Crypto

The Convergence of Cryptocurrency and Online Casinos – CryptoMode

The worlds of online gambling and cryptocurrency have begun an intriguing dance of integration. As technology continues to shape our lives, cryptocurrencies have started to redefine online gambling, enhancing the efficiency and privacy of transactions.

The Cryptocurrency Revolution

Cryptocurrencies, digital or virtual currencies employing cryptography for security, have revolutionized financial transactions. They operate on blockchain technology, a decentralized ledger spread across multiple computers. Bitcoin, the first and most well-known cryptocurrency, initiated the revolution, and has since been joined by many others, including Ethereum, Litecoin, and Ripple.

The Allure of Cryptocurrency in Online Casinos

Online casinos have enjoyed a significant rise over the past two decades, capitalizing on technological advancements and the convenience of remote accessibility. Recently, many of these platforms have started to embrace cryptocurrencies, marking a new chapter in the world of online gambling.

Cryptocurrencies offer multiple advantages in online gambling. Players can enjoy enhanced privacy, as transactions do not involve personal or banking information. Transaction fees are often lower due to the absence of traditional intermediaries like banks. Most importantly, cryptocurrencies can drastically reduce transaction processing times, resulting in faster payouts.

Fast Payouts: Cryptocurrency Makes a Difference

The speed of cryptocurrency transactions comes from blockchain’s design and the absence of intermediaries. Blockchain transactions can be processed 24/7, regardless of weekends or holidays. With cryptocurrencies, the long wait times traditionally associated with withdrawals from online casinos can be reduced significantly, allowing players to enjoy their winnings sooner. Fast withdrawals at online casinos are also attainable when using other payment methods. You can read this authoritative article to find out more.

Practical Guide: How to Use Cryptocurrency in Online Casinos

Using cryptocurrency in online casinos involves several steps. First, you’ll need to set up a digital wallet to store your cryptocurrency. Next, you’ll need to purchase cryptocurrency through a reputable exchange. Once you’ve funded your wallet, you can deposit the cryptocurrency into your casino account. For withdrawals, the process is similar, with winnings sent to your digital wallet, from where you can choose to hold or convert back to fiat currency.

Security Measures for Cryptocurrency Transactions in Online Casinos

When transacting with cryptocurrencies in online casinos, security should be a top priority. Cryptocurrencies offer a unique set of security features mainly due to their underlying blockchain technology (despite worries that fast advancements in quantum computing might change that). Here’s a deeper look at these security measures and how they safeguard your online transactions:

- Decentralization. At the heart of cryptocurrencies is blockchain, a decentralized technology spread across multiple computers. This decentralization makes cryptocurrencies less vulnerable to attacks because the information is not stored at a central point. If a hacker were to manipulate the transaction data, they would need to alter over 50% of the network’s blocks, a near-impossible feat.

- Cryptography. Cryptography is fundamental to the functioning of cryptocurrencies, hence the ‘crypto’ in the name. It involves converting transaction data into complex codes, which are then stored in blocks on the blockchain. This complex coding makes it extremely difficult for hackers to decipher and manipulate the data.

- Private and Public Keys. Every cryptocurrency holder has a pair of cryptographic keys: a public key, which is like your email address, and a private key, which is akin to your email password. Your public key is what others use to send you cryptocurrency, while your private key is used to sign off on transactions and access your funds. The private key must be kept secret; if someone else gets hold of it, they can access and transfer your funds.

- Transparency and Immutability. The blockchain ledger is transparent; anyone can track the transaction history of a particular cryptocurrency. However, the transactions are linked to the cryptographic address, not your real-world identity, ensuring privacy. Moreover, once a transaction is confirmed and added to the blockchain, it is immutable. This means it cannot be altered or deleted, preventing fraudulent changes to the transaction history.

- Two-Factor Authentication (2FA). While not unique to cryptocurrencies, 2FA is an additional layer of security that users should employ when dealing with cryptocurrency transactions. This process requires users to provide two different authentication factors to verify themselves. Typically, this is something you know (a password), and something you have (a device to receive a verification code).

- Hardware Wallets. Hardware wallets, or cold wallets, offer one of the safest methods to store cryptocurrencies. These are physical devices, disconnected from the internet, minimizing the risk of online hacking attempts. They store private keys offline, making it even more difficult for unauthorized users to access your cryptocurrency.

Legal and Regulatory Aspects of Cryptocurrency in Online Casinos

The legal landscape for cryptocurrencies and online gambling varies significantly between jurisdictions (look at the different stances adopted by Latin American countries, for example) . While some countries openly embrace cryptocurrencies, others have stringent regulations or outright bans. Therefore, it’s crucial to understand the legal implications in your country before using cryptocurrencies in online casinos.

Embracing the Future of Online Gambling

Cryptocurrencies are reshaping the online gambling landscape, providing players the promise of fast payouts, improved privacy, and enhanced control over their finances. As more casinos adopt these digital currencies, it’s important to understand the technology, its advantages, and potential risks. With proper security measures and a keen understanding of cryptocurrency, players can confidently step into this new era of online gambling.

None of the information on this website is investment or financial advice and does not necessarily reflect the views of CryptoMode or the author. CryptoMode is not responsible for any financial losses sustained by acting on information provided on this website by its authors or clients. Always conduct your research before making financial commitments, especially with third-party reviews, presales, and other opportunities.

Crypto

'Dogecoin Killer' Shiba Inu Burn Rate Spikes 800%, Crypto Market Rallies As Sentiment Soars And More: This Week In Cryptocurrency

The week was a rollercoaster ride for the cryptocurrency market. The crypto world was buzzing with news, from Shiba Inu’s surging burn rate to speculation of certain altcoins becoming irrelevant. Major cryptocurrencies like Bitcoin BTC/USD, Ethereum ETH/USD, and Dogecoin DOGE/USD ended April with heavy losses, but the market sentiment soared as the new week began. Let’s dive into the details.

‘Dogecoin Killer’ Shiba Inu Burn Rate Spikes 800%

Shiba Inu experienced a resurgence in its burn rates, with an 800% surge and millions of coins burned in recent transactions prompting positive market sentiment and an increase in prices. Read the full article here.

Altcoins’ Fate: Strong Performers or Irrelevant?

Pseudonymous crypto trader “Cold Blooded Shiller” questions whether the market is beginning to phase out certain altcoins in favor of stronger performers and Bitcoin. He notes that while Bitcoin’s strength is undeniable, there’s an interesting separation among altcoins. Meme coins like Dogwifhat, Pepe, and Floki Inu have seen significant gains, but will they maintain their momentum? Read the full article here.

See Also: Bitcoin, Ethereum, Dogecoin Rally, As Market Sentiment Soars On Macro Data: ‘Above $67,000 We Fly Like A

Heavy Losses for Bitcoin, Ethereum, Dogecoin in April

April ended on a sour note for major cryptocurrencies. Bitcoin, Ethereum, and Dogecoin closed the month with losses of 16%, 19%, and 40%, respectively. The new Hong Kong Bitcoin ETFs, contrary to bullish expectations, may turn out to be a “complete failure,” according to finance and crypto newsletter, WhaleWire. Read the full article here.

Are Dogecoin and Shiba Inu Due for a Bounce?

Despite a turbulent month, traders remain optimistic about Dogecoin and Shiba Inu. Chart analyst Ali Martinez predicts a bullish breakout for Shiba Inu SHIB/USD, while crypto trader YG Crypto analyzes Dogecoin’s recent performance, which saw a dramatic 40% price drop. Read the full article here.

Crypto Market Rallies as Sentiment Soars

Despite the losses in April, the cryptocurrency market started May on a positive note. Major cryptocurrencies are trading higher, with Bitcoin bouncing well above the $60,000 mark. Read the full article here.

Read Next: Dogecoin Is ‘Primed For Higher’ But Pepe Is ‘On A Moon Mission,’ Exclaims Trader

Image: Eivind Pedersen from Pixabay

Engineered by

Benzinga Neuro, Edited by

Anan Ashraf

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Crypto

Cryptocurrency Price Analysis: SHIB, DOGE, and XRP Face Varied Challenges

Throughout much of the month, the majority of top assets maintained a sideways trajectory. While some experienced marginal upticks, others contended with declines. Let’s delve into the price analysis of Shiba Inu (SHIB), Dogecoin (DOGE), and Ripple (XRP). Shiba Inu (SHIB)Coin Edition’s evaluation of SHIB’s 4-hour chart revealed a bearish signal. Specifically, attention was drawn to the Exponential Moving Average (EMA), where the 20 EMA (yellow) crossed below the 9 EMA (blue)—a phenomenon known as a death cross. Moreover, SHIB’s price lingered beneath these indicators, signaling a diminishing strength for the token. Presently, there’s a prospect of SHIB’s price descending

Crypto

Bitcoin (BTC) User Paid Eye-Watering $100,254 for Single Transaction

A single Bitcoin BTCUSD transaction has caught the attention of many owing to its gas fee size. Blockchain analytics platform Whale Alert confirmed that a fee of 1.5 BTC was paid for a single transaction. This fee is equivalent to $100,254 based on the current market value of the top cryptocurrency. This fee is quite higher than the average transaction cost.

This user paid this enormous fee to have their transfer included in an ordinary Bitcoin block. Some of these transactions have been recorded in the past. In September 2023, a Bitcoin user paid a transaction fee of 19 BTC. This was around the time when Bitcoin price was trading at $26,000, hence, the 19 BTC was equivalent to $509,563.

Then again, in January, another BTC account paid over 4 BTC to have their transfer included in an ordinary Bitcoin block. The transaction was therefore charged with a whopping 1,800,890 sat/vB fee.

Potential reason for high transaction fee

Payment of such exorbitant fees usually raise suspicions as many market observers wonder the circumstances that could have led to it. At press time, Bitcoin’s average transaction fee was at a level of $4.696, up from $3.740 on May 4 and down from $6.696 one year ago. This is also a change of 25.57% from yesterday and -29.86% from one year ago, per data from YChart.

It is worth noting that ordinarily transaction fees can fluctuate due to network congestion. It once reached as high as $60 during the 2017 cryptocurrency boom. Hence, this outrageous transaction fee recently recorded could be a result of a mistake or a misconfiguration in transaction software. It could also be potentially for reasons known only to the transaction initiator or even a possible money laundering scheme.

-

News1 week ago

News1 week agoFirst cargo ship passes through new channel since Baltimore bridge collapse

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

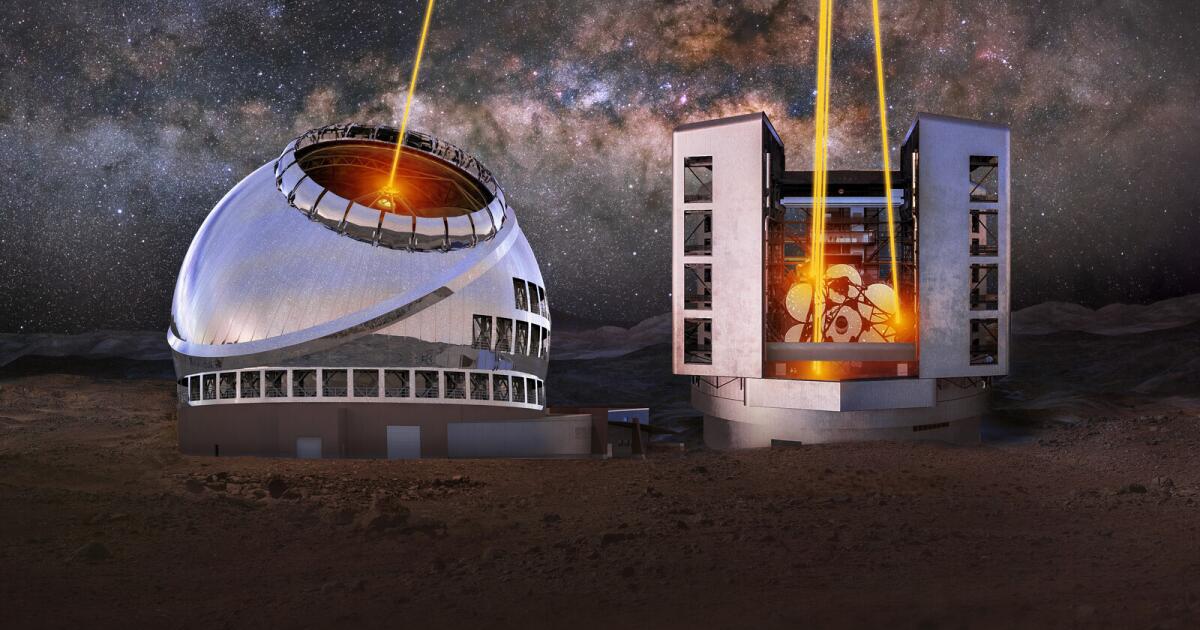

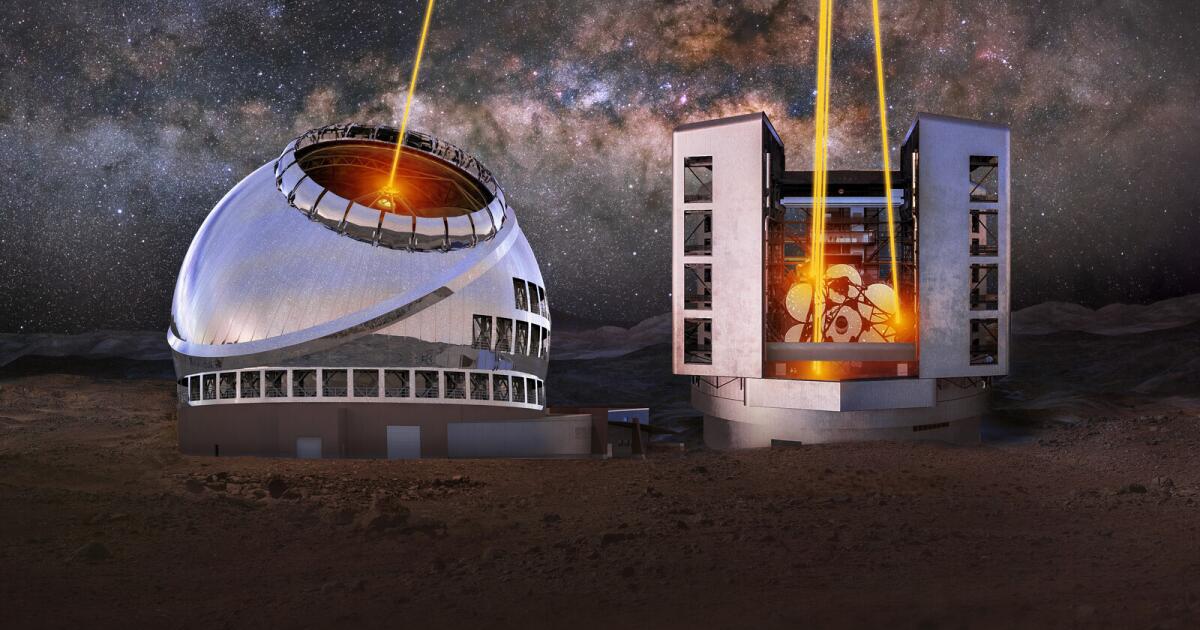

Science1 week ago

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire

/cdn.vox-cdn.com/uploads/chorus_asset/file/25432052/installer.png)