled to carry a digital assembly with Ukrainian President Volodymyr Zelenskyy on Friday, which marks one yr since Russia launched its invasion of the nation, after he was invited by Prime Minister Fumio Kishida to hitch.

The G-7 teams Britain, Canada, Germany, France, Italy, Japan and america plus the European Union.

Suzuki will journey to Bengaluru in southern India to fulfill along with his G-20 counterparts who will maintain substantive talks on Friday and Saturday. Russia is a member of the G-20.

Finance

Basel Committee Reports on Digitalisation of Finance

- The Basel Committee has published a report on the implications of the digitalisation of finance for banks and supervision.

- The report considers both the benefits and risks of new technologies and the emergence of new technologically enabled suppliers for the provision of banking services.

- It identifies eight implications for banks and supervisors relating to macro-structural elements, specific digitalisation themes, and capacity building and coordination.

The Basel Committee on Banking Supervision published a report that considers the implications of the ongoing digitalisation of finance on banks and supervision. The report builds on the Sound Practices: implications of fintech developments for banks and bank supervisors published in 2018, and takes stock of recent developments in the digitalisation of finance.

The report reviews the use of key innovative technologies across various aspects of the banking value chain, including application programming interfaces, artificial intelligence and machine learning, distributed ledger technology and cloud computing. It also considers the role of new technologically enabled suppliers (eg big techs, fintechs and third-party service providers) and business models.

While digitalisation can benefit both banks and their customers, it can also create new vulnerabilities and amplify existing risks. These can include greater strategic and reputational risks, a larger scope of factors that could test banks’ operational risk and resilience, and potential system-wide risks due to increased interconnections. Banks are implementing various strategies and practices to mitigate these risks, but effective governance and risk management processes remain fundamental.

Digitalisation raises regulatory and supervisory implications for both banks and supervisors. These include:

- monitoring evolving risks and adopting a responsible approach to innovation;

- safeguarding data and implementing robust risk management processes; and

- securing the necessary resources, staff and capabilities to assess and mitigate risks from new technologies and business models.

The Committee will continue to monitor developments related to the digitalisation of finance. Where necessary, it will consider whether additional standards or guidance are needed to mitigate risks and vulnerabilities.

Source: BIS

Finance

Treasury Department to Use ‘Automation and Innovation’ to Fight Illicit Finance

The Department of the Treasury has outlined the priorities it will pursue this year to step up the fight against illicit finance.

The agency aims to increase transparency, leverage partnerships and support responsible technological innovation, it said in a Thursday (May 16) press release announcing the publication of its “2024 National Strategy for Combating Terrorist and Other Illicit Financing.”

One of the Department’s priorities for the year is closing legal and regulatory gaps in the country’s anti-money laundering and combating the financing of terrorism (AML/CFT) framework, according to the release. It aims to do so by operationalizing the beneficial ownership information registry; finalizing rules covering the residential real estate and investment advisor sectors; and assessing the vulnerability of other sectors.

A second priority is promoting a more effective and risk-focused AML/CFT regulatory and supervisory framework for financial institutions, the release said. The Department will work to do so by providing clear compliance guidance, sharing information and providing resources for supervision and enforcement.

The Department also aims to enhance the operational effectiveness of law enforcement, other U.S. government agencies and international partnerships to combat illicit finance, per the release.

The fourth priority announced in the press release is realizing “the benefits of responsible technological innovation” by developing new payments technology, supporting the use of new mechanisms for compliance, and using automation and innovation to find new ways to fight illicit finance, the release said.

“In this critical moment for our national and economic security, we need to continue to close the pathways that illicit actors seek to exploit for their schemes,” Brian E. Nelson, Under Secretary of the Treasury for terrorism and financial intelligence, said in the release. “We recognize the threat illicit financial activity represents to our national security, economic prosperity, and our democratic values, and are focused on addressing both the challenges of today and emerging concerns.”

These recommendations are meant to address key risks the Department of the Treasury identified in February in its “2024 National Money Laundering, Terrorist Financing, and Proliferation Financing Risk Assessments.”

In another recent move, the Treasury Department said in April that it wants more tools to curb terror financing.

In testimony released ahead of an April 9 appearance before the Senate Banking Committee, Deputy Secretary Wally Adeyemo said terrorist groups and state actors continually “seek new ways to move their resources in light of the actions we are taking to cut them off from accessing the traditional financial system.”

For all PYMNTS B2B coverage, subscribe to the daily B2B Newsletter.

Finance

The Great Financial Crisis kick started the private credit boom, but SVB was its true 'watershed' moment, Sixth Street co-president says

The Global Financial Crisis threw millions of Americans out of their homes and jobs, upending the entire economy. But for the private credit industry, it was actually an awakening of sorts.

Over the past few decades, U.S. banks’ problems have signaled opportunity for the private credit market, and that’s particularly true of the Global Financial Crisis and the collapse of Silicon Valley Bank last March. When banks have issues, U.S. businesses’ desire for capital rarely wanes dramatically, and that leaves room for alternate lenders.

At the Fortune Future of Finance conference on Thursday, Joshua Easterly, co-CIO and co-president of the global investment firm Sixth Street, explained how he was working at Goldman Sachs after the Global Financial Crisis in 2009, running a team that did public and private market transactions in distressed debt and special situations, when he came to the realization that the lending industry had changed forever.

“It was the intended consequence, not the unintended consequence of regulations after the Crisis,” he said of the private credit boom. “Policymakers…wanted to figure out how to diffuse risk away from the taxpayer, but you couldn’t crush the economy by reducing credit, and so private credit history grew.”

Easterly argued that the private credit industry has a “better model” than the banking industry when it comes to lending risk, because it holds more capital for loans on balance sheets. And that made him come to a startling realization in 2009. “Huh? I think I need to go find a new job,” he recalled saying to a colleague. “So [the move to private credit] was a little bit about necessity.”

Carey Lathrop, partner and chief operating officer of credit at Apollo Global Management, echoed Easterly’s comments, noting that when he started in the private credit industry “it was clear how hard it was to get things done that made economic sense” in public markets after the GFC.

The rise of private credit since 2008 has been historic, to say the least. Before the crisis, there was under $400 billion in total assets and committed capital in private credit. In 2023, that number jumped to $2.1 trillion, according to the International Monetary Fund. But it wasn’t just the Crisis that spurred the private credit boom. After the collapse of several regional banks in March 2023, headlined by the tech startup focused Silicon Valley Bank, businesses nationwide once again turned to private credit amid a liquidity crunch.

While SVB struggled after rapidly rising interest rates devalued its long-dated bonds, leading to a run on deposits from its list of influential and well-connected clientele, the manner in which private credit operates can lead to more stability in trying times.

Apollo’s Lathrop explained that banks like SVB “had this mismatch with a lot of long-term assets with assets with short term liabilities” that led to unrealized loan losses on their books as rates soared. But private credit doesn’t have this same issue. “We don’t run the [private credit] business that way,” he noted. “We were much more match funded.”

To his point, unlike banks, which fund a majority of their lending through customer deposits (and often uninsured deposits), private credit funds tend to use money from wealthy investors and institutions to make loans, leaving them less exposed to rising interest rates.

Sixth Street’s Easterly said the SVB drama essentially showed “the robustness” of the private credit] business model, leading a raft of new clientele. “I think it was a watershed moment for the value of the asset class.”

-

Politics1 week ago

Politics1 week ago'You need to stop': Gov. Noem lashes out during heated interview over book anecdote about killing dog

-

Politics1 week ago

Politics1 week agoRFK Jr said a worm ate part of his brain and died in his head

-

World1 week ago

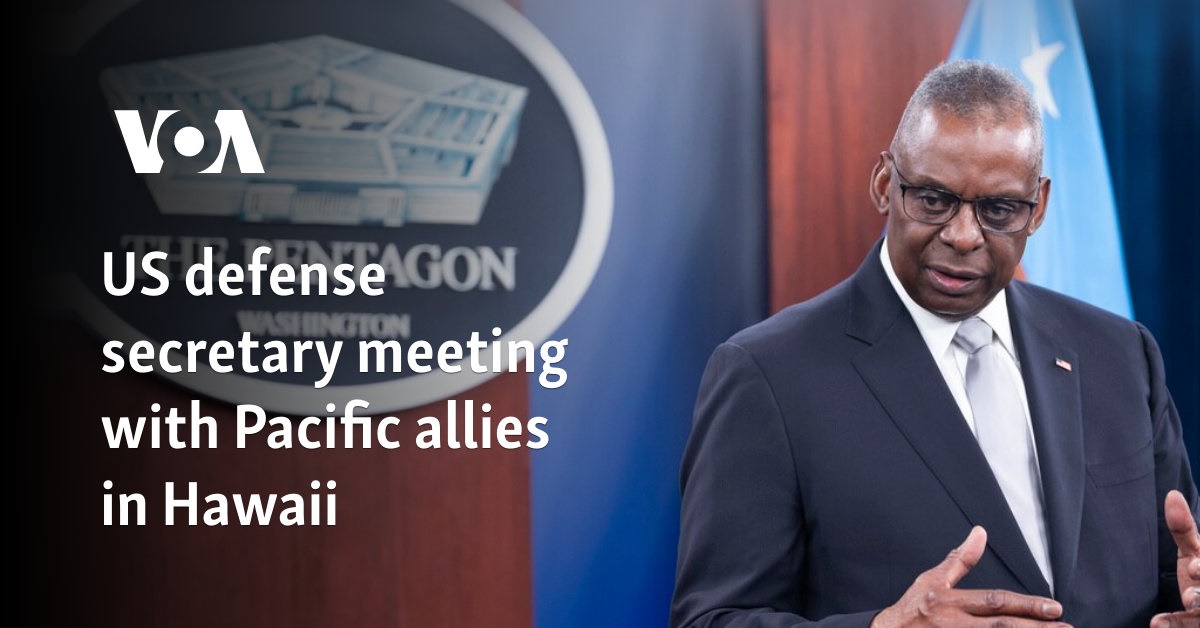

World1 week agoPentagon chief confirms US pause on weapons shipment to Israel

-

Politics1 week ago

Politics1 week agoHere's what GOP rebels want from Johnson amid threats to oust him from speakership

-

World1 week ago

World1 week agoPro-Palestine protests: How some universities reached deals with students

-

World1 week ago

World1 week agoConvicted MEP's expense claims must be published: EU court

-

Politics1 week ago

Politics1 week agoCalifornia Gov Gavin Newsom roasted over video promoting state's ‘record’ tourism: ‘Smoke and mirrors’

-

Politics1 week ago

Politics1 week agoOhio AG defends letter warning 'woke' masked anti-Israel protesters they face prison time: 'We have a society'