Finance

George Santos scrutinized over ties to investment firm accused of ‘Ponzi scheme’

Embattled Rep. George Santos (R-NY) is dealing with questions on his ties to an funding agency accused of working a “traditional Ponzi scheme.”

Santos, who flipped his district from blue to purple in November, has largely saved a low profile since a report within the New York Occasions final month revealed that he had lied through the marketing campaign about his household, faith, schooling, work expertise, sexuality, and maybe even an animal rescue charity he allegedly based. On prime of bipartisan condemnation for his string of lies, Santos additionally faces a number of investigations, together with one into discrepancies on monetary disclosure kinds.

SANTOS DEFENDS RECORD, HINTS AT RUNNING AGAIN IN 2024: ‘I’VE LIVED AN HONEST LIFE’

It seems that Santos was sincere in presenting one portion of his resume. The reality-challenged lawmaker served as a director on the funding agency Harbor Metropolis Capital Corp. from January 2020 to April 2021. The corporate, in line with a Securities and Alternate Fee grievance from the identical month Santos left, bilked thousands and thousands of {dollars} from its clients in what the company described as a “traditional Ponzi scheme.”

The grievance alleged that Harbor Metropolis promised buyers annual returns of 10% to 60% and instructed buyers their funds can be used to finance “buyer lead technology campaigns,” and that reselling results in different companies would herald money. In actuality, nonetheless, the cash went towards firm proprietor Jonathan Maroney’s private bills.

Santos was employed to lift capital for the agency, and landed not less than one vital funding from a rich investor, in line with a Saturday report from the Wall Road Journal.

“When the funding didn’t ship on the promised returns, in line with one of many folks, Mr. Santos sought to reassure the investor by saying he had personally raised practically $100 million and had invested his family’s cash in Harbor Metropolis,” the report learn.

Santos was not named within the SEC grievance, although he maintains shut ties with a variety of people from the agency, which has since shut down. A court-appointed legal professional reviewing the corporate’s belongings instructed the Washington Put up in an interview revealed Wednesday that Santos obtained funds from the agency not less than a month after his April 2021 departure.

These funds have been made weeks earlier than Santos would register a enterprise referred to as the Devolder Group, an organization that he would declare in marketing campaign monetary disclosure kinds as the idea for his wealth. The New York lawmaker has beforehand passed by George Devolder-Santos to incorporate his mom’s maiden title.

Joseph Murray, a lawyer for the scandal-plagued congressman, instructed CNN on Thursday that Santos was unaware of wrongdoing at firm, saying in an announcement: “As to any questions on Harbor Metropolis Capital, in gentle of the continued investigation, and for the advantage of the victims, it will be inappropriate to reply apart from to say that Congressman Santos was fully unaware of any criminality happening at Harbor Metropolis Capital.”

Requested in regards to the matter for an April 2022 piece by The Each day Beast, previous to being uncovered for mendacity about his background, Santos stated he was “as distraught and disturbed as everybody else” to be taught of the allegations towards his former employer. Santos was questioned in that very same interview about incorporating the Devolder Group with the assistance of Harbor Metropolis’s ex-chief monetary officer and going into enterprise with others from the shuttered firm, none of whom have been singled out within the SEC grievance.

“That firm too was all of the individuals who have been left adrift I attempted to assist,” Santos defined. “All of us acquired collectively to begin a enterprise, however that was dissolved as properly, already.”

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

Along with launching the Devolder Group, he seems to be behind the creation of RedStone Methods LLC, a political group that the Federal Election Fee says was by no means registered with their company. Santos and his lawyer declined to reply questions from the New York Occasions about RedStone’s fundraising efforts in previous election cycles, regardless of the agency itemizing the Devolder Group as one in every of its managing officers in incorporation paperwork.

The outlet reviewed the restricted marketing campaign finance information related to the group, and located that RedStone was paid $6,000 in April 2022 by a PAC referred to as Rise NY, which is run by Santos’s sister Tiffany. The report additionally claimed that Santos was immediately concerned in not less than one donor solicitation for RedStone, which might be a violation of legal guidelines barring candidates or their campaigns from coordinating with such organizations.

Finance

US labor market finishes 2024 on high note, adding 256,000 jobs in December as unemployment falls to 4.1%

The US economy added more jobs than forecast in December while the unemployment rate unexpectedly fell.

Data from the Bureau of Labor Statistics released Friday showed 256,000 new jobs were created in December, far more than the 165,000 expected by economists and higher than the 212,000 seen in November. The unemployment rate fell to 4.1% from 4.2% in November. December marked the most monthly job gains seen since March 2023.

Revisions to the unemployment rate in 2024 also showed the labor market was stronger than initially thought. The cycle high for the unemployment rate had initially been 4.3% in July but that figure was revised down to 4.2% in Friday’s release.

“There is no denying that this is a strong report,” Jefferies US economist Thomas Simons wrote in a note to clients on Friday.

Wage growth, an important measure for gauging inflation pressures, rose 0.3% in December, in line with economists’ expectations and below the 0.4% seen in November.

Compared to the prior year, wages rose 3.9% in December, below the 4% seen in November. Meanwhile, the labor force participation rate was flat at 62.5%.

The strong picture of the US labor market presented in Friday’s report pushed out investor bets on when the Federal Reserve will cut interest rates next. Traders now see a less than 50% chance of the Fed cutting interest rates until June, per the CME Fed Watch Tool. A day prior, investors had favored a cut in May.

Read more: How the Fed rate cut affects your bank accounts, loans, credit cards, and investments

“You’re seeing this steady but slightly cooling labor market trend, which is very encouraging from a Fed perspective,” EY chief economist Gregory Daco told Yahoo Finance. “I think the attention will actually pivot back towards inflation developments over the course of the next three months.”

Stocks sank following the report, with futures tied to all three major averages down nearly 1%. Meanwhile, the 10-year Treasury yield (^TNX), a recent headwind for stocks, added about 8 basis points to reach 4.78%, its highest level since November 2023.

“The problem here now is if you’re looking for rate cuts based on a weakening labor market..stop looking for those,” Steve Sosnick, chief strategist at Interactive Brokers, told Yahoo Finance. “It’s not going to happen in the immediate term.”

Josh Schafer is a reporter for Yahoo Finance. Follow him on X @_joshschafer.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Finance

SBA Offers Financial Relief to Los Angeles County Businesses and Residents Impacted by Devastating Wildfires

Administrator Guzman to Travel to Southern California to Assess Needs

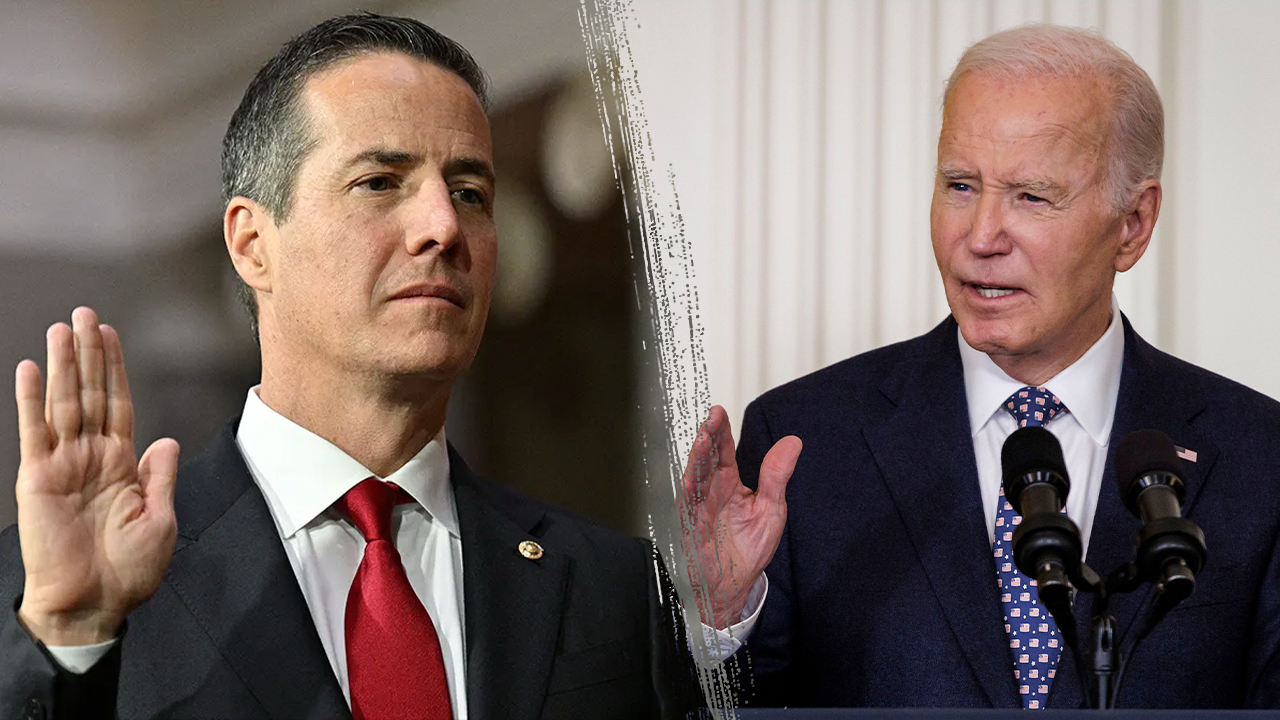

WASHINGTON, Jan. 09, 2025 (GLOBE NEWSWIRE) — Today, SBA Administrator Isabel Casillas Guzman announced that low-interest federal disaster loans are now available to Southern California businesses, homeowners, renters and private nonprofit (PNP) organizations following President Joe Biden’s major disaster declaration. The declaration covers Los Angeles and the contiguous counties of Kern, Orange, San Bernardino, and Ventura due to wildfires and straight-line winds that began Jan. 7, 2025.

Administrator Guzman also will join FEMA Administrator Deanne Criswell in Southern California this week to assess on-the-ground needs and ensure the SBA is fully prepared to assist businesses, homeowners, and renters impacted by this disaster.

“As heroic firefighters and first responders continue to battle the devastating wildfires sweeping across Southern California, the federal government is surging resources to ensure that Angelenos are prepared to recover and rebuild from this catastrophe,” said SBA Administrator Guzman. “In response to President Biden’s major disaster declaration, the SBA is mobilizing to provide financial relief to impacted businesses and residents. Our continued prayers are with the brave individuals working to put out these fires as well as all those who have lost loved ones, their homes, and their businesses to this disaster. We stand ready to support our fellow Americans for as long as it takes.”

Loans are available to businesses of all sizes and PNP organizations to repair or replace damaged or destroyed real estate, machinery, equipment, inventory, and other business assets. The SBA also offers Economic Injury Disaster Loans (EIDLs) to small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most PNP organizations to help meet working capital needs caused by the disaster, even if there is no physical damage. EIDLs may be used to pay fixed debts, payroll, accounts payable, and other expenses that would have been met if not for the disaster. Businesses can apply for loans of up to $2 million.

Disaster loans of up to $500,000 are available to homeowners to repair or replace damaged or destroyed real estate. Homeowners and renters also are eligible for up to $100,000 to repair or replace damaged or destroyed personal property, including personal vehicles.

Interest rates can be as low as 4% for businesses, 3.625% for PNP organizations, and 2.563% for homeowners and renters, with terms up to 30 years. Loan amounts and terms are set by the SBA and based on each applicant’s financial condition. Interest does not begin to accrue until 12 months from the date of the first disaster loan disbursement and loan repayment can be deferred 12 months from the date of the first disbursement.

Finance

Using The Emotions Wheel To Transform Financial Help

Diverse people holding emoticon ***These graphics are derived from our own 3D generic designs. They … [+]

I recently launched a peer financial coaching center at my university, providing students with a place to receive financial coaching help. While the center primarily relies on trained peer financial coaches to assist fellow students, I occasionally step in as a financial coach. During one of my sessions, a young college student arrived with a big smile, radiating confidence and maturity. She seemed poised and self-assured, and I assumed our session would likely cover advanced financial topics, like stocks or Roth IRAs.

Still, I decided to start by asking her how she was feeling.

She gave me a sideways glance and replied, “OK.”

Seeing her hesitation, I decided to ask a follow-up question: “Would you mind looking at this emotion wheel and letting me know which emotion best matches how you’re feeling?”

She studied the colorful wheel for a moment, then handed it back and said, “‘Powerless’ and ‘bleak.’”

Her serious tone caught me off guard—I hadn’t expected that response.

“Let’s start there,” I said. “Tell me more about why you’re feeling that way.”

Financial Facilitator, Not Advice Giver

In my article, The Path to Financial Health Goes Deeper Than Advice, I argued that most people are not ready to change, which is why traditional financial advice often falls short. Instead, the key to improving financial health is having someone come alongside as a financial facilitator—not simply an advice giver. Rather than looking down from the metaphorical mountain-top of financial expertise, a financial facilitator walks alongside the individual, helping them move toward a place where they are ready to make meaningful changes.

The book, Facilitating Financial Health, emphasizes that the most important characteristic of a financial facilitator is empathy. Empathy involves warmth, genuineness, and positive regard. It involves feeling another person’s emotions alongside them. However, empathy is only possible once you truly understand how someone is feeling.

Reflecting on my encounter with the student who described feeling “powerless” and “bleak,” imagine how the meeting might have unfolded if, after she initially replied that she was “OK,” I had simply launched into a discussion about stocks and Roth IRAs.

Given her kind nature, I suspect she would have smiled politely and even thanked me for my efforts. However, beneath the surface, she would have left the session feeling just as unsupported—if not worse—than before. While I might have walked away feeling accomplished, she would have gained nothing meaningful from our conversation, and the opportunity to truly help her would have been lost.

Magnify Your Empathy Powers With Emotional Wheels

One way to improve your ability to express empathy is by helping someone discover and articulate their emotions. Simply asking, “How are you feeling?” may not yield a clear response, as the person might not be ready to answer or may struggle to put their emotions into words. An emotion wheel is a powerful tool that assists individuals in identifying their feelings. The most effective emotion wheels provide enough granularity to ensure that everyone, regardless of their emotional state, can find the precise word(s) to describe how they are feeling.

Over the past 50 years, psychologists and researchers have significantly advanced the development of emotion wheels to better understand and categorize human emotions. Robert Plutchik’s influential “Wheel of Emotions” (1980) was one of the earliest models, highlighting eight core emotions—joy, trust, fear, surprise, sadness, disgust, anger, and anticipation—arranged in a circular structure to illustrate their intensities, combinations, and opposites.

More recent emotion wheels distinguish between comfortable and uncomfortable emotions, reflecting findings that these types of emotions are processed in different parts of the body (Enete et al., 2020). This distinction helps explain why individuals can simultaneously experience seemingly contradictory emotions, such as being “thrilled” and “scared.”

Using Emotion Wheels

The emotion wheel I use comes from Human Systems, which provides two emotion wheels: one for comfortable emotions and another for uncomfortable emotions. Each wheel identifies five or six broad emotions and breaks them down into up to nine sub-emotions.” Each sub-emotion is further refined into two sub-sub emotions for greater specificity.

For instance, the uncomfortable emotion wheel by Human Systems includes six broad emotions: Angry, Embarrassed, Afraid, Sad, Dislike, and Alone. Under “Angry,” there are nine sub-emotions such as Offended, Indignant, Dismayed, Bitter, Frustrated, Aggressive, Harassed, Bored, and Rushed. Each sub-emotion is further detailed, like “Insulted” or “Mocked” under “Offended,” and “Pushed” or “Pressured” under “Rushed.”

I often use these emotion wheels with my two children as part of teaching them to identify their emotions. My wife and I believe this helps them develop better coping and communication skills. When our kids are overwhelmed by their emotions, asking them to pinpoint how they’re feeling can be incredibly effective. (Although, one time my son humorously thwarted this approach by circling the entire uncomfortable emotions wheel and walking away!)

Conclusion

When providing financial help to others, it’s essential to first help them identify their emotions. Emotion wheels are powerful tools for assisting individuals in recognizing and naming their feelings. The understanding that you gain from an emotion wheel enables you to express genuine empathy with others, which is crucial for effectively “walking with them” on their journey toward greater financial health.

-

Business1 week ago

Business1 week agoThese are the top 7 issues facing the struggling restaurant industry in 2025

-

Culture1 week ago

Culture1 week agoThe 25 worst losses in college football history, including Baylor’s 2024 entry at Colorado

-

Sports1 week ago

Sports1 week agoThe top out-of-contract players available as free transfers: Kimmich, De Bruyne, Van Dijk…

-

Politics1 week ago

Politics1 week agoNew Orleans attacker had 'remote detonator' for explosives in French Quarter, Biden says

-

Politics1 week ago

Politics1 week agoCarter's judicial picks reshaped the federal bench across the country

-

Politics6 days ago

Politics6 days agoWho Are the Recipients of the Presidential Medal of Freedom?

-

Health5 days ago

Health5 days agoOzempic ‘microdosing’ is the new weight-loss trend: Should you try it?

-

World1 week ago

World1 week agoIvory Coast says French troops to leave country after decades

/cdn.vox-cdn.com/uploads/chorus_asset/file/23935560/acastro_STK103__03.jpg)