A Webster County man is suing a group of unknown individuals behind a growing cryptocurrency-romance scam that allegedly cost him $232,793 and resulted in threats to harvest his organs.

The alleged theft occurred through an increasingly common scheme known as a “pig butchering.” In this sort of scam, victims are befriended by online perpetrators, then gradually “fattened” for financial slaughter. The victims are tricked into making investments though a website that mimics a legitimate cryptocurrency exchange.

Such scams are alleged to be responsible for more than $2 billion in losses incurred during 2022 alone.

In a newly filed federal lawsuit, Brian Hoop of Fort Dodge alleges that in September 2022, he received a text message on his cell phone from an unfamiliar phone number. The sender of the text introduced herself as “Emma” and indicated the text was intended for someone else.

People are also reading…

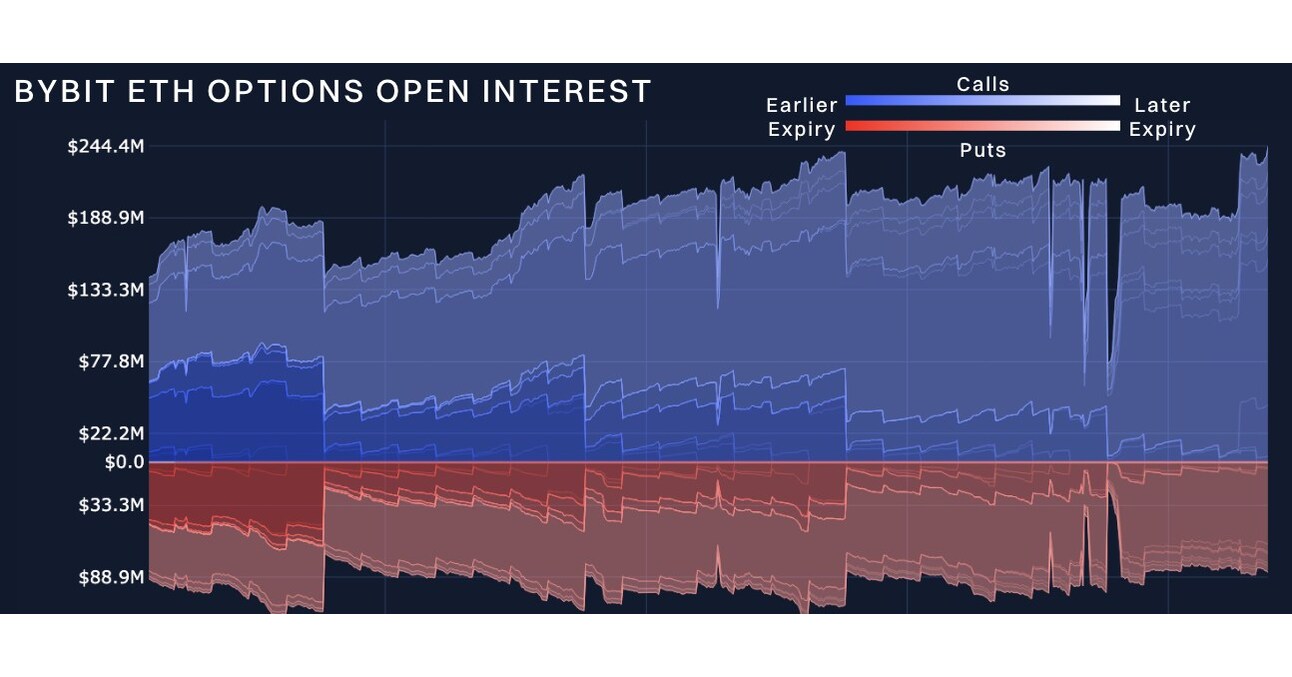

Over the next six months, Hoop and “Emma” continued to text daily and eventually exchanged intimate messages and photos, with Hoop treating her as his girlfriend. Three months into their virtual relationship, in December 2022, “Emma” told Hoop she created substantial income for herself through carefully timed trades in cryptocurrencies and volunteered to assist Hoop in executing his own trades on what appeared to be a legitimate cryptocurrency exchange called Energise Trade.

Over the next several weeks, Hoop liquidated his retirement and savings accounts, borrowed money from a bank and from his mother, and ultimately delivered $232,793 to Energise Trade, believing his investment had resulted in $1.1 million in returns.

When he attempted to access those funds, he was asked to pay an additional $100,000 as payment of taxes. After he refused, “Emma” attempted to extort money from Hoop by threatening to expose his intimate conversations and photographs to others, and by threatening his safety and that of his family. The lawsuit alleges “Emma” specifically claimed to have hired agents who would ambush him, torture him and harvest his organs to be sold on the black market.

The lawsuit accuses the individual known only as “Emma” and 20 “John Does,” all believed to reside in China, with conversion, racketeering, conspiracy, unauthorized disclosure of intimate images, and negligent infliction of emotional distress. Also named as a defendant is a Delaware corporation named MEXC Global, which allegedly controls the accounts into which Hoop’s money was deposited.

The defendants’ actions, the lawsuit claims, are “not isolated events and are part of a widespread scheme to defraud other unsuspecting victims for the same or similar purposes and to achieve the same or similar results.”

The lawsuit seeks actual damages of at least $232,793; trebled damages, as allowed under federal law, of $698,378; statutory damages, as allowed under state law, of $10,000; punitive damages of at least $931,171; plus attorneys’ fees.

The defendants have yet to file a response to the lawsuit.

In March, the Federal Bureau of Investigation warned consumers of a huge spike in pig-butchering scams that are based on cryptocurrency exchanges. The bureau said the perpetrators were using fictitious identities to develop relationships with victims, often targeting people through dating apps, social media platforms, professional networking sites or encrypted messaging apps. Newer iterations of the scheme include so-called “liquidity mining” and “play-to-earn” games, according to the FBI.

In February, the Federal Trade Commission said that in 2022, nearly 70,000 people had reported being victimized in various romance scams, with their collective losses totaling $1.3 billion.

A beginner’s guide to crypto lingo

Bitcoin

Bitcoin is a cryptocurrency created in 2009 by an unknown person (or people) using the alias Satoshi Nakamoto. Unlike traditional currencies such as the US dollar, bitcoin isn’t controlled by a bank or government. Bitcoin is by far the most valuable and popular cryptocurrency in use today.

Investing in cryptocurrencies requires an appetite for risk and a whole new vocabulary.

Blockchain

A blockchain is a digital ledger and the key technology underpinning most cryptocurrencies, non-fungible tokens (more on those later) and other unique digital items.

Blockchain can be used to store all kinds of information, but so far its most common use is in recording cryptocurrency transactions. Once a transaction is made, it’s entered on this public ledger, which is managed by a global peer-to-peer network — millions of computers, in bitcoin’s case.

Blockchain is fundamental to bitcoin’s appeal: As a decentralized database, it can’t be controlled by any one person or group — unlike a fiat currency such as the US dollar, which is managed by a central bank.

Buy the f****ing dip (BTFD)

A rally cry for crypto bulls that urges investors to buy coins when prices drop.

Coinbase

The leading cryptocurrency exchange platform. The company went public in April, an event that many viewed as a turning point in the story of cryptocurrencies’ journey into the mainstream marketplace.

The mobile phone icon for the Coinbase app is shown in this photo, in New York, Tuesday, April 13, 2021. (AP Photo/Richard Drew)

Cryptocurrency

An all-digital money system made up of “coins” or “tokens” that are controlled by a decentralized ledger.

Dogecoin

The oddball of the crypto family began as a joke based on the “doge” meme in 2013. But as cryptos have broadly gained mainstream interest, dogecoin has emerged as an unexpected heavy hitter. It now has a market cap of more than $30 billion and it has surged more than 5,000% so far this year. And unlike its more popular brethren, a single dogecoin is still cheap — it hit an all-time high of about 45 cents in April. Whether or not its a smart investment remains an active question.

Elon Musk

Tesla CEO whose tweets have been known to spark rallies in cryptocurrencies such as bitcoin and dogecoin.

FILE – In this Tuesday, Dec. 1, 2020 file photo, SpaceX owner and Tesla CEO Elon Musk arrives on the red carpet for the Axel Springer media award, in Berlin, Germany. (AP Photo/Britta Pedersen, Pool, File)

Ethereum

An open-source blockchain-based software that controls the cryptocurrency Ether. It is the second-largest digital currency by market cap at nearly $300 billion.

FUD (“fear, uncertainty, doubt”)

In crypto parlance, FUD refers to negative information that weighs on an asset’s value.

Mining

The complicated process by which new bitcoins are entered into circulation. Mining is not for amateur enthusiasts: It requires high-powered computers that solve complex mathematical puzzles to create a new “block” on the blockchain.

The mining process eats up a lot of computing power and electricity, which has led to concerns about bitcoin’s environmental impact.

NFT

Non-fungible tokens, or NFTs, are pieces of digital content linked to the Ethereum blockchain. “Non-fungible” essentially means one-of-a-kind, something that can’t be replaced, unlike, for example, a dollar bill that you can replace with any other dollar bill. In the simplest terms, NFTs transform digital works of art and other collectibles into one-of-a-kind, verifiable assets.

Sophia uses a brush to paint at Hanson Robotics studio in Hong Kong on March 29, 2021. Sophia is a robot of many talents — she speaks, jokes, sings and even makes art. In March, she caused a stir in the art world when a digital work she created as part of a collaboration was sold at an auction for $688,888 in the form of a non-fungible token (NFT). (AP Photo/Vincent Yu)

Satoshi Nakamoto

The pseudonym that refers to the person (or people) who invented bitcoin. Their real identity remains unknown.

Satoshis, aka “Sats”

The smallest unit of bitcoin ever recorded on the blockchain, equal to one one-millionth of a bitcoin.

Wallet

Like the physical thing you carry your cash and cards in, a wallet in the crypto world is a place to store digital currency. The main thing you need to know about wallets is that you must never, ever lose or forget your password.

Eyonys González poses for the photo with his bitcoin wallet at his home in Havana, Cuba, Monday, March 29, 2021. (AP Photo/Ramon Espinosa)

(Photo by Getty Images)

/cdn.vox-cdn.com/uploads/chorus_asset/file/24924653/236780_Google_AntiTrust_Trial_Custom_Art_CVirginia__0003_1.png)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25672934/Metaphor_Key_Art_Horizontal.png)