Crypto

Better Business Bureau warns consumers about the growing trend of cryptocurrency scams happening nationwide

Erica Dilworth, Director of Operations with The Higher Cleveland Higher Enterprise Bureau, spoke about the kind of crypto scams that we’re seeing right here in Ohio.

“We’re seeing that you understand, in in a whole lot of the completely different scams that we’re delivered to our consideration. Typically it is romance scams, the place the individual pretends to be in a relationship with that individual. We’re additionally seeing it in, imposter scams. So, somebody claiming to be from the IRS or somebody claiming to be from one other authorities company,” Dilworth mentioned.

Though older adults usually tend to be a sufferer of one among these scams than youthful adults, scammers are always discovering new subtle methods to achieve peoples belief and cash.

“You recognize, there are definitely these ATM’s the place you may go and do a transaction. And typically it is so simple as that. Typically persons are much less type of conscious,” Dilworth mentioned.

One other signal that signifies it’s a scammer might be discovered of their responses. Scammers are sometimes in fixed communication with their targets, guiding them by way of the method till the cost is made.

Some prevention ideas embody:

• No reputable enterprise goes to demand you ship cryptocurrency upfront of a purchase order or to guard your cash. If the person does, this could possibly be an indicator of a rip-off.

• Should you meet somebody on a courting website or app and so they wish to present you how you can put money into cryptocurrency or asks you to ship them cryptocurrency, this could possibly be an indicator of a rip-off.

• Earlier than you put money into cryptocurrency, search on-line for the title of the corporate or individual and cryptocurrency title and likewise embody phrases like “overview,” “rip-off,” or “grievance” to see what others are saying.

• No reputable enterprise or authorities will ever e mail, textual content, or message you on social media to ask for cash, and they’ll by no means demand that you just purchase or pay with cryptocurrency.

• By no means click on on a hyperlink from an surprising textual content, e mail, or social media message, even when it appears to return from an organization you understand.

For native companies and help for older adults and caregivers, name 1-866-243-5678 to be related to the world company on growing older serving your group.

Should you really feel you’ve got been the goal of a rip-off, you may report it to the Ohio Lawyer Basic’s Workplace. If in case you have misplaced cash or really feel unsafe due to a rip-off, please contact native regulation enforcement.

Watch stay and native information any time:

Information 5 Night

Obtain the Information 5 Cleveland app now for extra tales from us, plus alerts on main information, the newest climate forecast, visitors info and far more. Obtain now in your Apple gadget right here, and your Android gadget right here.

You may as well catch Information 5 Cleveland on Roku, Apple TV, Amazon Fireplace TV, YouTube TV, DIRECTV NOW, Hulu Stay and extra. We’re additionally on Amazon Alexa units. Study extra about our streaming choices right here.

Crypto

Cryptocurrency exchanges to evaluate listed coins

Representations of cryptocurrencies Bitcoin, Ethereum, DogeCoin, Ripple, Litecoin are placed on a PC motherboard in this illustration. REUTERS-Yonhap

Implementation of Korea’s first cryptocurrency act on user protection to take effect from July 19

By Anna J. Park

With the implementation of Korea’s first law on virtual asset user protection, due to occur on July 19, cryptocurrency exchanges are set to comprehensively review the listing status of over 600 virtual assets currently being traded.

According to the Financial Supervisory Service (FSS) and the virtual asset industry on Sunday, 29 cryptocurrency exchanges registered to the financial authorities, including Upbit, Bithumb, Coinone, Korbit and Gopax, must regularly evaluate whether to continue supporting the trading of their listed coins.

The exchanges are each required to set up their own evaluation and decision-making body within their organizations, with the said bodies assessing the reliability of the issuer of their listed coins, user protection measures, technology and security and compliance with regulations.

With regards to assets like Bitcoin, of which the issuer is not specified, alternative review criteria will be introduced.

When cryptocurrency coins do not meet certain standards, they will be designated as cautionary and will face delisting.

“Financial authorities will support cryptocurrency exchanges to conduct reviews on their listed coins every six months regarding whether to continue supporting the trading of the virtual assets. After this initial review, the exchanges will be required to conduct maintenance reviews every three months,” an official from the financial authorities said.

Financial authorities are also preparing guidelines for virtual asset transactions, aiming for them to be utilized by virtual asset exchanges from next month, when the virtual asset user protection law is set to come into effect.

The figures from the Korea Financial Intelligence Unit under the Financial Services Commission (FSC) showed that the total number of cryptocurrency coins listed on the domestic virtual asset exchanges stood at around 600 as of the second half of last year, which is about a 3.5 percent fall compared to the first half of last year.

Meanwhile, the financial authorities are also preparing a change in their internal structures to devise policies on the cryptocurrency industry effectively.

The FSC plans to establish a new bureau solely dedicated to virtual assets so as to oversee the overall regulatory framework for the virtual asset industry as early as the end of this month.

The FSC’s organizational amendment, which includes these details, will complete its legislative notice by Monday and will be reviewed by the cabinet meeting on Tuesday.

The FSS is also gearing up for its supervision and investigations into unfair trade in the virtual asset sector at two new bureaus established at the end of last year.

Crypto

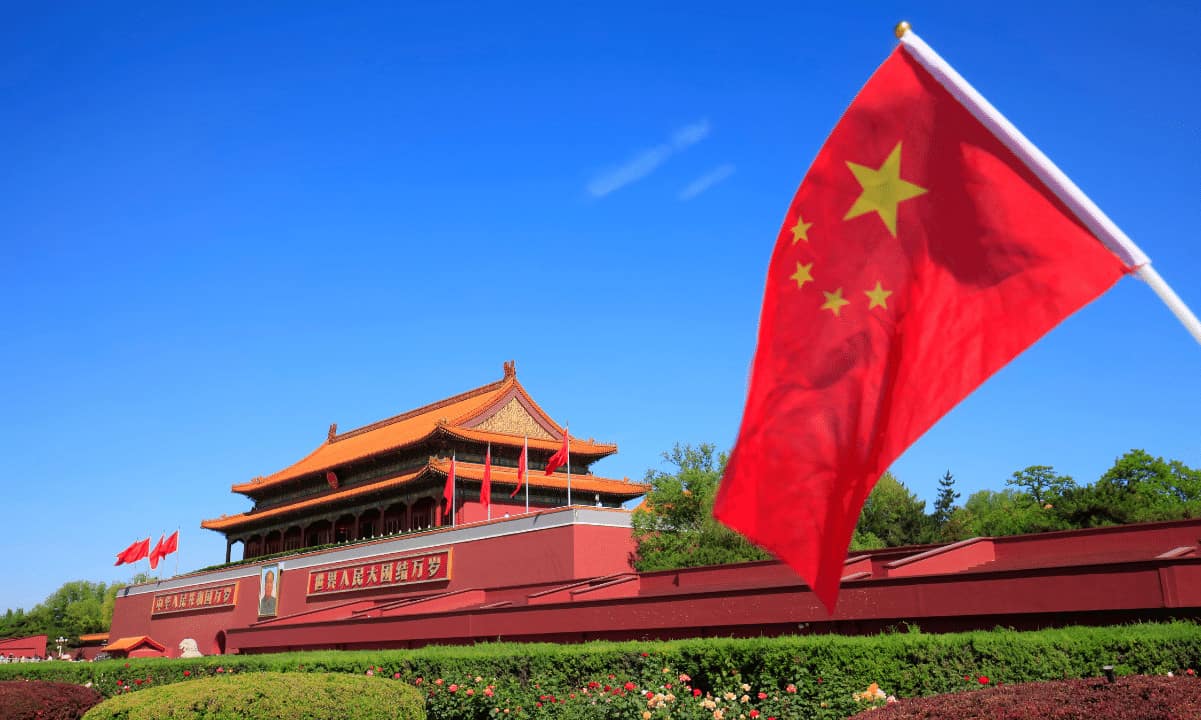

Crypto Deposits to Chinese Drug Producers' Addresses Double in Early 2024 Compared to 2023

Blockchain intelligence firm TRM Labs has revealed that cryptocurrency deposits into crypto addresses linked to Chinese drug precursor manufacturers more than doubled in the first four months of 2024 compared to the same period in 2023.

In 2023, Chinese precursor networks received over $26 million in cryptocurrency, with 97% of the over 120 manufacturers studied offering payment options in digital currencies.

Bitcoin Dominates Transactions

According to TRM Labs, the overall amount of cryptocurrency deposited into wallets linked to these manufacturers increased by more than 600% from 2022 to 2023.

Bitcoin remains the dominant cryptocurrency used for these transactions, accounting for approximately 60% of the total payment volume. Following Bitcoin, the TRON blockchain saw about 30% of transactions, while Ethereum was used for roughly 6%.

The report also highlighted that 11 manufacturers were responsible for over 70% of all crypto-denominated sales of drug precursors. These manufacturers receive funds from unhosted wallets, cryptocurrency exchanges, and payment services, with their wallets most commonly hosted at exchanges.

In addition to the preference for cryptocurrencies, Chinese manufacturers also accept fiat currencies through platforms like PayPal, MoneyGram, Western Union, and traditional bank transfers.

The report revealed that Chinese drug precursor manufacturers mainly target countries including Canada, the Netherlands, Australia, Germany, and the United States. Advertisements have also been directed towards Russia and neighboring countries, particularly for mephedrone precursors.

China’s Role in The US Fentanyl Crisis

A U.S. congressional committee recently reported that the root cause of the U.S. fentanyl crisis lies in the People’s Republic of China, which manufactures over 97% of the precursors used in the global illicit fentanyl trade.

According to the report, China subsidizes the production of illicit fentanyl precursors, which has significantly contributed to the opioid crisis in the United States.

“The CCP has had this program in place since at least 2018. At that time, they subsidized at least 17 illegal synthetic narcotics that are Schedule I controlled substances, including 14 deadly fentanyl analogues.”

The committee found that China provides value-added tax rebates to companies manufacturing fentanyl analogs and other synthetic narcotics, provided these products are sold outside China.

Another September 2023 report by blockchain intelligence firm Elliptic also uncovered a network of 100 individual suppliers facilitating the illicit fentanyl trade. Elliptic noted that these suppliers use cryptocurrencies, particularly Bitcoin, Ethereum, Tron, and Monero, to conduct transactions and facilitate the transfer of funds from buyers to suppliers.

Binance Free $600 (CryptoPotato Exclusive): Use this link to register a new account and receive $600 exclusive welcome offer on Binance (full details).

LIMITED OFFER 2024 at BYDFi Exchange: Up to $2,888 welcome reward, use this link to register and open a 100 USDT-M position for free!

Crypto

Cryptocurrency startup funding surpasses $100B (Cryptocurrency:BTC-USD)

bizoo_n

Cryptocurrency startups have drawn over $100B in total funding since 2014, as per data compiled by DeFiLlama, with $3.54B raised up to May this year alone amid a surge in bitcoin (BTC-USD) and other digital tokens.

DeFiLlama is an aggregator that tracks the crypto sector’s total value locked – or the total U.S. dollar value of digital assets locked, or staked, on a particular blockchain network via decentralized finance platforms.

According to the data, since 2014, crypto startups have seen a total of 5,287 funding rounds that have raised in total $101.36B. October 2021 was the best month in this time period, with over $7B raised.

Earlier this year, crypto industry news and research outlet The Block said the total, all-time dollar amount invested into crypto and blockchain-related companies exceeded $90B in February. The firm cited funding data for startups that it tracked since 2017.

The $100B milestone comes a few months after the crypto industry received a shot in the arm from the U.S. Securities and Exchange Commission’s (SEC) long-awaited approval of spot bitcoin (BTC-USD) exchange-traded products in January.

Not long after, bitcoin (BTC-USD) surged to a record high north of $73,000 in March, though it has since retreated after its last halving on April 19, 2024. Halving events reduce the rate at which new coins are created and thus lower the available amount of new supply.

For investors that want to track bitcoin (BTC-USD) focused funds, here are some names to look at: (IBIT), (GBTC), (FBTC), (ARKB), (BITB), (HODL), (BRRR), (BTCO), (EZBC), and (BTCW).

More on Bitcoin and Crypto

-

News1 week ago

News1 week agoIsrael used a U.S.-made bomb in a deadly U.N. school strike in Gaza

-

World1 week ago

World1 week agoFrance to provide Ukraine with its Mirage combat aircraft

-

World1 week ago

World1 week agoWorld leaders, veterans mark D-Day’s 80th anniversary in France

-

World1 week ago

World1 week agoRussia-Ukraine war: List of key events, day 833

-

News1 week ago

News1 week agoNonprofit CFO Accused of 'Simply Astonishing' Fraud

-

Movie Reviews1 week ago

Movie Reviews1 week agoInsane Like Me? – Review | Vampire Horror Movie | Heaven of Horror

-

Politics1 week ago

Politics1 week agoGeorge Clooney called White House to complain about Biden’s criticism of ICC and defend wife’s work: report

-

Politics1 week ago

Politics1 week agoNewson, Dem leaders try to negotiate Prop 47 reform off California ballots, as GOP wants to let voters decide

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/342Y3T6FN5GE7DLTKACPOPFAJM.png)