Crypto

Cryptocurrency exchange FTX reportedly exploring Robinhood acquisition – SiliconANGLE

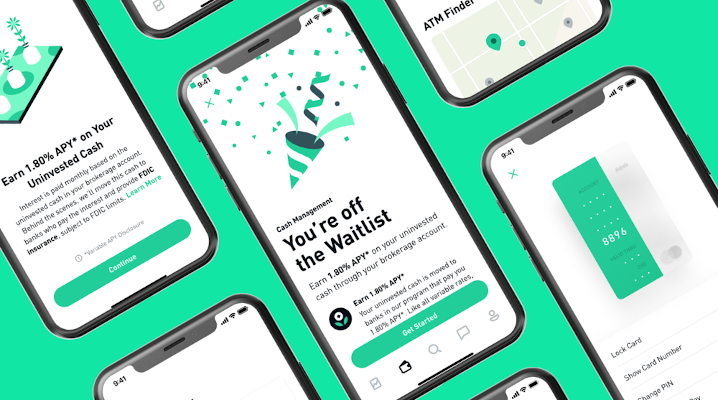

Shares in Robinhood Markets Inc. surged 14% right this moment after Bloomberg revealed a report claiming that cryptocurrency alternate FTX Digital Markets Ltd. is exploring buying the corporate.

The report, referencing folks with information of the matter, says FTX is deliberating internally on purchase Robinhood. No formal takeover strategy has been made and FTX might choose in opposition to pursuing the deal.

FTX Chief Govt Officer Sam Bankman-Fried neither denied nor confirmed the report. “We’re enthusiastic about Robinhood’s enterprise prospects and potential methods we might companion with them,” Bankman-Fried stated in an announcement. “That being stated, there are not any lively M&A conversations with Robinhood.”

The important thing within the assertion is the wording: Bankman-Fried doesn’t deny that FTX is contemplating buying Robinhood, solely stating that there are at the moment no merger and acquisition conversations, which is in keeping with the Bloomberg report. Notably, Emergent Constancy Applied sciences Ltd., an organization managed by Bankman-Fried, has owned a 7.6% stake in Robinhood since Could.

Any try by FTX to amass Robinhood would come at a time of continued points in cryptocurrency markets and an ongoing decline in Robinhood’s share worth. After buying and selling as excessive as $55 per share in August, Robinhood’s share worth has hit a low of $6.89 per share.

Robinhood has reported common disappointing earnings stories — 4 straight quarters of misses because it went public in July. The corporate reduce 9% of its full-time workers on April 26 forward of one other disappointing earnings report on April 28.

FTX snapping up Robinhood might ship benefits to each corporations. Though Robinhood’s fortunes have floundered, combining the 2 corporations would offer synergies. Though Robinhood’s customers are buying and selling much less, they nonetheless have a big buyer base that FTX might leverage.

Robinhood shares closed common buying and selling at $9.12 however dropped nearly 5% after the bell. Robinhood’s market cap sat at $7.95 billion.

FTX is an alternate that has raised critical cash — $1.7 billion in whole and $400 million as of its final spherical in January on a $32 billion valuation. Nonetheless, that was earlier than the crypto crash that has seen the worth of fashionable cryptocurrencies drop by two-thirds and generally extra throughout the 12 months.

Presuming a premium is obtainable in a deal to amass Robinhood, FTX will want someplace within the neighborhood of $8 billion to $10 billion, presumably larger, except the deal is equity-based. Even in its distressed state, Robinhood remains to be a dear acquisition for FTX, given its funds.

Photograph: Nasdaq

Present your help for our mission by becoming a member of our Dice Membership and Dice Occasion Group of specialists. Be a part of the neighborhood that features Amazon Net Companies and Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger and plenty of extra luminaries and specialists.

Crypto

Has Musk announced a $20 million cryptocurrency giveaway? Deepfake video goes viral

A deepfake video of Elon Musk promising a massive cryptocurrency giveaway has gone viral, sparking confusion and concern. The misleading video falsely promotes a $20 million cryptocurrency giveaway, luring viewers to a website called Elon4u.com.

In the video, Musk appears to announce a surprise crypto giveaway, claiming, “I’ll be doing a $20 million crypto giveaway at Elon4u.com for one week starting December 13,” urging viewers to act fast and participate. The clip presents Musk as inviting people to take part in the giveaway, reassuring them that the process is quick and easy.

However, the video was soon debunked as a deepfake. A post from DogeDesigner, a well-known figure in the crypto community, quickly circulated on X (formerly Twitter), warning followers about the scam. “Elon Musk and his companies are NOT doing any crypto giveaways. Don’t fall for scams! Stay safe,” the post emphasised, urging people not to be deceived by the fake video.

Rise of Deepfakes

This incident highlights the growing risks posed by deepfakes, which can convincingly replicate the voices and appearances of public figures. Experts warn that scams using deepfakes are becoming more sophisticated, making it essential for users to double-check such claims from trusted sources.

In recent years, cryptocurrency scams have been on the rise, often taking advantage of high-profile figures like Musk to create a sense of legitimacy. With deepfake videos becoming more prevalent and realistic, the ability to distinguish between authentic content and manipulation is increasingly challenging for the public.

While Musk has not publicly commented on the deepfake incident, his reputation as a target for online scams, including fake giveaways, is well-known. In the past, similar fraudulent schemes have leveraged his name and social media presence, causing significant concern among his followers.

The Elon4u.com website featured in the video is now under scrutiny, with experts advising internet users to avoid visiting suspicious sites and to report any potentially harmful content.

Crypto

Bitcoin hits record high above $105k amid whale trades, MicroStrategy cheer By Investing.com

Investing.com– Bitcoin surged to a record high on Sunday evening amid signs of increased whale trading, while crypto markets also cheered MicroStrategy’s addition to the Nasdaq 100.

The jumped 3.9% to a record high of $105,120.9 by 18:27 ET (23:27 GMT).

On-chain data showed a flurry of major trades by large Bitcoin holders over the weekend. These holders, referred to as whales, were seen moving hundreds of millions of Bitcoin off exchanges and onto private wallets.

X account Whale Alert, which tracks major crypto transactions, showed at least 27,000 Bitcoins, worth a total of $2.8 billion, had been moved off major crypto exchanges such as Bybit and Binance over the weekend.

Such a move points to limited supply of Bitcoin on public exchanges, entailing a higher price for the crypto.

Bitcoin was also buoyed by optimism over MicroStrategy Incorporated (NASDAQ:)- the world’s biggest corporate holder of the crypto- being added to the . MicroStrategy- which is largely regarded as a proxy trade for Bitcoin- surged over 400% so far in 2024, with its valuation spike making it eligible for addition to the index.

The stock will be added to the index effective December 23, and could see further gains as exchange-traded funds move to add exposure to the stock.

Crypto

Donald Trump Knows More About Cryptocurrency Than Anybody – WhoWhatWhy

The president-elect was courted by crypto investors to become the father of the American Bitcoin Reserve, which is designed to take prices for Bitcoin to the next level.

|

Listen To This Story |

President-elect Donald Trump has become a cryptocurrency enthusiast, egged on by crypto investors who are seeking to insure their investments in this dodgy asset keep gaining in value. Trump has promoted the idea of a US Federal Bitcoin Reserve. According to a Hill report, “Speaking at the Nashville Bitcoin 2024 Conference, Sen. Cynthia Lummis (R-WY.) floated a ‘revolutionary proposal’ to make the federal government a Bitcoin investor. It is hard to imagine how this might benefit US taxpayers or support the dollar’s value, but it certainly would raise the dollar price of Bitcoin.” Lummis describes “a strategic Bitcoin reserve” of 1 million Bitcoins that the government “would be required to hold … for 20 years.” At the current value of near $100,000 per Bitcoin, the reserve would be a Bitcoin buyer/holder to the tune of roughly $100 billion, a substantial market share with obvious market impact for crypto investors.

Here is a summary of Trump’s relationship with crypto-currencies.

While you’re here enjoying DonkeyHotey’s latest cartoon, please take a moment to read these articles on related topics:

The cartoon above was created by DonkeyHotey for WhoWhatWhy from these images: Donald Trump caricature (DonkeyHotey / Flickr – CC BY 2.0 DEED), body (Airborne1901 / Wikimedia – CC0 1.0 DEED), truck (Sergio Calleja / Wikimedia – CC BY-SA 2.0 DEED), warehouse (US Army / Wikimedia – PD), and bitcoin (Johannes Blümel / Pixabay).

-

Technology1 week ago

Technology1 week agoStruggling to hear TV dialogue? Try these simple fixes

-

Business7 days ago

Business7 days agoOpenAI's controversial Sora is finally launching today. Will it truly disrupt Hollywood?

-

Politics3 days ago

Politics3 days agoCanadian premier threatens to cut off energy imports to US if Trump imposes tariff on country

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25782636/247422_ChatGPT_anniversary_CVirginia.jpg) Technology4 days ago

Technology4 days agoInside the launch — and future — of ChatGPT

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25789444/1258459915.jpg) Technology2 days ago

Technology2 days agoOpenAI cofounder Ilya Sutskever says the way AI is built is about to change

-

Politics2 days ago

Politics2 days agoU.S. Supreme Court will decide if oil industry may sue to block California's zero-emissions goal

-

Politics4 days ago

Politics4 days agoConservative group debuts major ad buy in key senators' states as 'soft appeal' for Hegseth, Gabbard, Patel

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25546252/STK169_Mark_Zuckerburg_CVIRGINIA_D.jpg) Technology2 days ago

Technology2 days agoMeta asks the US government to block OpenAI’s switch to a for-profit