Editing by Peter Thal Larsen and Thomas Shum

Crypto

Breakingviews – Breakingviews: SBF’s guilty verdict will help crypto break free

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RACU3YBDHVLL3OC2DNXGUKL3NM.jpg)

Judge Lewis Kaplan watches as FTX founder Sam Bankman-Fried testifies in his fraud trial over the collapse of the bankrupt cryptocurrency exchange, at federal court in New York City, U.S., October 27, 2023 in this courtroom sketch. REUTERS/Jane Rosenberg Acquire Licensing Rights

NEW YORK, Nov 2 (Reuters Breakingviews) – Just over a year ago, Sam Bankman-Fried might have been counting his large stash of virtual coins. Soon, he may be counting bars in prison instead. A Manhattan jury on Thursday convicted the FTX founder of seven counts related to crimes he committed at the helm of the now-bankrupt cryptocurrency exchange. With some $8 billion in customer funds stolen, his misdeeds will go down as one of the biggest financial frauds on record. Bankman-Fried’s shot at redemption is all but over, yet for the broader cryptocurrency business it could provide a long-awaited chance to move forward.

The trial of the former billionaire widely known as SBF lasted roughly four weeks, but it took the jury just over four hours of deliberation to unanimously determine his guilt. Several ex-colleagues testified against him in court, saying he siphoned customer funds away from the exchange to finance personal investments, political contributions and even charitable donations. He didn’t garner much sympathy while on trial. Even the judge overseeing the case chided him for evasive answers on the witness stand.

The outlandish details of FTX’s collapse fueled broader mistrust of the cryptocurrency sector. Crypto and blockchain startups raised less money in the last four quarters combined than in the first quarter of 2022, when FTX was still riding high, according to research by digital asset investment firm Galaxy Digital. The failed firm’s tentacles seemed to extend to every corner of the sector, from lenders like Genesis to hedge funds like Three Arrows Capital. To be sure, the speculative bubble in crypto would probably have deflated even without Bankman-Fried. But his prominent role in promoting U.S. legislation to govern such assets meant that his downfall in some ways halted progress entirely.

Yet despite widespread predictions of cryptocurrency’s demise, there is still a market for virtual assets. The price of bitcoin has more than doubled this year as large financial institutions like BlackRock (BLK.N) seek to make the virtual currency more respectable. Even FTX may be set for its own rebirth. CEO John J. Ray III is working on a payout plan for customers who lost money. The bankrupt exchange is also negotiating with three bidders to help it relaunch trading services, Bloomberg reported last month.

Assistant U.S. attorney Nicolas Roos said in his closing statement before the jury, “this is not about complicated crypto, it’s about deception.” Even if Bankman-Fried appeals the verdict, his swift conviction should cause a collective sigh of relief from firms using blockchain technology to solve real problems like streamlining cross-border payments and remittances. Crypto enthusiasts argue that technology permits the creation of decentralized financial networks. It may take some old-fashioned U.S. justice to restore trust in the idea of a trustless system.

Follow @AnitaRamaswamy on X

CONTEXT NEWS

A jury in Manhattan federal court on Nov. 2 convicted Sam Bankman-Fried, founder and former CEO of cryptocurrency exchange FTX, of seven counts related to wire fraud and money laundering in connection with his role in its collapse.

(The author is a Reuters Breakingviews columnist. The opinions expressed are her own.)

Our Standards: The Thomson Reuters Trust Principles.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

Crypto

As May comes to a close, the cryptocurrency market is trending upward, leading many to anticipate the imminent arrival of the long-speculated crypto summer. With the next bull run taking shape, individuals are increasingly exploring diverse methods to profit from digital assets.

Crypto

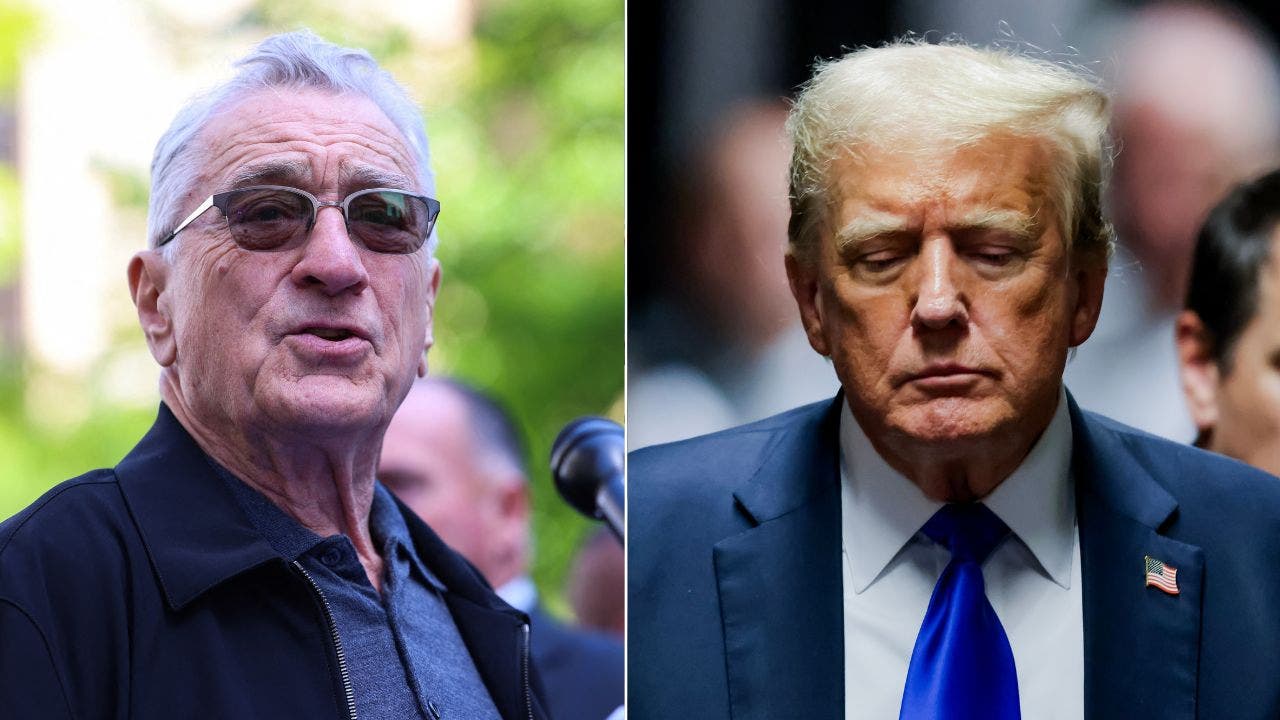

Robert Kennedy Jr. Applauds Trump's Crypto Commitment, Expresses Hope For Biden's Alignment

Presidential candidate Robert F. Kennedy Jr. has expressed his admiration for former President Donald Trump’s pro-cryptocurrency stance

What Happened: Kennedy made the remarks at the Consensus 2024 conference, CoinDesk reported Thursday.

“Commitment to crypto is a commitment to freedom and transparency,” Kennedy stated. He abstained from conjecturing whether Trump’s decision was politically driven, but expressed optimism that President Joe Biden would follow the same path.

Kennedy underscored the significance of transactional freedom and the necessity for a transparent currency. He also stressed the importance of America continuing to be the center of blockchain technology. Kennedy disclosed that he had acquired 21 bitcoins since the commencement of his campaign, in addition to purchasing three coins for each of his children.

See Also: Dogecoin Could Go To $0.322 If It Overcomes This Key Resistance Level, Analyst Notes

Furthermore, Kennedy expressed his intention, if elected, to establish cryptocurrency as a transactional currency. He voiced his conviction that cryptocurrency should be treated as a currency, not taxed as capital gains, and used for everyday purchases.

Why It Matters: Kennedy’s pro-cryptocurrency stance is not new. Earlier in March, he blamed big banks for turning Congress members against Bitcoin BTC/USD and emphasized the need for transactional freedom. He has also called cryptocurrencies the best hedge against inflation.

Interestingly enough, Trump’s view on Bitcoin was also negative around that time, in contrast to the 180-degree pivot that is currently on display.

In other news, RFKJ, the cryptocurrency themed on Kennedy, was rebranded as “BOBBY,” which Kennedy is affectionately called by his friends, family, and supporters.

Image Via Shutterstock

Price Action: At the time of writing, the PolitiFi token was trading at $0.00000259, following a 14% plunge in the last 24 hours, according to CoinMarketCap.

Read Next: Trump’s Maga Coin Jumps 7%, Coin Parodying Biden Sinks Despite Ex-President’s Conviction In Hush Money Trial —NFTs Also Show Strength

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Crypto

Cryptocurrencies maintain their negative trend ahead of U.S. inflation data By Investing.com

Investing.com – While remained in the $67,000 range before the economic data to be announced in the US, losses exceeding 5% were observed among altcoins with high market value.

After Bitcoin was quickly rejected at the $70,000 level in transactions at the beginning of the week, there were moves towards the $67,000 limit. Some market commentators emphasized the decline in momentum in the Bitcoin market, warning that its negative momentum could continue towards $65,000. However, Bitcoin maintaining the $67,000 range throughout the week made optimistic investors hopeful about the rise. As a result, there is an unstable outlook in the crypto market ahead of important inflation data.

What do billionaire investors invest in? InvestingPro has the answer! Use code WIN now and sign up for up to 20% off.

Unemployment claims and growth are priced in ahead of PCE data

If the data to be announced today and tomorrow in the USA deviate from expectations, volatile transactions are expected to increase in risky asset markets.

While unemployment applications and growth data in the USA today have the potential to increase volatility in the markets, the Personal Consumption Expenditures Price Index, which will be announced tomorrow, is seen as more important as inflation data closely followed by the Fed.

Accordingly, it is estimated that consumer sentiment is higher than expected, which may put pressure on cryptocurrencies along with risky markets.

While pessimistic comments about the crypto market predominated, the report of Blockchain analysis company Glassnode suggested that there were signs of a recovery in Bitcoin buyer interest. The report noted that long-term investors started saving again for the first time since December last year.

Latest situation in the altcoin market

While the overall outlook for the rest of the market remains negative, meme coins appear to be leading the decline in the top 100 cryptocurrencies. According to the latest situation, , , , and were the altcoins that fell the most in the last 24 hours.

While , one of the market’s new crypto assets, differentiates itself positively from the market with a value increase exceeding 35%, there is no cryptocurrency in the top 100 that has recorded a value increase of more than 5% in the last 24 hours.

-

News1 week ago

News1 week agoThe states where abortion is on the ballot in November : Consider This from NPR

-

News1 week ago

News1 week agoRead Prosecutors’ Filing on Mar-a-Lago Evidence in Trump Documents Case

-

Politics1 week ago

Politics1 week agoMichael Cohen swore he had nothing derogatory on Trump, his ex-lawyer says – another lie – as testimony ends

-

Politics1 week ago

Politics1 week agoAnti-Israel agitators interrupt Blinken Senate testimony, hauled out by Capitol police

-

World1 week ago

World1 week agoSerbian parliamentary minnow pushes for 'Russian law' equivalent

-

World1 week ago

World1 week agoWho is Ali Bagheri Kani, Iran’s acting foreign minister?

-

Technology1 week ago

Microsoft’s new Windows Copilot Runtime aims to win over AI developers

-

News1 week ago

News1 week agoBuy-now, pay-later returns and disputes are about to get federal oversight

/cdn.vox-cdn.com/uploads/chorus_asset/file/25458338/DSC00620.JPG)