Crypto

Ticker: Crypto exchange allowed money laundering, plea; Home sales at slowest pace in 13 years

The government dealt a massive blow to the world’s largest cryptocurrency exchange Binance as its founder, Changpeng Zhao, pleaded guilty to a felony charge Tuesday related to his failure to prevent money laundering on his platform.

Binance also agreed to a roughly $4 billion settlement with the U.S. over violations of the Bank Secrecy Act and apparent violations of sanctions programs, including failure to put into place a suspicious transaction reporting programs. Zhao has stepped down as the company’s chief executive.

Over the summer, the company was accused of operating as an unregistered securities exchange and violating a slew of securities laws in a lawsuit from regulators. That case was similar to practices uncovered after the collapse of FTX, the second largest cryptocurrency exchange, last year.

“Binance became the world’s largest cryptocurrency exchange in part because of the crimes it committed — now it is paying one of the largest corporate penalties in U.S. history,” said Attorney General Merrick B. Garland.

Home sales at slowest pace in 13 years

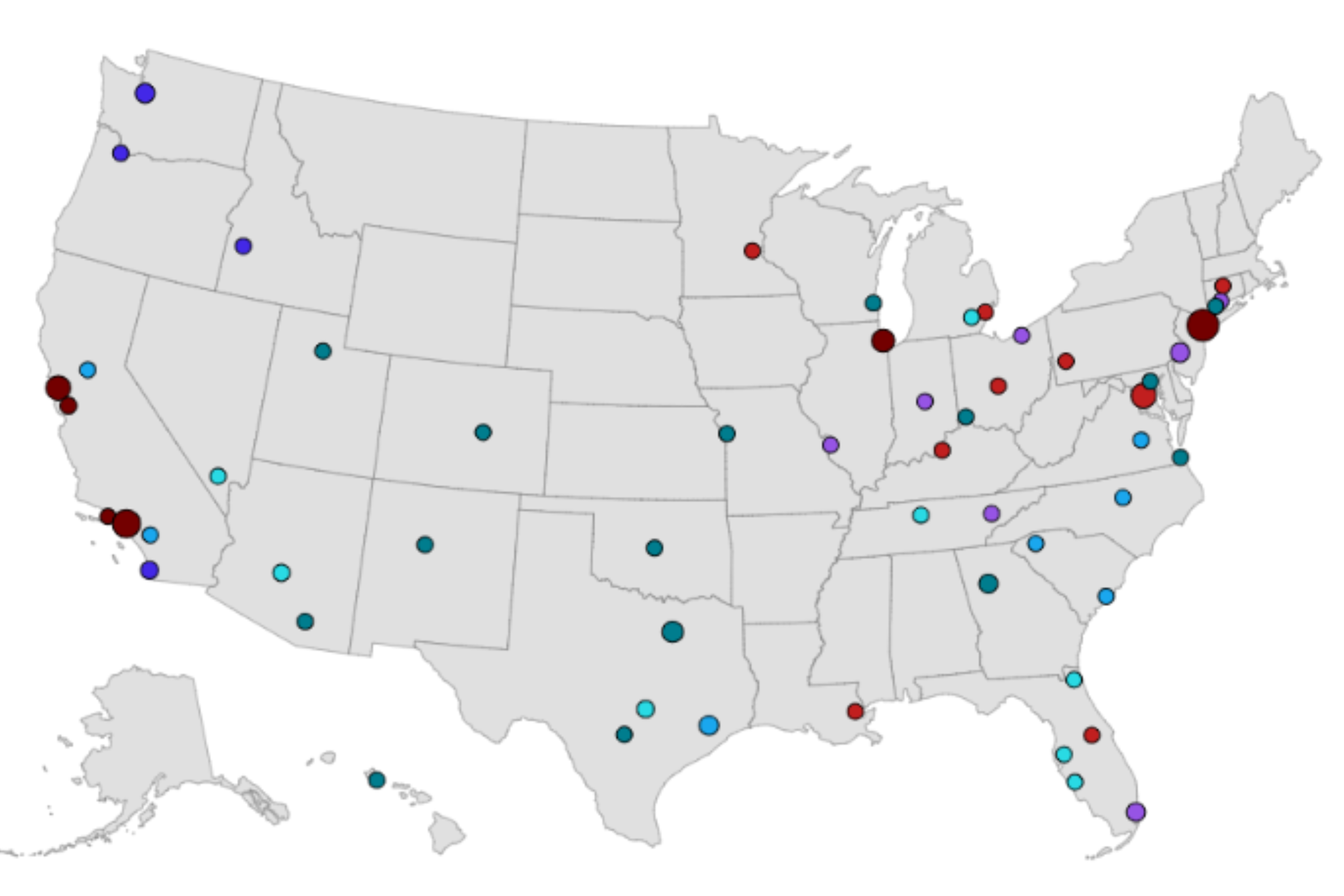

Sales of previously occupied U.S. homes slumped in October to their slowest pace in more than 13 years as surging mortgage rates and rising prices kept many prospective homebuyers on the sidelines.

Existing home sales fell 4.1% last month from September to a seasonally adjusted annual rate of 3.79 million, the National Association of Realtors said Tuesday. That’s weaker than the 3.90 million sales pace economists were expecting, according to FactSet.

The last time sales slumped this hard was in August 2010.

Sales sank 14.6% compared with the same month last year. They have fallen five months in a row, held back by climbing mortgage rates and a thin supply of properties on the market.

Crypto

The world of online casinos has changed drastically in the last couple of years because many new “players” entered the market. Today, people can come across many different sites that have casino services, and many of them look very similar.

Crypto

House Rejects SEC Rule on Cryptocurrency Custody

In an impressive bipartisanship , the U. S. House voted for a resolution to disown a SEC rule that deals with the management of digital assets by the custodians of cryptocurrency. SEC bulletin, which doesn’t require full process of rulemaking, is obliging companies to demonstrate accounts of crypto assets according to hard rules.

Republicans were mostly in support of the motion, their arguments based on the fact that there were too many requirements which would end up becoming burdensome for banks. They feel that the commissions and environmental preservation will drive banks out of such business lines with little ability to support their customers.

Democrats were split, with some like Congressman Maxine Waters defending SEC efforts to protect investors from fraudulent practices and informing the market while some others said that SEC’s role was only important at the initial stages.

This proves to be a real challenge, and the authorities will need to take a complex approach to the wide range of jobs they do in regulating the field of cryptocurrency, which is still emerging. Managing a suitable middle ground between innovation and the safety of consumers will be critical. The SEC is an important watchdog, but overly complex rules could indirectly shorten the crypto market.

Also Read:Alchemy Pay and Bitget Enable Seamless INR Crypto Purchases

Crypto

Nigeria rejects Binance CEO's bribery claim as 'diversionary tactic' By Reuters

By Camillus Eboh

ABUJA (Reuters) – Nigerian authorities on Wednesday denied allegations from Binance’s CEO of soliciting bribes, saying the claim was a “diversionary tactic” and an “act of blackmail” aimed at undermining ongoing criminal charges against the company.

Binance, the world’s largest crypto exchange, and two of its executives face separate trials on charges of tax evasion and laundering more than $35 million, which the company is challenging.

Tigran Gambaryan, a U.S. citizen and Binance’s head of financial crime compliance, remains in custody while British-Kenyan Nadeem Anjarwalla has fled the country.

CEO Richard Teng in a blog post accused unidentified Nigerian officials of demanding a $150 million cryptocurrency bribe to halt the investigations.

In a statement on Wednesday, Nigeria’s Information Ministry spokesperson Rabiu Ibrahim said the claims “lack any iota of substance”. He accused Binance of attempting to undermine the country’s legal proceedings.

“It is nothing but a diversionary tactic and an attempted act of blackmail by a company desperate to obfuscate the grievous criminal charges it is facing in Nigeria,” Ibrahim said.

“The facts of this matter remain that Binance is being investigated in Nigeria for allowing its platform to be used for money laundering, terrorism financing, and foreign exchange manipulation through illegal trading,” he said.

Nigerian authorities claim the bribery allegations are part of a wider campaign by Binance to discredit investigations against the company, citing similar legal troubles in the United States.

Binance did not immediately comment, but in a statement on Tuesday accused Nigeria of setting a dangerous precedent after its executives were invited for talks and then detained as part of a crackdown on the crypto industry.

remove ads

.

Teng’s blog is the latest in a dispute that has already seen Binance close in Nigeria.

Nigeria blamed Binance for its currency problems after cryptocurrency websites emerged as platforms of choice for trading the Nigerian naira as the country grappled with chronic dollar shortages.

Binance said in early March it was stopping all transactions and trading in naira.

-

Politics1 week ago

Politics1 week agoStefanik hits special counsel Jack Smith with ethics complaint, accuses him of election meddling

-

Politics1 week ago

Politics1 week agoThe White House has a new curator. Donna Hayashi Smith is the first Asian American to hold the post

-

Politics1 week ago

Politics1 week agoAnti-Trump DA's no-show at debate leaves challenger facing off against empty podium

-

News1 week ago

News1 week agoAs student protesters get arrested, they risk being banned from campus too

-

News1 week ago

News1 week agoVideo: Police Arrest Columbia Protesters Occupying Hamilton Hall

-

World1 week ago

World1 week agoNine on trial in Germany over alleged far-right coup plot

-

World1 week ago

World1 week agoStrack-Zimmermann blasts von der Leyen's defence policy

-

Politics1 week ago

Politics1 week agoNewsom, state officials silent on anti-Israel protests at UCLA