Finance

Hackers Pillage $197 Million in Crypto From Euler Finance

Unidentified cybercriminals managed to spice up almost $200 million from the decentralized finance lender Euler Finance on Monday. The assault, which stole thousands and thousands in crypto property like DAI and USD Coin, is being hailed as the most important crypto hack of the yr thus far. If this yr is something like 2022, when hackers stole greater than $3 billion in crypto, the Euler theft received’t be the final.

Euler, which refers to itself as a crew of software program engineers “specialising within the analysis and improvement of economic purposes,” is the developer behind a “capital-efficient permissionless lending protocol” that the corporate says helps customers “earn curiosity on their crypto property or hedge towards unstable markets with out the necessity for a trusted third-party.” Sadly, a trusted third-party may need really been type of helpful when it got here to defending customers’ property from whoever simply hijacked them by the armful.

One of many first to identify the assault was Peckshield, a blockchain safety firm that’s identified for flagging irregular asset transfers. On Monday, Peckshield tweeted out a hyperlink exhibiting abnormally excessive transfers from Euler:

Euler confirmed it was conscious, replying: “We’re conscious and our crew is at the moment working with safety professionals and regulation enforcement.”

In a while Monday, Euler tweeted: “We proceed to research this morning’s illegal extraction of funds from the Euler protocol. The Euler Labs crew has taken a number of instant actions to aim to get better the funds and determine precisely what occurred, together with contacting and sharing data with regulation enforcement, and dealing with unbiased third-party auditors and safety corporations.”

G/O Media could get a fee

One other blockchain safety firm, SlowMist, has deduced that the theft was carried out utilizing what is named a “flash mortgage assault.” Such assaults use refined manipulation of a crypto lender’s sensible contracts to borrow large quantities of crypto with out having to entrance any collateral.

That mentioned, it’s unclear what regulation enforcement can really do on this case or whether or not customers will inevitably get their a refund. Like quite a lot of different crypto heists of latest reminiscence, victims could also be up the proverbial creek and not using a paddle.

Finance

Taxes and Finance: Understanding the home gain exclusion

When is a tax planning session essential?

One of the biggest tax benefits available today is the exclusion of gains when you sell your qualified home. Here is what you need to know.

The tax benefit explained

For those who qualify, a married couple can exclude up to $500,000 ($250,000 for unmarried taxpayers) in capital gains from the sale of your principal residence. This exclusion can be taken once every two years as long as you pass two tests; a two-years out of five residency test and an ownership test before you sell the property.

Special situations can cause complications

Often tax planning is required to ensure you maximize this tax benefit. Here are some situations that require a review prior to selling your home.

Ownership and principal residency tests met using different years. As long as the two-year requirement is met for both tests you can take the deduction. It does not matter that you use different years for each test. The most common example of this occurs when you rent a home or condo and then buy it later.

Life events complicate things

Marriage, divorce, and death are common life-events that require planning to maximize the gain exclusion tax benefit. For example, you can take advantage of the full $500,000 gain exclusion after the death of a spouse, but usually only during the time you are able to file a joint tax return.

Selling a second home requires planning

While you can use the gain exclusion every two years, you need to be careful with a second home. You may be able to plan your living arrangements to make each home a primary residence during different tax years to meet the two-year requirement for both properties. This means you need to determine your primary residence each year with good record keeping in case you are audited.

Business use of your home

You will need to adjust your home basis (cost) for any business activity and depreciation of your home. This can create a depreciation recapture tax event when you sell your home.

A partial gain exemption is possible

There are exceptions to the two-year tests when certain events occur. The normal exceptions include a required move for work, health reasons, or unforeseen circumstances. Since the IRS definition of each is vague, you should review your options if you are required to move.

Record keeping matters

Be prepared to document the gain on your property and how you meet the residency and ownership tests. Please keep all documents relating to the purchase and sale of your property. Save any receipts that document improvements to your home. Also keep an accurate record to support your claim of principal residence if you own a second home.

Given the potential for tax savings, please ask for help before selling your home or vacation property.

James Angell is a Willits based Certified Public Accountant. His office is located at 461 S. Main St. and he can be reached at 707-459-4205.

Finance

What are the best ways to finance excellent hotel studies? – Part 2

While the hospitality industry is renowned for being a veritable social ladder, where someone without a degree can start out as a dishwasher before working their way up to become a hotel manager, education remains the quickest route to positions of great responsibility. Future talents are turning to the best hotel schools to train and join this rich industry. However, the cost of excellent studies can be daunting for many students. This is a financial barrier that schools, authorities and even the students themselves are trying to overcome through various financing solutions.

To (re)discover part 1 of this analysis, which looks at the cost of student life in 2024, click here. A wide range of funding options Grants, funding and support While such studies may seem out of reach for many students because of their cost, there are many ways of financing them. Whether it’s the…

Finance

Rana Abbasova, Adams aide whose home was raided, is cooperating with feds’ campaign finance probe

An aide to Mayor Adams whose home was raided amid an FBI probe into his 2021 campaign is cooperating with federal authorities, a source with knowledge of the matter said Monday.

The aide, Rana Abbasova, is one of several people whose residence was raided as the feds probe allegations that the Turkish government funneled illegal cash into Adams’ campaign through straw donors.

The mayor has not been accused of any wrongdoing and strongly denies any suggestion of impropriety in connection with the investigation.

It’s unclear what Abbasova may have discussed with the feds, though her cooperation pertains to the general allegation of illegal Turkish government-financed contributions to the mayor’s campaign, according to The New York Times, which first reported her cooperation. Her lawyer Rachel Maimin declined to comment.

Brendan McGuire, the mayor’s former chief counsel at City Hall who now represents him and his 2021 campaign in the FBI investigation, confirmed Abbasova’s cooperation, but said it’s “not a new or meaningful development.”

Abbasova, the director of protocol in Adams’ International Affairs Office and the mayor’s unofficial liaison to the local Turkish community, was put on unpaid leave days after her home was raided in November, according to two sources with knowledge of the matter. She remains on unpaid leave, and her position at City Hall has not been filled, they added.

The sources spoke on condition of anonymity due to the sensitive nature of the Adams campaign probe, which burst into the headlines when the home of the mayor’s chief campaign fundraiser, Brianna Suggs, was raided in November. Days later, Adams had his own electronic devices seized by the feds.

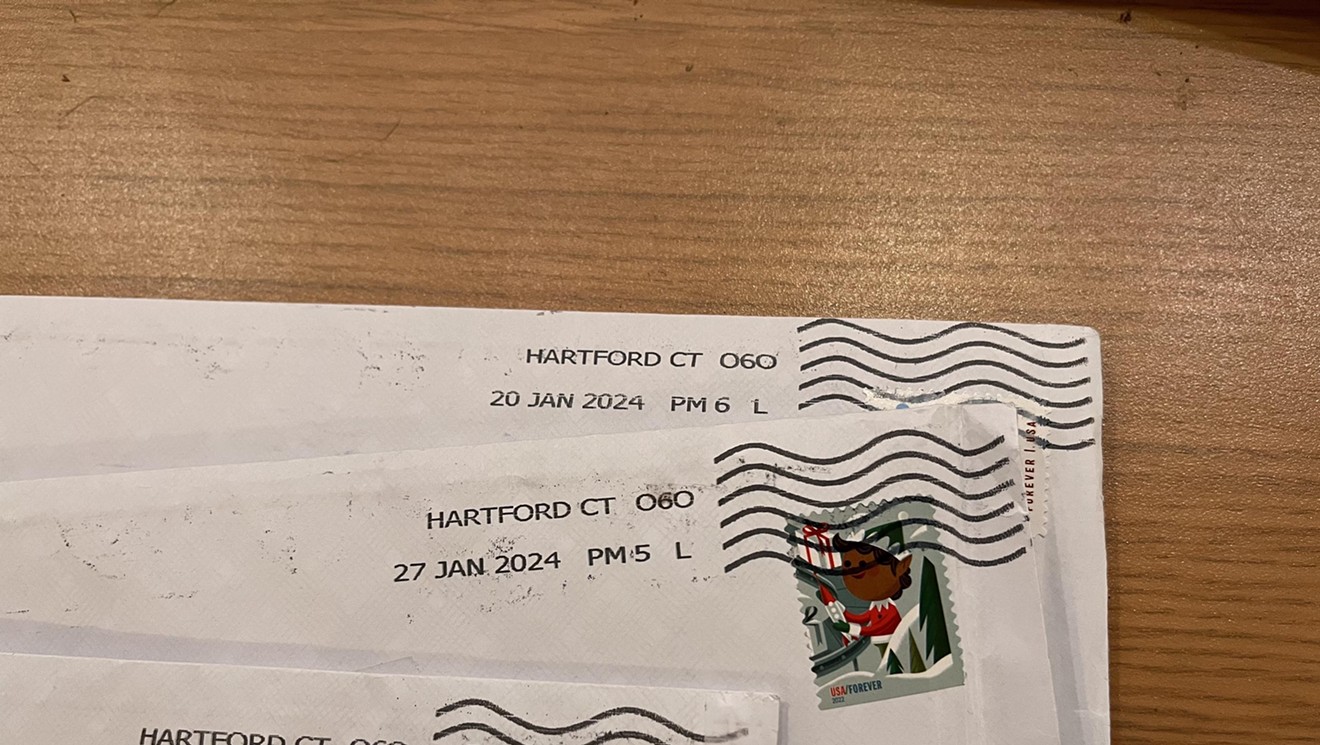

Abbasova received three tickets in New Jersey in January for offenses linked to driving a for-hire vehicle, the Daily News previously reported.

While she’s been on unpaid leave, another Adams aide targeted by the feds in a separate matter went on paid sick leave after her Bronx homes were raided in February. That aide, Winnie Greco, has since returned to work at City Hall, receiving a raise earlier this month.

McGuire noted the mayor’s administration reported to investigators late last year that Abbasova had engaged in “improper conduct.” Sources confirmed at the time that the conduct in question was Abbasova instructing other Adams staffers to delete text messages they’d exchanged with her.

“It is our understanding that Ms. Abbasova has been talking to investigators since her improper conduct was reported by the administration in November,” McGuire said in a Monday night statement.

-

News1 week ago

News1 week agoSkeletal remains found almost 40 years ago identified as woman who disappeared in 1968

-

World1 week ago

World1 week agoIndia Lok Sabha election 2024 Phase 4: Who votes and what’s at stake?

-

World1 week ago

World1 week agoUkraine’s military chief admits ‘difficult situation’ in Kharkiv region

-

Movie Reviews1 week ago

Movie Reviews1 week agoAavesham Movie Review

-

News1 week ago

News1 week agoTrump, Reciting Songs And Praising Cannibals, Draws Yawns And Raises Eyebrows

-

World1 week ago

World1 week agoCatalans vote in crucial regional election for the separatist movement

-

Movie Reviews1 week ago

Movie Reviews1 week agoUnfrosted Movie Review: A sweet origins film which borders on the saccharine

-

Politics1 week ago

Politics1 week agoNorth Dakota gov, former presidential candidate Doug Burgum front and center at Trump New Jersey rally