Finance

IMF warns deeper financial turmoil would slam global growth

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3R7G4P67GJI73DUWNIIYE56CNE.jpg)

WASHINGTON, April 11 (Reuters) – The Worldwide Financial Fund on Tuesday trimmed its 2023 world progress outlook barely as increased rates of interest cool exercise however warned {that a} extreme flare-up of economic system turmoil might slash output to close recessionary ranges.

The IMF stated in its newest World Financial Outlook report that banking system contagion dangers have been contained by robust coverage actions after the failures of two U.S. regional banks and the pressured merger of Credit score Suisse. However the turmoil added one other layer of uncertainty on prime of stubbornly excessive inflation and spillovers from Russia’s struggle in Ukraine.

“With the latest improve in monetary market volatility, the fog all over the world financial outlook has thickened,” the IMF stated because it and the World Financial institution launch spring conferences this week in Washington.

“Uncertainty is excessive and the stability of dangers has shifted firmly to the draw back as long as the monetary sector stays unsettled,” the Fund added.

The IMF is now forecasting world actual GDP progress at 2.8% for 2023 and three.0% for 2024, marking a pointy slowdown from 3.4% progress in 2022 as a result of tighter financial coverage.

Each the 2023 and 2024 forecasts have been marked down by 0.1 proportion level from estimates issued in January, partly as a result of weaker performances in some bigger economies in addition to expectations of additional financial tightening to battle persistent inflation.

The IMF’s U.S. outlook improved barely, with progress in 2023 forecast at 1.6% versus 1.4% forecast in January as labor markets stay robust. However the Fund minimize forecasts for some main economies together with Germany, now forecast to contract 0.1% in 2023 and Japan, now forecast to develop 1.3% this 12 months as an alternative of 1.8% forecast in January.

The IMF raised its 2023 core inflation forecast to five.1%, from a 4.5% prediction in January, saying it had but to peak in lots of international locations regardless of decrease vitality and meals costs.

“Our recommendation is for financial coverage to stay centered on bringing down inflation,” IMF chief economist Pierre-Olivier Gourinchas instructed reporters.

In a Reuters interview, Gourinchas stated central banks mustn’t halt their battle towards inflation due to monetary stability dangers, which look “very a lot contained.”

BANKING TURMOIL SCENARIOS

Whereas a serious banking disaster was not within the IMF’s baseline, Gourinchas stated a big worsening of economic situations “might end in a sharper and extra elevated downturn.”

The report included two analyses displaying monetary turmoil inflicting reasonable and extreme impacts on world progress.

In a “believable” state of affairs, stress on weak banks – some like failed Silicon Valley Financial institution and Signature Financial institution burdened by unrealized losses as a result of financial coverage tightening and reliant on uninsured deposits – creates a scenario the place “funding situations for all banks tighten, as a result of larger concern for financial institution solvency and potential exposures throughout the monetary system,” the IMF stated.

This “reasonable tightening” of economic situations might slice 0.3 proportion level off of worldwide progress for 2023, chopping it to 2.5%.

The Fund additionally included a extreme draw back state of affairs with a lot broader impacts from financial institution stability sheet dangers, resulting in sharp cuts in lending within the U.S. and different superior economies, a serious pullback in family spending and a “risk-off” flight of funding funds to safe-haven dollar-denominated belongings.

Rising market economies can be hit laborious by decrease demand for exports, forex depreciation and a flare-up of inflation.

This state of affairs might slash 2023 progress by as a lot as 1.8 proportion factors, lowering it to 1.0% – a degree that means near-zero GDP progress per capita. The unfavorable affect could possibly be about one-quarter of the recessionary affect of the 2008-2009 monetary disaster.

Different draw back dangers highlighted by the IMF embrace persistently excessive inflation that requires extra aggressive central financial institution price hikes, escalation of Russia’s struggle in Ukraine, and setbacks in China’s restoration from COVID-19, together with worsened difficulties in its actual property sector.

OIL PRICE RISK

The IMF forecasts don’t embrace the affect of a latest oil output minimize by OPEC+ international locations that has induced oil costs to spike. It assumes a mean 2023 world oil value of $73 per barrel – properly beneath Monday’s $84 Brent crude futures value, however Gourinchas stated it was unclear if this degree could possibly be sustained.

For each 10% rise within the value of oil, IMF fashions present a 0.1 proportion level discount in progress and a 0.3 proportion level improve in inflation, Gourinchas added.

The IMF additionally now pegs world progress at 3% in 2028, its lowest five-year progress outlook for the reason that WEO was first revealed in 1990, reflecting naturally slowing progress as some rising economies mature, but additionally slower progress in workforce populations and fragmentation of the worldwide financial system alongside geopolitical traces, marked by U.S.-China tensions and Russia’s struggle in Ukraine.

Reporting by David Lawder; Enhancing by Andrea Ricci

Our Requirements: The Thomson Reuters Belief Rules.

Finance

Finance Committee Chair Denice Kronau Stepping Down Next Month

Nantucket Finance Committee chair Denice Kronau announced Tuesday that she will be stepping down from her seat on the influential town committee next month to focus on the release of her forthcoming book, “The Stars That Guide Us.”

Kronau, who has one year left on her term, was first appointed to the Finance Committee by the Select Board in 2017. She informed the town administration of her intention to resign effective June 30 last week and made a formal announcement at Tuesday’s Finance Committee meeting.

“It has been my honor to serve the community for the past eight years,” Kronau wrote to Select Board chair Brooke Mohr.

Kronau’s background as a corporate executive and non-profit board member for more than three decades included leadership positions with several multinational companies, including Siemens, Diageo, Kraft, and Philip Morris.

On the Finance Committee on Nantucket, she most recently made headlines after breaking with the majority of her committee on its initial recommendation to support the $105 million appropriation for the new Our Island Home. She spoke out publicly before the Select Board to explain her dissent and why she opposed the project. After the price tag for the new Our Island Home climbed to $125 million in the month before Town Meeting, a majority of the committee ultimately joined her in opposing the appropriation.

Kronau’s upcoming book is the second in a historical fiction trilogy she is writing that is set on Nantucket.

The Select Board is expected to appoint a candidate to fulfill the final year of Kronau’s term later this year. Three other FinCom members – Stephen Maury, Chris Glowacki, and Jill Vieth – will also be up for reappointment in 2025.

Finance

Here’s how Fibonacci retracement predicts market moves

0:03 spk_0

Two hours into the trading day, it’s time for Yahoo Finance’s market minute. Stocks are surging after the US and China agreed to temporarily reduce tariffs in the negotiations for a final trade deal. Magnificent Seven names Amazon, Apple, Nvidia, and Meta rallying off the tariffs. Meantime, retailers are also getting a boost from progress on those negotiations. Nike, Lululemon, and Target all rising, not a minimum exemption, which allowed packages below a certain value to be imported.Tax-free does not appear to be part of the US-China truce. I can still be a headwind for so-called fast fashion retailers going forward. Energy energy soaring after agreeing to buy a fleet of natural gas-fired power plants from ES Power equity advisors for $12 billion. This is a bet the fuel will be critical to meet electricity demand from data centers, and that’s a Yahoo Finance market minute for more on what’s trending on Yahoo Finance, scan the QR code below.

1:17 spk_1

Welcome to Wealth, everyone. I’m Brad Smith, and this is Yahoo Finance’s guide to building your financial footprint. Our community of experts will give you the resources, tools, tips, and the tricks that you need to grow your money. And on today’s show, stocks are rallying off the back of US China trade talks. The nation’s agreeing to temporarily cut tariffs amid negotiations. We’ll talk about how to play the rally today.And general generational wealth playbook all week long will be your guidebook for transferring wealth from the initial tricky conversations to the paperwork behind gifting stock and even real estate. We’ll take you through the details that you need to know. Plus saving strategies. Once you tackle the basics, it’s time to jump on more advanced strategies. We’ll discuss with a personal finance expert. We’ve got all that much more coming up over the course of today’s show, but first.Let’s begin as we always do, taking a look at some of the market action 90 minutes into the trading day, stocks soaring today as the US and China agree to temporarily reduce tariffs. Joining me now, we’ve got Burns McKinney, NFJ Investment Group managing director and senior portfolio manager. I mean, Burns, you see a stock rally like this coming after some of the weekend trade talks that we were all anticipating to take place. How should investors be looking at the market right now?

2:36 spk_2

Thank you, Brad. I, I appreciate y’all having me and uh you know, really today’s market reaction is the perfect example of what matters is not necessarily what policy is or what you find out in the markets, but what happens relative to what is priced in andYou know, we’ve, we’ve seen a, a, a gradual de-escalation of the trade war over the last 3 or 4 weeks, and I think there was some expectation of a deal with China to, to kind of pull back from the brink even more. But what we did find over the weekend was that the uh the president in fact did rein in the uh the tariffs on China even more than was expected andYou know, as such, you know, like the markets are reacting positively to that. I think really the what the markets like to see is they, they like a renewed certainty and they like the fact that, you know, you’re really, you know, there’s a demonstration that, you know, if the economic pain or if the stock market pain gets too bad that the president will in fact umYou know, will in fact pull back from, you know, any of his, uh, you know, larger threats. If there’s anything that we still have a little bit of concern about, it’s the fact that, you know, if you go back a month, a little over a month ago, our worst case scenario for tariffs was 10% tariffs across the board. And as of today, even with the agreement in China, that 10% across the board is now probably the best case for tariffs, and yet, the market is now actually up fromWhere it was prior to April 2nd. So, um, you know, in many ways, I think the stock market is, is, is kind of looking above and beyond, uh, any of the risks. And

4:12 spk_1

so as we await some more of the details, because that’s truly what is going to impact some of the businesses, the companies that have tried to have the ear of the president, what is the checklist for those details to really kind of bake into your own portfolio strategy?

4:30 spk_2

Yeah, I think that, you know, we, we, the signposts that we look for and, you know, bear in mind this is simply, you know, it’s, it’s punting, you know, we’re getting, you know, 3 months, um, reprieve, uh, for negotiations to, to have a framework for negotiations, but it does appear that at least in the interim time that China is going to be facing the same 10% tariffs that the UK does. And, you know, ultimately it appears that China tariffs will probably settle out at, you know, around, um.You know, around 30, 30 to 35%.That said, um, you know, when you factor that in, plus the 10% across the board tariffs, this still amounts to one of the largest tax increases in history. And so really the most important signpost we have is the fact that this 3 month period does give the administration time to, uh, you know, negotiate and work on a tax cut to help offset those tariffs. In many ways, this is a bit of a reversal from what we saw during the first term where you sawLarge tax cuts, significant deregulation, and then they kind of, you know, use that to get through some, some smaller tariffs. And in this case, we’ve seen a bit of the opposite, whereas, um, you know, the tariffs have been large and now we’re actually going for the, uh, the tax cuts. And so that’s really the place tokeep an eye on.

5:45 spk_1

And so Burns, a lot of questions out there, a lot of investors might be just pondering, OK, so what next? US China was the biggest deal that a lot of investors.We’re really looking across and we don’t have a firm deal yet, but we do at least have people coming to the table reducing some of the 100% plus tariffs that were on the table so that they can have those discussions over the next 90 day period. But for investors trying to figure out all right what next from here, what should they then be doing with their own portfolio, how should they be trading amid what many large institutions are still anticipating to be some of the heightened volatility.

6:25 spk_2

Well, I, I think that the, the place to, to look at any point in time is to find areas that are out of favor or areas where, uh, the, the broader stock market has overreacted. And, you know, one place, and this is, you know, probably a bit of an out of favor view, but you know, given the fact that recession risks, uh, or at least the perception of recession risks have really escalated as a result of the trade war, um, a lot of the cyclicals have started to, to kind of come into our wheelhouse and look cheap again.You know, the, the consumers remained a workhorse. You know, you still have unemployment, uh, you know, around 4%. Inflation is pulling back and you do still have a Fed that is broadly in easing mode. And so some of the cyclical areas, you know, places like, uh, you know, industrials that have kind of gone a long way towards pricing in a recession might be kind of a, a way of kind of zagging when the market or zigging when the marketzags.

7:18 spk_1

Burns, thanks so much for joining us here. Really appreciate it.

7:22 spk_2

Thanks for having me.

7:24 spk_1

We’re set to get a fresh look at the state of the consumer this week. Yahoo Finance’s Josh Lipton is here with us now on more on what we can expect here. Josh, what are we watching for? That’s right, Brad.

7:33 spk_3

So investors we know always eager for more insight into the health and resilience of the American consumer, and this week they will get more important data on that front, including Walmart’s first quarter earnings. We’ve got retail sales and University of Michigan consumer sentiment. So what has been the state.The consumer as we head into these reports, the Bank of America Institute says consumers continue to show moderate spending momentum, with most being in good financial health. April card spending per household was up 1% year over year. That follows a 1.1% rise in March, according to Bank of America, aggregated credit and debit card data. They say the financial position of most consumers appears sound.Out the XLY, that’s the consumer discretionary ETF. It is down about 5% this year, but it’s up around 20% now from that April 8th low. The Telsey Advisory Group, a consulting brokerage firm focused on the consumer sector, says a barbell approach to the consumer does make sense given that lower to middle income income consumers face more challenges and will need to stretch their dollars in spending on basics while the upper income consumer.Argue has the means to continue spending on goods and services in the apparel and footwear category. They are fans of Birkenstock. As for consumer technology plays, it’s Amazon and Warby Parker. For department stores, Burlington and among the discounters and supermarkets, they tell their clients Costco and Walmart remain top picks. Brad. All right,

8:58 spk_1

we’re gonna be watching for this closely here. Thanks so much for got it lining this up for us, Josh. All your markets actions straight ahead. Stay tuned. You’re watching Yahoo Finance.The median list price for new builds fell again during the first quarter according to a new report from Realtor.com. Here to discuss, we’ve got Joel Berner, who is the chief economist at Realtor.com. Joel, great to have you here with us. Let’s focus first on prices for new homes. What contributed to the decline in new median prices this quarter?

9:35 spk_4

Well, the biggest thing, Brad, is the builders are building smaller, smaller and more affordable homes in a lot of the US metros. In 26 out of the 100 largest metros across the country, the median price and the median square footage of newly built homes fell on a year over year basis. So while a lot of home buyers are looking around for a home that meets their needs and seeing thatThe existing home market just doesn’t have anything in their price range. Builders are delivering new inventory that fits that price consideration really well.

10:04 spk_1

And so in the first quarter, existing home prices actually increased on a year over year basis, though they’re still cheaper than new builds. What does that mean for buyers and how is that influencing the decision making process?

10:17 spk_4

I think buyers are going to see that even though there are a lot more homes on the market right now, especially in the existing home space with people starting to list homes that have been reluctant to in recent years, the buyers are still going to see price challenges on the market. The existing homes continue to increase in value, which is a great thing for homeowners.But difficult for first time home buyers especially. So what we’re seeing instead is that builders are offering the choices for prospective first time home buyers that meet their budgets better than the existing home market does.

10:46 spk_1

Is there a material difference for mortgage rates between new home buyers versus those who purchase an existing home?

10:53 spk_4

There is actually. Not only do new home buyers save on the cost of home ownership because there’s less maintenance to do on a new home, but we see that they pay about half a percentage point lower mortgage rate than existing home buyers. It’s about 6.6% to 6.1% in 2024. Uh, and that’s really interesting because what a lot of the home builders are doing.is offering mortgage rate buy downs as an incentive to close the deal. So builders or buyers of new homes can save on their financing as well as cost of home ownership by locking in these lower mortgagerates.

11:23 spk_1

So tell us more about how tariffs could potentially impact the price and and just the psychology around some of the new home builds.

11:31 spk_4

Yeah, I think you’re exactly right, Brad. There’s two pieces to this. There’s the direct effects on new builds. There’s a 14% lumber on 14% tariff on Canadian lumber right now that’s set to go up to 34% this fall, and that will simply add to the cost of a new home. That will bring housing prices up, uh, pretty directly and, uh, not a whole lot of questions as to the direction of the impact there. But where tTariffs are a little more confusing and more interesting, I think, is in consumer sentiment. We’ve been talking a lot about it for months now, as consumers are looking at the stock market, which has looked good in the last week or so as trade wars have kind of been walked down a little bit, but continues to be a little bit rocky and, uh, as well as considering their own financial situation and their own employment situation, which tariffs are going to jeopardize.Because you know, the only thing that really pins up to the housing market is the labor market. So if people are afraid of losing their jobs, it’s going to impact the housing market. It’s going to bring down housing values and going to slow home sales even more than they already have been.

12:33 spk_1

Wow, OK. And so as you’re reading through the employment situation and the labor market more broadly here, what are your kind of best anticipations around what that could signal for the home market for the rest of this year?

12:45 spk_4

Yeah, it really depends if these tariff effects are going to be felt in the labor market statistics that come out, uh, already or not. I think there’s a lot of uncertainty in the market. There has been over the last couple of months, and that could drive companies to slow down their hiring, could lead companies to start layoffs. Uh, it could have a negative impact on the, on the labor market. But if this was really all just posturing and we’re kind of pulling back from some of these extremely high tariffs.had been put in place and now settling somewhere a little bit more manageable, then we might get through this tariff situation without a major impact to the labor market, which is what we’re allhoping for.

13:21 spk_1

With that in mind, we have a Fed that is very data dependent and has signaled that it’s not going to be too quick to move on rates unless the data is specifically spelling that out. You’re shaking your head. What’s going through your mind as you hear the comments from Fed Chair Jay Powell and the committee?

13:39 spk_4

Yeah, I think the Fed’s doing the right thing. They’re not going to overreact, uh, not to one month of data, not to one policy decision. They’re going to move slowly and take this as a, as a whole picture, and I know that some people, some very prominent people are a little bit critical of the pace at which the Fed decides to move. But until we get more information about how all of this economic activity is making its way into everyday Americans’ lives, it would beFoolish to make large drastic decisions before plenty of data has come in and we’re seeing how the labor market has really shakenout.

14:12 spk_1

Uh, yes, that one prominent figure I believe calling Fed Chair Jay Powell a fool, and we will continue to see how Fed Chair Jay Powell just continues to navigate, perhaps keep his blinders and the team around him focused on the mission here. Joel, thanks so much for the context and the insights. Appreciate it. Thank you, Brad.We’ve got new data from the National Association of Realtors revealing the vast majority of metro areas registered price increases for existing home sales in the first quarter of the year. Here with the details we’ve got senior housing reporter Claire Boston. Claire, what do we know on

14:45 spk_5

this? Hi Brad. So you are right, in 83% of measured metro areas, home prices increased in the first quarter. Once again, this is the latest sign that affordability.In this country is very, very challenged, but you know there was actually a little bit of a smaller amount of counties seeing an increase uh than the prior quarter when it was 89%. So you know maybe things are getting a little bit easier, um, and then nationwide we saw a 3.4% increase from a year ago that brings the average home in this country to over $400,000.

15:17 spk_1

Now there’s another story you’re watching as well, a city here.With particularly here as we’re thinking about what is taking place within the city and the population of just over 200,000, 1 of the toughest housing markets in the US this spring. So where is it and why is there such tough competition?

15:34 spk_5

Right? It’s a little counterintuitive, but one of the toughest housing markets in the country right now is Rochester, New York. Upstate New York, 200,000 people, about a million people in the metro area, and yet.Prices there are up 12%. The average time on market is 8 days. I talked to a bunch of people who have experienced this market, and they say competition is extremely intense. And what we’re seeing in Rochester and some other cities is basically these are cities that are catching up to national home prices. It is still really affordable to live there in Rochester, the average home costs about $225,000 and as a result, uh, the competition for those homes is steep. They’re also not.Building very much and then going back to the NAR data, you know, I was looking at some of the biggest home price increases were happening in places like Syracuse, New York, and Montgomery, Alabama, and those are also towns that I think are pretty similar to Rochester in that, you know, overall they are still relatively affordable places to live and that makes competition harder than ever in those markets.

16:31 spk_1

Claire, thanks so much for breaking this down gonna be interesting to watch those dynamics in Rochester. We’ll see.Now time for some of today’s trending tickers. We are watching Target, Estera Labs, and Kindly MD. First up, Target downgraded to underperform from market perform at Bernstein. The analyst says that the retailer faces a difficult trade-off between fueling sales growth and maintaining margins. Bernstein says Target.Losing market share in core discretionary categories like home and apparel and that e-commerce growth could be a persistent margin headwind for Target. The analyst says poor weather, weak consumer sentiment, and a DEI-related strike in March weighed on first quarter results, and that tariff risks aren’t fully priced in.Next up here we’ve got Esterra Labs getting an upgrade to overweight at Morgan Stanley. This is following the chip manufacturing company’s quarterly results. The firm says recent weakness in the stock represents a good entry point despite the stock being highly polarizing. The analysts cites AI optimism, saying they believe there is too much pessimism in AI and says new products should give the company sustained growth. And finally here, healthcare services company Kindly MD.Surging the most on record on an agreement to merge with Bitcoin Holding company Nakamoto Holdings to start a Bitcoin treasury strategy here. Nakamoto was founded by David Bailey, a crypto adviser to President Trump, and the merger includes $510 million in private investment, $200 million in convertible notes. You can scan the QR code below to track the best and worst performing stocks of the session with Yahoo Finance’s trending ticker’s page.We’ve got all your markets actions straight ahead. Stay tuned. You’re watching Yahoo Finance.Let’s get a check of the markets, everyone, as we’re taking a look at some of the major averages here on the day, still holding on to some handed gains right now by about 2.2%. It’s handily higher here on the day the Nasdaq Composite. That’s off of its session highs, but still, hey, we’ve been in that territory in that ballpark just kind of hovering around 3.4% in gains on today’s activity. The S&P 500, that too, hovering around 2.5% in gains on the day. Let’s.Put this in a little bit of a longer context, year to date perhaps here because I was taking a look at some of the price action correlation around when we first started hearing President Trump after the inauguration talking about what some of the tariff policy or even some of the actions that the administration was looking to set off in late February and early March and some of those truth social posts here as I was correlating it back to this.The first week of March, kind of late February when we started to hear it teased about, this is where the markets are going to see that next critical test here because as you’re taking a look at the levels that we still have to usurp, even though we’ve taken out the losses since the Liberation Day announcements for tariffs, now the next big test is, oh yeah, the pullback that we were already starting to see even prior to and especially in some of the larger names. Think about.Video. Think about Apple here. And so two of those names that had actually led the market lower to start off the year taking a look at some of that year to date activity, we still got a ways to go here for Apple, AAPL that’s down 16.7% year to date, and some of those declines had already started to happen even prior to the rest of the market downturn and prior to some of the Liberation Day comments. Andy was the same case there andy going into some of those announcements.I believe at some point was down by about 8%. Again, still they had come off of the highs, but you go into that announcement and you still had some of the declines even prior to some of the posts starting to emerge here. As of here and now, as Luther Vandross would say, Nvidia is up 4.4% on the day. Year to date is still down 9%, so still got some area to claw back there. Apple is up by about 5.25% here on the day. We mentioned that year to date move.tech stocks certainly catching a bid here on today’s activity. Amazon perhaps a sigh of relief there that some of the products of course that go into their e-commerce platform, depending upon where they are sourced from around the world, that could alleviate some pressures if we do see the trade talks continue in a favorable manner that would benefit Amazon here. And interestingly here, Netflix pulling back one of the few names at least scattered names that is pulling.Back within the Nasdaq 100 today, and this has often been seen in recent weeks as one of the most insulated places. You’re less likely to cut that subscription, and Netflix is continuing to tout some of the subscriber growth metrics here. So over the course of the year to date scale, bucking the wider trend, it’s up by about 24%, but still here today, pulling back just a little bit by about 2.3.75%. So we’ll continue to track all those moves here. A lot of time left in the trading day.Well, stocks are surging today after the US and China agreed to temporarily lower tariffs for 90 days as they work out a final trade deal. We want to talk about how investors should think about the rally within their portfolio. Here with more we’ve got Preston Cherry, concurrent wealth management founder and wealth.Adviser Preston, good to have you on the program with us. So what do you do with a day like today coming off of a Sunday two day meeting concluding here where you have some easing in the pressures for both sides and hopefully some of the cooler heads prevail?

22:01 spk_6

Absolutely I think you just continue your contributions over time so investors have a little bit more confidence now with the trade announcement and nobody likes hearing more of the same during corrections or crashes, but more of the same is good for rallies. So continuing contributions during a rally helps dollar cost averaging with so business owners with paychecks and also professionals with paychecks continue.Use that investing over time and buys at highs and low points and smoothing out that price that cost basis overtime.

22:34 spk_1

What’s the number one question that you receive from clients when things are rosy, bright versus when things are a little bit more tumultuous, unpredictable perhaps, and they’re trying to figure out, OK, what should I be doing with my own portfolio strategy at this juncture?

22:53 spk_6

Yeah, sure. So when times are bad, the question is should we go to cash? And when times are good is should we hold our cash and wait for the next correction or crash. So it’s all surrounding around cash and cash is good for emergencies, liquidity purposes, lifestyle choices, and during times of uncertainty.That said, cash doesn’t earn the market return, historical market returns, inflation eats up that cash and if you continue to stay invested, you can capture the best performing days historically after low historically performing days.

23:28 spk_1

With all of this in mind, are you too late if stocks are already rallying on the day like today?

23:34 spk_6

Uh, the worst behavioral finance behavior is FOMO, so fear of missing out. Actually, uh, last year there were 57 new highs in the market, so this question came up often, uh, do we hold our cash and wait for the next crash? Well, with 57 new highs last year there were 62 new market highs in 2017. Uh, so when the market has good momentum.And there’s not as much uncertainty in the market and the economy, then the market historically tends to keep the momentum and go higher.

24:09 spk_1

And so with that in mind, how do you kind of best gauge what your exposure should be coming out of or even in the midst of times where the markets are more volatile and how you start to selectively pick areas where for the long term you feel comfortable being invested in?

24:27 spk_6

Yes, uh, you, folks should always consider their risk capacity, their risk tolerance, and their goals, and have an intentional.Investing plan in order to help them maintain that good investing behavior and also too, there’s opportunities in the market. For example, uh, we’re looking at Delta, uh, Delta’s consumer discretionary during times of uncertainty, then folks are looking at their pockets, they’re gonna pull back their travel budgets and Delta did not list any guidance in their last call in their market, their stock went down about 25+%. Now you haveNew tariff announcements on the positive side and folks are saying I have a little bit more confidence to re-engage with my budget and now Delta is up 25, 27%.

25:14 spk_1

Preston, as best uh indicator as it has been for risk on sentiment, Bitcoin is back in the ballpark of some of its highs here. So what should investors do with that information if they’re trying to figure out what the broader sentiment, what the bullish or or animal spirits are that might prevail in the equities market.

25:35 spk_6

Yes, with uh Bitcoin, cryptocurrency as a whole, folks call that decentralized finance and, and the market’s traditional finance and usually or nowadays they’re acting kind of the same. So with the cryptocoin investors, they have more of a belief system in that particular structure which is different from, say, printing money, so to speak, uh, that said, there’s a lot of correlation there in those two areas, however.In the Bitcoin and crypto space in general, lots of volatility. So peel off a small portion of your overall portfolio, say 57, 10% in order to gain exposure to those volatile areas if it fits your risk capacity and goals and invest that way, not your whole entireportfolio.

26:23 spk_1

Preston, just lastly while we have you, we have two companies that could be bellwethers both for the consumer.And Walmart’s capacity and then for the semiconductor trade in Nvidia and neither one of them has reported yet. We’re gonna hear from Walmart and then later on in May we’re gonna hear from Nvidia. What are your anticipations for what these two earnings bellwethers could signal to the markets?

26:45 spk_6

I think Walmart is a steady as they go type of company, uh, particularly when you have uncertainty and uh lack of confidence in the overall market. We have uh political risk, we have economic risk with the trade on and off. So folks are going to be watching their spending plans over time and people are trading, uh, or swapping out their target visits or higher income grocery store or uh consumer needs in one.To more bargain elements like Walmart. So I think Walmart will stay consistent with higher foot traffic and Nvidia, when uh those type of companies have those innovative, uh, mindsets and also moats around the protective moats have good cash flow. So when the market has a little bit more confidence in there then I expect those uh companies like Nvidia to rally.

27:36 spk_1

Preston, great to see you again. Thanks so much for taking the time here with us.I appreciate it. Thank you. We’ve got all your markets action ahead. Stay tuned. You’re watching Yahoo Finance.Financial consultants predict that older Americans will pass on $124 trillion in assets to their heirs over the next two decades, but let’s face it, talking about money can be uncomfortable. That’s why we’ve got a few tips to help make those conversations a little easier. Joining me now, we’ve got Tom Deans, author of The Happy Inheritor. Tom, great to have you here with us. Let’s, let’s just start there. How can families begin the conversation about inheritance and wealth transfer without creating tension or discomfort?

28:22 spk_7

Well, Brad, it’s a great place to dive into a complex subject. I mean, we got, uh, I mean, you quoted that number there, it’s, it’s roughly 30 I mean $300 billion a day. I mean it’s a staggering amount of wealth that is transitioning between the generations, most of it chaotically, we have a,You know, we have 137 million American adults without a will. I mean, the most important document in the state plan is missing roughly in half of all American adults. It’s not good, Brad, um, so we know why. Um, it’s, it is an uncomfortable subject. It’s awkward. Culturally, parents don’t really want to talk to their children about, you know, what they’re going to inherit, what the kids are gonna inherit, because that kind of feels like.I don’t know, they’re setting their kids up to receive a windfall, and they don’t want to take away their drive and ambition. And of course, kids don’t know how to, you know, children don’t know how to start this conversation with their parents. It feels awkward or like they’re clamoring for stuff. So, often the result is silence.Right? Parents and children find this kind of awkward ambivalence around this important subject called money. So my, my advice is really straightforward. It’s, first of all, I, I think.I think when children can actually get their own, when I say children, anyone over 18 needs a will. Uh, nothing says we die in order. So I, I say to young adults all the time, if your parents aren’t talking about this stuff, you can get your own will done and give your own will to your parents. You can maybe say, Listen, I’m gonna, I’m gonna be on a, on a flight, I’m gonna be traveling, uh, nothing says we die in order. You should have my estate planning document.Most parents will think, well, that’s kind of weird, but, you know, you’re kind of parenting us. When children parent their parents on an awkward subject like state planning, many parents will reciprocate. There’s that kind of reciprocity, and they may, that may be the trigger that, that causes them to kind of, you know, pass on their documents and start a family conversation. Um, it’s really, really important. Alternatively,Um, Brad, I, I would suggest that parents can say, listen, we’d like to talk about our long-term care. So before we talk about who gets what, you know, in our estate, we’d also like to talk about our long-term care and who in the family is going to oversee our care. The two subjects are reallyintertwined.

30:35 spk_1

So at what age should you have the wealth transfer talk with your kids? And, and I like to.Strategy that you mentioned up in uh up front which is you know say your kids are old enough to have their own planning and you know put that in front of their parents but you know what if your kids are not old enough to have that planning started up so you’re trying to figure out now as a parent when you begin kind of the familial conversation with your younger kids.

31:02 spk_7

Well, well, this answer may shock you, Brett, but I think the age is 5, at 5 years old, children are capable of understanding basic money concepts. They are not gonna understand anything in detail, but they will, they can be introduced to the idea of wealth andHow it’s earned versus gifting, general concept, basic concepts. And as those children get older and older and older, then the level of detail that is shared can be comprehended slowly and absorbed. I think people want to go from 0 to 100 miles an hour when it comes to money and teach everyone all in one moment in time. The reality is that moment rarely comes, and most adult children are left in the dark. It’s why most wills in this country are revealed.When someone dies, which is way too late, way too late to teach people about, you know, the, you know, the power of compounding interest and the importance of saving early on and investing early on, all of these concepts can be taught at a young age, as young as 5.

32:05 spk_1

So what are some things that parents should make sure to discuss with their children when it does come to transferring their wealth?

32:13 spk_7

Well, I, I think first of all, um, you, you absolutely need to, and this again is counterintuitive, but it is this idea of sharing your estate planning documents is absolutely crucial. Um, you know, 137 million Americans without a without a will, there is no estate plan and to leave that conversation, um, right to the very end, when someone dies, it’s not just.People learning about what they get, it’s finding the backup documents that go, you know, the, the title, the deeds to land, to real estate, uh, insurance policies, it is staggering the amount of questions that start getting fired when when someone dies. Of course it’s too late. Those conversations are irretrievable. So it’s not just enough to do estate planning, it’s.Important to get your family to participate in those conversations before you draft those documents. In other words, draft the documents with their input and then go one step further and share those documents so that the people who are named as beneficiaries will, will be prepared. I mean, really, my book The Happy Inheritor is really about preparing errors for the smooth, calm transition.Of, of wealth, um, it, it’s a, it’s an enormously complex subject that requires time and effort.

33:32 spk_1

What are thethree questions that kids should ask their parents about their wealth?

33:38 spk_7

Well I think the obvious one is, who have you selected as executor? Um, the children will be dealing with the executor. If, if it’s not a, a family member, then it’s going to be a, it’s gonna be a someone who’s been appointed, uh, a public trustee, and it would be really great for family to know who that is. It would be even better if the family participated in those, in those conversations to help, you know, help make better, better, more informed decisions.That would be number one,I think number 2 would be to have a really good list of assets. Uh, what do you want? Where is it? Um, the wealthier you are, the more stuff you’ve accumulated in, in many cases, it’s assets that are located in other countries. Uh, getting that list of assets, setting the executor and the family up to succeed with the administration of those estates is absolutely crucial.Tom and then, and then third I’d say share share your wills right? like share your will, your health care, your power of attorney for finance and your healthcare uh power of attorney all those three documents are crucial so that people can be empowered to serve that family member who is aging and ultimately going to die.

34:55 spk_1

Tom, thanks so much for taking the time here with us today really important conversation and hopefully a lot of helpful tools there for families to begin these discussions. Appreciate the time.You’re welcome, Brad.If you have credit cards with high interest rates and credit card debts, a 0% APR card could help pay off that debt. Yahoo Finance reporter Madison Mills explains how a balance transfer card with a 0% annual percentage introductory rate could help save you some money.

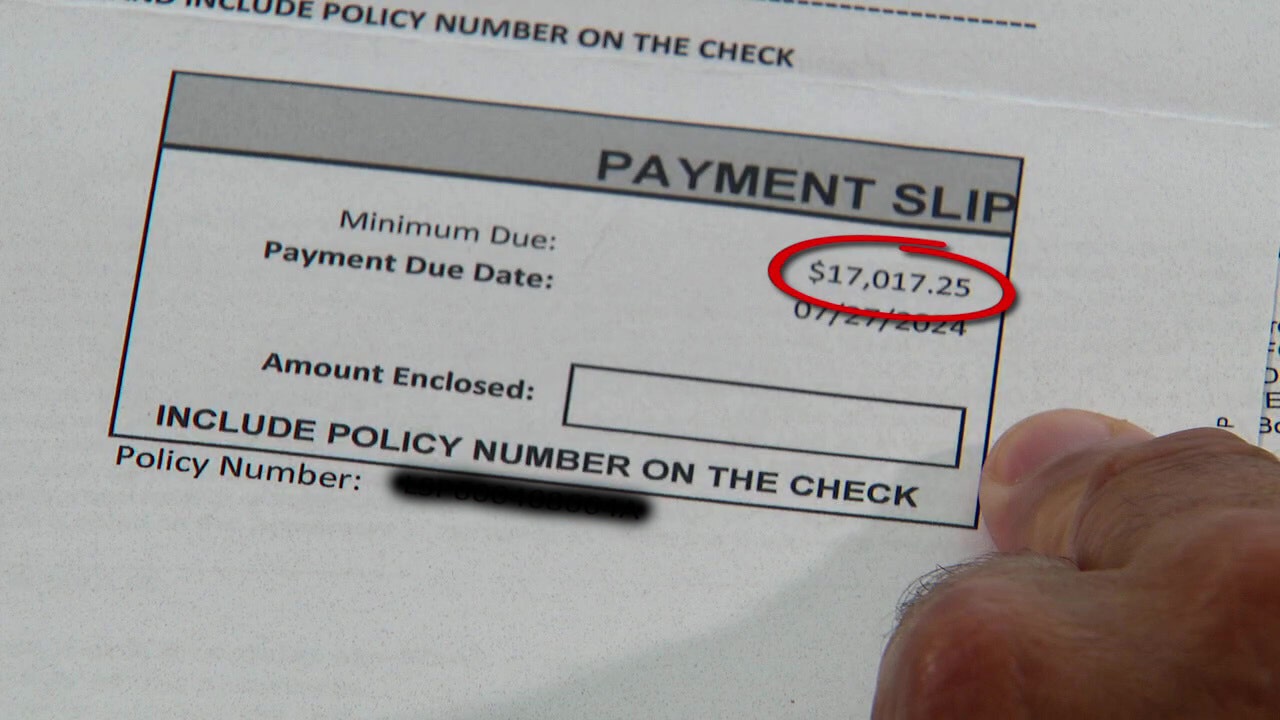

35:23 spk_0

If you’re struggling to pay off credit card debt, 0 APR cards could help you.The card has a 0% APR annual percentage rate introductory offer. That means you don’t pay interest on the balance you transfer for a set period of time. If you didn’t pay any interest on that debt for more than a year, could you pay it off? The best zero APR credit card for you depends on your current balance, the length of the 0% APR intro period, balance transfer fee, and how much you can pay each month. For context, a recent study shows the average credit card debt is more than $6500 and 0% APR.Introductory periods range from about a year to 21 months. So let’s do the math. Say you have a $6500 credit card balance on a 21% APR card. If you make only the minimum payments starting at $178.75 the first month, you would pay more than $10,000 in interest over more than 25 years before you can pay off your full balance. Now let’s compare. Say you transfer your $6500 credit card debt to a new card that has an 18 month.introductory APR and a 3% balance transfer fee. If you pay at least $361 each month toward that credit card bill, you could pay your balance in full in 18 months without any additional interest. You would still have to add in the 3% balance transfer fee of $195 bringing your total to $6,695 on a 21% APR card, your total more than $17,000.Be aware there are ways you can get in trouble here. If you transfer a balance to a 0% APR card and keep using the old card, making only minimum payments, you can run up your debt. If you can’t pay off the full balance here on the new card before the intro period ends, you will need to pay the card’s standard interest rate on the remainder.And that interest rate is typically high. Using a zero APR balance transfer credit card can be a savvy financial move as long as you can commit to paying down that credit card debt. Scan the QR code for more information on the best zero APR credit cards.

37:39 spk_1

Rewards cards can be another tool to help you maximize credit card perks. Scan the QR code for our personal finance teams, credit card picks. You can see which specific cards could be a good fit for you.Coming up, we’ve got much more wealth on the other side of the break. You’re watching Yahoo Finance.According to Pew Research, about 50% of Americans have an emergency fund that can cover 3 months of expenses. But once you start saving every month, what should you do next? I want to bring in Bobby Rebell, who is the Cardrates.com, certified financial planner and personal finance expert as part of our savings series brought to you by Synchrony. Great to see you, Bobby. So let’s dive into this right now. How can you take action to make sure you’re saving as much as possible?

38:28 spk_8

Well, first of all, thank you so much, Brad, for having me and taking action is exactly where we want.because we have to be proactive, it’s not gonna just happen by itself. One of the best things we can do is set very specific goals by separating our savings goals. You mentioned an emergency fund that of course is the priority. I thought that statistic was actually better than I would have expected, so kudos to the people that are saving already, but separate, you know, you wanna have your emergency fund, you wanna have your vacation fund, you wanna have your retirement funds, whatever it may be, and make sure that you’re separating them to make it more realistic and more tangible. You also want.Track your spending backwards and what that means is by putting your savings first, you prioritize that and you say that’s the way I’m really going to give to myself. The way to get there, use the right tools. Obviously traditional budgeting apps are a smart way to go, but even AI tools can be really productive when it comes to putting our savings first. Throw it into chat GPT. If you can’t figure out where to get that extra savings, throw in what’s going on in your personal situation. You might be surprised some good ideas could really come out of it.

39:29 spk_1

How do you approach setting a savings goal?

39:33 spk_8

So you want to really focus on, um, what matters most to you. Be intentional, be thoughtful, be proactive, as I mentioned, and also, of course, take specific steps. You might want to, as a graphic that just went away mentioned, you know, do things like stopping automatic renewals on subscriptions because that way you aren’t just mindless.Paying for things that you may or may not be using, I promise you they will come back to you to renew many times, often with better offers and also make it a little bit harder to spend that money by removing your credit card information from your computer. So you have to actually physically get up, go get the number, reinput it. I can’t tell you how many times I just haven’t bothered or I got distracted.With something else and it just didn’t happen and I forgot to buy that thing and I guess that money can go into savings.

40:18 spk_1

Yeah, I might have to, uh, Men in black flashy thing myself in the mirror just to make sure that I could forget those numbers because I, I just remember them all. So what do you do if you get an unexpected windfall whether your tax refund or an inheritance or even a bonus check from work?

40:34 spk_8

Don’t we wish this would happen to us? Yes, just the season of the tax refund, I hope for many of us, although we don’t want too big a refund because that means we misestimated our taxes. That’s a different segment. But I want everyone to respect the money by saving it. And again, making that a priority. A good goal if you want a random number is 50%. Obviously 100% is the ideal, but the most important thing is toAvoid lifestyle creeps. Sometimes we tend to say, Well, now we’re making more money, or I got this bonus this year. I’m sure I’ll get it next year. So now I’m going to live a little bit larger than I was previously. Don’t do that. Stay true to yourself. You’ve been doing just fine as it is, and enjoy the bonus by rewarding yourself and savingit.

41:12 spk_1

So how can you reframe your savings mindset?

41:16 spk_8

I love this. What you want to do is really think of it as a reward to yourself. Very often our friends and they’re well-meaning will say, Oh, we’re all going out this night. What are you doing? Are you going to buy a new outfit? You deserve a new outfit. This has happened to me so many times. And I think to myself, Well, instead of spending this amount of money on a new outfit, maybe if I have the money, I can put it into my savings account and put it towards, you know, the next vacation I want.Think of it as an investment in your financial freedom for the future. I love to set up mood boards. You can even do this digitally and picture where that money’s going to go in the future, and it can be the way future. It can be your retirement. It doesn’t have to be buying something or splurging onsomething.

41:52 spk_1

Bobby, thanks so much for taking the time here with us today. I really appreciate the time and insights. Thank you for having me.Let’s do a final check of the markets here as we’re approaching 12 noon Eastern time. The Dow, the S&P 500, and the Nasdaq all rallying here today following some of the trade talks between the US and China over the weekend here. We’re taking a look at the Dow up 2%, the S&P 500 up by about 2.5%, and the Nasdaq composite up by about 3.5% right now.We’ll continue to track some of the market movements with the back half of today’s trading session, but that’s it for wealth. I’m Brad Smith. Thank you for watching. You can stay tuned for market domination with Julie Hyman and Josh Lipton. I’ve seen them both in office, so they’re definitely here, and that’s definitely coming your way at 3 p.m. Eastern time. They’ll count you down to and through the market close.

Finance

Stash Secures $146 Million to Add AI to Financial Guidance Platform | PYMNTS.com

Stash has secured $146 million in a Series H funding round to deepen its investment in artificial intelligence (AI) for its financial guidance platform.

“For a decade, Stash has helped millions take control of their financial futures,” Stash Co-Founder and Co-CEO Ed Robinson said in a Monday (May 12) press release. “Now, we’re doubling down — transforming how people save, invest and build long-term wealth with AI-powered intelligence at the core.”

Stash’s platform has 1.3 million paying subscribers and $4.3 billion in assets under management, according to the release.

The company said in the release that its recently launched Money Coach AI, a platform that helps customers build savings and start investing, has had 2.2 million customer interactions.

One in four customers who interacted with the platform went on to make an investment, deposit funds, diversify or take other positive actions, according to the release.

Chi-Hua Chien, founder and managing partner at Goodwater Capital, which led the funding round, said in the release that Stash is “laser-focused on innovation, growth and setting a new industry standard.”

“Stash isn’t just using AI to enhance its platform — it’s using AI to transform how people engage with their money,” Chien said. “The company’s momentum is undeniable, and we are proud to support this next frontier in FinTech.”

A growing number of consumers are seeking personal finance advice amid economic headwinds that have left them worried about their financial future, according to the PYMNTS Intelligence and NCR Voyix collaboration, “Navigating Financial Uncertainty: Whose Advice Do Americans Trust?”

The report found that 57% of Americans sought personal finance advice in 2023. It also found that among those who have never received financial planning advice, nearly three-quarters are now open to the idea and more than half plan to seek advice in the next three years.

DailyPay added a financial wellness tool called “Credit Health” to its earned wage access app in September. Credit Health delivers insights such as credit bureau scores and histories, credit reports, monitoring/alerts and score factors.

Brightfin debuted a financial wellness app designed for younger consumers in July, saying the app helps younger generations understand their money and manage their finances.

-

Austin, TX4 days ago

Austin, TX4 days agoBest Austin Salads – 15 Food Places For Good Greens!

-

Education1 week ago

Education1 week agoIn Alabama Commencement Speech, Trump Mixes In the Political

-

Technology1 week ago

Technology1 week agoBe careful what you read about an Elden Ring movie

-

Culture1 week ago

Culture1 week agoPulitzer Prizes 2025: A Guide to the Winning Books and Finalists

-

World5 days ago

World5 days agoThe Take: Can India and Pakistan avoid a fourth war over Kashmir?

-

Education1 week ago

Education1 week agoUniversity of Michigan President, Santa Ono, Set to Lead University of Florida

-

Technology5 days ago

Technology5 days agoNetflix is removing Black Mirror: Bandersnatch

-

Politics1 week ago

Politics1 week agoEPA chief Zeldin announces overhauls to bring agency back to Reagan-level staffing