Business

Stocks Drop as Recession Fears Surface

Stock markets tumbled on Monday, on track for their worst day of the year as investors fretted about the economy after President Trump refused to rule out the possibility of a recession caused by his trade policies.

The S&P 500 slid more than 2 percent in afternoon trading on Wall Street, dragging portfolios even lower following three straight weeks of selling. The index is now more than 8 percent below a record high set last month, approaching a “correction,” a Wall Street term for a decline of 10 percent or more from a recent high.

“The markets are scared of the uncertainty that the tariff rhetoric is bringing,” said Andrew Brenner, head of international fixed income at National Alliance Securities. The S&P 500 is now slightly down from Election Day, erasing all of the gains it made since the vote, and then some.

The tech-heavy Nasdaq has been hit even harder, as the rally driven by enthusiasm for artificial intelligence reversed course. The index fell into a correction last week, and dropped more than 3 percent on Monday. Tesla’s shares plunged more than 11 percent, while Alphabet, Apple and Nvidia each fell over 4 percent.

“There’s just no support in the tech stocks right now,” said Larry Tentarelli, the chief technical strategist at Blue Chip Daily Trend Report. Many tech companies have grown so large that movements in their stocks have an outsize influence on the broader market.

Stocks in Europe and Asia also came under pressure but the declines paled in comparison to losses in the United States. An index tracking the eurozone’s largest public companies, which hit a record high last week, dropped 1.6 percent. Hong Kong’s Hang Seng Index fell more than 1.8 percent.

Investors seeking havens continued to opt for the relative safety of bonds, pushing down the 10-year U.S. Treasury yield to 4.23 percent; bond prices move inversely to yields. The combination of falling stocks and declining interest rates is often seen as a sign of economic unease.

Those worries are partly reflected by traders’ bets that the Federal Reserve will resume cutting the rate it controls, pricing in three cuts this year, according to CME FedWatch. Stock investors generally embrace rate reductions, which lower the cost of borrowing for businesses and consumers, but not when they are spurred by concerns about economic growth.

In a Fox News interview that aired on Sunday, President Trump refused to rule out the possibility that his policies would cause a recession.

Over the past few weeks, Mr. Trump has threatened, imposed, suspended and resumed tariffs on America’s largest trade partners: Canada, Mexico and China. The dizzying shifts, including last-minute exemptions for some automakers and energy products, have led to heightened uncertainty, unnerving investors.

“The market volatility is much less about the bad news of tariffs and much more about the uncertainty of tariffs, especially uncertainty as to what the policy is, where it is headed, how long it will last and what the end result will be,” said David Bahnsen, the chief investment officer at the Bahnsen Group.

By most measures, the U.S. economy is still solid, with the latest data on hiring holding steady. But economists have turned gloomier as they come to grips with Mr. Trump’s seesawing approach to tariffs, which has hamstrung businesses trying to plan investments and hiring. Cuts to the federal work force and government spending freezes have also dented consumer sentiment.

A report on inflation due this week will be closely watched, as surveys of consumers suggest that they expect price increases to pick up, a potentially worrying sign for the Fed as it tries to bring inflation down further. The rising cost of eggs and other necessities has squeezed shoppers’ wallets, and tariffs and mass deportations could push prices higher.

U.S. stocks have underperformed markets elsewhere in recent weeks. Given a murkier outlook for the American economy, “the recent moves might well have further to go,” Jan Hatzius, the chief economist at Goldman Sachs, said in a note on Monday. Strategists at the bank recently increased the chances of a U.S. recession in the coming year to 20 percent.

Analysts at JPMorgan Chase warned in a report that the spillover from a possible U.S. slowdown has resulted in a “materially higher risk of a global recession this year due to extreme U.S. policies.” They put the probability of such a downturn at 40 percent.

On Monday, retaliatory tariffs by China on U.S. agricultural products came into effect. On Wednesday, the Trump administration is set to put in place a 25 percent tariff on all steel and aluminum imports. Mr. Trump has also threatened to impose “reciprocal tariffs” on all U.S. imports to match other countries’ tariffs and trading policies next month.

Business

How the S&P 500 Stock Index Became So Skewed to Tech and A.I.

Nvidia, the chipmaker that became the world’s most valuable public company two years ago, was alone worth more than $4.75 trillion as of Thursday morning. Its value, or market capitalization, is more than double the combined worth of all the companies in the energy sector, including oil giants like Exxon Mobil and Chevron.

The chipmaker’s market cap has swelled so much recently, it is now 20 percent greater than the sum of all of the companies in the materials, utilities and real estate sectors combined.

What unifies these giant tech companies is artificial intelligence. Nvidia makes the hardware that powers it; Microsoft, Apple and others have been making big bets on products that people can use in their everyday lives.

But as worries grow over lavish spending on A.I., as well as the technology’s potential to disrupt large swaths of the economy, the outsize influence that these companies exert over markets has raised alarms. They can mask underlying risks in other parts of the index. And if a handful of these giants falter, it could mean widespread damage to investors’ portfolios and retirement funds in ways that could ripple more broadly across the economy.

The dynamic has drawn comparisons to past crises, notably the dot-com bubble. Tech companies also made up a large share of the stock index then — though not as much as today, and many were not nearly as profitable, if they made money at all.

How the current moment compares with past pre-crisis moments

To understand how abnormal and worrisome this moment might be, The New York Times analyzed data from S&P Dow Jones Indices that compiled the market values of the companies in the S&P 500 in December 1999 and August 2007. Each date was chosen roughly three months before a downturn to capture the weighted breakdown of the index before crises fully took hold and values fell.

The companies that make up the index have periodically cycled in and out, and the sectors were reclassified over the last two decades. But even after factoring in those changes, the picture that emerges is a market that is becoming increasingly one-sided.

In December 1999, the tech sector made up 26 percent of the total.

In August 2007, just before the Great Recession, it was only 14 percent.

Today, tech is worth a third of the market, as other vital sectors, such as energy and those that include manufacturing, have shrunk.

Since then, the huge growth of the internet, social media and other technologies propelled the economy.

Now, never has so much of the market been concentrated in so few companies. The top 10 make up almost 40 percent of the S&P 500.

How much of the S&P 500 is occupied by the top 10 companies

With greater concentration of wealth comes greater risk. When so much money has accumulated in just a handful of companies, stock trading can be more volatile and susceptible to large swings. One day after Nvidia posted a huge profit for its most recent quarter, its stock price paradoxically fell by 5.5 percent. So far in 2026, more than a fifth of the stocks in the S&P 500 have moved by 20 percent or more. Companies and industries that are seen as particularly prone to disruption by A.I. have been hard hit.

The volatility can be compounded as everyone reorients their businesses around A.I, or in response to it.

The artificial intelligence boom has touched every corner of the economy. As data centers proliferate to support massive computation, the utilities sector has seen huge growth, fueled by the energy demands of the grid. In 2025, companies like NextEra and Exelon saw their valuations surge.

The industrials sector, too, has undergone a notable shift. General Electric was its undisputed heavyweight in 1999 and 2007, but the recent explosion in data center construction has evened out growth in the sector. GE still leads today, but Caterpillar is a very close second. Caterpillar, which is often associated with construction, has seen a spike in sales of its turbines and power-generation equipment, which are used in data centers.

One large difference between the big tech companies now and their counterparts during the dot-com boom is that many now earn money. A lot of the well-known names in the late 1990s, including Pets.com, had soaring valuations and little revenue, which meant that when the bubble popped, many companies quickly collapsed.

Nvidia, Apple, Alphabet and others generate hundreds of billions of dollars in revenue each year.

And many of the biggest players in artificial intelligence these days are private companies. OpenAI, Anthropic and SpaceX are expected to go public later this year, which could further tilt the market dynamic toward tech and A.I.

Methodology

Sector values reflect the GICS code classification system of companies in the S&P 500. As changes to the GICS system took place from 1999 to now, The New York Times reclassified all companies in the index in 1999 and 2007 with current sector values. All monetary figures from 1999 and 2007 have been adjusted for inflation.

Business

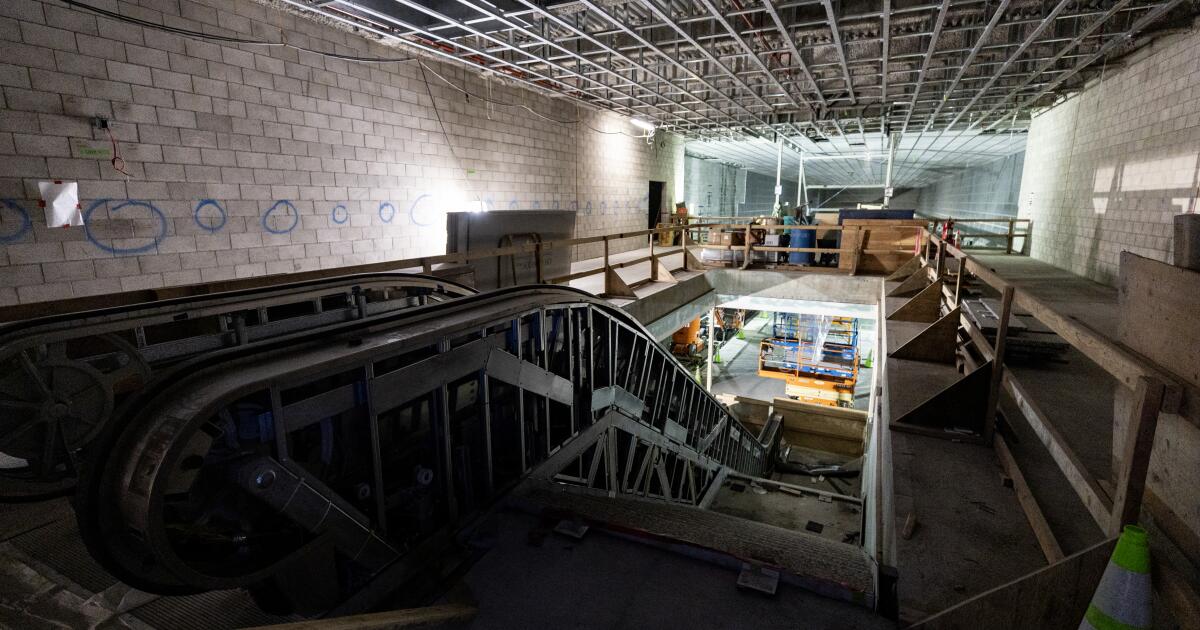

Coming soon: L.A. Metro stops that connect downtown to Beverly Hills, Miracle Mile

Metro has announced it will open three new stations connecting downtown Los Angeles to Beverly Hills in May.

The new stations mark the first phase of a rail extension project on the Metro D line, also known as the Purple Line, beneath Wilshire Boulevard. The extension will open to the public on May 8.

It’s part of a broader plan to enhance the region’s transit infrastructure in time for the 2028 Olympic and Paralympic Games.

The new stations will take riders west, past the existing Wilshire/Western station in Koreatown, and stopping along the Miracle Mile before arriving at Beverly Hills. The 3.92-mile addition winds through Hancock Park, Windsor Square, the Fairfax District and Carthay Circle. The stations will be located at Wilshire/La Brea, Wilshire/Fairfax and Wilshire/La Cienega.

This is the first of three phases in the D Line extension project. The completion of the this phase, budgeted at $3.7 billion, comes months later than earlier projections. Metro said in 2025 it expected to wrap up the phase by the end of the year.

The route between downtown Los Angeles and Koreatown is one of Metro’s most heavily used rail lines, with an average of around 65,000 daily boardings. The Purple Line extension project — with the goal of adding seven stations and expanding service on the line to Hancock Park, Century City, Beverly Hills and Westwood — broke ground more than a decade ago. Metro’s goal is to finish by the 2028 Summer Olympics.

In a news release on Thursday, Metro described its D Line expansion as “one of the highest-priority” transit projects in its portfolio and “a historic milestone.”

“Traveling through Mid-Wilshire to experience the culture, cuisine and commerce across diverse neighborhoods will be easier, faster and more accessible,” said Fernando Dutra, Metro board chair and Whittier City Council member, in the release. “That connectivity from Downtown LA to the westside will serve as a lasting legacy for all Angelenos.”

The D line was closed for more than two months last year for construction under Wilshire Boulevard, contributing to a 13.5% drop in ridership that was exacerbated by immigration raids in the area.

“I can’t wait for everyone to enjoy and discover the vibrance of mid-Wilshire without the traffic,” Metro CEO Stephanie Wiggins said in a statement.

Business

Commentary: AI isn’t ready to be your doctor yet — but will it ever be?

As almost everybody knows, the AI gold rush is upon us. And in few fields is it happening as fast and furiously as in healthcare.

That points to an important corollary: Beware.

Artificial intelligence technology has helped radiologists identify anomalies in images that human users have missed. It has some evident benefits in relieving doctors of the back-office routines that consume hours better spent treating patients, such as filing insurance claims and scheduling appointments.

Eventually, a lot of this stuff is going to be great, but we’re not there yet.

— Eric Topol, Scripps Research

But it has also been accused of providing erroneous information to surgeons during operations that placed their patients at grave risk of injury, and fomenting panic among users who take its offhand responses as serious diagnoses.

The commercial direct-to-consumer applications being promoted by AI firms, such as OpenAI’s ChatGPT Health and Anthropic’s Claude for Healthcare — both of which were introduced in January — raise special concerns among medical professionals. That’s because they’ve been pitched to users who may not appreciate their tendency to output erroneous information errors and offer inappropriate advice.

“Eventually, a lot of this stuff is going to be great, but we’re not there yet,” says Eric Topol, a cardiologist associated with Scripps Research Institute in La Jolla.

“The fact that they’re putting these out without enough anchoring in safety and quality and consistency concerns me,” Topol says. “They need much tighter testing. The problem I have is that these efforts are largely stemming from commercial interests — there’s furious competition to be the first to come out with an app for patients, even if it’s not quite ready yet.”

That was the experience reported by Washington Post technology columnist Geoffrey A. Fowler, who provided ChatGPT with 10 years of health data compiled by his Apple Watch — and received a warning about his cardiac health so dire that it sent him to his cardiologist, who told him he was in the bloom of health.

Fowler also sought out Topol, who reviewed the data and found the Chatbot’s warning to be “baseless.” Anthropic’s chatbot also provided Fowler with a health grade that Topol deemed dubious.

“Claude is designed to help users understand and organize their health information, framing responses as general health information rather than medical advice,” an Anthropic spokesman told me by email. “It can provide clinical context—for example, explaining how a lab value compares to diagnostic thresholds—while clearly stating that formal diagnosis requires professional evaluation.”

OpenAI didn’t respond to my questions about the safety and reliability of its consumer app.

Topol, who has written extensively about advanced technology in medicine, is nothing like an AI skeptic. He calls himself an AI optimist, citing numerous studies showing that artificial intelligence can help doctors treat patients more effectively and even to improve their bedside manners.

But he cautions that “healthcare can’t tolerate significant errors. We have to minimize the errors, the hallucinations, the confabulations, the BS and the sycophancy” that AI technology commonly displays.

In medicine, as in many other fields, AI looks to have been oversold as a labor-saving technology. According to a study of AI-equipped stethoscopes provided to about 100 British medical groups published earlier this month in the Lancet, the British medical journal, the high-tech stethoscopes effectively identified some (but not all) indications of heart failure better than conventional stethoscopes. But 40% of the groups abandoned the new devices during the 12-month period of the study.

The main complaint was the “additional workflow burden” experienced by the users — an indication that whatever the virtues of the new technology, they didn’t outweigh the time and effort needed to use them.

Other studies have found that AI can augment physicians’ skills — when the doctors have learned to trust their AI tools and when they’re used in relatively uncomplicated, even generic, conditions.

The most notable benefits have been found in radiology; according to a Dutch study published last year, radiologists using AI to help interpret breast X-rays did as well in finding cancers as two radiologists working together. That suggested that judicious use of AI could free up time for one of the two radiologists. But in this case as in others, the AI helper didn’t do consistently well.

“AI misses some breast cancers that are recalled by human assessment,” a study author said, “but detects a similar number of breast cancers otherwise missed by the interpreting radiologists.”

AI’s incursion into healthcare even has become something of a cultural touchstone: In HBO’s up-to-the-minute emergency room series “The Pitt,” beleaguered ER doctors discover that an AI app pushed on them as a time-saving charting tool has “hallucinated” a history of appendicitis for a patient, endangering the patient’s treatment.

“Generative AI is not perfect,” the app’s sponsor responds. “We still need to proofread every chart it creates” — thus acknowledging, accurately, that AI can increase, not relieve, users’ workloads.

A future in which robots perform surgical operations or make accurate diagnoses remains the stuff of science fiction. In medicine, as elsewhere, AI technology has been shown to be useful to take over automatable tasks from humans, but not in situations requiring human ingenuity or creativity — or precision. And attempts to use AI-related algorithms to make healthcare judgments have been challenged in court.

In a class-action lawsuit filed in Minnesota federal court in 2023, five Medicare patients and survivors of three others allege that UnitedHealth Group, the nation’s largest medical insurer, relied on an AI algorithm to deny coverage for their care, “overriding their treating physicians’ determinations as to medically necessary care based on an AI model” with a 90% error rate.

The case is pending. In its defense, UnitedHealth has asserted that decisions on whether to approve or deny coverage remain entirely in the hands of physicians and other clinical professionals the company employs, and their decisions on coverage and care comply with Medicare standards.

The AI algorithm cited by the plaintiffs, UnitedHealth says, is not used “to deny care to members or to make adverse medical necessity coverage determinations,” but rather to help physicians and patients “anticipate and plan for future care needs.” The company didn’t address the plaintiffs’ assertion about the algorithm’s error rate.

“We shouldn’t be complacent about accepting errors” from AI tools, Topol told me. But it’s proper to wonder whether that message has been absorbed by promoters of AI health applications.

Disclaimers warning that AI responses “are not professionally vetted or a substitute for medical advice” have all but disappeared from AI platforms, according to a survey by researchers at Stanford and UC Berkeley.

The issue becomes more urgent as the language of chatbots becomes more sophisticated and fluent, inspiring unwarranted confidence in their conclusions, the researchers cautioned. “Users may misinterpret AI-generated content as expert guidance,” they wrote, “potentially resulting in delayed treatment, inappropriate self-care, or misplaced trust in non-validated information.”

Typically, state laws require that medical diagnoses and clinical decisions proceed from physical examinations by licensed doctors and after a full workup of a patient’s medical and family history. They don’t necessarily rule out doctors’ use of AI to help them develop diagnoses or treatment plans, but the doctors must remain in control.

The Food and Drug Administration exempts medical devices from government licensing if they’re “intended generally for patient education, and … not intended for use in the diagnosis of disease or other conditions. That may cover AI bots if they’re not issuing diagnoses.

But that may not help users who have willingly uploaded their medical histories and test results to AI bots, unaware of concerns, including whether their information will be kept private or used against them in insurance decisions. Gaps in their uploaded data my affect the advice they receive from bots. And because the bots know nothing except the content they’ve been fed, their healthcare outputs may reflect cultural biases in the basic data, such as ethnic disparities in disease incidence and treatment.

“If there’s a mistake with all your data, you could get into a pretty severe anxiety attack,” Topol says. “Patients should verify, not just trust” what they’ve heard from a bot.

Topol warns that the negative effect of misleading AI information may not only fall on patients, but on the AI field itself. “The public doesn’t really differentiate between individual bots,” he told me. “All we need are some horror stories” about misdiagnoses or dangerous advice, “and that whole area is tarred.”

In his view, that would limit the promise of technologies that could improve the effectiveness of medical practice in many ways. The remedy is for AI applications to be subjected to the same clinical standards applied to “a drug, a device, a diagnostic. We can’t lower the threshold because it’s something new, or different, with some broad appeal.”

-

World1 day ago

World1 day agoExclusive: DeepSeek withholds latest AI model from US chipmakers including Nvidia, sources say

-

Massachusetts2 days ago

Massachusetts2 days agoMother and daughter injured in Taunton house explosion

-

Montana1 week ago

Montana1 week ago2026 MHSA Montana Wrestling State Championship Brackets And Results – FloWrestling

-

Oklahoma1 week ago

Oklahoma1 week agoWildfires rage in Oklahoma as thousands urged to evacuate a small city

-

Louisiana4 days ago

Louisiana4 days agoWildfire near Gum Swamp Road in Livingston Parish now under control; more than 200 acres burned

-

Technology6 days ago

Technology6 days agoYouTube TV billing scam emails are hitting inboxes

-

Denver, CO2 days ago

Denver, CO2 days ago10 acres charred, 5 injured in Thornton grass fire, evacuation orders lifted

-

Technology6 days ago

Technology6 days agoStellantis is in a crisis of its own making