Crypto

Crypto firm Ripple gets in-principle payments license in Singapore

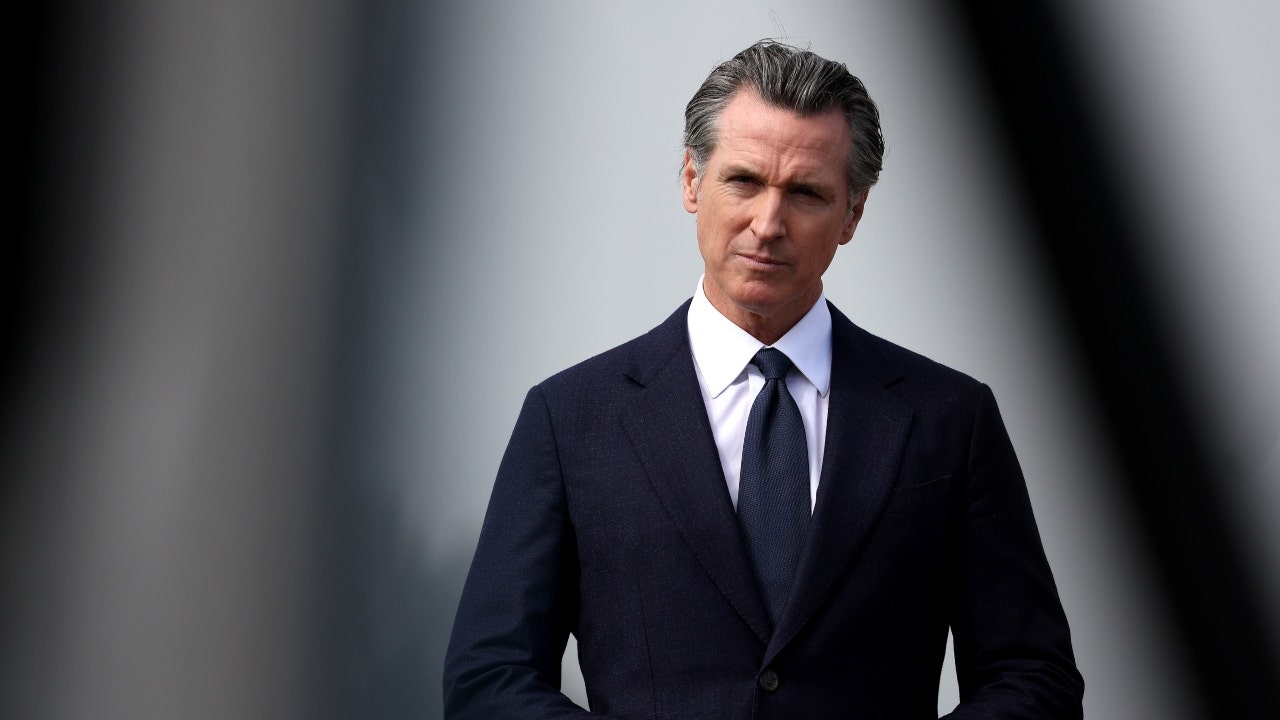

Brad Garlinghouse, chief executive officer of Ripple, speaks during the CoinDesk 2022 Consensus Festival in Austin, Texas, US, on Saturday, June 11, 2022.

Jordan Vonderhaar | Bloomberg | Getty Images

Blockchain company Ripple said Thursday it received in-principle regulatory approval to operate in Singapore, in a rare moment of good news for the cryptocurrency industry globally as it faces tightening policy back home in the United States.

Ripple said that it was granted in-principle approval of a Major Payment Institution Licence from the Monetary Authority of Singapore, the country’s central bank.

The license will allow Ripple to offer regulated digital payment token products and services and expand the cross-border transfers of XRP, a cryptocurrency the company is closely associated with, among its customers, which are banks and financial institutions.

XRP was trading at around 50 cents late Wednesday evening.

Ripple, a San Francisco-based fintech company, is mostly known for XRP as well as an interbank messaging services based on blockchain, the distributed ledger technology that underpins many cryptocurrencies.

The company’s on-demand liquidity service uses XRP as a kind of “bridge” between currencies, which it says allows payment providers and banks to process cross-border transactions much faster than they would over legacy payment rails.

But Ripple also operates a blockchain-based international messaging system called RippleNet to facilitate massive transfers of funds between banks and other financial institutions, similar to the global interbank messaging system SWIFT.

The Securities and Exchange Commission charged Ripple, co-founder Christian Larsen and CEO Brad Garlinghouse with conducting an illegal securities offering that raised more than $1.3 billion through sales of XRP.

Ripple denies the SEC allegations, contending that XRP is a currency rather than a security that would be subject to strict rules.

Singapore is one of the largest currency corridors from which Ripple sends money across borders using XRP, the company said in a press release.

A majority of Ripple’s global on-demand liquidity transactions flow through Singapore, which serves as the company’s regional Asia-Pacific headquarters, Ripple said.

Ripple has doubled its headcount in Singapore over the past year across key functions including business development, compliance, and finance, and plans to continue increasing its presence there.

MAS, the Singaporean financial regulator, was not immediately available for comment when contacted by CNBC.

The central bank was previously in the news for blasting Three Arrows Capital, the disgraced crypto hedge fund that imploded after betting billions on failed stablecoin terraUSD, for providing misleading information concerning its relocation to the British Virgin Islands in 2021.

The Asian megacity has gained a reputation over the years for being a more financial technology and crypto-friendly jurisdiction, opening its doors to a number of major companies including domestic banking giant DBS, British fintech firm Revolut, and Singapore-based crypto exchange Crypto.com.

Garlinghouse is due to speak at the Point Zero Forum in Zurich, Switzerland, next Wednesday to “discuss the resurgence of innovation in digital assets through investment and thoughtful regulation,” the company said.

It comes on the heels of Ripple’s $250 million purchase of Metaco, a crypto custody services firm, to expand its reach in the Swiss market and diversify away from its home in the U.S. Recently, Ripple’s Garlinghouse said the firm will have spent more than $200 million in legal fees by the time its legal battle with the SEC is wrapped up.

Crypto

4 Ways Cryptocurrency is Empowering Communities and Individuals

You mostly know cryptocurrencies for their impact on the financial world, but there’s more to learn about their social impact on communities and individuals. Their impact on philanthropic initiatives is quickly becoming noticed by individuals, communities, and governments of all levels in different regions. They boast borderless and decentralized features, offering a new path toward financial freedom and empowerment.

If you plan to explore the uses of cryptocurrencies, especially how they help empower communities and individuals, this is the right place. Below, we’ll look at four ways cryptocurrency empowers communities and individuals to help you get started with crypto correctly.

Improved Access to Financial Services

As a digital asset, cryptocurrency provides greater financial inclusion to individuals and communities disadvantaged by the lack of access to traditional financial systems. With superpowers like the U.S. still having 2.6% of an unbanked population, the situation could worsen in less developed countries with inferior banking systems. Registering cryptocurrency as a substitute solution is a great reprieve for many individuals and communities in these regions.

Users can send and receive crypto coins between family and friends in record time without worrying about huge transaction fees and delayed remittance. For example, you can now buy Bitcoin faster and add it to your wallet, where you can send it to your loved ones whenever and wherever you are. Organizations in these disadvantaged regions can equally receive generous donations through crypto donations for their sustenance.

Protection from Inflation and Economic Uncertainty

When inflation and other economic mishaps occur, traditional fiat currencies tend to lose their value, which disadvantages holders. However, with cryptocurrency, especially scarce ones, you can enjoy an alternative store of value not subject to inflationary pressure and government manipulation. This is a great way for individuals and businesses to protect their wealth and hedge against economic uncertainties.

Investment and Wealth Creation Opportunities

Cryptocurrencies have opened many opportunities for individuals and businesses looking to explore decentralized finance (DeFi) and innovative blockchain projects. Through these two main paths, individuals can now lend, stake, and tokenize assets to grow wealth and diversify their investment portfolio. The good thing about crypto investment opportunities is that you can explore its borderless features and interact with clients and businesses across the globe.

Since it also allows for satisfactory privacy when transacting, cryptocurrency can open your thinking about money, ushering you to an open gateway to endless investment options. Whether your interest is in crowdfunding, NFTs, or tokenization of assets, crypto offers numerous avenues to generate crypto tokens or income.

Philanthropy and Charity

The challenges of transparency in charity organizations are slowly becoming a thing of the past with the adoption of Bitcoin technology in philanthropy. Organizations and individuals can now track the flow of funds, ensuring that donations are used for their intended purpose. This way, donors can be confident that their funds are put to good use, thus building trust and opening doors for more future donations.

Thanks to crypto’s borderless acceptance, organizations can receive donations from anywhere in the world instantly and even anonymously. All the bureaucratic transaction processes associated with traditional fiat currency barely concern organizations already subscribing to crypto donations.

The use of cryptocurrency has had its fair share of benefits, especially in empowering individuals and communities. Regardless of the angle of opportunity you want to explore with your new-found crypto assets; you can always find something to smile about from these four options above. So, if you had doubts about the uses of crypto and its communal and individual benefits, now you have something to help you explore your options courageously.

* The information in this article and the links provided are for general information purposes only

and should not constitute any financial or investment advice. We advise you to do your own research

or consult a professional before making financial decisions. Please acknowledge that we are not

responsible for any loss caused by any information present on this website.

Crypto

Cryptocurrency Price Today: Bitcoin Dips Below $67,000 As Top Coins Continue To Land In Reds

Bitcoin (BTC), the world’s oldest and most valued cryptocurrency, dipped below the $67,000 mark over the weekend. Other popular altcoins — including the likes of Ethereum (ETH), Dogecoin (DOGE), Ripple (XRP), Solana (SOL), and Litecoin (LTC) — landed in the reds across the board as the overall Market Fear & Greed Index stood at 55 (Neutral) out of 100, as per CoinMarketCap data. The BRETT token emerged to be the biggest gainer, with a 24-hour jump of over 15 percent. Notcoin (NOT) became the biggest loser, with a 24-hour dip of nearly 8 percent.

The global crypto market cap stood at $2.43 trillion at the time of writing, registering a 24-hour dip of 0.88 percent.

Bitcoin (BTC) Price Today

Bitcoin price stood at $66,480.09, registering a 24-hour gain of 0.42 percent, as per CoinMarketCap. According to Indian exchange WazirX, BTC price stood at Rs 59.66 lakh.

Ethereum (ETH) Price Today

ETH price stood at $3,517.76, marking a 24-hour dip of 1.25 percent at the time of writing. As per WazirX, Ethereum price in India stood at Rs 3.21 lakh.

Dogecoin (DOGE) Price Today

DOGE registered a 24-hour loss of 1.30 percent, as per CoinMarketCap data, currently priced at $0.1394. As per WazirX, Dogecoin price in India stood at Rs 12.23.

Litecoin (LTC) Price Today

Litecoin saw a 24-hour dip of 0.58 percent. At the time of writing, it was trading at $77.25. LTC price in India stood at Rs 6,959.64.

Ripple (XRP) Price Today

XRP price stood at $0.4816, seeing a 24-hour loss of 1.15 percent. As per WazirX, Ripple price stood at Rs 43.87.

Solana (SOL) Price Today

Solana price stood at $150.85, marking a 24-hour dip of 2.19 percent. As per WazirX, SOL price in India stood at Rs 13,358.12.

Top Crypto Gainers Today (June 17)

As per CoinMarketCap data, here are the top five crypto gainers over the past 24 hours:

Brett (Based) (BRETT)

Price: $0.1595

24-hour gain: 15.45 percent

JasmyCoin (JASMY)

Price: $0.03748

24-hour gain: 11.77 percent

Lido DAO (LDO)

Price: $2.17

24-hour gain: 9.21 percent

Dog (Runes) (DOG)

Price: $0.0073

24-hour gain: 9.18 percent

Jupiter (JUP)

Price: $0.9176

24-hour gain: 7.48 percent

Top Crypto Losers Today (June 17)

As per CoinMarketCap data, here are the top five crypto losers over the past 24 hours:

Bitcoin (NOT)

Price: $0.0186

24-hour loss: 7.24 percent

Akash Network (AKT)

Price: $3.18

24-hour loss: 5.04 percent

BitTorrent [New] (BTT)

Price: $0.0000009525

24-hour loss: 4.70 percent

Oasis (ROSE)

Price: $0.1117

24-hour loss: 4.22 percent

Ondo (ONDO)

Price: $1.14

24-hour loss: 4.04 percent

What Crypto Exchanges Are Saying About Current Market Scenario

Mudrex co-founder and CEO Edul Patel told ABP Live, “Bitcoin witnessed selling pressure over the past week as prices dropped below the $67,000 mark, but then easing up over the past 24 hours as price movement flattened. Bitcoin’s closest support level lies at $64,825, while the next resistance point awaits at $66,978. Meanwhile, Ethereum too has witnessed marginal selling pressure in the past week as the market gears up for Ethereum ETFs to go live in early July. The overall sentiment in the market continues to point to greed.”

Rajagopal Menon, Vice President, WazirX, said, “Bitcoin remains below its 50-day moving average, a technical indicator that could suggest a potential short-term price decline. However, a healthy buffer above the key 200-day moving average hints at a possible long-term bullish trend. If bulls can push Bitcoin above the 50-day hurdle at $66,425, it could trigger a rally towards the crucial resistance level of $69,000. Breaking decisively above that level could even put the coveted all-time high of $73,808 back on the table.”

Sathvik Vishwanath, CEO and co-founder of Unocoin, said, “The Biden administration is set to discuss bitcoin policy in early July, signalling a potential shift in US crypto strategy. The round table is organized by the pro-crypto-democratic Rep. Silicon Valley’s Ro Khanna and will be attended by billionaire Mark Cuban and other lawmakers. The meeting aims to maintain US leadership in bitcoin and blockchain innovation amid regulatory debates. Cuban believes Biden’s crypto stance could influence the 2024 election. Meanwhile, Trump has pledged to end Biden’s “war on crypto” and support bitcoin mining, promising a more favourable regulatory environment if elected. Bitcoin is trading around $66,400 with a bearish outlook.”

Subscribe And Follow ABP Live On Telegram: t.me/officialabplive

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Cryptocurrency is not a legal tender and is subject to market risks. Readers are advised to seek expert advice and read offer document(s) along with related important literature on the subject carefully before making any kind of investment whatsoever. Cryptocurrency market predictions are speculative and any investment made shall be at the sole cost and risk of the readers.

Crypto

JPMorgan Doubts Crypto Inflows Will Remain as Robust

America’s largest bank says the state of the cryptocurrency market may not be sustainable.

This year has seen crypto net inflows of $12 billion thus far — a figure that could jump to $26 billion by year’s end assuming flows continue apace — a trend driven by demand for spot bitcoin exchange-traded funds (ETFs), JPMorgan Chase analyst Nikolaos Panigirtzoglou wrote in a note cited in a Sunday (June 16) report by Seeking Alpha.

While this number is impressive, Panigirtzoglou wrote it might not be entirely made up of new funds coming into the crypto space.

“We believe there has likely been a significant rotation away from digital wallets on exchanges to the new spot bitcoin ETFs,” he explained.

This movement is noticeable, he noted, as bitcoin reserves on exchanges have dropped by 220,000 BTC, or $13 billion, since the Securities and Exchange Commission (SEC) approved bitcoins ETFs in January.

“This implies that the majority of the $16 billion inflows into spot bitcoin ETFs since launch likely reflects a rotation from existing digital wallets on exchanges.”

Panigirtzoglou attributed the rotation to “the cost effectiveness, deeper liquidity, regulatory protection and convenience of the ETF wrapper that has become market participants’ preferred choice of instrument for bitcoin exposure for both existing and new crypto investors.”

All told, the analyst has doubts that crypto inflows will continue at the same pace for the remainder of 2024, considering how high the price of bitcoin is relative to the cost to produce one or when compared to gold.

This isn’t the first time this year that the banking giant has expressed its doubts about bitcoin ETFs, writing soon after the SEC’s ETF approval that the funds would draw money for existing crypto products but not attract new capital.

“We are skeptical of the optimism shared by many market participants at the moment that a lot of fresh capital will enter the crypto space as a result of the spot bitcoin ETF approval,” the banks’ analysts wrote in January.

Last month saw reports that venture capital investment in crypto companies had begun increasing after cooling for two years, climbing to $2.4 billion in the first quarter of 2024.

“The crypto industry is still in its early stages, and there is a lot of room for growth and innovation,” PitchBook senior analyst Robert Le wrote in a report quoted by Reuters.

“Barring any major market downturns, we expect the volume and pace of investments to continue increasing throughout the year,” he added.

-

News1 week ago

News1 week agoWould President Biden’s asylum restrictions work? It’s a short-term fix, analysts say

-

Politics1 week ago

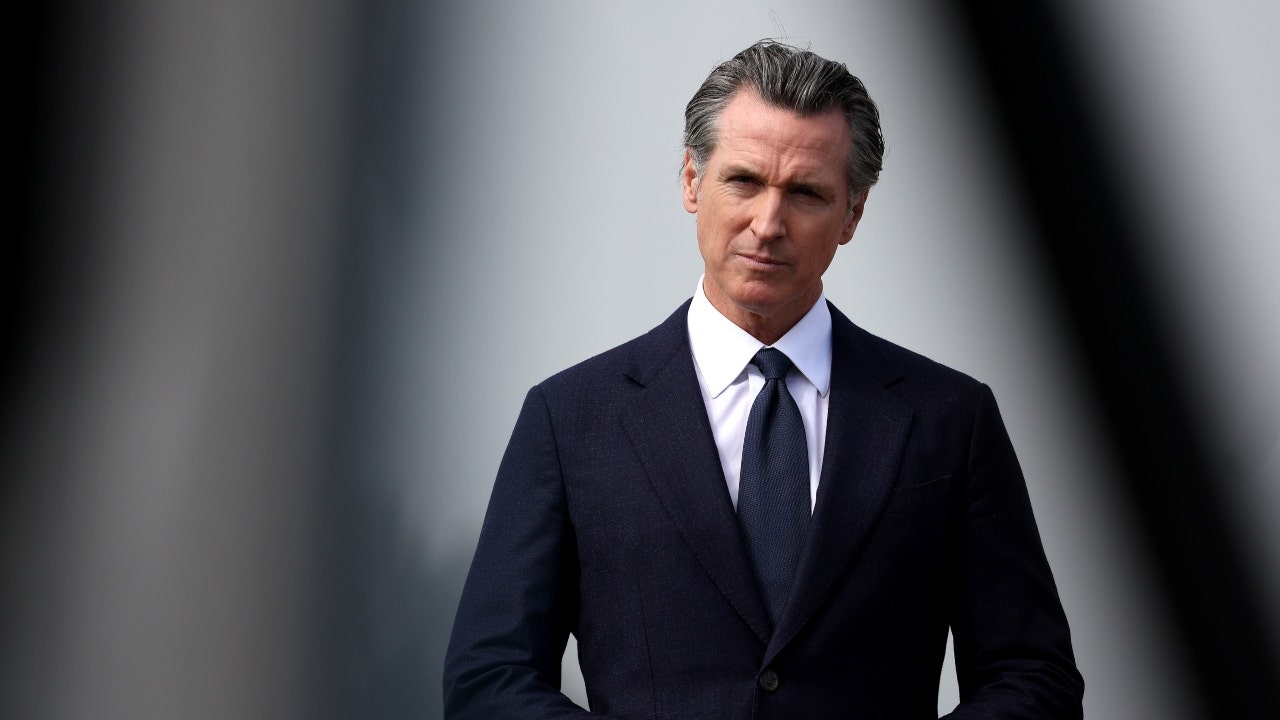

Politics1 week agoNewson, Dem leaders try to negotiate Prop 47 reform off California ballots, as GOP wants to let voters decide

-

World1 week ago

World1 week agoDozens killed near Sudan’s capital as UN warns of soaring displacement

-

News1 week ago

News1 week agoRead Justice Clarence Thomas’s Financial Disclosures for 2023

-

World1 week ago

World1 week ago‘Bloody policies’: Bodies of 11 refugees and migrants recovered off Libya

-

Politics1 week ago

Politics1 week agoGun group vows to 'defend' Trump's concealed carry license after conviction

-

Politics1 week ago

Politics1 week agoShould Trump have confidence in his lawyers? Legal experts weigh in

-

Politics6 days ago

Politics6 days agoGOP releases Jan. 6 clip of Pelosi saying 'I take responsibility' as she discussed National Guard absence

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/shawmedia/VQCTU2CNN5Y5TYBSTTH7WEGK3Q.jpg)