Reporting by Tetsushi Kajimoto and Takaya Yamaguchi

Editing by Shri Navaratnam

Finance

Japan may intervene on yen again, BOJ should ditch easy policy – ex-financial diplomat

/cloudfront-us-east-2.images.arcpublishing.com/reuters/7PFZG3RA6FKGLKCVD7EFXTCYPU.jpg)

Takehiko Nakao, former vice finance minister for international affairs and former president of Asian Development Bank, speaks during an interview with Reuters in Tokyo, Japan December 27, 2022. REUTERS/Issei Kato/File Photo Acquire Licensing Rights

TOKYO, Sept 20 (Reuters) – Japan could intervene again to support the yen if it declines further, former top currency diplomat Takehiko Nakao told Reuters on Wednesday, and said the time is right for the Bank of Japan to ditch or modify its ultra-easy policy settings.

The former vice minister of finance for international affairs said prolonged monetary easing risks depreciating the yen further.

“There may be views that the intervention is not imminent as the depreciation has not been so rapid compared to the last time when authorities intervened in September/October,” he said.

“But it’s fully possible the authorities will conduct intervention in case the yen weakens further.”

Japan spent more than 9 trillion yen ($60.88 billion)intervening in currency markets last year to arrest the yen’s decline, buying yen in September and October – first at levels around 145 and again at a 32-year low just short of 152.

The yen is currently trading around 147.77 against the dollar.

Nakao, who served as top currency diplomat from August 2011 to March 2013, oversaw a heavy intervention in 2011 by buying the dollar to stem yen strength in the wake of the U.S. Federal Reserve’s quantitative easing, which made Japanese exports less competitive.

While the situation is reversed now with the yen sharply weaker, the benefits accruing to Japanese exports have been offset to some extent by the dramatic surge in prices of imports and the cost of living. The prolonged monetary easing has also been criticised by investors as distorting markets and hurting bank profits.

A weak yen is seen as a byproduct of Japan being the outlier of the global trend of monetary tightening. While the BOJ has continued powerful monetary stimulus, the Fed and other major central banks have raised interest rates to fight inflation.

At the two-day meeting ending on Friday, the BOJ is expected to maintain its yield curve control (YCC) targets at -0.1% for short-term interest rates and 0% for the 10-year bond yield.

Nakao, now chairman of the institute at Mizuho Research & Technologies and maintains close contact with incumbent policymakers, argued that the central bank should tweak its ultra-easy policy sooner rather than later.

“In the face of the ongoing headline inflation and excessively weak yen, the BOJ may have no choice but proceed with monetary policy normalization, including exit from negative rate policy and yield curve control, so as not to fall behind the curve,” he said.

“Given that JGB yields remain stable and the inflation is on the rise, now is the chance to tweak yield curve control.”

($1 = 147.7700 yen)

Our Standards: The Thomson Reuters Trust Principles.

Finance

Energiekontor Full Year 2024 Earnings: Beats Expectations

-

Revenue: €147.4m (down 39% from FY 2023).

-

Net income: €22.6m (down 73% from FY 2023).

-

Profit margin: 15% (down from 35% in FY 2023). The decrease in margin was driven by lower revenue.

-

EPS: €1.62 (down from €5.98 in FY 2023).

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10bn in marketcap – there is still time to get in early.

All figures shown in the chart above are for the trailing 12 month (TTM) period

Revenue exceeded analyst estimates by 29%. Earnings per share (EPS) also surpassed analyst estimates by 3.5%.

Looking ahead, revenue is forecast to grow 46% p.a. on average during the next 2 years, compared to a 8.3% growth forecast for the Electrical industry in Germany.

Performance of the German Electrical industry.

The company’s shares are down 9.9% from a week ago.

Before we wrap up, we’ve discovered 3 warning signs for Energiekontor (1 is significant!) that you should be aware of.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Finance

Financial conditions turn negative amid risks of trade war

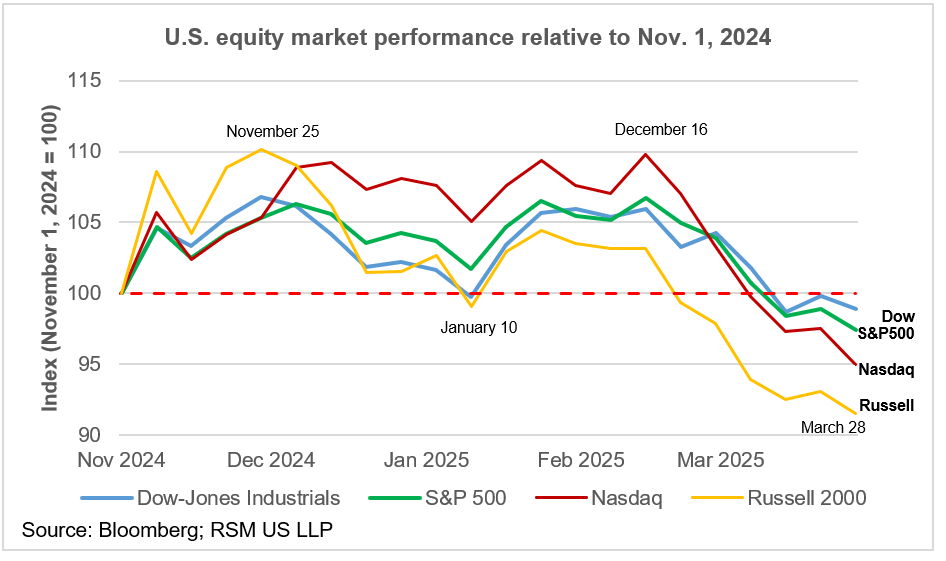

Friday was another in the series of dramatic losses in the equity markets as investors pushed financial conditions into negative terrain because of mounting concerns around the costs linked to an expanding trade war.

Given the ever-widening scope of U.S. tariffs, with the next round set to take effect on April 2, the risks to the economic outlook through the financial channel are elevated and rising.

We anticipate that the economies targeted by the tariffs will retaliate in-kind. investors, firm managers and policymakers should also anticipate that retaliation will most likely include the tradeable services sector and not just agriculture, goods and politically sensitive industries like transportation.

Read more of RSM’s insights on the economy and the middle market.

The S&P 500 equity index peaked on Feb. 19 and has since lost 9% of its value with losses in seven of the past nine weekly sessions. On Friday alone, roughly $1.25 trillion in equity valuations were wiped away.

Interestingly, the Russell 2000 index of small cap corporations—a proxy for the health of privately held small and medium-sized businesses—has lost the most ground among the major stock indices.

The RTY index has now lost 17% of its value since peaking on Nov. 25, suggesting a loss of confidence in economic growth that will result in a slower pace of hiring and outlays on capital expenditures that will show up in hard data in the near term.

It is not just the equity market showing excessive levels of risk. Volatility in the Treasury market remains above its long-term average and corporate yield spreads are widening, offering more evidence of the concern over the direction of the economy.

While not yet significantly different than neutral, our RSM US Financial Conditions Index fell below zero on the last Friday of March.

Our index is designed such that negative values indicate increased levels of risk being priced into financial assets. Higher risk implies a higher cost of credit, which will affect the willingness to borrow or to lend that will hamper economic growth.

Finance

WashTec Full Year 2024 Earnings: EPS Beats Expectations

-

Revenue: €476.9m (down 2.6% from FY 2023).

-

Net income: €31.0m (up 11% from FY 2023).

-

Profit margin: 6.5% (up from 5.7% in FY 2023). The increase in margin was driven by lower expenses.

-

EPS: €2.32 (up from €2.09 in FY 2023).

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

All figures shown in the chart above are for the trailing 12 month (TTM) period

Revenue was in line with analyst estimates. Earnings per share (EPS) surpassed analyst estimates by 2.0%.

Looking ahead, revenue is forecast to grow 5.1% p.a. on average during the next 3 years, compared to a 5.0% growth forecast for the Machinery industry in Germany.

Performance of the German Machinery industry.

The company’s share price is broadly unchanged from a week ago.

It is worth noting though that we have found 1 warning sign for WashTec that you need to take into consideration.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

-

News1 week ago

News1 week agoMusk Offers $100 to Wisconsin Voters, Bringing Back a Controversial Tactic

-

News1 week ago

News1 week agoHow a Major Democratic Law Firm Ended Up Bowing to Trump

-

Education1 week ago

Education1 week agoICE Tells a Cornell Student Activist to Turn Himself In

-

News1 week ago

News1 week agoTaliban Frees an American, George Glezmann, Held in Afghanistan Since 2022

-

World1 week ago

World1 week agoDonald Trump signs executive order to ‘eliminate’ Department of Education

-

News1 week ago

News1 week agoWere the Kennedy Files a Bust? Not So Fast, Historians Say.

-

News1 week ago

News1 week agoDismantling the Department of Education will strip resources from disabled children, parents and advocates say | CNN

-

Politics1 week ago

Politics1 week agoStudent loans, Pell grants will continue despite Education Department downsizing, expert says