Finance

Forget meme stocks: ‘The smartest people in finance do one thing,’ says investing expert

Should you observe monetary figures on social media, chances are high you are getting inundated with new concepts every single day. Whether or not it is shopping for shares, “HODLing” cryptocurrency or buying and selling choices, there’s at all times seemingly a brand new strategy to get richer sooner.

Whereas some folks do handle to get wealthy fast via buying and selling, for many, constructing wealth is a long-term sport. And when your aim is a long time away, the perfect recommendation tends to be boring. Actually, it could boil all the way down to doing one easy factor.

“The neatest folks in finance do one factor: they purchase a basket of shares (ETFs, MFs) that is low charges, and so they do not have a look at it once more,” advertising and marketing professor, podcaster, creator and all-around monetary influencer Scott Galloway wrote in a latest tweet.

Eric Balchunas, a senior exchange-traded fund analyst at Bloomberg, expressed an identical sentiment. “In case your aim is to stay it to the billionaire Wall St ppl/equipment then simply purchase and maintain an affordable index fund. That is solely strategy to do it. And you will get rich in course of, a two-fer,” he wrote on Twitter.

Fairly than toiling away out there’s every day nitty gritty, long-term buyers are higher off shopping for diversified investments on a budget and hanging onto them over the long run, monetary consultants say. This is why.

Why diversification helps you as an investor

Shopping for a broad basket of investments ensures that you simply’re not taking too massive a guess on anybody particularly.

“All of it goes again to the entire thought of not placing your eggs in a single basket,” says Amy Arnott, a portfolio strategist at Morningstar. “By diversifying, that may aid you keep away from being overexposed to anybody specific space of the market when it is out of favor.”

That is the place mutual funds and exchange-traded funds are available in. These baskets of shares are designed to provide you publicity to a large swath of the market. Funds branded as “whole inventory” funds usually maintain a consultant pattern of your complete U.S. inventory market, whereas “whole bond” funds do the identical for bonds.

Holding giant mixes of shares and bonds has traditionally been play — one which has relied on the upward trajectory of broad U.S. markets.

A portfolio of 80% shares and 20% bonds, with every element represented by broad market indexes, earned an annual return of 9.6% from 1926 via 2019, in keeping with calculations by Vanguard.

Low-fee mutual funds and ETFs: ‘You get what you do not pay for’

Should you agree with the consultants that you simply’re higher off shopping for diversified funds than particular person investments, the query then turns into, which fund do you select? All issues being equal, the most cost effective one.

Put succinctly by Vanguard founder Jack Bogle: “You get what you do not pay for.”

That is as a result of each greenback that you simply pay to a mutual fund or ETF firm within the type of an expense ratio — the annual administration price you pay to personal a fund — is a greenback that might be rising at a compounding fee alongside your investments.

Take into account two funds. You make investments $10,000 into every, maintain for 40 years, and every earns an 8% annualized return.

One fund prices annual bills of 0.50%. After 40 years, your $10,000 funding in such a fund can be price practically $178,000 with you having paid $12,145 in charges over that interval.

The opposite fund prices an expense ratio of 0.03% — the going fee for a lot of ETFs that observe the efficiency of broad inventory market indexes. After 40 years, your funding on this fund is price simply shy of $215,000. Your whole charges over 4 a long time: $832.

Depart your portfolio alone

As soon as you have established a low-cost, broadly diversified portfolio, Galloway and different monetary professionals counsel that you simply’d be smart to by no means have a look at it once more.

Whereas it is good to verify in in your portfolio often, particularly to ensure your allocations are in keeping with your tolerance for threat, the extra you meddle within the day-to-day goings on of your portfolio, the likelier you might be to decide that hurts your investments.

Many years of educational research present that just about all day-traders — those that try and earn income from shopping for and promoting investments each day — lose cash over lengthy intervals.

Plus, practically all buyers — 98% in a latest Morningstar examine — exhibit not less than one cognitive bias that negatively impacts their monetary decision-making.

Should you’re skeptical, consider how you’ll make investments throughout a roaring bull market versus instances when inventory costs are falling. Ideally, buyers would have a tendency to purchase extra when costs are low. However that is not often the case, says Kelly LaVigne, vice chairman of client insights at Allianz Life.

“When the market is doing nicely, persons are throwing their cash at it. When it is doing poorly, they’re maintaining their cash out,” he instructed CNBC Make It. “It is doing the precise reverse of what you are speculated to be doing.”

Enroll now: Get smarter about your cash and profession with our weekly publication

Do not miss: That is the minimal amount of money it’s essential be ready for an surprising emergency, new information finds

Finance

Personal finance lessons from Warren Buffett’s latest letter

Last Nov. 25, Warren Buffett announced that he would donate a substantial portion of the shares he owned in Berkshire Hathaway to his four family foundations.

In his announcement, he included a letter which contained some important personal finance lessons that we can apply to our own situation.

One of my favorites is his comment that hugely wealthy parents should only leave their children enough so they can do anything but not enough that they can do nothing.

Despite being one of the richest men in the world, Buffett shared that his children only received $10 million each when his wife died. Although $10 million is a lot of money, it’s less than 1% of his wife’s estate.

I am not hugely wealthy, nor do I have $10 million. However, Buffett’s comment about just giving our children enough made me reflect on the importance of also making our children resilient.

Many of us want to make sure that our children will be financially secure by the time we pass away. While there is nothing wrong with this, sometimes we go overboard in making sure that this goal is met.

Article continues after this advertisement

For example, sometimes my husband and I are guilty of overindulging our children.

Article continues after this advertisement

Warren Buffett’s comment reminded me that we should also allow our children to go through difficulties so that they will become resilient and learn how to survive comfortably with less. Aside from letting them know that they shouldn’t expect much in terms of inheritance, this could mean limiting their allowance, allowing them to commute to school when there is no car available, and saying “no” to their request to buy nice and expensive things like the latest top of the line gadgets.

Another thing that we are guilty of (especially if you are Filipino Chinese like me) is thinking that we need to build a successful business so that our children will eventually have a steady source of income and the bragging rights of being their own boss.

Although there is nothing wrong with building a successful business, passing it on to our children should not be a priority. This is because there’s no guarantee that our children will want to run our business. In fact, they might not be equipped to run the business properly. If that is the case, they may end up running our business to the ground. This would put them in a worse position, especially if they were raised to think that they do not have to worry about money because they have a business that will take care of them.

Another personal finance lesson Warren Buffett shared is the importance of being grateful and learning to give back.

In his comments, Warren Buffett acknowledged the role of luck in making him wealthy—being born in the US as a white male in 1930 and living long enough to enjoy the power compounding.

However, he recognized that not everyone is as lucky as he is. Because of this, Buffett and his family are focused on giving back so that others who were given a very short straw at birth would have a better chance at gaining wealth.

Learning how to be grateful is very important. We cannot be truly happy unless we are grateful for what we have. In fact, many people who are rich are unhappy because they constantly compare themselves to others who have something that they don’t.

Meanwhile, giving back is a natural outcome of being grateful. It is also very fulfilling. For example, in my company COL Financial, we believe that everyone deserves to be rich. This is why we actively educate Filipinos on personal finance and the stock market.

Helping Filipinos better manage their hard-earned money is one of the greatest fulfillments of my career as an analyst. In fact, this is one of the reasons why I have stayed as an analyst despite the availability of other higher paying jobs.

Finally, Warren Buffett shared the importance of learning how to say no.

People who are wealthy will always be approached by friends, family and others seeking help. Although giving back is important, there is a limit as to how much we can give. Because of that, we need to learn how to say no, even if it is difficult or unpleasant.

To make it easier for his children to say no, Buffett’s foundations have a “unanimous decision” provision which states that unless all his three children agree, the foundations cannot distribute funds to grant seekers.

Although most of us are not as rich as Buffett, we can also benefit from having an accountability partner to help us say no to requests for help. That person can be our spouse, our sibling, or someone who shares our values and understands that while we want to be generous, our resources are limited. Our accountability partner can also help us decide who we should or should not help which is also a difficult task.

Warren Buffett ended his letter by saying that his children spend more time directly helping others than he has and are financially comfortable but not preoccupied with wealth. Because of that, his late wife would be proud of them and so is he.

As a parent, I’d be happier to have children who grow up to become productive citizens with good values rather than to have children who become very rich but are dishonest and greedy. INQ

Finance

Personal finance guru Dave Ramsey warns over 'mind-blowing' Christmas debt

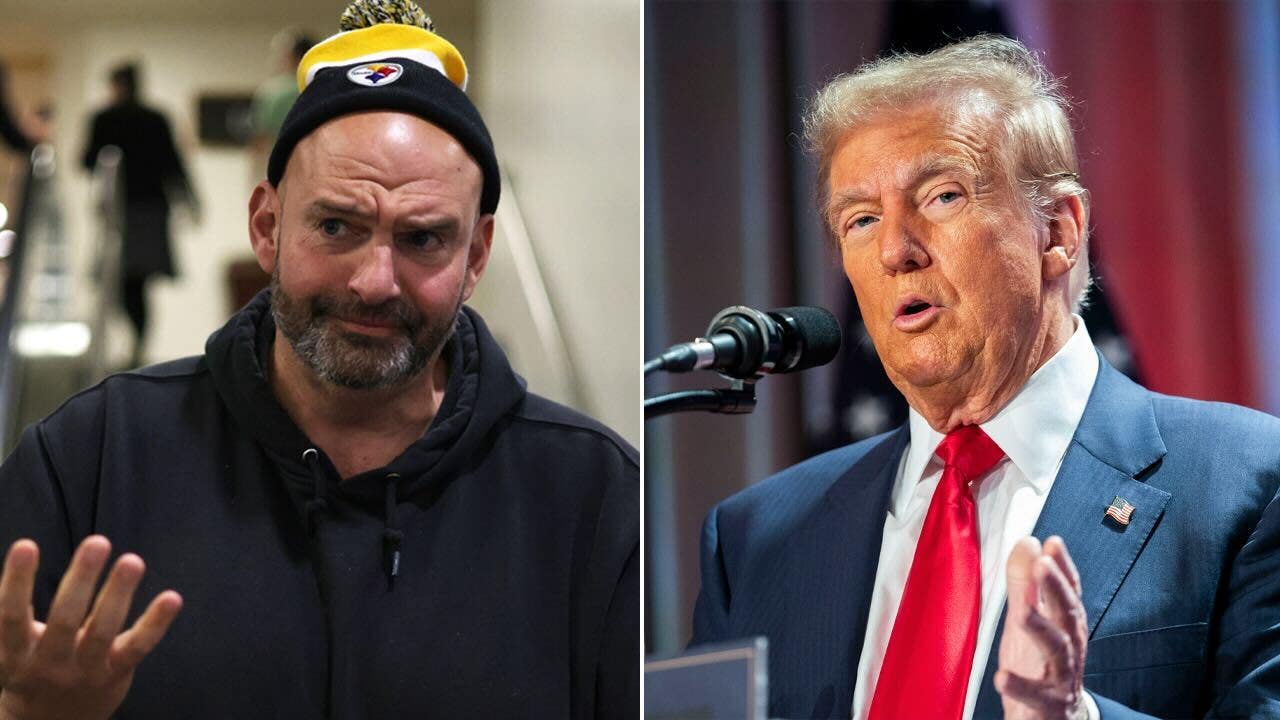

Personal finance expert Dave Ramsey joined ‘Fox & Friends’ to discuss the Federal Reserve possibly cutting interest rates and how Americans can avoid overspending during the holidays.

Holiday spending is putting a big strain on American wallets and leaving some in debt well past the holiday season; however, personal finance expert Dave Ramsey said ‘mind-blowing’ debt can be avoided.

“The average over the last several years has been that people pay their credit card debt from Christmas into May,” The Ramsey Solutions personality shared during an appearance on “Fox & Friends” on Wednesday. “So it takes them about half the year to come back, and because they don’t plan for Christmas… it sneaks up on them like they move it or something.”

According to a study conducted by Achieve, the average American will spend more than $2,000 for the 2024 holiday season, breaking down the outflow of cash into travel and holiday spending on hosting parties, food, clothing, and other gifts.

STOP OVERSPENDING OVER THE HOLIDAYS AND START THE NEW YEAR OFF FINANCIALLY STRONG

Another recent survey by CouponBirds indicated that parents will spend an average of $461 per child and that 49% of parents will go into debt to pay for this Christmas.

Ramsey Solutions’ Dave Ramsey says “you won’t overspend” if you stick to a Christmas budget. (Getty Images)

The Ramsey Solutions personality balked at the amount of money shelled out for the season while explaining that the holiday should not come as a shock, and that spending for it should be planned out.

“Those numbers are mind-blowing when you look at the averages there. That’s a lot of money going out,” Ramsey added, “all in the name of happiness comes from stuff, and it doesn’t.”

He also weighed in and agreed on advice from fellow expert, Ramsey Solutions personality and daughter Rachel Cruze, who suggested making a list of people to shop for and noting how much to spend on each.

FOX Business’ Lauren Simonetti details the holiday shopping season on ‘Cavuto: Coast to Coast.’

“You know, I’m old, and I met a guy from the North Pole,” the expert joked. “He said ‘make a list and check it twice,’ so Rachel’s right.”

Ramsey followed up by expanding on his daughter’s suggestion: “If you do that, and you put a name beside it, and then you total up those dollar amounts, you have what’s called a Christmas budget.”

“If you stick to that, you won’t overspend,” “The Ramsey Show” host remarked.

National Retail Federation CEO Matt Shay reacts to the latest report that holiday spending is expected to reach $989B this year.

The money guru pointed out what he sees as problematic with the holiday season – not taking a shot at Christmas itself – but referring back to the spending issues.

“The problem with Christmas is not that we enjoy buying gifts for someone else. That’s a wonderful thing,” he reassured. “The problem is we impulse our butts off, and we double up what we spend because the retailers make all their money during this season.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Ramsey concluded by advising shoppers to be wary of retailers and to not be ensnared by their marketing strategies.

“They’re great merchandisers,” he warned. “They’re great at putting stuff in front of us that we hadn’t planned to buy.”

READ MORE FROM FOX BUSINESS

Ramsey Solutions personality Jade Warshaw breaks down the latest economic data that shows consumer credit card debt is piling up amid a jump in spending.

Finance

Can AI Solve Your Personal Finance Problems? Well …

Switch the Market flag

for targeted data from your country of choice.

Open the menu and switch the

Market flag for targeted data from your country of choice.

Need More Chart Options?

Right-click on the chart to open the Interactive Chart menu.

Use your up/down arrows to move through the symbols.

-

Politics1 week ago

Politics1 week agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology1 week ago

Technology1 week agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics1 week ago

Politics1 week agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology1 week ago

Technology1 week agoMeta asks the US government to block OpenAI’s switch to a for-profit

-

Business7 days ago

Business7 days agoFreddie Freeman's World Series walk-off grand slam baseball sells at auction for $1.56 million

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/23951353/STK043_VRG_Illo_N_Barclay_3_Meta.jpg) Technology7 days ago

Technology7 days agoMeta’s Instagram boss: who posted something matters more in the AI age

-

News1 week ago

East’s wintry mix could make travel dicey. And yes, that was a tornado in Calif.

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png) Technology1 day ago

Technology1 day agoGoogle’s counteroffer to the government trying to break it up is unbundling Android apps