Business

It’s a good time to be an American in Britain, as the pound declines in value

When Julian Asher moved from New York to London 16 years in the past to work as a administration marketing consultant, his six-figure wage stopped going thus far. The British pound, value twice as a lot because the greenback, was at a historic excessive.

It was “near $25 for a fast lunch” at his native sandwich store, Asher mentioned. “I used to be mentally doubling each value in my head.”

In order the pound got here tumbling down in current weeks, Asher saved an in depth eye on change charges — and finally transferred $20,000 from his U.S. financial savings account to his U.Ok. financial institution at a near-equal change fee to fund an intensive kitchen renovation he had lengthy postpone.

The pound, lengthy one of many world’s strongest currencies, a supply of satisfaction for Brits and one in all misery for vacationers and newly arrived immigrants, is right now a shell of its former self. Since hitting an all-time low final month of 1 pound to $1.03, it’s made little restoration and hovers round $1.10, one in all its lowest values in many years.

Because the the Guardian newspaper just lately put it, the British “jewel has misplaced its shine.”

The tarnishing began in earnest six years in the past when Britain voted to depart the European Union. Its forex has steadily declined as markets query the financial knowledge of the choice, which has made once-near-seamless commerce with neighboring international locations expensive and sophisticated. The pound was value $1.44 earlier than the Brexit referendum in June 2016. It’s misplaced a couple of quarter of its worth since.

Then got here the pandemic — Britain is the one nation among the many Group of seven industrialized democracies whose financial system has not recovered to pre-pandemic ranges — and now there are the insurance policies of the brand new British authorities.

After changing Boris Johnson as chief final month, Conservative Prime Minister Liz Truss vowed to chop tens of billions of {dollars} in taxes — together with for the richest earners — however didn’t spell out how Britain would recoup the misplaced income. That despatched traders fleeing the pound in droves and the forex plummeting to its historic low earlier than a unprecedented intervention by the Financial institution of England helped stabilize it.

A powerful greenback throughout the board — spurred by a U.S. Federal Reserve hike of rates of interest to fight inflation — has solely made issues worse. The dollar has additionally hit highs in opposition to the euro, the Japanese yen and the Chinese language renminbi as traders search a secure haven amid the worldwide political and financial turmoil ensuing from Russia’s struggle in Ukraine.

Within the U.Ok., which is combating a cost-of-living disaster and gazing a darkish winter of report gasoline prices, the a number of blows have led to predictions of a recession. Some economists say the nation has already entered one; new figures Wednesday confirmed that the British financial system contracted by 0.3% in August.

However for most of the 166,000 People who name the U.Ok. house, together with the 4 million who go to annually, the change in forex fortunes has modified the calculus of life and journey overseas in a constructive route.

“It’s a uncommon likelihood to really be on the higher facet of the cash equation as an American in London,” mentioned Asher, 48, who grew up within the San Francisco Bay Space and right now runs a luxurious journey firm. He considers himself fortunate: A lot of his shoppers pay in {dollars}, and he owns an funding property within the San Francisco Bay Space that he rents out in {dollars}.

For Emily Ashleigh, an American visiting the British capital, the extremely shrinking pound has additionally been a boon.

“I had budgeted $2,000 for just a few days between the resort, consuming out and buying,” mentioned Ashleigh, 27, who traveled from Arizona with mates and strolled final week alongside Oxford Avenue, a significant buying vacation spot lined with memento outlets, malls and world retailers like Uniqlo, the Disney Retailer and Adidas. “However that was just a few months in the past after I was planning and the pound was value extra. Now, as an alternative of 1 drink out at a restaurant, I can get two.”

Customers cross a memento store on London’s Oxford Avenue in April.

(Kirsty Wigglesworth / Related Press)

The scenario is reversed for her British pal Beatriz Gonzalez, who can be touring New York and the West Coast in January and is already dreading the prices.

“I booked a boutique resort in Tribeca, which is one thing I can afford for just a few days when the pound is doing higher,” mentioned Gonzalez, who works in finance. “I don’t anticipate the pound going wherever constructive. So I modified my reserving to the Vacation Inn.”

Justin Yoo, an American who has lived on and off in London since first arriving as a pupil in 1994 — when the pound was round $1.50 — mentioned its drop in worth made him really feel “nearly a little bit ripped off.”

“I’ve been in a number of graduate packages in London, and it’s at all times felt prefer it prices a lot to pay your pupil loans as an American as a result of the schooling would generally be twice the quantity if you transformed it to {dollars},” mentioned Yoo, a doctoral candidate in Egyptology at College Faculty London. “College students coming in right now, in the meantime, are getting a deal, and I’m pleased for them.

“I really feel unhealthy for British folks, who’re those actually struggling,” Yoo added. “A minimum of I’ve an instructional enhancing job that pays me in {dollars}, so I can get by.”

The plunging pound is a blow to the U.Ok.’s status in addition to its pocketbook. The pound is inextricably certain up in British id; when the nation belonged to the EU, it demanded — and obtained — an exemption from having to undertake the euro. However the forex’s poor efficiency of late has dented the sense of British superiority.

“The pound has been a part of a wider understanding of Britain’s energy and sense of self,” mentioned David Cobham, an economics professor at Heriot-Watt College in Scotland who research financial coverage. “However what is going on is that the chickens are coming house to roost due to financial selections through the years.”

Forward of the busy journey season together with Thanksgiving and Christmas, the pinched pound is already on the thoughts of Suki Fuller, an American whose job in London as an intelligence advisor pays her in kilos.

“Going again to the U.S. used to at all times be about two issues for me: seeing household and buying,” mentioned Fuller, 50, who has lived overseas for a lot of her grownup life. “I’d go to T.J. Maxx, Marshalls and Macy’s as a result of the choice was higher than in London, and it might seem to be a steal with the conversion fee since I’d receives a commission in kilos. Not anymore.”

Afeef Ahmed, an Amazon employee who moved from the Bay Space to London final 12 months and who additionally earns in kilos, is now rethinking journey again to the U.S. in favor of shorter-haul journeys on a tighter funds.

Ahmed, 34, mentioned he and his spouse generally joke “that we got here to the U.Ok. throughout its downfall.”

“It’s not simply the financial downfall and Boris Johnson getting kicked out however the queen dying, it hitting 104 levels over the previous summer season. I believe we’re most likely nicely previous ‘peak U.Ok.,’” mentioned Ahmed. “Perhaps by the tip of my lifetime the U.Ok. can be extra like a Second World nation.”

Business

FTC lawsuit accuses L.A. cash app Dave of charging hidden fees

The Federal Trade Commission has accused Los Angeles cash app Dave Inc. of misleading its financially vulnerable customers about fees it charges and the amount of money it gives out.

In a federal lawsuit filed Tuesday in Los Angeles, the agency alleges that although Dave advertises it offers $500 advances “instantly,” only a “miniscule” number of customers receive close to that amount. It also says customers are unaware they must pay a fee to get immediate cash, or else wait several days, and that the app charges a default “tip” of 15% that many customers don’t know they are paying.

The lawsuit, which includes additional allegations of wrongdoing, seeks a permanent injunction to prevent future violations of FTC regulations and a 2010 law that regulates online commerce.

“Dave lured in consumers living paycheck-to-paycheck with false claims of big-dollar advances, then reached into their pockets to give itself a so-called ‘tip,’” Samuel Levine, director of the agency’s Bureau of Consumer Protection, said in a statement.

Dave founder and Chief Executive Jason Wilk declined to comment, but the company issued a statement disputing the allegations. It said it intended to “vigorously defend” itself and that none of the allegations in the lawsuit, if proved, would prevent the app from charging the fees or “optional tips,” but instead were about issues around “consumer disclosures and consent.”

The lawsuit was approved by a bipartisan 4-1 vote of the FTC, with Republican Commissioner Andrew Ferguson joining Chair Lina Khan and the two other Democrats on the board voting in its favor. Khan is widely expected to be replaced under the new Trump administration.

Khan, who has pursued an aggressive antitrust agenda, has been a divisive figure among politicians and business elites. Among critics calling for her ouster was billionaire Mark Cuban, an early Dave investor, who feared Khan might break up big Silicon Valley tech companies. He later pulled back some of those comments.

Consumer advocates have worried that a second Trump administration would give short shrift to financial protection laws. During Trump’s first term, another federal body, the Consumer Financial Protection Bureau, weakened proposed regulations targeting payday lenders.

Lauren Saunders, associate director of the National Consumer Law Center, said the future work of the CFPB would be dictated by a new administrator under Trump; but because the FTC is governed by commissioners with staggered seven-year terms, change could come slowly.

“They will be able to appoint the chair and appoint new members, but it might take a little time,” she said.

The lawsuit was the first time the agency has targeted the practice of “tipping,” which other cash advance apps such as MoneyLion also employ.

However, it filed two similar lawsuits against the cash apps Brigit and FloatMe, accusing them of promising large advances for free and then charging fees for immediate access to the money. Both companies settled with the agency, agreeing to change their practices and refund customers.

For the record:

1:23 p.m. Nov. 6, 2024An earlier version of this story said that DailyPay, a paycheck advance app, charges tips. It does not.

The Consumer Financial Protection Bureau has targeted tips charged by companies that typically partner with employers to give workers access to money prior to payday. Earlier this year it proposed a regulation that would include certain tips and expedited delivery fees in the total disclosed finance charges on such advances.

Dave, in a July news release, said it would not be subject to the new rules given how its advances are structured. The National Consumer Law Center has called on the CFPB to broaden the proposed regulations to include all forms of cash advances made by direct-to-consumer financial technology companies.

The lawsuit against Dave accuses the company of charging “express fees” of $3 to $25 and misleading customers into giving the default tip of 15% through a deceptive interface on the app that links tips to “healthy meals” for children in need — when only a fraction of the tips goes to charity.

It also accuses the company of charging a $1 monthly fee and making it extremely difficult for customers to stop the charge.

The Dave statement said the company was in the midst of “good-faith negotiations” over the allegations when the agency decided to instead file the lawsuit.

The company, which went public in 2022, has seen sales grow from $205 million that year to $259 million last year. It said Tuesday that it expects third-quarter revenue to hit $92.5 million, a 41% increase over the same period last year, while turning a small profit.

Shares of Dave, which have risen more than 700% since last year, rose 22% to $45.87 on Wednesday.

Business

Ref needs glasses? Not anymore. Lasik company offers free procedures for referees

The officials missed not one, but two apparent penalties on one key play late in the Cincinnati Bengals-Baltimore Ravens showdown Thursday night that could have cost Joe Burrow and Co. the game.

That came just two weeks after the officials appeared to have missed another crucial call at the end of the “Thursday Night Football” game between the Minnesota Vikings and the Rams that could have altered the outcome.

Can anything be done about all these referees who appear unable to see what’s happening right in front of them?

The folks at Lasik.com, seeing a golden opportunity to promote their services, have stepped forward to help. The company is offering free corrective eye surgery for NFL officials as well as for anyone who is in such a capacity for a number of other U.S. sports leagues.

Are professional referees upset about the Lasik promotion? A representative for the union representing NFL referees did not immediately respond to a request for comment.

The program is called “Better Vision, Better Calls.” And, yes, it’s legit.

“Yeah, it is real,” Eddy Gilfilen, a marketing director for Lasik.com, told The Times. “It is completely complimentary as long as they are an official referee across the NFL, NHL, NBA, MLB, USNT, WNBA, MLS and NWSL, so really just the top major women’s and men’s professional leagues.

“If a referee is deemed a safe candidate, they are absolutely, fully covered, including drops and any other extra charges they might have.”

Gilfilen said the company’s network of providers have already treated numerous referees across multiple leagues through the promotion.

But, that’s not all: Anybody who nominates an official whose eyes seem to need fixing will receive $1,000 off their own Lasik procedure.

“We’ve had hundreds of nominations over the last couple weeks,” Gilfilen said.

The program was launched in May, but it didn’t receive much attention until after the Vikings-Rams game Oct. 24 at SoFi Stadium.

With less than two minutes left in the game, Minnesota quarterback Sam Darnold was tackled in the end zone for a safety, giving L.A. the ball and a two-score lead. Replays showed that Rams linebacker Byron Young had illegally grabbed Darnold’s facemask in making the play, but the play couldn’t be reviewed and the Rams went on to a claim a 30-20 win.

Later that night, Lasik.com took to X and posted a photo of the play, with the caption “Better Vision. Better Calls” and a link to the offer in the comments.

Suddenly, people noticed.

“Really the first kind of lift that we saw was from that Rams game,” Gilfilen said. “That was the first campaign where it really kind of took off and we’re like, OK, we gotta figure out a way to keep the momentum going.”

That opportunity came Thursday night, after the Bengals pulled to within 35-34 with 38 seconds left in the game and opted to go for a two-point conversion and the likely win. But Burrow’s pass to receiver Tanner Hudson fell incomplete and sealed the Ravens’ win, as the officials did not throw flags on the apparent pass interference and roughing the passer penalties against Baltimore.

Afterward, Lasik.com posted a video of the missed interference call, along with a friendly reminder: “Obviously, we’re still offering NFL refs free LASIK.”

Business

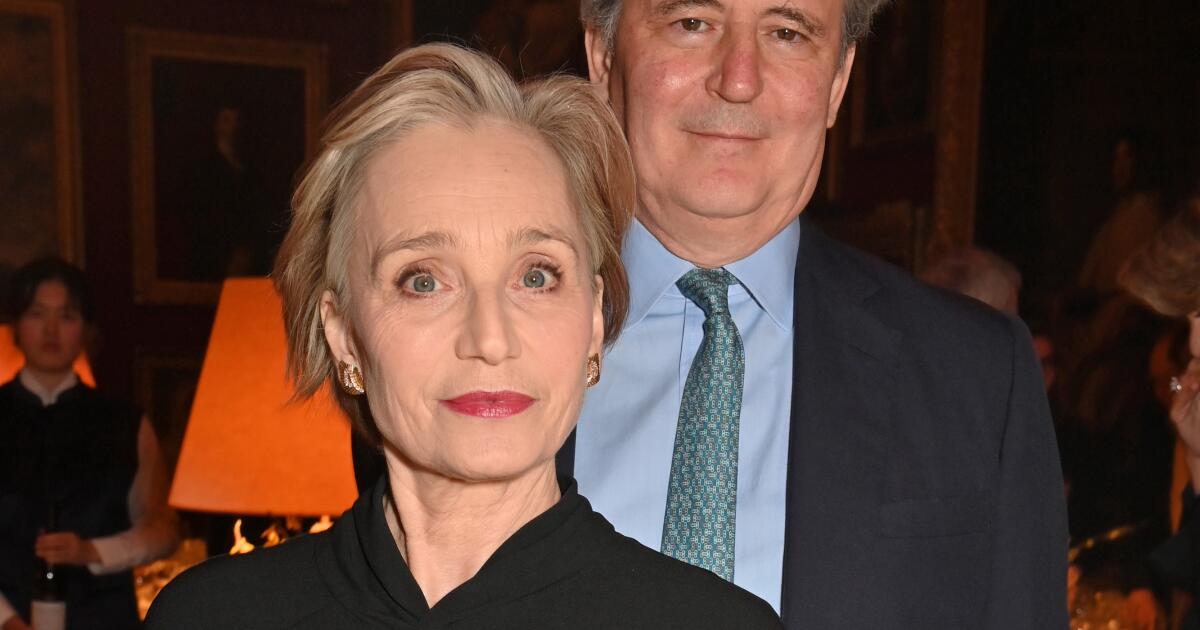

Kristin Scott Thomas confirms secret wedding to Bloomberg News' John Micklethwait

British actor Kristin Scott Thomas has wed Bloomberg News editor Johh Micklethwait.

The “Slow Horses” star confirmed her nuptials on Tuesday’s “Ruthie’s Table 4” podcast after host Ruth Rogers mentioned the wedding in the episode’s introduction.

“Kristin is basking in love and the joy of just a few weeks ago marrying the editor and my friend John Micklethwait,” Rogers said. The Independent had previously reported that the two, who reportedly dated for about five years, secretly wed in September.

Representatives for Scott Thomas did not immediately respond Wednesday to The Times’ request for comment.

Scott Thomas added that she had been “longing for stability” rather than traveling the world, including sleeping in the same bed for more than two weeks at a time. Her work in television has allowed for that.

“So much life happens in those four years,” Scott Thomas said of her time on the AppleTV+ thriller series. “People have died, people have been born, people have got divorced, people have got married. And this year we’ve had two weddings. We had Jack [Lowden]’s wedding [to Saoirse Ronan] and my wedding.”

The Oscar-nominated star of “The English Patient” said she and Micklethwait got married in Rutland, England, where his family is from. Discussing the wedding menu on the food podcast, the Cornish performer said that they had coronation chicken, a cold chicken salad famously created for a luncheon during Queen Elizabeth II’s 1953 coronation. As a wedding present, her sister collected and compiled maternal and paternal family recipes and put them into a book for her.

The “Four Weddings and a Funeral” and “Gosford Park” star previously was married to obstetrician François Olivennes from 1987 to 2005. The former couple share three adult children.

-

Business1 week ago

Carol Lombardini, studio negotiator during Hollywood strikes, to step down

-

Health1 week ago

Health1 week agoJust Walking Can Help You Lose Weight: Try These Simple Fat-Burning Tips!

-

Business1 week ago

Hall of Fame won't get Freddie Freeman's grand slam ball, but Dodgers donate World Series memorabilia

-

Culture7 days ago

Culture7 days agoYankees’ Gerrit Cole opts out of contract, per source: How New York could prevent him from testing free agency

-

Culture5 days ago

Culture5 days agoTry This Quiz on Books That Were Made Into Great Space Movies

-

Business1 week ago

Business1 week agoApple is trying to sell loyal iPhone users on AI tools. Here's what Apple Intelligence can do

-

/cdn.vox-cdn.com/uploads/chorus_asset/file/25299201/STK453_PRIVACY_B_CVirginia.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25299201/STK453_PRIVACY_B_CVirginia.jpg) Technology1 week ago

Technology1 week agoAn Okta login bug bypassed checking passwords on some long usernames

-

Health2 days ago

Health2 days agoLose Weight Without the Gym? Try These Easy Lifestyle Hacks