Register now for FREE limitless entry to Reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/UKP5NNQRL5IIVG5GXU63E6HTUM.jpg)

A common view of Lima from Pescadores seashore within the Chorrillos district of Lima, October 27, 2015. REUTERS/Mariana Bazo/File Photograph

LIMA, Sept 8 (Reuters) – Peru can obtain financial progress of 4.3% in 2023, beating official forecasts which can be already optimistic, due to a brand new financial bundle, Finance Minister Kurt Burneo mentioned on Thursday.

“We’re speaking about round 4.3% (progress),” Burneo informed Reuters in an interview, a beforehand unreported determine that comes after the federal government unveiled an financial bundle that he says will considerably increase the financial system.

“The outcomes depend upon issues like how lengthy Congress takes to approve our bundle,” Burneo added.

The bullish expectations construct on already optimistic forecasts. Peru’s finance ministry mentioned in August that the nation would develop 3.5% in 2023, a lot larger than the typical estimate of two.8% as compiled by Refinitiv.

Peru is the world’s No. 2 copper producer and Burneo mentioned he needs to facilitate new mines and expansions. He has met with Newmont Mining Corp (NEM.N) and plans to take action once more, he added, in hopes of securing its $2 bln Yanacocha Sulfuros venture.

Burneo has made boosting financial progress his key precedence amid a slowdown in world situations. He unveiled a bundle on Thursday that features subsidies, money transfers and better public spending. learn extra

Peru’s financial system has additionally been impacted by political turmoil beneath President Pedro Castillo, who campaigned on a far-left platform that spooked buyers earlier than he moderated it as soon as in workplace. learn extra

Burneo himself is a center-left economist who has served as a central financial institution board member and former economics vice minister.

He added that the ministry’s present forecast of three.3% progress for this 12 months is “prudent” and will are available in larger due to the preliminary influence of his financial bundle.

Reporting by Marcelo Rochabrun and Marco Aquino in Lima

Enhancing by Matthew Lewis

Our Requirements: The Thomson Reuters Belief Ideas.

TOKYO – New ruling Liberal Democratic Party leader Shigeru Ishiba, set to soon become Japan’s next prime minister, is considering naming former Chief Cabinet Secretary and health minister Katsunobu Kato as finance minister, sources close to the matter said Saturday.

Former Defense Minister Ishiba, the winner of the LDP’s presidential race on Friday, also plans to appoint former Environment Minister Shinjiro Koizumi as its election campaign chief, the sources said, as lawmakers brace for the possibility of a general election by the end of this year.

Ishiba, meanwhile, has decided to retain Yoshimasa Hayashi, known as a right-hand man to outgoing Prime Minister Fumio Kishida, as chief Cabinet secretary and the top government spokesperson. Hayashi previously served as foreign minister.

Former Japanese Chief Cabinet Secretary Katsunobu Kato, a candidate contesting the upcoming leadership race of Japan’s ruling Liberal Democratic Party, speaks during a debate at the Japan National Press Club in Tokyo on Sept. 14, 2024. (Kyodo) ==Kyodo

Kato, a former Finance Ministry bureaucrat, Hayashi and Koizumi were among the record nine candidates in the leadership race to choose the successor to Kishida, who did not seek reelection following a slush fund scandal that has hit the party.

Ishiba plans to launch the new LDP leadership on Monday. He is expected to become prime minister on Tuesday, as both houses of parliament are controlled by the LDP and its coalition partner, the Komeito party. He will then form a Cabinet on Tuesday.

The new president has decided to appoint Hiroshi Moriyama, the head of the LDP’s decision-making general council, as its secretary general, the party’s No. 2 position, while tapping former Defense Minister Itsunori Onodera as its policy chief, the sources said.

In his fifth presidential bid, Ishiba, who also served as the party’s secretary general, won 215 of the 409 valid votes cast by LDP lawmakers and rank-and-file members in a runoff vote on Friday, while economic security minister Sanae Takaichi secured 194.

Regarding the Cabinet lineup, senior vice finance minister Ryosei Akazawa, a close aide to Ishiba, is set to be given a ministerial post and transport minister Tetsuo Saito, a lawmaker of Komeito, is certain to be retained, the sources said.

Ishiba said at a press conference after he was elected LDP chief, “I will ask each of them (the other leadership candidates) to take the position that suits them best.” But Takaichi, who was narrowly defeated by 21 votes in the runoff, said, “I will support” Ishiba “as a member of parliament.”

Amid mounting speculation that Ishiba may dissolve the House of Representatives for a snap election in the near future, he apparently accelerated preparations on Saturday by having photos taken for campaign posters.

Related coverage:

U.S. expresses hope to foster even closer ties with Japan’s next PM

Public urges incoming Japan leader Ishiba to improve cost of living

FOCUS:New Japan ruling LDP chief Ishiba may face make-or-break moment as PM

By Patricia A. Scheyer

NKyTribune reporter

Linda Chapman is about to close a chapter on her life as Finance Director in the city of Florence, a position she has held for the last 21 years.

She finished her last week, and though she is a little sad about leaving, a part of her is looking forward to the freedom that comes with not having to report to work at a certain time of the morning.

“This is the first time in years that I haven’t had to plan anything,” she said, looking over her desk full of papers, and computers with three screens. “From January to August things are really busy with taxes and the budget, then we have the property taxes in October, so I always took my vacation in November or December. I felt like this was the best time to retire, too.”

Chapman is from the west side of Cincinnati and she said the roots are strong there — “you never leave the west side.”

She attended McCauley high school and the University of Cincinnati and then became an accountant.

“I didn’t know what I wanted to do until my senior year in high school,” she said. “I always thought I would go into a dental or nursing field and I took classes that would help with those fields, but there were things I didn’t like about those fields. So I decided to go with numbers.”

She eventually found her way to Rankin and Rankin, where she worked for ten years, doing audits for different cities in the Northern Kentucky area.

It was while she was doing the June 30, 2002 audit for the city of Florence that she discovered a problem on the books.

“Things just didn’t add up,” she explained. “The numbers weren’t right.”

Ron Epling had been the Finance Director for ten years at Florence, and Chapman knew him, so she worked the numbers over and over before she turned the evidence over to her boss at Rankin and Rankin, and the police brought charges against Epling for embezzling $4.9 million from the city.

Linda Chapman was hired as Finance Director in March of 2003.

“The embezzlement meant I started with a big mess,” she said. “The city was able to recover everything. It was bad, but it was up to me to come up with programs to install so that it never happened again. I put several safeguards in, and had to change all the systems over. It took about two years. So even though it was a big mess, it was a challenge for me, and I really like challenges.”

She said that the embezzlement was definitely the worst thing she had to deal with, but the result was the greatest satisfaction of her job, because she met the challenge and she fixed it. Governmental accounting is a special niche, she commented. Chapman said the people who work with her are very great to work with, the five ladies who work up front and her right hand man, Jason Cobb.

Through the years, she said she has had ups and downs, but her attitude is equanimical— most things ‘are what they are’ and she handles them with ease. Her philosophy is ‘one day at a time’, and she said she would come into work each day with the expectation of something good happening, something different, to make her smile.

Without the job to come into, what does she want to do as the next step in her life?

“I have no clue,” Chapman said with a smile.

Her first idea is that she has yard work to do, as well as some gardening chores to take care of.

Gardening is one of her passions. Chapman has a large garden, the length of the side of her house, and garden boxes in the back of her house.

“I grow green beans, tomatoes, zucchini, peppers, cucumbers, and a lot more,” she said. “Gardening is my stress relief.”

She is not a person who travels a lot. She likes to take her annual vacation to Pigeon Forge, an area she loves, but she has no sites she wants to see, like Mount Rushmore, or Hawaii.

“I don’t want to spend that much time in the air,” she explained about visiting Hawaii. “And I don’t want to go on a cruise. I can just picture me on a boat that becomes Titanic number two.”

Chapman has plans to go to Opryland for their Christmas extravaganza. Another passion she enjoys is Christmas.

“I am a big Christmas person,” she said, pointing to pictures of her decorated yard. “My yard isn’t that big, but I squeeze it all in.”

The lights and inflatables cover every available inch of yard, and she said it is such a glorious site people stop in front of the house to take it all in. It does take awhile to put it all up and take it all down, but she doesn’t mind.

“Inside, I put up my tree at Halloween, and during the time while I hand out candy, I also decorate the tree,” she said, laughing. “I love my Christmas decorations!”

She also decorates her office, and her co-workers like to decorate, so that tradition will continue.

Chapman loves to do jigsaw puzzles, and she said her minimum puzzle is 1000 pieces. She showed pictures of her special setup for puzzles so she can concentrate on them and not lose any of the tiny pieces.

“I do a lot of puzzles, and one of the worst ones I have done was candy canes,” she pointed to a picture that showed a massive amount of striped candy canes. “Another one that was challenging was one with pictures of rolls of toilet paper. I finished it, though, even though it took about a month, and I had to get new lighting. I haven’t met a puzzle I haven’t finished yet.”

Chapman feels she has enough to keep her busy through the end of the year, but she understands that when January gets here, she might reach a point where she looks around and there is nothing to do.

“I will still take it one day at a time, but I will be looking for different challenges, different things to fulfill me,” she said. “I have no doubt I will find things. I would like to get a better exercise regimen, to add to my walking.”

Chapman said her mom and dad live in the same area, and she has two brothers and a sister who live relatively close, so she knows she will be getting together with family a lot.

She always thought she might like to have a dog, but she hasn’t had one since she was a child, largely because she didn’t feel that she had the time that a dog requires, but she is now thinking about pet ownership.

“I figure I will take a breather, and then keep on keeping on, stay busy and keep my mind fresh,” she ventured. “I think it’s kind of exciting to see what’s going to develop out there. If something comes up, I can take advantage of being spontaneous. I am looking forward to it.”

Stocks traded mixed on Friday but closed the week on a high as investors embraced an inflation report seen as crucial to the Federal Reserve’s next decision on interest rate cuts.

The Dow Jones Industrial Average (^DJI) gained 0.3% and finished with a fresh record. The S&P 500 (^GSPC) lost 0.1%, but is coming off a record-high close from the prior session. Meanwhile, the tech-heavy Nasdaq Composite (^IXIC) sank about 0.4%.

Despite the mixed trading on Friday, the stock gauges all recorded wins for the week after confidence in the economy returned to the market. The Dow and the S&P added about 0.7%, while the Nasdaq rose 1%.

A solid GDP reading, combined with continued cooling in inflation, has cemented growing conviction that the Fed can nail a “soft landing” as it embarks on a rate-cutting campaign.

The August reading of the Personal Consumption Expenditures (PCE) index, the inflation metric favored by the Fed, showed continued cooling in price pressures. The “core” PCE index, which is most closely watched by policymakers, rose 0.1% month over month, lower than Wall Street forecasts.

The PCE reading appeared to goose up bets on another jumbo-sized rate cut from the Fed next month. More than half of traders — around 52% — now expect a 50 basis point cut.

Read more: What the Fed rate cut means for bank accounts, CDs, loans, and credit cards

Elsewhere, China added to its stream of stimulus measures, boosting markets once again. Mainland stocks scored their biggest weekly win since 2008, and luxury stocks are set for their best week in years as hopes for Chinese demand rise. Meanwhile, shares of Alibaba (BABA, 9988.HK), JD.com (JD, 9618.HK), and Meituan (3690.HK, MPNGY) surged amid the buying spree.

Live13 updates

One of the most important debates sparked over the sudden rise of generative AI tools is whether the process of training large language models using existing artistic works is a new form of copyright infringement.

An array of authors, media outlets and other creative professionals have sued to stop AI companies from using their content on the internet, arguing that their works are being used without compensation in order to advance a new technology and market opportunities.

Meta CEO Mark Zuckerberg will soon play a direct role in one of the most important lawsuits tackling this subject. Earlier this week a US District Court judge overseeing a suit brought by authors including Sarah Silverman and Ta-Nehisi Coates rejected Meta’s bid to prevent the deposition of Zuckerberg, the Associated Press reported Friday.

Meta had tried to block Zuckerberg’s deposition by arguing that he does not have unique knowledge of the company’s AI operations and other Meta employees could provide the same information. Zuckerberg’s participation will likely draw even more attention to the legal matter, similar to his high-profile appearances on Capitol Hill during Congressional hearings on the role of social media in society.

Toplines: September 2024 Inquirer/Times/Siena Poll of Pennsylvania Registered Voters

Video: Federal Reserve Cuts Interest Rates for the First Time in Four Years

Video: Who Are the Black Swing Voters?

Dem lawmakers push bill to restore funding to UN agency with alleged ties to Hamas: 'So necessary'

'I've never seen this': Top Republican details level of Secret Service 'lack of cooperation'

Election 2024 Polls: Florida

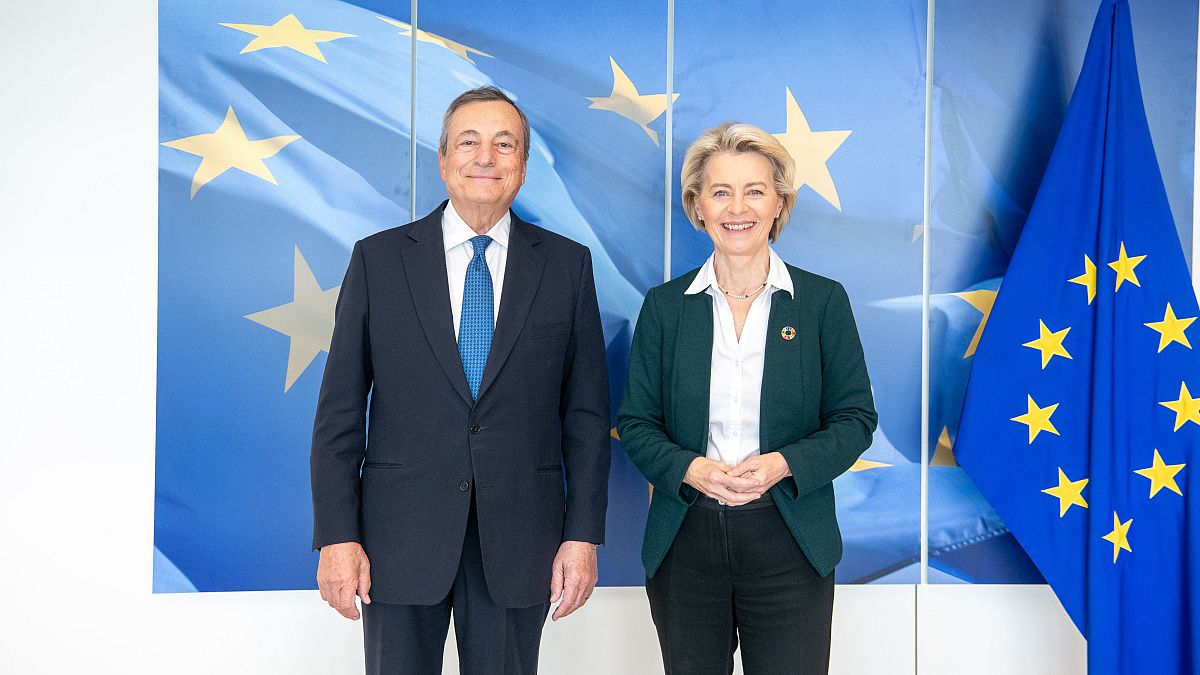

Critics slam landmark EU competitiveness report as 'one-sided'

This ETF uses ChatGPT to invest like Warren Buffett