TORONTO–(BUSINESS WIRE)–Almonty Industries Inc. (“Almonty” or the “Firm”) (TSX: AII / ASX: AII / OTCQX: ALMTF / Frankfurt: ALI) is happy to announce the closing of its personal placement to Administrators of Almonty, present shareholders and different insiders of two,852,251 frequent shares at CDN$0.94 per share and 1,428,571 Items at US$0.70 per Unit to boost gross proceeds of roughly US$3.3 million (“Placement”). Every Unit of the 1,428,571 items shall be comprised of 1 frequent share and one-half share buy warrant with every entire warrant being exercisable at a value of US$0.84 for twenty-four months from closing.

Using proceeds of this Placement shall be to pay the Plansee/GTP charges, of which the upfront money portion of US$3.0 million has now been paid.

PLANSEE/GTP SATISFACTION OF CONDITIONS PRECEDENT

The Firm is happy to advise that it has executed a Circumstances Precedent Letter with Plansee/GTP whereby each events have agreed that Almonty has glad the situations precedents required by Plansee/GTP to allow monetary closing of the KfW US$75.1 million finance facility. They key phrases of the Circumstances Precedent Letter are:

- Cost of GTP Obligations of US$3.0 million– paid in money from the proceeds of the Placement.

- Inside 120 calendar days of the monetary closing of the undertaking financing, Almonty remitting the Excellent Steadiness owing of roughly US$1.8 million. Within the occasion that the Excellent Steadiness is just not paid inside 120 calendar days of the monetary closing of the Venture Financing, Almonty will fulfill any remaining portion of the Excellent Steadiness by issuing frequent shares in Almonty to Plansee/GTP, at a value per share equal to the closing market value of Almonty’s frequent shares on the buying and selling day previous to issuance.

Now that Plansee/GTP have signed the satisfaction of Circumstances Precedent letter, KfW IPEX–Financial institution will now transfer to inside log off. Almonty expects by Friday Could twenty first that KfW IPEX–Financial institution will affirm monetary shut at which level the drawdown of the US$75.1 million will start.

SANGDONG AND COMPANY UPDATE

Almonty President and CEO, Mr Lewis Black, mentioned:

“The Firm want to take the chance of updating the shareholders on the present standing at web site in Korea and the Tungsten market usually. What’s necessary is to spotlight that the Firm positioned orders for all the lengthy lead time gear, each milling and flotation final 12 months in 2021, previous to the drawdown. This enabled us to seize pricing and supply occasions on considerably extra beneficial phrases than if ordered at the moment.

Nevertheless, supply dates have been prolonged by 2 months with world transport delays being the primary concern, but it surely won’t delay work on the web site as now we have merely adjusted our schedule to convey ahead areas which are manufactured or deliberate in South Korea and pushed set up of imported gadgets not but in nation to compensate for the transport delays. On the again of this, now we have up to date our commissioning date towards the top of Q2 2023. Given our persevering with push to save lots of prices to counter ongoing inflation on sure consumable/constructing gadgets and the delays in transport, the Firm feels this delay is warranted and justified.

On our newest evaluation of complete value escalation has resulted in a most of 5% value enhance which is comfortably absorbed by our 15% contingency constructed into the undertaking value. At present this enhance stands at 4.75%. We intend to cut back that by taking a look at areas the place we will save additional cash. I’d additionally like so as to add that vitality prices in South Korea have risen roughly 8% however is just not anticipated to rise additional as costs are set by the State by way of KEPCO. Nuclear and renewables account for greater than 35% of South Korea’s vitality platform.

As for vitality prices in Portugal at our Panasquiera mine, now we have fastened our ahead value for the subsequent 2 years at which is now at a discount on our 2021 value and saves the mine approx. EUR560,000 per 12 months. That is roughly 60% under present Portuguese vitality market costs. Manufacturing continues to be secure in Portugal. We at the moment are prepared for drawdown as we enter the accelerated building part in South Korea.”

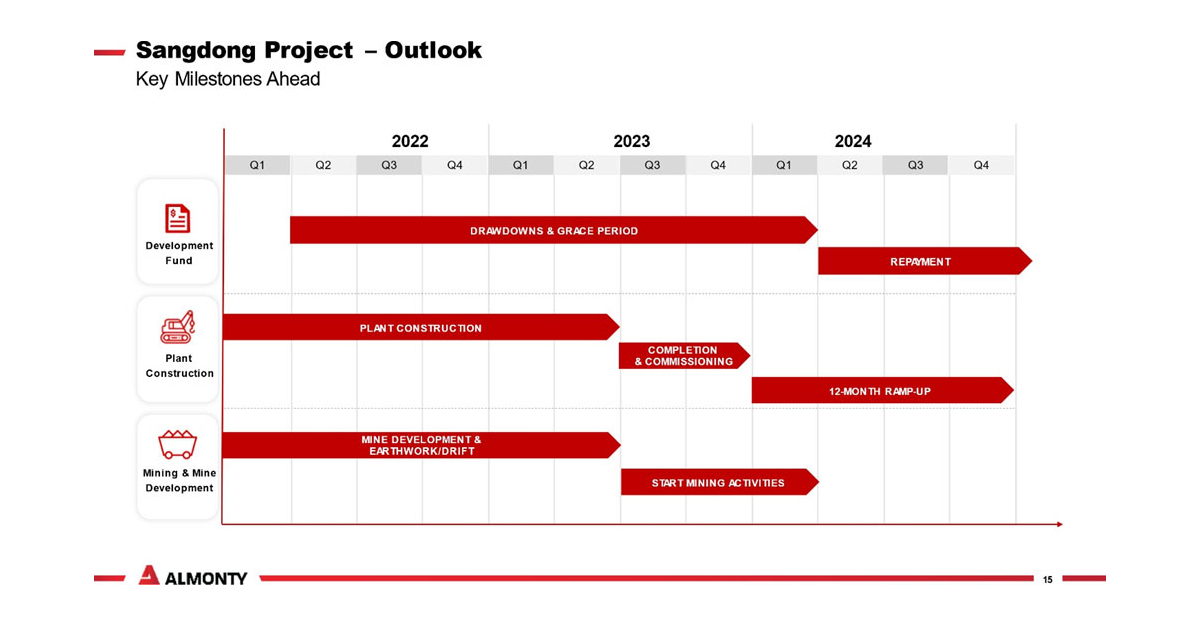

UPDATED SANGTON TUNGSTEN MINE TIMELINE

DIRECTOR SHARE SALE

The Firm advises that on April 14, 2022, Mr Lewis Black bought 300,000 frequent shares in Almonty to cowl a capital features tax legal responsibility. The frequent shares had been crossed to an present long run holder of Almonty. After the sale, Mr Lewis Black stays one of many largest shareholders within the Firm with 11,032,895 frequent shares (direct) and 13,893,920 frequent shares (oblique) which represents roughly 11.91% of the Firm, and confirms that there are not any additional gross sales deliberate presently.

For and on behalf of the board of

Almonty Industries Inc.

About Almonty

The principal enterprise of Toronto, Canada-based Almonty Industries Inc. is the mining, processing and transport of tungsten focus from its Los Santos Mine in western Spain and its Panasqueira mine in Portugal in addition to the event of its Sangdong tungsten mine in Gangwon Province, South Korea and the event of the Valtreixal tin/tungsten undertaking in north western Spain. The Los Santos Mine was acquired by Almonty in September 2011 and is positioned roughly 50 kilometres from Salamanca in western Spain and produces tungsten focus. The Panasqueira mine, which has been in manufacturing since 1896, is positioned roughly 260 kilometres northeast of Lisbon, Portugal, was acquired in January 2016 and produces tungsten focus. The Sangdong mine, which was traditionally one of many largest tungsten mines on the earth and one of many few long-life, high-grade tungsten deposits exterior of China, was acquired in September 2015 by way of the acquisition of a 100% curiosity in Woulfe Mining Corp. Almonty owns 100% of the Valtreixal tin-tungsten undertaking in north- western Spain. Additional details about Almonty’s actions could also be discovered at www.almonty.com and underneath Almonty’s profile at www.sedar.com.

Authorized Discover

The discharge, publication or distribution of this announcement in sure jurisdictions could also be restricted by legislation and subsequently individuals in such jurisdictions into which this announcement is launched, printed or distributed ought to inform themselves about and observe such restrictions.

Neither the TSX nor its Regulation Providers Supplier (as that time period is outlined within the insurance policies of the TSX) accepts duty for the adequacy or accuracy of this launch.

Disclaimer for Ahead-Trying Data

When used on this press launch, the phrases “estimate”, “undertaking”, “perception”, “anticipate”, “intend”, “anticipate”, “plan”, “predict”, “might” or “ought to” and the damaging of those phrases or such variations thereon or comparable terminology are supposed to determine forward-looking statements and knowledge. These statements and knowledge are based mostly on administration’s beliefs, estimates and opinions on the date that statements are made and replicate Almonty’s present expectations.

Ahead-looking statements are topic to identified and unknown dangers, uncertainties and different components that will trigger the precise outcomes, stage of exercise, efficiency or achievements of Almonty to be materially totally different from these expressed or implied by such forward-looking statements, together with however not restricted to: any particular dangers referring to fluctuations within the value of ammonium para tungstate (“APT”) from which the sale value of Almonty’s tungsten focus is derived, precise outcomes of mining and exploration actions, environmental, financial and political dangers of the jurisdictions wherein Almonty’s operations are positioned and adjustments in undertaking parameters as plans proceed to be refined, forecasts and assessments referring to Almonty’s enterprise, credit score and liquidity dangers, hedging threat, competitors within the mining business, dangers associated to the market value of Almonty’s shares, the flexibility of Almonty to retain key administration workers or procure the companies of expert and skilled personnel, dangers associated to claims and authorized proceedings in opposition to Almonty and any of its working mines, dangers referring to unknown defects and impairments, dangers associated to the adequacy of inside management over monetary reporting, dangers associated to governmental laws, together with environmental laws, dangers associated to worldwide operations of Almonty, dangers referring to exploration, improvement and operations at Almonty’s tungsten mines, the flexibility of Almonty to acquire and preserve obligatory permits, the flexibility of Almonty to adjust to relevant legal guidelines, laws and allowing necessities, lack of appropriate infrastructure and workers to help Almonty’s mining operations, uncertainty within the accuracy of mineral reserves and mineral assets estimates, manufacturing estimates from Almonty’s mining operations, incapacity to interchange and develop mineral reserves, uncertainties associated to title and indigenous rights with respect to mineral properties owned straight or not directly by Almonty, the flexibility of Almonty to acquire sufficient financing, the flexibility of Almonty to finish allowing, building, improvement and enlargement, challenges associated to world monetary situations, dangers associated to future gross sales or issuance of fairness securities, variations within the interpretation or software of tax legal guidelines and laws or accounting insurance policies and guidelines and acceptance of the TSX of the itemizing of Almonty shares on the TSX.

Ahead-looking statements are based mostly on assumptions administration believes to be cheap, together with however not restricted to, no materials antagonistic change available in the market value of ammonium para tungstate (APT), the persevering with potential to fund or get hold of funding for excellent commitments, expectations concerning the decision of authorized and tax issues, no damaging change to relevant legal guidelines, the flexibility to safe native contractors, workers and help as and when required and on cheap phrases, and such different assumptions and components as are set out herein. Though Almonty has tried to determine necessary components that would trigger precise outcomes, stage of exercise, efficiency or achievements to vary materially from these contained in forward-looking statements, there could also be different components that trigger outcomes, stage of exercise, efficiency or achievements to not be as anticipated, estimated or supposed. There will be no assurance that forward-looking statements will show to be correct and even when occasions or outcomes described within the forward-looking statements are realized or considerably realized, there will be no assurance that they are going to have the anticipated penalties to, or results on, Almonty. Accordingly, readers mustn’t place undue reliance on forward-looking statements and are cautioned that precise outcomes might differ.

Buyers are cautioned in opposition to attributing undue certainty to forward-looking statements. Almonty cautions that the foregoing checklist of fabric components is just not exhaustive. When counting on Almonty’s forward-looking statements and knowledge to make selections, buyers and others ought to fastidiously take into account the foregoing components and different uncertainties and potential occasions.

Almonty has additionally assumed that materials components won’t trigger any forward-looking statements and knowledge to vary materially from precise outcomes or occasions. Nevertheless, the checklist of those components is just not exhaustive and is topic to vary and there will be no assurance that such assumptions will replicate the precise consequence of such gadgets or components.

THE FORWARD-LOOKING INFORMATION CONTAINED IN THIS PRESS RELEASE REPRESENTS THE EXPECTATIONS OF ALMONTY AS OF THE DATE OF THIS PRESS RELEASE AND, ACCORDINGLY, IS SUBJECT TO CHANGE AFTER SUCH DATE. READERS SHOULD NOT PLACE UNDUE IMPORTANCE ON FORWARD- LOOKING INFORMATION AND SHOULD NOT RELY UPON THIS INFORMATION AS OF ANY OTHER DATE. WHILE ALMONTY MAY ELECT TO, IT DOES NOT UNDERTAKE TO UPDATE THIS INFORMATION AT ANY PARTICULAR TIME EXCEPT AS REQUIRED IN ACCORDANCE WITH APPLICABLE LAWS.