Art Market

Arun Kakar

Maurizio Cattelan, Comedian, 2019. Courtesy of Sotheby’s.

It may not have been the most expensive sale from last week’s marquee slate of auctions in New York, but there was no question that Maurizio Cattelan’s Comedian (2019) was the most talked-about lot of the week.

The work, a banana duct-taped to a wall, sold for $6.2 million at Sotheby’s, including fees, well above its $1 million–$1.5 million estimate. But the sale was also notable for another reason: Sotheby’s confirmed that the winning bidder, cryptocurrency entrepreneur Justin Sun, would pay in cryptocurrency.

The sale was part of a growing trend that’s been gathering steam once again in the art world: the growth in prominence of cryptocurrencies. Museum acquisitions, new collectors, and even a meme coin have all made their way into art world headlines in recent months, sparking discussion about the role of these tokens in the market.

Sun, in speaking about the sale, recognized its significance as a case study of how the crypto community could be involved in the conversation around artworks, particularly those with viral potential online. “This is not just an artwork; it represents a cultural phenomenon that bridges the worlds of art, memes, and the cryptocurrency community,” said Sun. “I believe this piece will inspire more thought and discussion in the future and will become a part of history.”

Cryptocurrencies in the art market

The sale of Comedian in crypto has shocked corners of the art world but comes as less of a surprise to others.

“Cryptocurrency wealth is now encroaching on spaces once dominated by traditional collectors and has become hard for the art world to ignore,” said Alejandro Cartagena, co-founder of Fellowship, a gallery specializing in human-machine collaboration. “Crypto entrepreneurs are bringing new energy to the art world, challenging its established hierarchies and expanding its horizons in an exciting new dynamic.”

While they have been around since the creation of Bitcoin in 2009, cryptocurrencies first entered the art market mainstream in 2021 when they gained a huge rise in public popularity. This came mainly in the growth of non-fungible tokens (NFTs), unique digital identifiers that use blockchain technology to certify ownership of artworks, along with other assets. While NFTs are distinct from cryptocurrencies, both rely on blockchain technology and are associated with each other.

While the fervor around the NFT market has cooled since they initially burst onto the market, demand for this type of work is, like other cryptocurrencies, rallying towards the end of 2024. According to MSN, the NFT market is on track to close November with “strong momentum,” following an October where there was $356 million in sales volume—an 18% increase from September.

“Interest in cryptocurrencies within the art market is growing, although not as fervently as during the crypto boom of 2020–21,” said Stefanie De Regel, head of development for digital art platform TAEX. “This steady growth reflects the evolving integration of blockchain technology and the art world, driven by opportunities…such as NFTs, and innovative platforms for creative expression.”

Why cryptocurrencies are surging

The frenzy around the Cattelan sale underscored the fact that crypto is back in a big way, more than ever following the reelection of Donald Trump in the U.S. Though most cryptocurrencies slumped in the “crypto winter” of 2022 (a sign of their essential volatility), they are now on the rise again.

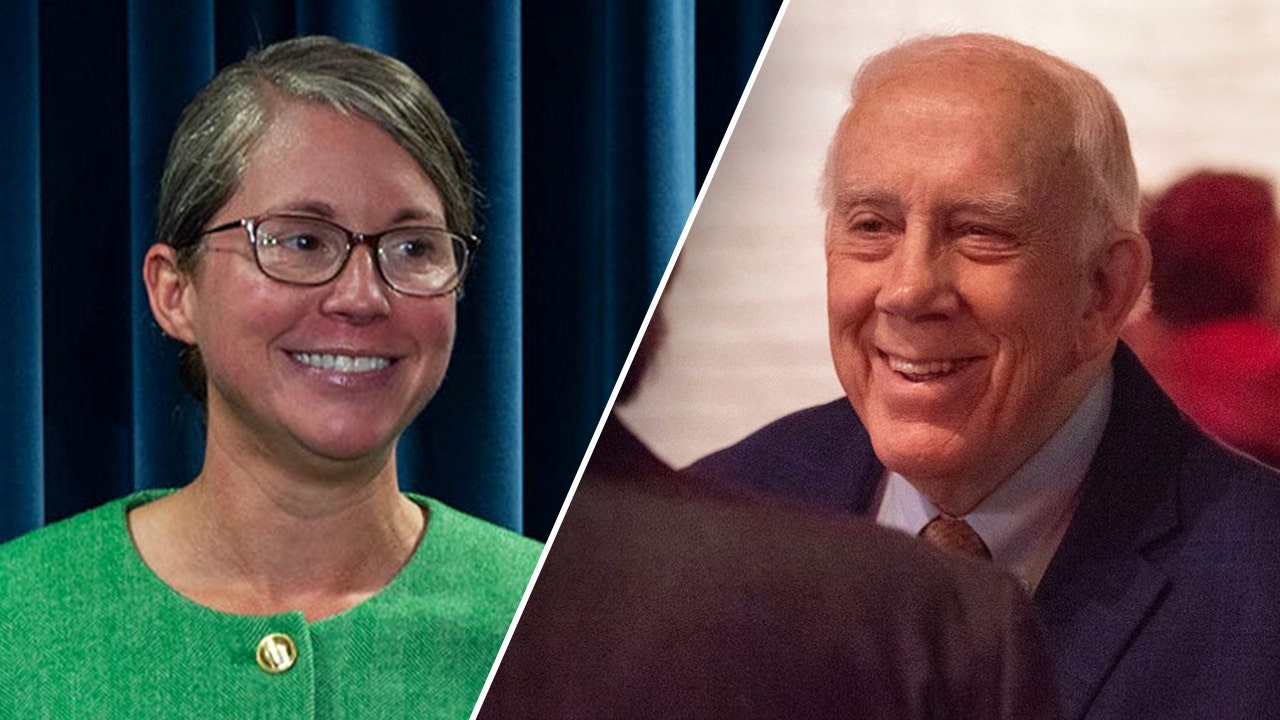

Earlier this month, the global crypto market reached a $3.2 trillion high, spurred on by a belief that the incoming president will enact crypto-friendly regulatory policies. This was boosted further last week when Trump nominated the pro-crypto hedge fund manager Scott Bessent as his treasury secretary, which caused Bitcoin to surge to a new all-time high.

There are other cultural signals for crypto market watchers, showing that the incoming administration intends to acknowledge its importance. Another Trump appointment, Elon Musk, will co-lead a newly set-up “Department of Governmental Efficiency,” (abbreviated to DOGE, likely in a sly reference to the meme coin Dogecoin). Musk is a crypto enthusiast, and once vowed to send Dogecoin “to the moon,” a popular slang used in crypto circles to express conviction. The cryptocurrency with the new department’s name has surged to a three-year high this month.

What is a memecoin?

Bitcoin isn’t the only cryptocurrency on the market: There are thousands more blockchain-backed currencies and tokens that are traded online. And the Cattelan sale also led to a bull run of its own. The cryptocurrency $BAN or Comedian is unaffiliated with Sotheby’s but describes itself as “inspired by Maurizio Cattelan’s artwork, featuring a banana taped to a wall.” The coin was picked up in the chatter of speculators online, who began trading it at high volumes. The meme coin (a term given to cryptocurrencies that are typically inspired by internet and cultural trends) saw its market cap—the total value of all its coins—surge to $300 million. It is now listed on major crypto exchanges such as Binance and Bybit—a significant sign of legitimacy in the crypto world.

Later, it was revealed that Michael Bouhanna, head of digital art and NFTs at Sotheby’s, created the cryptocurrency $BAN as what he called a “spontaneous project and a personal hobby” inspired by the “conceptual questioning of value,” which Comedian as an artwork represents.

As the price began to climb and the coin gained traction in crypto circles, Bouhanna was accused on social media of “insider trading.” Bouhanna took to X to deny accusations that he’d made $1 million in profit, noting that he did not “promote $BAN or encourage anyone to buy it.”

Cryptocurrency and museums

Yatreda ያጥሬዳ, Abyssinian Queen, 2024. Courtesy of Yatreda ያጥሬዳ.

Institutional support for NFTs has also become more widespread. NFTs are in the collections of the Centre Pompidou and LACMA. Last week, the Toledo Museum of Art in Ohio became the first major museum to acquire artwork using cryptocurrency when it purchased the digital artwork Abyssinian Queen (2024) by the Ethiopian artist collective Yatreda ያጥሬዳ. The purchase was made using USDC, a stable coin (a cryptocurrency that is pegged to a traditional, or “fiat” currency like USD or euro).

The decision to purchase the work, explained Adam Levine, the museum’s president, director, and CEO, was to “respect and align with the practices of the artist collective we were working with.”

“Just as we would pay in euros when purchasing from a French gallery or in pounds when dealing with an English auction house, it felt appropriate to transact in the preferred currency of Yatreda ያጥሬዳ, a web3 artist collective,” he told Artsy.

Where next for cryptocurrencies in the art market?

Comedian is unlikely to be the last headline-grabbing sale to be paid for in a blockchain-backed currency.

Cryptocurrencies are bringing new collectors into the art market with their own set of motivations, Cartagena points out. “We’re seeing a convergence of tech entrepreneurs and traditional collectors that fosters new dialogues,” he said. “We’ve also noticed that crypto collectors are less interested in singular ownership and more fascinated by shared authorship, networked systems, and ideas of co-creation. This dovetails with how artists are thinking about AI, decentralized platforms, and collaborative processes.”

This is reflected in auction sales, too. For example, Sotheby’s announced that it would accept cryptocurrency for A.I. God. Portrait of Alan Turing (2024), the first artwork to be painted by a humanoid robot. It sold for $1.08 million, far outstripping its estimate. Sales such as this are unlikely to be the last of their kind as crypto’s role in the art market becomes increasingly hard to ignore.

“Since Bitcoin’s inception only 16 years ago, the combined market capitalization of cryptocurrency globally has grown from $0 to more than $3 trillion; that value surpasses the GDP of the U.K. or France and is more than the market capitalization of any company in the world except NVIDIA and Apple,” said Levine. “Seen this way, it is hard to imagine how such value accumulation will not impact the art world.”

Arun Kakar

Arun Kakar is Artsy’s Art Market Editor.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25739950/247386_Elon_Musk_Open_AI_CVirginia.jpg)