Crypto

NFTs, crypto & a web of deceit: How a Bengaluru digital artist was duped

Bengaluru: A dubious website, non-fungible tokens (NFTs), and cryptocurrency payments formed the crux of a scam that saw a 71-year-old digital artist in East Bengaluru getting conned into paying about Rs 1.58 lakh over a non-existent sale.

Shivaprasad R (name changed), a practising chartered accountant (CA), said he began doing digital art during the Covid-19 pandemic and nearly 50 of his paintings were part of several exhibitions in Bengaluru. His works were also uploaded on his Facebook and Instagram accounts.

In October 2023, a person claiming to be an NFT art dealer on Facebook introduced Shivaprasad to www.nfttradeplace.com — a marketplace for NFTs which are digital certificates of ownership for unique items like art, music, etc. stored on a blockchain that works as a digital ledger. Unlike cryptocurrencies, NFTs are distinct and cannot be exchanged on a like-for-like basis.

The “art dealer” told the artist that he was interested in his paintings and offered to buy them. Next, “negotiations” were held through Facebook and email, and 42 Ethereum (ETH) — a type of cryptocurrency worth approximately Rs 1.09 crore as of April 17, when the complaint was filed — was decided as the price.

“The bill was quoted by the victim during the negotiations,” a cybercrime investigator told DH.

Shivaprasad listed four paintings — Climactic, Wuhan Effect-1, Welcome to Kashmir and Climactic (second copy) — with 10, 10, 10 and 12 ETH as going rates, respectively. On February 1, 2024, he made the first payment and sent 0.115 ETH, equivalent to Rs 21,653.72, as “Gas Fee” or transaction fee.

“The victim made the payment from his crypto wallet, which he set up at the scammer’s behest,” the investigator said. As the sale was completed, Shivaprasad raised his first withdrawal request of 6 ETH. He waited for a few days, but no transaction was made. When he checked again, Shivaprasad was asked to pay a “delay fee” as he had held up the withdrawal of the cryptocurrency.

“This delay fee was never discussed nor was it exhibited on the website,” Shivaprasad said in his complaint. “Helpless, since I did not have ETH in my wallet, I asked if I could make the delay fee payment in Indian rupees,” he said.

The fraudsters accepted Shivaprasad’s request and as instructed on the website, the victim made four payments to Mohammed Ekramul Haque and Mohammad Farooq through bank and UPI transfers on February 5 (two payments of Rs 25,000 each), February 6 (Rs 22,000), and February 9 (Rs 50,000).

The last payment of Rs 15,000 was made to SK Humayun through PhonePe on March 15. “Even after making the above-said payments, the website kept asking me for further payments for the withdrawal of 6 ETH,” Shivaprasad said. He added that he hadn’t raised a request for the balance cryptocurrency as he was worried about more demands for payment.

His request to deduct the delay fees from the amount of sale and remit the rest was ignored.

On April 17, he reached out to the cyber police who opened a case under 66C (punishment for identity theft) and 66D (punishment for cheating by personation by using computer resources) of the Information Technology (IT) Act and 420 (cheating and dishonestly inducing delivery of property) of the Indian Penal Code (IPC).

“The first red flag was when the victim had to pay money in the form of fees,” an officer said. “It is highly difficult to trace cryptocurrency trails. As of now, bank details and domain details of the email address used by the scammers have been sought,” the officer said.

The sale that wasn’t

The scam centred around a website posing as a non-fungible token (NFT) marketplace Conman targets senior digital artist, feigning interest in his work Negotiations made through social media and email, with a high cryptocurrency price set for the art Despite completing the sale, fund withdrawal blocked by a ‘delay fee’ Multiple payments extracted from the victim under various pretexts.

(Published 22 April 2024, 02:17 IST)

Crypto

Top Cryptocurrency Gainers and Losers of the Week

Insights into recent surges and dips, and the importance of caution in investment

Cryptocurrency Gainers and Losers of the Week: Cryptocurrency markets are famously volatile, with prices soaring and dipping on a regular basis. In this week’s recap, we delve into the top cryptocurrency gainers and losers of the week, examining the factors behind their impressive surges or significant dips.

Top Gainers:

Helium

Price: US$5.39

Surge in 7days: 41.33%

Market Cap: US$30,168,995

During the week, the decentralized wireless network Helium has demonstrated an outstanding growth. Such a rapid growth might be associated with the increased demand for the services of the network, including IOT applications. Since Helium is rather unique in its way of arranging a global, decentralized wireless network, it has attracted the attention of the investors looking for the most innovative products in the cryptocurrency market.

Optimism

Price: US$2.83

Surge in 7days: 16.12

Market Cap: US$470,387,039

Layer 2 scaling solution for Ethereum, Optimism has recorded an exceptional gain in its price within the last week. This significant growth emerges at a time of increasing interest in layer 2 solutions to tackle the present scalability problem Ethereum experiences. The technology developed by Optimism makes the process on Ethereum better while lowering transaction fees and increasing the network’s throughput .

Axelar

Price: US$1.24

Surge in 7days:11.29%

Market Cap: US$43,249,928

Recently, the price of Axelar, a decentralized network aiming to connect various blockchain ecosystems, has skyrocketed. This phenomenon is caused by the growing need for interoperability solutions in the cryptocurrency industry. With abundant blockchain networks the issue of efficient communication or asset transfer over separate systems arise, and therefore the interest in such projects as Axelar increases.

Wormhole

Price: US$0.7299

Surge in 7days: 10.45%

Market Cap: US$339,987,856

Wormhole, a cross-chain communication protocol, has risen in trading price over the past week. This growth clearly indicates that the market recognizes the importance of interoperability solutions in the cryptocurrency industry. Investors are beginning to flock to projects that offer ways to quickly exchange assets and data among a variety of blockchains and tackle this critical issue.

Starknet

Price: US$1.29

Surge in 7days: 7.86%

Market Cap: US$167,854,564

Starknet, the layer 2 scaling solution for StarkWare, has recently experienced a rapid increase in its price. More specifically, the layer 2 solutions have recently drawn more attention to solve Ethereum scalability issues. Starknet facilitates security and privacy of decentralized applications on the Ethereum network and thus been considered an attractive investment option.

Top Losers:

Pendle

Price: US$4.44

Dip in 7days: 26.04%

Market Cap: US$78,101,979

Pendle — a protocol that tokenizes future yield — has experienced a dip in its price over the past week. Possible reasons for the dip include profit-taking by investors following a period of rapid price appreciation and concerns about the project’s long-term fundamentals. As with all cryptocurrency projects, investors should conduct their own research and assess the risks involved before putting their money in a token like Pendle.

Stacks

Price: US$2.07

Dip in 7days: 23.79%

Market Cap: US$170,055,324

Recently, the price of Stacks, a blockchain that makes smart contracts possible on Bitcoin, has dropped sharply. This decline in value may be driven by market sentiment, profit booking, or ethical concerns about the advancement of the initiative. Projects that concentrate in this sector face significant hurdles and concerns, and investors should be wary of them.

ORDI

Price: US$35.43

Dip in 7days: 18.59%

Market Cap: US$179,099,369

Over the past week, the decentralized identity protocol ORDI has witnessed a notable dip. Various factors may be contributing to this dip, such as market dynamics, regulatory uncertainty, or other particularities linked to the development of this project. Ultimately, the cryptocurrency market is a rapidly changing environment; as a result, projects such as ORDI have ample opportunities and challenges to ensure the broad and general adoption of the given technology in the future.

Theta Network

Price: US$2.03

Dip in 7days: 17.81%

Market Cap: US$56,591,821

Theta Network — a decentralized video delivery network — has seen its price drop substantially recently. This drop could be the response of market dynamics, concerns about the level of competition in the sector, or specific improvements in the ecosystem building on Theta. As people continue to look for decentralized video delivery solutions, Theta Network will have a chance to capture a share of the market.

Hedera

Price: US$0.09864

Dip in 7days: 16.86%

Market Cap: US$225,149,589

Hedera — a decentralized public network — has seen a significant drop in its price over the past week. The decline could be an indicator of market trends, profit-taking by investors, or doubts about the project’s prospects. As with all cryptocurrencies, investors should research the risks before putting their funds in this token.

To conclude, the cryptocurrency market is currently volatile, and its prices have been updating serially. The top cryptocurrency gainers and losers of the week speaks of some specific projects that have massively gained over the past few days while others have equally lost a lot. Therefore, for investors that desire to conduct business within such a dynamic market, it is necessary to make in-depth research, methodize specific risks and remain up-to-date with the current trends in the cryptocurrency world.

Crypto

'Dogecoin Killer' Shiba Inu Burn Rate Spikes 800%, Crypto Market Rallies As Sentiment Soars And More: This Week In Cryptocurrency

The week was a rollercoaster ride for the cryptocurrency market. The crypto world was buzzing with news, from Shiba Inu’s surging burn rate to speculation of certain altcoins becoming irrelevant. Major cryptocurrencies like Bitcoin BTC/USD, Ethereum ETH/USD, and Dogecoin DOGE/USD ended April with heavy losses, but the market sentiment soared as the new week began. Let’s dive into the details.

‘Dogecoin Killer’ Shiba Inu Burn Rate Spikes 800%

Shiba Inu experienced a resurgence in its burn rates, with an 800% surge and millions of coins burned in recent transactions prompting positive market sentiment and an increase in prices. Read the full article here.

Altcoins’ Fate: Strong Performers or Irrelevant?

Pseudonymous crypto trader “Cold Blooded Shiller” questions whether the market is beginning to phase out certain altcoins in favor of stronger performers and Bitcoin. He notes that while Bitcoin’s strength is undeniable, there’s an interesting separation among altcoins. Meme coins like Dogwifhat, Pepe, and Floki Inu have seen significant gains, but will they maintain their momentum? Read the full article here.

See Also: Bitcoin, Ethereum, Dogecoin Rally, As Market Sentiment Soars On Macro Data: ‘Above $67,000 We Fly Like A

Heavy Losses for Bitcoin, Ethereum, Dogecoin in April

April ended on a sour note for major cryptocurrencies. Bitcoin, Ethereum, and Dogecoin closed the month with losses of 16%, 19%, and 40%, respectively. The new Hong Kong Bitcoin ETFs, contrary to bullish expectations, may turn out to be a “complete failure,” according to finance and crypto newsletter, WhaleWire. Read the full article here.

Are Dogecoin and Shiba Inu Due for a Bounce?

Despite a turbulent month, traders remain optimistic about Dogecoin and Shiba Inu. Chart analyst Ali Martinez predicts a bullish breakout for Shiba Inu SHIB/USD, while crypto trader YG Crypto analyzes Dogecoin’s recent performance, which saw a dramatic 40% price drop. Read the full article here.

Crypto Market Rallies as Sentiment Soars

Despite the losses in April, the cryptocurrency market started May on a positive note. Major cryptocurrencies are trading higher, with Bitcoin bouncing well above the $60,000 mark. Read the full article here.

Read Next: Dogecoin Is ‘Primed For Higher’ But Pepe Is ‘On A Moon Mission,’ Exclaims Trader

Image: Eivind Pedersen from Pixabay

Engineered by

Benzinga Neuro, Edited by

Anan Ashraf

The GPT-4-based Benzinga Neuro content generation system exploits the

extensive Benzinga Ecosystem, including native data, APIs, and more to

create comprehensive and timely stories for you.

Learn more.

Crypto

Cryptocurrency Price Analysis: SHIB, DOGE, and XRP Face Varied Challenges

Throughout much of the month, the majority of top assets maintained a sideways trajectory. While some experienced marginal upticks, others contended with declines. Let’s delve into the price analysis of Shiba Inu (SHIB), Dogecoin (DOGE), and Ripple (XRP). Shiba Inu (SHIB)Coin Edition’s evaluation of SHIB’s 4-hour chart revealed a bearish signal. Specifically, attention was drawn to the Exponential Moving Average (EMA), where the 20 EMA (yellow) crossed below the 9 EMA (blue)—a phenomenon known as a death cross. Moreover, SHIB’s price lingered beneath these indicators, signaling a diminishing strength for the token. Presently, there’s a prospect of SHIB’s price descending

-

World1 week ago

World1 week agoHaiti Prime Minister Ariel Henry resigns, transitional council takes power

-

World1 week ago

World1 week agoEU Parliament leaders recall term's highs and lows at last sitting

-

Movie Reviews1 week ago

Movie Reviews1 week agoAbigail Movie Review: When pirouettes turn perilous

-

Politics1 week ago

Politics1 week ago911 call transcript details Democratic Minnesota state senator’s alleged burglary at stepmother's home

-

Politics1 week ago

Politics1 week agoGOP lawmakers demand major donors pull funding from Columbia over 'antisemitic incidents'

-

Science1 week ago

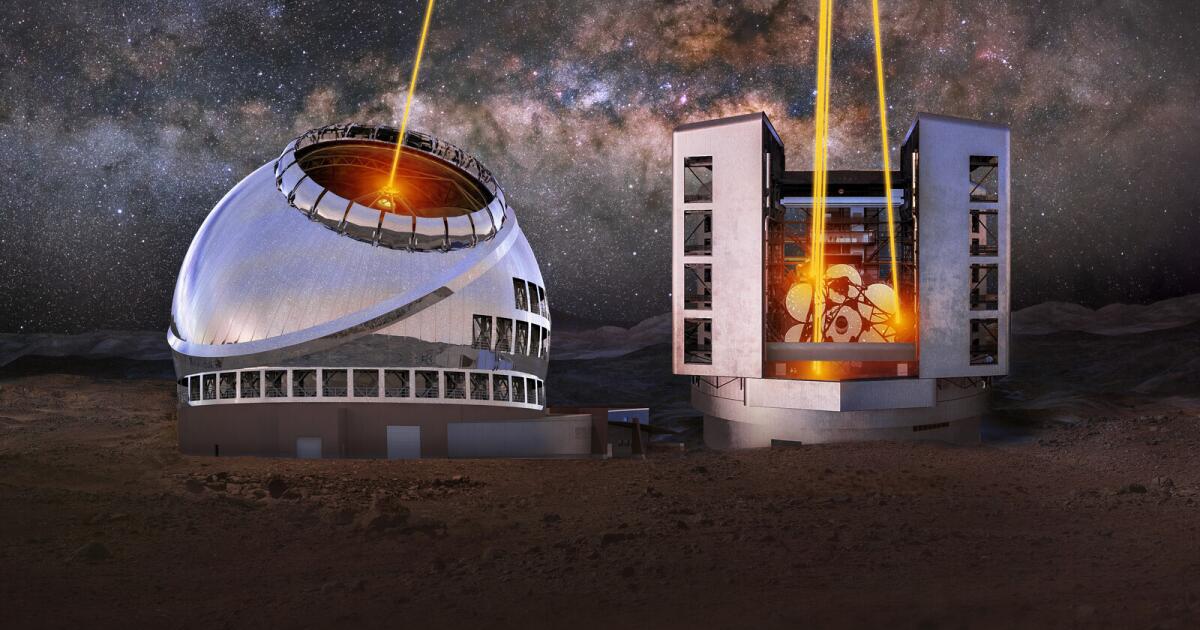

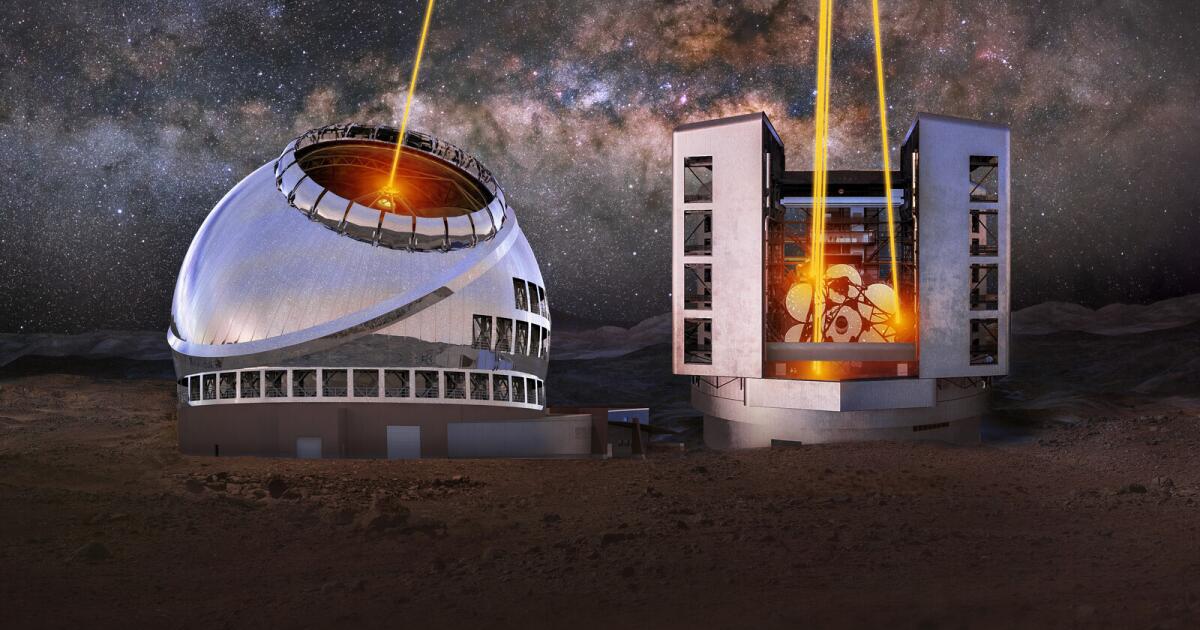

Science1 week agoOpinion: America's 'big glass' dominance hangs on the fate of two powerful new telescopes

-

World1 week ago

World1 week agoHamas ‘serious’ about captives’ release but not without Gaza ceasefire

-

Sports1 week ago

Sports1 week agoWhy drafting a successful NFL quarterback remains 'an inexact science'